Investment Banks

Bahrain

SICO

SICO is a leading regional asset manager, broker and investment bank with more than USD 1.8 bn in assets under management (AUM). Headquartered in the Kingdom of Bahrain with a growing regional and international presence, SICO has a well-established track record as a trusted regional bank offering a comprehensive suite of financial solutions

www.sicobank.comBrazil

BTG Pactual

BTG Pactual is Latin America’s largest investment bank and operates in a wide range of financial sectors. These include investment banking, corporate lending, sales and trading, wealth management, and asset management. Since its inception in 1983, the bank has been run in accordance with a meritocratic partnership model, and currently employs 2,037 staff members.

www.btgpactual.comCanada

RBC

Royal Bank of Canada (RBC) has been a leader in the Canadian investment banking sector ever since its incorporation in 1869. Today, it is one of the country’s largest banks, with more than 81,000 employees and a client base of over 16 million. In May this year, J D Power ranked RBC the highest of Canada’s five biggest banks in terms of customer satisfaction.

www.rbcroyalbank.comChile

BTG Pactual

Recent legislative changes have made Chile a market to watch, with interest rates now at their lowest level since 2010. BTG Pactual has been quick to capitalise on these new investment opportunities, launching Chile’s only two IPOs in 2017. In the coming months, the bank plans to focus on cross-border transactions by expanding its international presence.

www.btgpactual.clColombia

BTG Pactual

Although it only became a member of the group in 2013, the Colombian division of BTG Pactual has found just as much success as the group’s Brazilian flagship. This is largely down to the bank’s array of investment services, each of which is customised specifically to the needs of the client – whether that’s a company, government entity, financial institution, investment fund or individual.

www.btgpactual.com.coDominican Republic

Banreservas

Banreservas puts its people at the heart of everything it does and, in doing so, boasts some of the best talent in the region. Indeed, Banreservas’ highly experienced teams each specialise in specific segments of the investment banking landscape, giving a level of support to the bank’s clients that is unparalleled in the Dominican Republic.

www.banreservas.comFrance

BNP Paribas CIB

As the investment banking subsidiary of one of the world’s largest banking groups, BNP Paribas CIB employs more than 32,000 people across 57 countries. As part of its development plan leading up to the year 2020, the bank has committed to reinventing its investment business in order to provide a seamless digital experience for its customers.

cib.bnpparibas.comGermany

Deutsche Bank

As Christian Sewing begins his tenure as Deutsche Bank’s new CEO, the company faces an array of challenges, including increased regulation and the need to cut costs. Pre-tax profit for 2017 was $1.6bn, however, and the global behemoth has already displayed striking determination in its drive to overcome the adversity it has experienced over the past year.

www.db.comItaly

Mediobanca

Mediobanca’s roots lie in its corporate and investment banking subsidiary, which has grown to become Italy’s leading provider of investment banking solutions. As a result of its expansion initiative, which began in 2004 with the opening of a Paris office, international operations now account for almost half of the division’s income, with further expansion planned for the coming years.

www.mediobanca.comJordan

Arab Bank

Since its conception in 1930, Arab Bank has been recognised around the world as one of the most sophisticated banking institutions and is famed for its commitment to sustainability, excellent customer service and a wide range of financial solutions. Among its key products is the Elite personalised banking service, which gives clients access to investment services, as well as lifestyle benefits.

www.arabbank.joRussia

VTB Capital

As a leader in Russia’s international investment banking sector, VTB Capital has made its mark on the industry through a variety of innovative projects. Since its founding in 2008, the bank has participated in more than 805 equity capital market and debt capital market deals, which have collectively brought over $285bn worth of investments into Russia and the Commonwealth of Independent States.

www.vtbcapital.comKuwait

Boubyan Bank

Established in 2004, Boubyan Bank is one of the most reputable banks in Kuwait, with ample experience dealing in all types of Islamic trading. The bank prides itself on a commitment to truth, transparency and integrity, as well as its social responsibility programme, which saw the bank sponsor and take part in more than 250 different activities between 2009 and 2012.

