Private Banks

Austria

Bankhaus Spängler

Bankhaus Spängler, founded in 1828, is Austria’s oldest private bank. The Spängler family, which has roots that go back as far as 1590, still owns the bank to this day. Headquartered in Salzburg, the lender prides itself on embodying tradition and modernity, along with its ability to respond to customers’ needs more quickly and flexibly than large financial institutions.

www.spaengler.atBahrain

Ahli United Bank

Established in 2000 following a merger between the United Bank of Kuwait and Al-Ahli Commercial Bank, Ahli United Bank (AUB) has won a number of awards highlighting its success in Bahrain and the Middle East more widely. With a geographic footprint that spans the Middle East, North Africa and the UK, AUB provides services to a range of clients.

www.ahliunited.comBelgium

BNP Paribas Fortis

Formed after the Belgian Government sold Fortis Bank to France’s BNP Paribas in 2009, BNP Paribas Fortis is Belgium’s largest bank. It offers a range of financial services for families, private and corporate clients and companies. The bank is ambitious when it comes to social and environmental commitments, and strives to promote transparency and sustainability.

www.bnpparibasfortis.comCanada

BMO Private Banking

Backed by BMO Financial Group, BMO Private Banking offers wealth management services that are dedicated to helping affluent families, individuals and business owners with all aspects of their financial needs. Each client is assigned a relationship manager who, along with a team of specialists, provides expert advice and works with the client to develop a customised wealth plan.

www.bmo.com/privatebankingChile

Inversiones Security

Based in Chile, Inversiones Security provides a broad spectrum of services to individuals, corporations and institutional investors. The strong support of its research department, which examines trends taking place domestically as well as in the wider global economy, provides the company and its clients with the guidance they need to make informed financial decisions.

www.inversionessecurity.clCzech Republic

Česká Spořitelna

Česká Spořitelna’s private banking services provide first-class financial support to wealthy clients in the Czech Republic, helping them realise their financial goals. The bank focuses on asset management, investment advice and financial plans tailored to each customer’s needs. Intergenerational transfer services are provided in cooperation with partners with a well-established position in the market.

www.ersteprivatebanking.czDenmark

Danske Bank

Danske Bank is one of Northern Europe’s leading financial firms, offering a full range of banking services, with a particular emphasis on private banking. Based in Copenhagen, the bank is part of a wider group that provides services including asset management, investment support, pensions, mortgage finance, insurance, real estate and leasing.

www.danskebank.comFrance

BNP Paribas Banque Privée

BNP Paribas Banque Privée may be the number one private bank in France with €99.5bn ($122bn) in assets under management, but that doesn’t mean it is content with simply dominating the domestic market. Thanks to its private banking presence across Europe, Asia and the US, this is a French bank with a truly international focus.

www.mabanqueprivee.bnpparibasGreece

Eurobank

With its internationally recognised standards of wealth management services that are suitable to all market conditions, Eurobank provides top-class services to its private banking clientele. As the first bank in Greece to receive ISO 9001:2008 certification, Eurobank has demonstrated its commitment to quality management and a keen understanding of the market in which it operates.

www.eurobank.gr/en/private-bankingItaly

BNL-BNP Paribas

In a time of major industry disruption, BNL-BNP Paribas has targeted Millennials in particular through the introduction of personalised services and new digital products. As a result, the firm has successfully grown its presence in Italy, a market where clients are increasingly seeking omnichannel services through which they can quickly and easily conduct their private banking operations.

www.bnl.itLiechtenstein

Kaiser Partner

While many financial institutions have been reluctant to implement changes to their operations, Kaiser Partner has embraced today’s digitally centred world. By strengthening its technological backbone and incorporating innovative technology into its existing systems, the firm has strengthened relations with its clients, offering them more flexibility and improved channels of communication.

kaiserpartner.bankMonaco

CMB

CMB is a Monégasque private bank that has been deeply rooted in the Principality of Monaco since it was established 1976. The bank specialises in investment advice, offering a diversified range of products and services. These include asset management assistance, succession planning support and credit offerings adapted to the needs of each investor.

www.cmb.mcNigeria

First Bank of Nigeria

First Bank of Nigeria offers top-level financial support, finely honed over the bank’s 120-plus years of operations, to more than 10 million customers across Africa, Europe and Asia. By combining traditional services with more modern, digital offerings – including the bank’s two mobile apps – the First Bank brand has quickly become synonymous with innovation, fortitude and dynamism.

www.firstbanknigeria.comPeru

BBVA Continental

BBVA Continental places social impact at the core of its operations. With a mission statement to create a better future for Peru’s people, the bank works with the community to make financial support accessible. Additionally, BBVA Continental works alongside SMEs and is involved in educational projects aimed at supporting budding entrepreneurs.

www.bbvacontinental.peSweden

SEB

SEB believes entrepreneurial minds and innovative companies are key to creating a better world. The more than 160-year-old bank’s purpose, then, is to enable entrepreneurs and companies big and small to achieve their ambitions. In the private market, the bank has a particularly strong position in savings, where it has the second-largest share of households’ aggregate savings.

