Retail Banks

Angola

Banco de Fomento

Since first entering the Angolan financial sector in the 1990s, Banco de Fomento has made a name for itself as one of the country’s leading retail banks. Its main focus over the years has been to drive Angolan economic development, particularly through the creation of innovative financial solutions and by encouraging growth in the country’s retail sector.

www.bfa.aoDenmark

Danske Bank

Danske Bank’s roots go as far back as 1871, and today it enjoys a strong position in the Danish market in addition to a presence in 15 other countries. One of its main focuses is supporting small businesses, with its DynamicPay system giving business customers the opportunity to offer their customers discounts in return for early payments.

www.danskebank.comEgypt

Commercial International Bank

Commercial International Bank (CIB) has been Egypt’s most profitable commercial bank for more than 40 years. During this time, the firm has been a pioneer in the country’s financial services industry. CIB has shown great potential in the burgeoning retail market as it works to serve the millions of Egyptians who still do not belong to a bank or remain underserved.

www.cibeg.comLebanon

Bankmed

For more than 70 years, Bankmed has been keen to provide its customers with specialised financial solutions that best meet their needs. Through a forward-thinking strategy that focuses on technological development and the evolving demands of its clients, Bankmed has been able to strengthen its leading position in the Lebanese financial sector, especially with regards to retail banking.

www.bankmed.com.lbBulgaria

Postbank

As a member of the Eurobank Group, Postbank has more than 27 years’ experience as a leader in Bulgaria’s banking sector. It is currently the fifth-largest bank in the country in terms of assets and enjoys a strategic position in Bulgaria’s retail and wholesale banking segment. Following its acquisition of Alpha Bank Bulgaria in 2016, Postbank’s presence has expanded even further.

www.postbank.bgDominican Republic

Banreservas

Founded in 1941, Banreservas has since gone on to become the largest bank in the Dominican Republic by assets. The institution is renowned for its devotion to customer service, helping clients build and manage their finances through an array of innovative products. Banreservas promotes leadership, integrity and excellence among its staff.

www.banreservas.comGreece

Eurobank

Eurobank is one of Greece’s foremost financial institutions. For its work, World Finance has named it the best retail bank in Greece for the fourth consecutive year. Eurobank has made a strategic choice to embrace high-end technology, with the aim to fully digitalise basic processes to ensure efficiency and give its customers an omnichannel experience.

www.eurobank.gr/el/retailMalaysia

Maybank

As one of the top five banks in South-East Asia, Maybank has an international network of more than 2,400 branches, with offices in more than 20 countries. Since 2016, the bank has been gradually expanding its retail banking division by financing the regional retail SME sector, while also increasing its microfinance offering in Malaysia.

www.maybank2u.com.mynetherlands

ABN AMRO

Although it maintains a primary focus on the Dutch market, ABN AMRO has a worldwide presence within the retail, private and commercial banking sectors. The group’s operations are strengthened by its longstanding expertise and established footprint within the industry. In 2017, the bank launched its Mission 2030 vision, which will see it become a more sustainable company over the coming decade.

www.abnamro.nlPortugal

Santander Totta

Following the integration of Banco Popular Portugal in 2017, Santander Totta became the largest private bank in Portugal in terms of domestic assets and lendings. The bank’s broad customer base benefits from its network of branches and digital channels, making access to its financial services particularly easy. The bank’s goal is to help individuals and businesses prosper.

www.santandertotta.ptSaudi Arabia

Arab National Bank

Arab National Bank, established in 1979 in Riyadh, serves both corporate and retail clients. With a customer base exceeding two million people, the bank promises to be “a friend indeed” through transparent working practices and a commitment to customer satisfaction. At the end of 2017, the lender had assets worth $45.8bn and customer deposits of $36.3bn.

www.anb.com.saTurkey

Garanti Bank

Garanti Bank is built on the belief that its services should be delivered in a transparent, clear and responsible way. This strategy is proving successful for the company, which, in its 72nd year of operations, is one of Turkey’s largest banks. Garanti's high asset quality, the result of sophisticated risk management systems, sets it apart from competitors.

www.garanti.com.trNigeria

Guaranty Trust Bank

Guaranty Trust Bank has established itself as one of Nigeria’s most respected financial institutions by adhering to eight core principles: simplicity, professionalism, service, friendliness, excellence, trustworthiness, innovation and social responsibility. Since its founding in 1990, the bank has delivered consistent growth by pursuing profitability without compromising on its corporate governance standards.