www.bankboubyan.comNigeria

Coronation Merchant Bank

Founded in 1993, Coronation Merchant Bank has built up expertise in wealth management and investment banking, among other financial domains. The bank prides itself on its local knowledge and innovative solutions to customer needs. Coronation Merchant Bank also encourages its employees to support the bank’s surrounding communities, and hopes to become Africa’s premier investment bank.

www.coronationmb.comOman

Bank Muscat

Oman’s Bank Muscat is leading the way in a number of financial domains, including corporate, retail and investment banking. The bank has a huge network of 149 branches and boasts an extensive set of ATMs across the country. Bank Muscat advises on retail and banking products, as well as running a premier banking service.

www.bankmuscat.comQatar

Qatar National Bank

Headquartered in Doha, Qatar National Bank has become the country’s biggest and most influential financial institution, as well as the largest bank in the MENA region. Founded in 1964, the bank has benefitted from an aggressive expansion policy within its home market and a commitment to high-quality principles and services.

www.qnb.comSaudi Arabia

SaudiMed

As a core member of a multi-sector, geographically diverse conglomerate, SaudiMed is one of the leading boutique investment banks in Saudi Arabia and the wider Middle East region. SaudiMed’s investment banking team has carved a reputation for delivering difficult-to-match competencies and a wide range of financial solutions to both corporate and high-net-worth clients.

www.saudimed.com.saTurkey

Akbank

Akbank was founded as a privately owned commercial bank in 1948 with the intention of funding Istanbul’s cotton growers. More than 70 years of experience later and the bank has grown into a network of 840 branches employing 14,000 members of staff. Akbank’s mission is to become the most admired Turkish bank globally – a goal it’s well on its way to achieving.

www.akbank.comUAE

First Abu Dhabi Bank

Formed as the result of a merger between First Gulf Bank and the National Bank of Abu Dhabi in 2016, First Abu Dhabi Bank currently stands as one of the world’s largest financial institutions, with assets worth $182bn. A formidable player in world banking, First Abu Dhabi Bank is largely driven by its desire to support economic growth in the UAE.www.bankfortheuae.com

www.saudimed.com.saVietnam

MB Securities

Established in 2000, MB Securities (MBS) has garnered a well-deserved reputation for delivering high-quality securities brokerage and investment banking services. In particular, MBS’ advisory team is one of its main strengths, providing professional and independent advice on a number of projects that cover both debt capital market and equity capital market options.