www.seb.seUAE

First Abu Dhabi Bank

First Abu Dhabi Bank became the largest bank in the United Arab Emirates after First Gulf Bank merged with National Bank of Abu Dhabi in late 2016, creating a lender with around $182bn in assets as of December 2017. The combination created a well-balanced bank that is bolstering the UAE’s private sector. The bank has also found success in 19 countries outside the UAE.

www.bankfortheuae.com

Moving with the times

The ever-evolving nature of private banking means that only those institutions keeping up with change will find lasting success. The rest will lose out to more agile competitorsOver the past year, competition in the private banking arena has heated up, leaving players with no choice but to up their game, react swiftly and adapt as necessary. This shift can be largely attributed to an unparalleled period of transparency and mounting pressure from tax authorities – not just at a national level, but at a global one too.

And that’s not the only challenge private banks and wealth managers face today: client needs and shareholder expectations are also shifting at a rapid pace, as is new technology and the opportunities it presents.

According to the EY Wealth Management Outlook 2018 report, this environment will soon give way to new structures in the industry, a shift it expects will take place in the coming years.

Those who continue to make necessary adjustments – and do so promptly – will capitalise on future opportunities and flourish. Those who don’t could fade away.

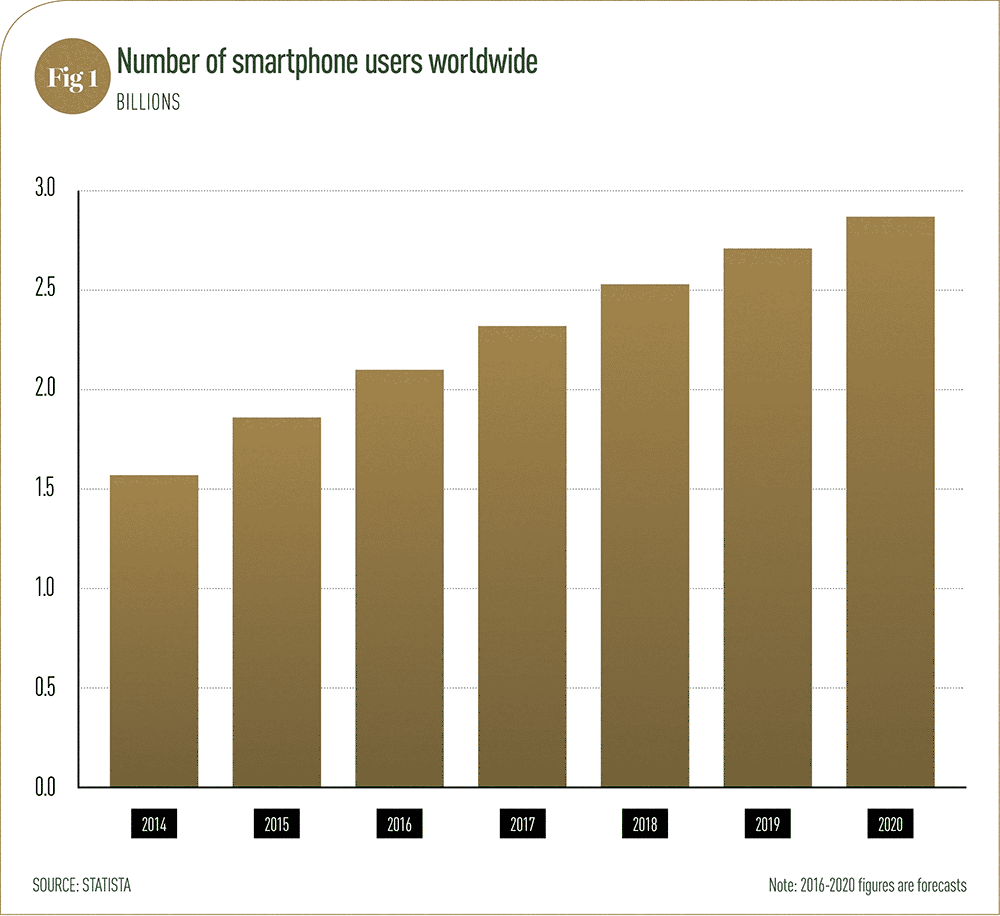

Growing demands Today, private banks are faced with an increasing set of demands from high-net-worth individuals (HNWIs). These demands are largely the result of the permeation of technology in our lives, particularly in terms of smartphones and apps (see Fig 1). The immediate access we now have to knowledge and services has placed higher expectations on private banks and wealth managers.

