From adversity, opportunity

Banking groups have had to contend with waves of regulatory reform and face new entrants threatening their position in the market, but the industry has always loved a challenge

Over the next 10 years, banks are set to experience both an evolution and a revolution in the ways in which they operate, with the most successful institutions likely to be the ones that are able to reinvent and reimagine themselves to overcome the challenges that exist today, while also remaining flexible enough to tackle the pressures of tomorrow.

In the coming years, banks must focus their efforts on implementing strategies that promote long-term profitability, with a targeted focus on revenue growth. This will require a far narrower scope and the development of simpler structures, with fewer customer segments, though across many more markets.

Stakeholder stresses

Seven years since the financial crisis, the banking industry is still feeling the effects. In Q4 2014, there was a $4.4bn increase in litigation costs, which contributed to a 7.3 percent decline in total industry earnings from the year previous in the US alone, according to a report published by the professional services and investment management company JLL.

This year began as the last ended, getting off to a particularly rocky start for one of the banking industry’s biggest firms, as it was forced to settle the biggest legal bill from the crisis in February 2015. The aggressive approach by regulators the world over shows little sign of calming down and conduct costs, along with the costs of regulatory compliance paid by the 15 leading banks from 2009 to 2013, totalled $270bn according to data collected by EY.

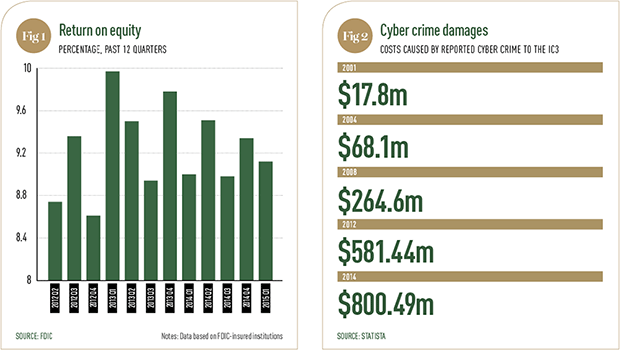

That is not the only burden that today’s banks must contend with. In fact, according to professional services firms, banking groups and the organisations that comprise them must attempt to satisfy investors who have grown tired of seeing low returns on equity, with the average ROE of 200 of the world’s largest banks from 2011-13 standing at around nine percent (down from 17 percent between 2005 and 2007). A similar trend can be seen in US banks (see Fig. 1).

The figures highlight that banks still have a long way to go in order to return to pre-crisis levels. But the crash has not only tested the patience of investors, it has also damaged the reputation of the banking industry, and with it, the desirability of a career

within it. Only 25 percent of Wharton graduates chose to take up a job in finance in 2013, compared to nearly double that figure in 2007.

Young people are not the only stakeholders with doubts, as customers are also seeing the industry in a new post-crisis light. Around half of all retail customers have opened or closed an account in the last year, and more than 70 percent now hold accounts with more than one bank.

Click to enlarge

Click to enlargeTidal shift

All this alone is enough to provide the necessary impetus for banking groups around the world to begin considering a change of tack. But, combine stakeholder pressure with a global economy struggling to find growth, along with megatrends such as the rise of digitisation weighing down on the industry, and it all adds up to create a large incentive for change.

One of the key areas where banking groups are attempting to overhaul the way they do business in order to meet the demands of this challenging environment is technology. Implementing an effective digital strategy has become one of the main focus areas for banks. The reason is not only that customers are demanding easier access to information, but also that massive investments must be made in order to provide the necessary levels of security.

In today’s world, would-be thieves are able to steal vast sums of money without ever leaving their bedrooms. Perpetrators now focus on identifying weaknesses in banks’ IT systems, which will allow them to transfer funds to multiple accounts across numerous jurisdictions, making the act both easier to accomplish and more difficult to stop.

Many commentators believe that cyber-crime (see Fig. 2) is going to grow and become a huge concern for banking groups in the near future, as current systems require massive overhauls in security in order to safeguard against potential threats. Cyber-crime, along with banking groups acknowledging the profit that can be garnered from improving the scope and efficacy of their digital offering, means that investment in this area is set to grow considerably in 2015 and beyond.

Click to enlarge

Click to enlargeOvercoming adversity

The road ahead definitely has its obstacles. China’s economy continues to slow, which is having a knock-on effect on economies around the world. Demand is also lessened by Russia, a country with its own economic issues to overcome, and the same can be said for a number of countries across Europe. All in all, economies are struggling to meet predicted growth rates, which poses a number of challenges for banking groups to consider and attempt to overcome.

However, adversity often brings out the best in people, and it appears to be providing the necessary impetus for the banking industry to make the right investments and decisions to expand its horizons. A willingness to make changes is important if banking groups are to unlock new markets (see Fig. 3), obtain new customers, design new products and build new business models capable of making profits in an era of low growth.

Overall, 2015 is shaping up to be a monumental year for the banking industry. It is a year where greater competition from non-traditional players, particularly within the technology sector, has caused banks to assess where their weaknesses and strengths really lie. And, it could be the period when the sector moves away from short-termism in favour of long-term profitability. On the following pages, we’ve selected some of the most impressive banking groups across the world.