Banking Groups

Azerbaijan

PASHA Bank

It may have only been founded in 2007, but PASHA Bank is already one of Azerbaijan’s most trusted financial institutions. In its relatively short history, the bank has grown its assets across a broad spectrum of industries (including insurance, construction and tourism), demonstrated a commitment to ethical investment and helped Azerbaijan diversify its economy.

www.pashabank.azBrunei

Baiduri Bank

Established in 1994, Baiduri Bank has become an integral player in Brunei’s financial landscape. Self-described as a “truly local entity”, the bank prides itself on offering comprehensive solutions to both the Bruneian community and foreign investors. Baiduri Bank’s finely tuned customer service allows clients to make the most of their investments, while always staying risk-aware.

www.baiduri.com.bnDominican Republic

Banreservas

Whether providing personal loans or investing in large-scale infrastructure projects, Banreservas, the Dominican Republic’s leading bank, is committed to enhancing the country’s economic and social wellbeing. Most notably, the bank’s efforts to improve financial education and inclusion are helping to turn the nation’s entrepreneurial potential into concrete economic gains.

www.banreservas.comFrance

Crédit Mutuel

As a cooperative bank, Crédit Mutuel doesn’t have to appease shareholders. Instead, it utilises a democratic and transparent decision-making process that focuses on the needs of its 7.8 million client members. In doing so, the bank delivers both the autonomy and accountability that its local divisions need in order to respond effectively to customer requirements.

www.creditmutuel.comBolivia

Banco Mercantil Santa Cruz

The product of a merger between two of Bolivia’s leading banks, Banco Mercantil Santa Cruz’s position in the country’s finance sector is only getting stronger. The bank’s mission is to bring value to shareholders while contributing to Bolivia’s economic development, never forgetting to provide the best service to its customers in the process.

www.bmsc.com.boCyprus

Eurobank

Having only commenced operations in 2007, Eurobank is still a relatively young financial institution. However, the bank’s impressive growth rate and healthy profitability have led it to develop a solid network of banking centres across all major cities in Cyprus. With a commitment to relationship management, Eurobank’s experienced team provides round-the-clock customer support.

www.eurobank.com.cyEgypt

AAIB

Arab African International Bank’s (AAIB) vision is to be the gateway for international businesses hoping to enter the Egyptian market. As the country’s fastest-growing bank in terms of size and profitability, AAIB has solidified its place as a leading financial institution in the region by expanding both its product portfolio and physical presence in recent years.

www.aaib.comGhana

Zenith Bank (Ghana)

With branches in almost all the Ghanaian regions, Zenith Bank’s services are far reaching. However, it’s the bank’s advances in digital banking that make it an industry leader. Striving to bring banking to all Ghanaians, Zenith Bank offers services on mobile, online and in branch. Bolstered by cutting-edge technology and a culture of excellence, the bank and its customers are thriving.

www.zenithbank.com.ghJordan

Jordan Islamic Bank

Established in 1978, Jordan Islamic Bank has grown rapidly by offering a broad range of financial services while remaining compliant with Sharia law. Across its 104 branches and offices, the bank shows a willingness to support and finance Jordan’s SME sector, exhibiting a thirst for innovation that its competitors simply cannot match.

www.jordanislamicbank.comLebanon

Bankmed

Bankmed demonstrates an unwavering dedication to its clients by placing them at the heart of all its operations. The bank’s cutting-edge technology allows it to offer customers the personalised services that best meet their needs. Since its inception, Bankmed’s commitment to practising sound corporate governance has enabled it to establish a strong foothold within the Lebanese financial sector.

www.bankmed.com.lbMalaysia

Maybank

Appearing 390th on Forbes’ list of the 2,000 biggest companies in the world – and first among Malaysian companies – Maybank has found success on both the domestic and international stage. Through the bank’s mission to humanise financial services in Asia with fair pricing and ethical operations, Maybank is ensuring the local community prospers too.

www.maybank.comSouth Korea

Woori Bank

In 1899, Emperor Gojong of Korea established Woori Bank using royal funds. The country’s leader stated that the bank’s purpose was to facilitate the flow of funds into Korea and to contribute to the development of the national economy. Nearly 120 years on, the bank continues to honour its original objectives, placing the country’s progress at the forefront of its operations.

eng.wooribank.comKenya

Kenya Commercial Bank

Although Kenya Commercial Bank only became known as such in 1970, it is a financial institution with a long-standing history. Established in 1896 as a branch of the National Bank of India, the bank is now registered as a non-operating holding company. To this day, the group’s values of transparency and sustainability help it expand its presence across East Africa.

www.kcbgroup.comMacau

ICBC (Macau)

The result of a 2009 merger between Seng Heng Bank and ICBC’s Macau branch, ICBC (Macau) is a financial powerhouse in Macau, a special administrative region of China. With a global network at its fingertips and a tendency to adopt the latest technology, ICBC (Macau) continues to outstrip the local competition in terms of funds, bonds and securities investments.