www.mbs.com.vn

Finding the right balance

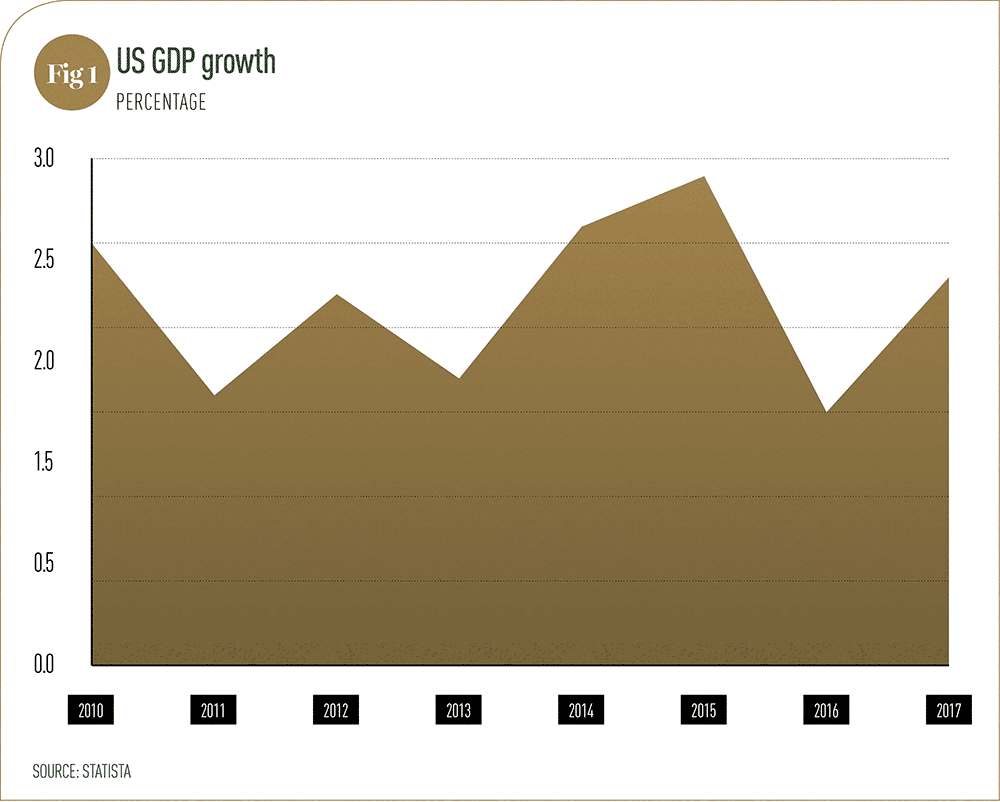

After facing difficulties in 2017, things are looking up for the investment banking sector. But financial institutions won’t be getting carried away, as uncertainty still lies aheadBy and large, 2017 was a good year for the global economy: the US saw growth of 2.3 percent (see Fig 1), a marked improvement when compared with the previous year; the eurozone experienced its fastest rate of expansion in a decade; and global stock markets soared.

However, it was not such a good year for investment banking. Sustained low volatility hit revenues hard, even among the industry’s biggest players, while many banks continued to struggle with internal restructuring and strategic indecision. Revenues for the world’s 12 largest investment banks fell by four percent compared with the previous year, reaching the lowest levels since 2008.

Income from equity trading and fixed income, currencies and commodities was particularly disappointing, with the latter falling by 11 percent during 2017. With profitability proving hard to achieve, banks will have to hope that the investment landscape becomes more favourable, or else find new ways to cut costs. Fortunately, 2018 has already provided grounds for optimism.

Volatility is returning, and a number of expected unicorn IPOs should stimulate increased investment banking activity. With 2018’s positive outlook underpinned by continued global growth, there are certainly plenty of reasons for banks to be bullish. However, with the investment landscape prone to sudden change, they shouldn’t get too carried away.

Reasons to be positive Although for the most part investment banks struggled during 2017, there was one bright spot: equity capital markets (ECM) activity totalled $872.6bn across the year, according to data published by Dealogic; a 20 percent increase compared with 2016. Follow-on offerings were up 13 percent year-on-year, global IPO activity had its strongest 12-month period since 2014, and ECM fees increased by 42 percent.

The ECM boom was largely propelled by robust global growth and record-breaking stock market performances. In the US, the Dow Jones Industrial Average experienced 70 record closes throughout 2017, a feat that hadn’t been achieved in 22 years. In addition, strong performances in Europe, Japan and emerging markets all contributed to a favourable investment landscape. The sustained period of low inflation seen across developed economies has made growth stocks particularly attractive and created a stable corporate environment. With interest rates also low, the temptation to bolster investment portfolios is high. Although loose monetary policy may entice investors to make riskier choices than they otherwise would, for investment banks it is a real boon.

There is evidence that last year’s positive trends will endure in 2018: stock markets are continuing their upward momentum, and consumer confidence remains high. Investment analysts expect these favourable conditions to encourage larger flotations, and – in the US market, at least – investment banks will surely be encouraged by the tax reforms passed by President Donald Trump at the tail end of 2017.