www.gtbank.comQatar

Qatar National Bank

Qatar National Bank’s continued investment in technology has led to the introduction of new products and services for its retail customers, including a revamp of the bank’s popular mobile app. The firm, which was established in 1964 as the country’s first Qatari-owned commercial bank, has a presence in 31 countries through its subsidiaries and associated companies.

www.qnb.comSri Lanka

Sampath Bank

Sampath Bank offers a range of retail banking solutions designed to assist its customers at every stage of their lives. As the bank’s customer base has grown, its services have evolved to meet the needs of each new customer. Using digital technology, Sampath Bank is always improving its product offering and, as such, remains one of Sri Lanka’s most formidable banks.

www.sampath.lkUAE

Union National Bank

Union National Bank (UNB) became the first UAE lender to establish a representative office in China in 2008, and the firm continues to grow internationally with branches in Qatar, Kuwait and Egypt. UNB is committed to being “the bank that cares”, and its numerous local and regional awards prove it has accomplished this goal.

www.unb.com

Keeping the personal touch

Storing customer data will introduce additional risk, but it may be the only way for retail banks to pursue digitalisation without sacrificing personal relationshipsRetail banks often struggle to make headlines in the same way their fellow financial institutions do. When investment banks are supporting multimillion-dollar stock market flotations, the goings-on at high street banks can feel a little insignificant. This way of thinking, however, underappreciates the importance of retail banking to the global economy.

Retail banks provide the medium through which the majority of people interact with the finance industry and, as such, account for 45 percent of all banking revenues. Worldwide, they are also fuelling much of the industry’s growth, particularly in emerging markets, where the retail banking sector is developing at a rapid pace.

In Western Europe and North America, however, retail banks are facing a number of challenges. Historically low interest rates, tepid GDP growth and tentative consumer confidence are all denting profit margins. Shifting customer demand, meanwhile, is challenging banks to change the way they deliver their services.

This leaves retail banks facing a difficult balancing act. Pressure is building to introduce further efficiencies, usually in the form of new digital technologies, but not every customer is willing to abandon their brick-and-mortar branch. Appealing to disparate customer demands, therefore, will be one of the major challenges facing banks in the coming years.

Best of both worlds The ubiquity of smartphones and the internet has prompted businesses in all sectors to adopt digital services at a rapid pace. Retail banking is certainly no exception, and an increasing number of customers would prefer to check their account balance using a mobile app than by standing in line at their local branch. In the US alone, there have been more than 10,000 bank branch closures since the 2008 financial crisis, and similar stories can be found elsewhere, particularly in the developed world.

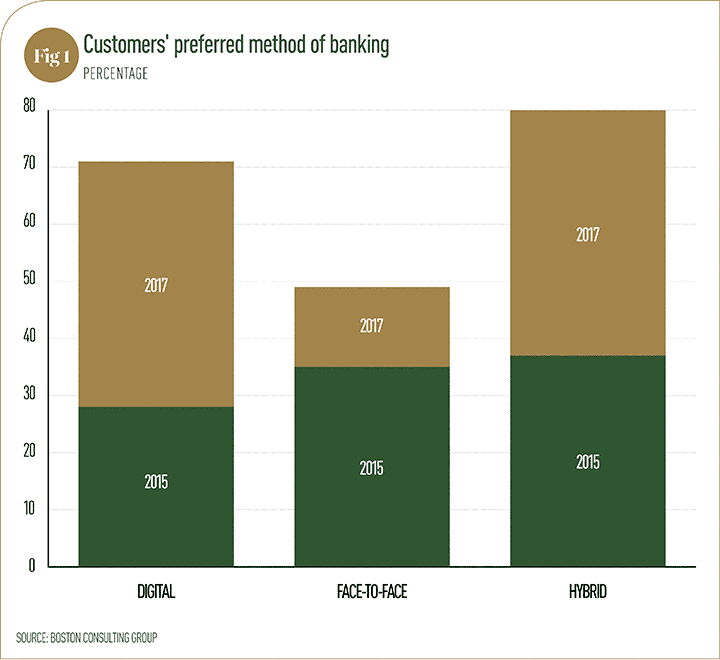

Customer behaviour is evidently shifting (see Fig 1), but that doesn’t mean that all banks should undergo a complete overhaul. According to the Boston Consulting Group’s report Global Retail Banking 2017: Accelerating Bionic Transformation, 43 percent of those surveyed preferred a digital-only banking experience, while the same percentage wanted a mix of virtual and physical interactions. Financial institutions should also be wary of neglecting the 14 percent of respondents who said they still carry out the majority of their banking face-to-face.