www.icbc.com.cnNigeria

Guaranty Trust Bank

Access to savings, credit, insurance and pensions is growing rapidly in Nigeria, thanks in large part to innovative banking groups such as Guaranty Trust Bank (GTBank). By placing a focus on digital inclusion and the increased presence of mobile banking, GTBank is having a positive impact on the number of people with access to banking services in Africa’s largest economy.

www.gtbank.comTurkey

Akbank

Akbank was founded as a privately owned commercial bank in 1948 with the intention of funding Istanbul’s cotton growers. More than 70 years of experience later and the bank has grown into a network of 840 branches employing 14,000 members of staff. Akbank’s mission is to become the most admired Turkish bank globally – a goal it’s well on its way to achieving.

www.akbank.com

Taking on a new role

Banking groups are tremendously complex organisations, which makes enacting significant change within them a difficult task. This will have to change as new customers, services and technology drive a shift in prioritiesBy their very nature, banking groups are unwieldy creatures, resistant to change. In an industry that is heavily regulated, conglomerates deal with infinitely volatile markets on a remarkably large scale. This means that banking groups as a whole tend to move far slower than other industries. An incentive is often needed to push an organisation to change – whether that’s a looming financial crisis or a crackdown on regulation. But even with these pressures, changes are often made too slowly to avert an impending catastrophe.

With the rapid development of technology, the sluggish pace at which banking groups tend to move is no longer viable. In every field banking groups operate in – be it fund management, insurance or financial planning – the way business is done faces titanic change. A cynical public and favourable regulatory framework have led to the rise of many start-ups in the wake of the global financial crisis, each one nimble and aggressive in a way that banking groups can’t easily match. To survive in this new landscape, banking groups will have to become very different creatures to what they are today.

The most significant change is likely to be in terms of the people who make up the sector’s workforce. For years, the potential benefits of robotic and automated processes have been touted. While many of these reports were overly optimistic, a mix of computing power, reliable and affordable technology, and a multitude of trackable data points has allowed previously far-fetched ideas to become feasible. With many tasks being placed in the hands of robots, the composition of workforces will undergo a fundamental shift.

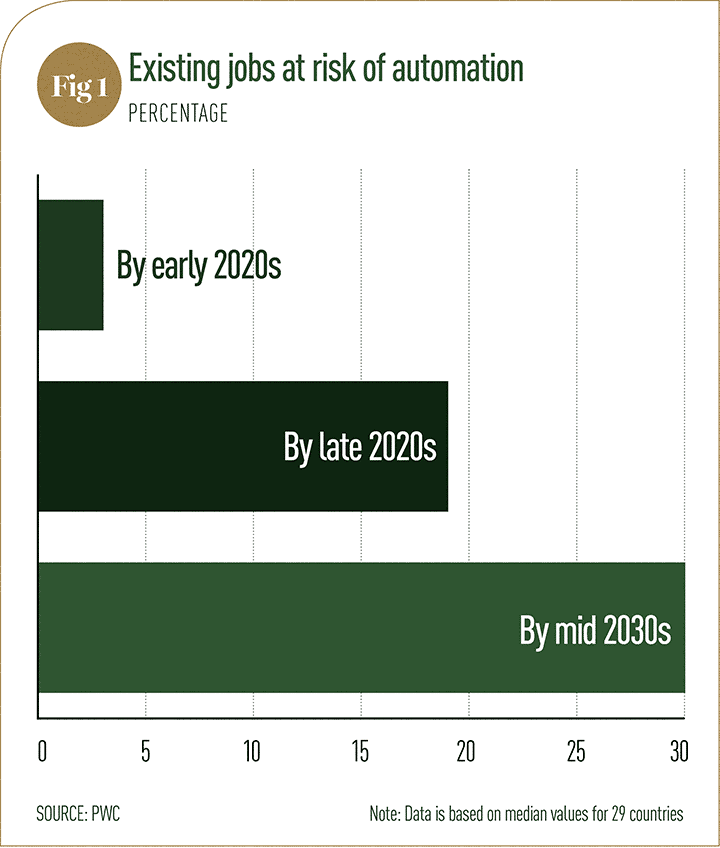

Rise of the machines The impact of robotic automation was underlined by Deloitte’s 2018 Banking Outlook report. The report states that the ongoing development of technology is leading to a more automated workforce, a trend that is only set to continue (see Fig 1).

With more core processes being automated, tasks that require a human touch will vary greatly, demanding that freelancers come and go as necessary. As such, the banking workforce of the future is expected to include a greater proportion of contractors and freelancers, many of whom may work with multiple banks. According to the MIT Sloan Management Review and a global study by Deloitte Digital, 78 percent of banking executives agree that their work is going to change significantly over the next three to five years as a result of digital business trends. To that end, 56 percent of banking executives are taking on projects that require learning new skills, and 60 percent of executives said their organisation is developing new talent by taking advantage of digital opportunities.

