Banking in 2018

The past decade has been a roller coaster for the global economy. The financial crisis prompted a period of upheaval, triggering substantial changes in regulation, as well as greater market division among the industry’s major players. The landscape that banks now exist in is quite different from the heady days of 2008, but stability has begun to return. Though interest rates remain low, optimism has started to take hold. Even the shock election of US President

Donald Trump and the UK’s vote to leave the European Union were only enough to temporarily dampen spirits, with the worst-case scenarios predicted by many pundits turning out to be well wide of the mark.

According to a report released by the Institute of International Finance (IIF) in April, the global economy is expected to grow 3.5 percent this year, building on the success of the previous 12 months. The positive global expectations are perhaps best reflected in the optimism surrounding the US economy, which the IIF now estimates will grow by 2.9 percent in 2018, up from its original forecast of 2.4 percent. While questions remain regarding the UK economy – largely due to a lack of progress in Brexit negotiations and a particularly cold winter hindering growth in early 2018 – prospects look better than the disaster scenarios predicted just a couple of years earlier.

For banks, the threat of a global economic catastrophe eating into already-narrow profits has subsided – for the time being, at least. However, there remains significant upheaval in the financial sector. The rise of technology-focused start-ups, many of which provide an alternative to the services traditionally offered by banks, is prompting a reduction in banks’ market share. Perhaps more significantly, cryptocurrencies have contested the fundamental concept of money, becoming a legitimate asset in a tremendously short space of time.

Aware of the threat these new companies and systems pose, banks are now focused on turning enemies into allies through strategic investment and acquisition. Amid the new regulatory framework, banks are also being forced to reconsider the role they can, and will, play in the economy. While in a strong position to address these threats, it would be naive to suggest the industry’s current pecking order is set in stone.

Plugged in The most significant trend set to alter the banking sector in the coming years is the gradual development of open banking as the new standard. Increasingly, banks will begin to offer certain tools and data packages to third parties. This is both a business opportunity and a regulatory requirement. With the revised Payment Services Directive being implemented in Europe, banks will soon be forced to make certain services available to external partners. Outside of Europe, initiatives like the Open Bank Project are equipping the marketplace with the tools to develop and distribute application programming interfaces (APIs).

APIs – software tools that allow third parties to work with the businesses that distribute them – will define the relationships banks develop in 2018 and beyond. APIs will provide banks with a straightforward method for working directly with fintech companies, without incurring the costs and complications associated with a direct investment or acquisition. This will significantly impact the way banks and fintech companies conduct business. By leveraging the experience and resources of traditional banks, nimble start-ups will have the tools to develop more innovative and complex applications than ever before. Banks, meanwhile, will be able to maintain a foothold in the market by licensing the infrastructure that underpins these new products, ensuring both parties benefit from the relationship.

According to Capgemini’s Top 10 Trends in Banking – 2017 report, this collaboration will provide banks with a new business model. Instead of rivalling – or acquiring – fintech companies, banks will increasingly monetise and compete in API development. This banking-as-a-platform model will allow banks to generate revenue from their established systems, without having to take on the risks that start-ups are often willing to. Similar business models have been utilised by tech giants like Amazon and Google for many years, but banks are only now realising the benefits of being more open.

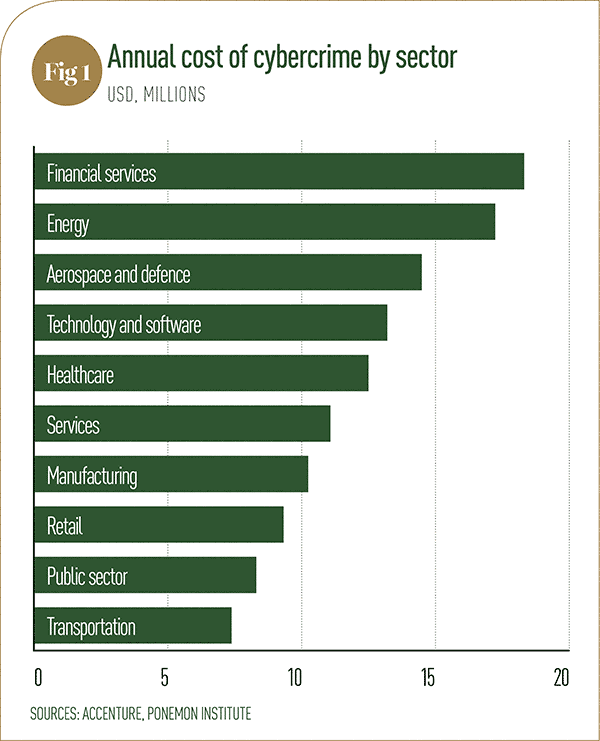

That’s not to say this new-found openness and increased focus on technology will be without its risks. As with the implementation of any new digital system, vulnerabilities will surface, leaving banks exposed to cyberattacks (see Fig 1).

In an industry as tightly regulated as banking, any breach could cause an irreparable amount of financial and reputational damage. Facebook may have weathered much of the storm caused by the Cambridge Analytica scandal earlier this year, but that was in no small part due to the lack of any real competitor. Unfortunately for banks, their customer bases are unlikely to be quite so resilient. Such risks are likely to be the focus of regulators in the coming years, with cybersecurity gradually shifting from a purely technological issue to a core business challenge.

Facing the facts With a growing emphasis on APIs, as well as a greater digital focus in general, banks are likely to see a lot less of their customers on a face-to-face basis. As more interfacing is conducted solely through digital channels, the global reduction in the number of bank branches is only going to continue. CACI research, published in 2017, estimated that consumer visits to retail banking branches would decrease by 36 percent between 2017 and 2022. If this prediction rings true, it will result in reduced costs and a significant change in the banking industry’s workforce, with more developers needed to handle the surge in online transactions and fewer administrative workers required to meet the day-to-day needs of customers.

In this period of change, it will be the banks that take advantage of today’s favourable climate in order to plan for the future that will flourish over the next decade. The 2018 World Finance Banking Awards have sought to identify the banks that have successfully held their nerve during a period of uncertainty and are now preparing tools to last them for the foreseeable future and beyond. Congratulations to all of our winners.