In order to please everyone, the most successful retail banks are delivering a hybrid customer experience. Certainly, the flexibility provided by mobile and online banking solutions is proving popular with customers who value convenience, but digital tools cannot replace a dedicated financial advisor – not yet, anyway.

There are, of course, many technological innovations that serve to enhance the customer experience without detracting from the human input they receive. Advanced security solutions, from two-factor authentication to biometrics, can be deployed to improve trust in the banking landscape, and social media output can be used to better interact and engage with customers. For many retail banks, the test will be whether they can embrace these technologies without disrupting the traditional banking services that customers continue to value.

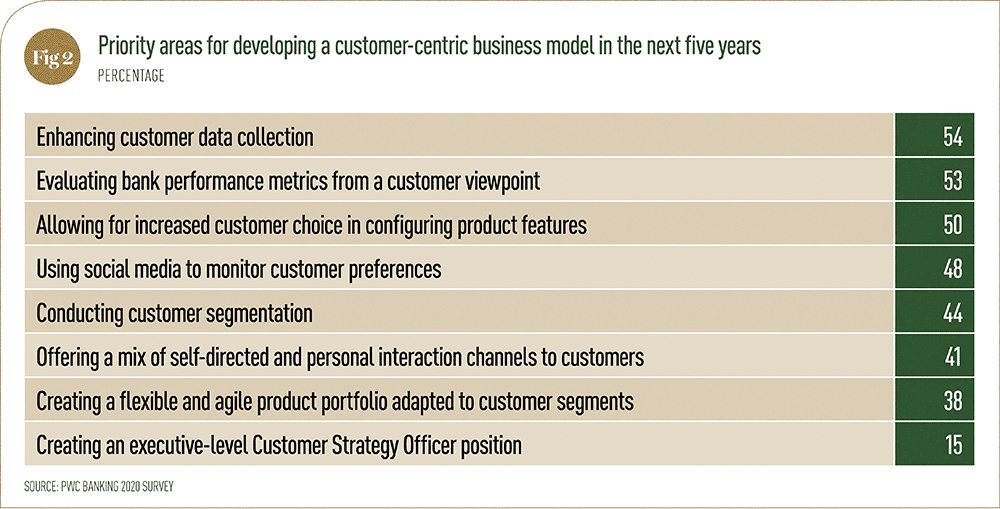

The customer is always right If retail banks are to keep customers onside as they move towards an increasing level of digitalisation, they’ll need to remember the importance of personalisation. Data could hold the key here (see Fig 2), providing financial institutions with a way of identifying individual needs, even as they cater to a customer base of thousands or more.

Fintech start-ups are already using data to give their customers saving tips, tailor account services and detect fraud with greater accuracy. More established banks have been slower to react, but there are signs that they too are beginning to leverage data on a greater scale.

Financial establishments have already found that data can reduce customer churn and give them a better understanding of risk, and further opportunities will surely emerge as data analysis tools become more advanced. It is for this reason that enhancing data analytics capabilities was cited as the second most important strategic priority in the Financial Brand’s annual Digital Banking Report.

Given that the amount of data available to them is increasing all the time, retail banks have little excuse for treating their customers as a homogeneous group. Even so, there are still general customer trends that banks would be wise to consider.

Looking at customer behaviour on a national scale could help banks decide which particular services to prioritise in each branch. In the Netherlands, for example, 76 percent of customers prefer to have a purely digital relationship with their bank, but this figure drops to just 11 percent in the United Arab Emirates. Similarly, banks may be able to use data to identify similar trends as a result of their customers’ age or employment backgrounds.

Regaining trust Although the retail banking sector is right to embrace data and customer personalisation on a greater scale, a note of caution is worth sounding: with memories of the financial crisis still lingering in many people’s minds, trust in banks is not particularly high. Storing and analysing large swathes of customer data, therefore, is a huge responsibility and one that could go a long way towards restoring broken trust – or damage it further still.

In order to improve this relationship between bank and customer, financial institutions must ensure that personalisation is not viewed as an intrusion. Transparency in terms of what data is collected and what it will be used for will play a key role in convincing customers to hand over their personal information. Security will perhaps prove even more important. While it’s true that banks have always been a major target of cyberattacks, do not be surprised if fraudulent activity increases further as banks grow their treasure troves of data.

Although retail banks should use data carefully, they should not reject digital solutions entirely. When used effectively, data enables banks to deliver the digital services that many customers crave, without compromising on personalisation. It promises a banking sector that is simultaneously more flexible and more understanding of customers’ individual needs.