For banking groups, technological adoption will manifest in different ways across the business. CEOs will be grappling with how to synergise development across all facets of their banking group for the next year and beyond. The importance of their decisions cannot be understated, as they will likely shape banking groups for the foreseeable future.

Juggling act In terms of banking groups’ retail arms, mobile applications will only continue to grow while brick-and-mortar branches close. According to recent data released by the European Banking Federation, 48,000 bank branches closed in the EU between 2008 and the end of 2016. In 2016 alone, the number of branches fell by 4.6 percent from the previous year. This shift away from physical banks will reduce costs in terms of rent and staff, but will increase expenses in terms of technology development, maintenance and support.

The situation within corporate banking looks quite similar. Deloitte’s 2018 Banking Outlook contends that, with middling demand for loans in the global commercial and industrial market, banks should instead focus on the emerging middle-market loan sector and how digital systems can be beneficial. “Corporate banking groups should ramp up their [digitalisation] efforts, especially in businesses that still heavily rely on manual, paper-based activities,” the report states. By pooling data and offering genuinely useful tools to business customers, banks can provide a differentiated service from competitors, particularly the many fintech start-ups encroaching on the market.

Automation and artificial intelligence will be the driving forces behind both the wealth management and capital market departments of banking groups. Robotic advisory systems are now reaching a level of competency that is making them a necessity for any wealth management or trading platform. In 2018, robo-advisor start-ups Betterment, Ellevest and Wealthfront launched services and products specifically targeted at high-net-worth individuals, rather than the low-stake and novice investors they targeted before. While investors making deposits higher than $100,000 will always demand face-to-face services, the tools that each of these new start-ups provide will no doubt appeal to information-hungry clients. Banking groups will have to be ready to compete with this.

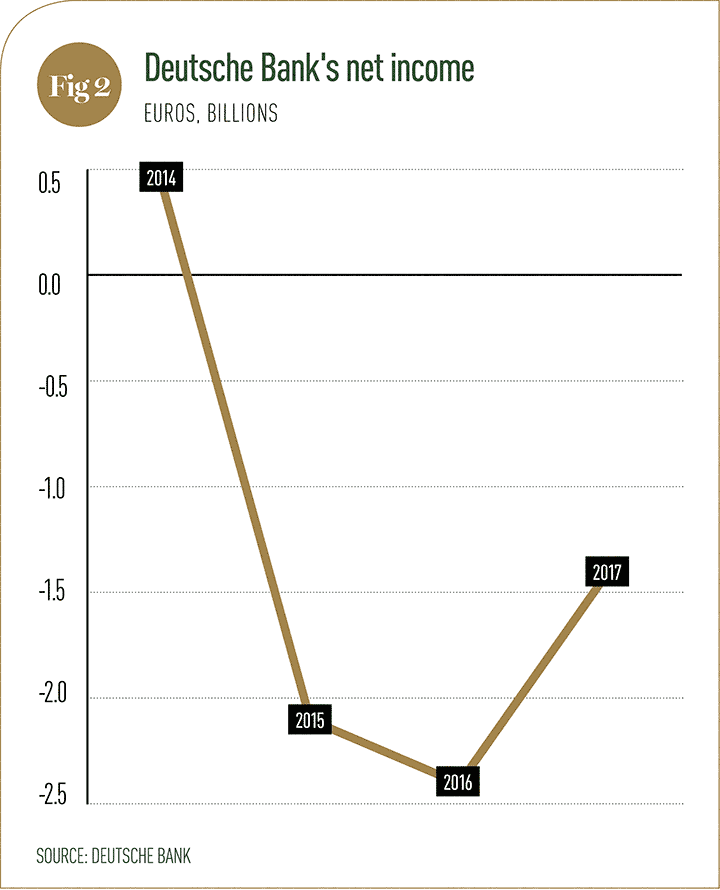

Increasing automation is no easy feat, however. After just three years in the job, former CEO of Deutsche Bank John Cryan was unceremoniously fired in April 2018. Cryan championed automation as the solution to the bank’s financial woes, unveiling a plan to cut as many as 9,000 jobs from the banking group’s workforce. “In our bank, we have people doing work like robots,” Cryan said in September 2017. “Tomorrow we will have robots behaving like people. It doesn’t matter if we as a bank will participate in these changes or not, it is going to happen.” Just a few months later, he was fired, with the bank continuing to struggle financially (see Fig 2). While a greater amount of automation may be inevitable, implementing it is a complex task that is easy to get wrong.

Finding a way to unite the many disparate parts of an organisation as large and complex as a banking group is a challenge. For the organisations that don’t manage to do so, both technology and competitors will leave them behind. Those that do will be rewarded with cost savings and an increase in productivity. Success in digitalisation projects will determine the banking groups that will lead in the future.