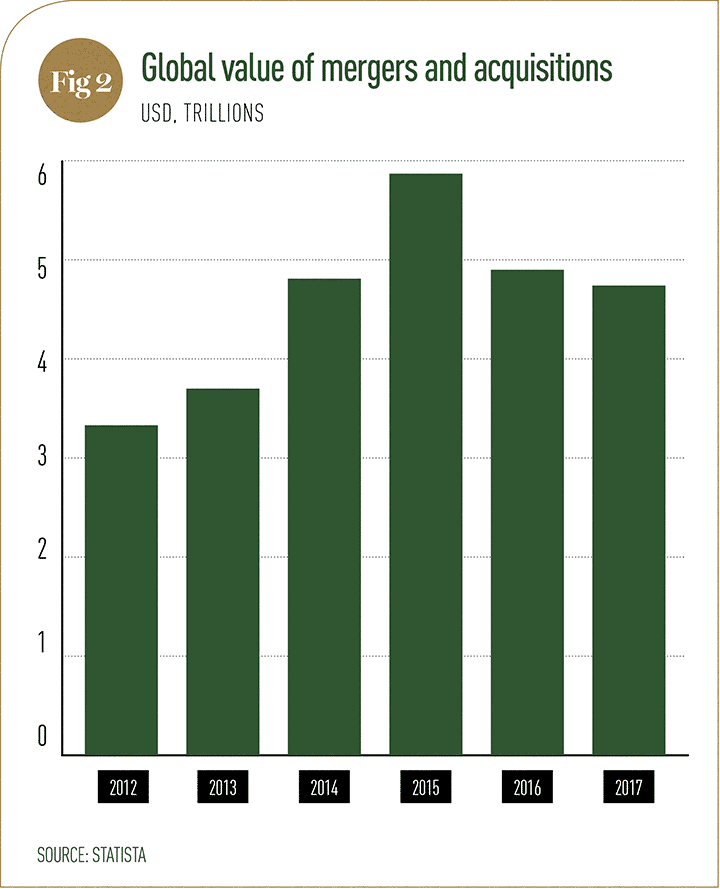

The cautious approach If the strong performance of equity capital markets gave investment banks something to cheer about in 2017, then the year’s disappointing mergers and acquisition figures will have curtailed celebrations somewhat. The global value of mergers and acquisitions fell 5.2 percent to $4.74trn compared with 2016 (see Fig 2). Uncertainty over US economic policy, protracted Brexit negotiations and anxieties over North Korea all helped to reduce the number of deals taking place.

While it is true that mergers and acquisitions did pick up in Q4 of last year – major tie-ups were announced for Cisco-BroadSoft and Apple-Shazam, among others – this has since been tempered by Trump’s increasingly protectionist economic policies. The president’s decision to block the proposed takeover of Qualcomm by Singapore-based rival Broadcom on the grounds of national security concerns back in March will have alarmed many in the investment banking community. Seven banks were supporting Broadcom’s bid, but now they and many others will surely hold a more sceptical outlook concerning international investments.

In addition, the market volatility that returned at the start of 2018 has given financial institutions something to think carefully about. A degree of volatility is certainly welcomed by investment banks as it encourages clients to trade. Too much volatility, however, can have the opposite effect, scaring off investors. When US stocks experienced their biggest single-day fall in more than six years back in February, many investment banks were bullish. This is unlikely to remain the case if this kind of market volatility is sustained over a prolonged period of time.

There are other uncertainties clouding 2018’s investment outlook. In the US, economic question marks surround Jerome Powell, the new chairman at the helm of the Federal Reserve, while November’s midterm elections could scupper Trump’s future policy proposals. What’s more, the lingering threat of a global trade war will have investors – and the banks that support them – concerned, regardless of where they are based.

Investing in innovation If investment banks are to minimise risk while capitalising on favourable economic conditions, then the adoption of new technologies must continue to be prioritised. Investment banks may be more complicated institutions than their high street counterparts, but they remain fully aware of the threat posed by fintech start-ups.

Given that many of the highest profile investment institutions have a long and well-established history, legacy architecture can prove difficult to shift. Nevertheless, recent IT advances are making their presence felt in many banks across the world. JPMorgan Chase, for example, has committed to spending an additional $1.4bn on technology throughout 2018 as it moves to a ‘digital everything’ model. New mobile applications, big data and blockchain solutions are among the main targets for investment.

Other innovations are also being pursued. Robotic process automation (RPA), where software is used to automate repetitive tasks like data entry, is proving increasingly popular in the financial services industry. Estimates indicate that RPA can improve processing speed and efficiency by as much as 80 percent, giving personnel more time to focus on strategic goals.

While 2018 promises to be a more rewarding year for investment banks, it will not be without risk. Technology can help mitigate this risk by limiting human error and providing more accurate insights. Even so, banks will still be tasked with finding the right balance between pursuing short-term profits and achieving long-term sustainability.