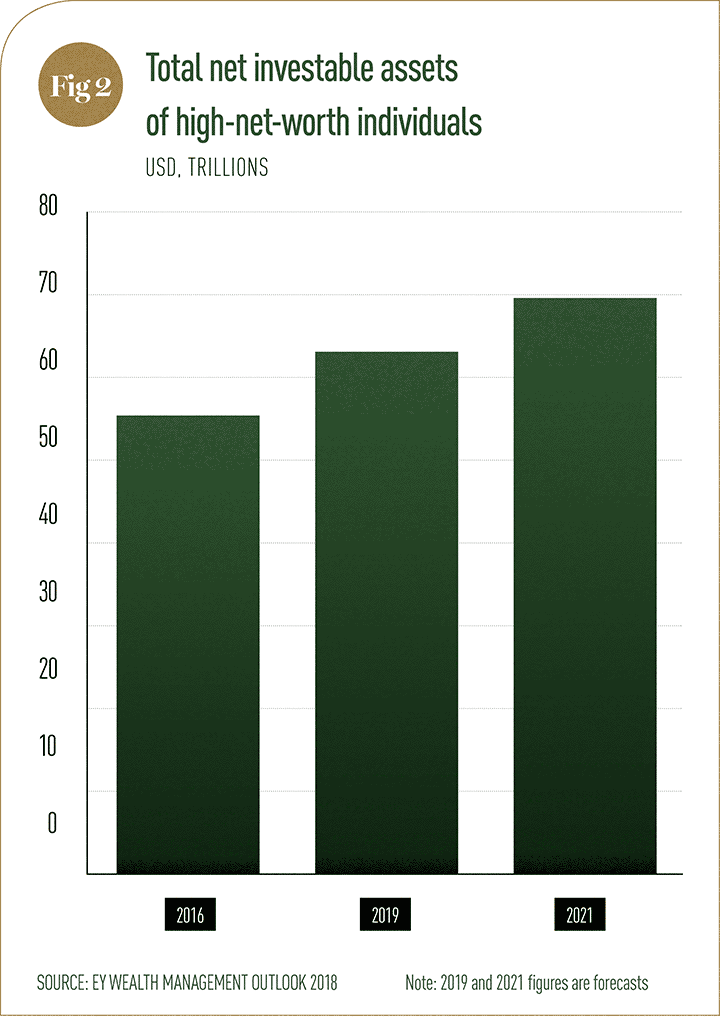

What’s more, e-commerce has reached a new stage in its development; it’s now the norm for artificial intelligence to help individuals make more personalised online purchases. Consequently, HNWIs – a growing segment of the global wealth management sector (see Fig 2) – now require equally personalised services from their private banks and wealth managers. Namely, they expect a digital infrastructure for smart, immediate support.

In response to these changing needs, more private banks are using big data to provide a personalised service, while also enabling them to better analyse the risk preferences of their clients. “Algorithms that draw on current market data optimise the structure of portfolios, allowing them to be continually and automatically rebalanced based on real-time information,” according to the report.

Tools such as video chat services can also be used as a means of convenient communication with clients. Private banks that offer such add-ons can create a positive and effective experience for their clients. Such an approach is crucial, because nowadays HNWIs want their wealth, assets, liabilities and life plans treated holistically. They are aware that doing so can help the preservation and performance of their wealth.

Shifting focus This digital focus is not the only change in clients’ expectations. “The ultra-low interest rate environment has made clients more price-sensitive and they expect a new breed of support, which is advisory rather than product-driven,” states the EY report. This environment, which is also characterised by volatile markets and a loss of confidence that has been in play since the global financial crisis, now sees a fading demand for conventional assets. Instead of money market investments, bonds and shares, for example, HNWIs are opting for alternative investments. Additionally, according to EY, investments into private equity funds and hedge funds are being supplemented by direct real-asset investments in areas such as infrastructure, agriculture and real estate.

In 2018, passion-based investments – like collectable coins, cars and artwork – are also in greater demand, as are ethical investments promoting social entrepreneurship and sustainability. The latter is growing in force, given that various existing social and political issues – such as mounting state control and rising taxes – can have a considerable impact on the private wealth of HNWIs.

Transparent future Unsurprisingly, since the 2008 crisis, financial entities have been hit with increasingly rigorous regulatory requirements in a trend that shows no signs of abating. Rules such as the Common Reporting Standard and the Foreign Account Tax Compliance Act have made offshore banking locations such as Switzerland, the Channel Islands and the Caribbean more stringent environments to operate in than ever. Specific requirements for funds and their management companies, such as the EU’s Undertakings for the Collective Investment of Transferable Securities Directive and the greatly anticipated MiFID II, are looming over private banks.

The variance in taxes and regulations in different markets is an increasingly resource-intensive process, particularly in terms of reporting and onboarding new clients. Unfortunately for private banks, the costs required to conform to MiFID II will not bring them or their clients added value. Yet there is little choice but for them to apply the resources necessary to adhere to an increasingly complex regulatory environment. Naturally, doing so has become a concern for private banks, which are under growing pressure to operate with more caution. While this environment is making it more difficult for new firms to enter the market, it also gives established players a greater opportunity to expand.

With all these changes afoot, a clearly defined business model for private banks, offering holistic, digitally advanced services, does not actually exist at present. Institutions are thus charged with the task of carving one out for themselves, while also evolving quickly and anticipating the changing demands of HNWIs. Those that proactively face these challenges are staying ahead of the game. Read on to find out more about our top picks from around the globe in 2018.