Commercial Banks

Azerbaijan

PASHA Bank

Internationally recognised for its work, PASHA Bank is regarded as one of Azerbaijan’s leading commercial banks. With clients operating in diverse sectors, ranging from agriculture to retail, PASHA Bank is helping the country diversify its economy. The bank strives to serve its stakeholders well and is committed to operating both profitably and ethically.

www.pashabank.azBelgium

BNP Paribas Fortis

By providing banking services to a diverse range of clients – from individuals and small companies to global institutions – BNP Paribas Fortis has truly established itself as a pillar of Belgium’s financial sector. The scale of the bank’s success does not, however, stop it from providing each of its customers with tailored solutions and a personal touch.

www.bnpparibasfortis.comDominican Republic

Banreservas

Owned by the national government of the Dominican Republic, Banreservas provides a variety of banking services for individuals, SMEs and corporate institutions. Founded in 1941, the bank made a name for itself by putting its customers first in all of its products and financial solutions. For the past few years, Banreservas has focused on providing services to unbanked members of the public.

www.banreservas.comHungary

ING

Working with a broad customer base, ING provides a range of services to large companies, multinational corporations and financial institutions. The bank’s diverse portfolio of clients has led it to cultivate market-leading expertise in a number of sectors, including energy and cross-border transactions. With so much experience at its disposal, ING is able to support its customers in any financial endeavour.

www.ingwb.comBahrain

Ahli United Bank

Ahli United Bank is one of the most highly regarded financial institutions in Bahrain, with expertise in private banking, wealth management, retail banking and corporate services, among others. Established in 2000, Ahli United Bank has wasted no time in impressing a varied customer base with its high-quality products, winning numerous awards along the way.

www.ahliunited.comCanada

BMO Bank of Montreal

In 1817, nine of Canada’s most prominent business leaders and entrepreneurs came together to establish the Bank of Montreal. Their legacy is now the country’s longest-standing financial institution. Today, more than 200 years after its founding, the bank remains an important fixture of Canadian life, supporting the people and communities it serves.

www.bmo.comUS

Bank of the West

In recent months, Bank of the West has redoubled its efforts to protect its customers from digital threats. From its position in the heart of the tech industry, the bank is able to utilise key market innovations to take a progressive approach to improving cybersecurity within the commercial banking sector. It also participated in a pilot of Zelle, a person-to-person US payments network that enables 86 million users to move funds in minutes.

www.bankofthewest.comGermany

Commerzbank

With one of the densest branch networks among German private banks – and two leading online banks under its umbrella – Commerzbank’s reach is wide and multidimensional. The bank has rebranded several times since it was founded in 1870, demonstrating a willingness to move with the times, while always keeping its customers at the heart of its corporate strategy.

www.commerzbank.deItaly

BNL Gruppo BNP Paribas

Having operated in Italy for more than 40 years, BNL Gruppo BNP Paribas’ presence in the country continues to go from strength to strength. In 2006, it acquired Banco Nazionale del Lavoro, bringing an even greater number of products to its clients, which range from private customers seeking savings advice to companies looking for support with their business strategies.

www.bnpparibas.itKuwait

National Bank of Kuwait

When it was founded in 1952, the National Bank of Kuwait (NBK) became the first national bank both in the country and in the Arabian Gulf region. Since then, it has been dedicated to providing world-class products for its clients and developing talent in the region. While it boasts strong global connections, NBK still prides itself on offering support to local communities.

www.nbk.comMyanmar

KBZ

With a mission to improve the quality of life for all in Myanmar, Kanbawza Bank (KBZ) is certainly aiming high. Headquartered in Yangon, KBZ is Myanmar’s largest privately-owned bank, with more than 500 branches. Today, the bank accounts for approximately 40 percent of the country’s retail and commercial banking markets, and has a growing international presence.

www.kbzbank.comPortugal

ActivoBank

Digital innovation is essential if businesses are to succeed in the modern day. As such, ActivoBank has adapted its strategy to bring online banking to all of its customers. The bank is currently focused on developing its market-leading app, which allows users to open accounts, apply for loans and access mortgage support at the touch of a button.

www.activobank.ptSri Lanka

Sampath Bank

Sampath Bank’s commercial banking arm strives to build long-term partnerships with corporate clients by meeting their needs with customised solutions and expert advisory services. As a staunch supporter of the country’s SME sector, Sampath Bank’s services are geared to help SMEs accelerate their growth and, in turn, encourage economic activity in Sri Lanka.

www.sampath.lkMacau

Banco Nacional Ultramarino

In the early 20th century, Banco Nacional Ultramarino (BNU) became the first commercial bank in Macau. Today, the bank is driven by a desire to contribute to Macau’s financial system by improving its economic development, competitiveness and stability. As one of the region’s key players, BNU strives to support each of its customers with a range of excellent products.

www.bnu.com.moNigeria

Zenith Bank

Through the global financial crisis and other instances of market volatility, Zenith Bank has remained strong and secure. By assessing how its capital requirements will be met and managed, the bank ensures that it is able to uphold consistently excellent service. Zenith Bank has also been integral to the process of bringing digital banking to Nigeria.

www.zenithbank.comSaudi Arabia

Alawwal Bank

Alawwal Bank opened its doors in 1926 and has since become one of Saudi Arabia’s most prominent financial institutions. The bank is dedicated to promoting the kingdom’s economic growth and has experienced solid returns in retail banking. Further, Alawwal has exhibited a staunch commitment to the wider community, launching various initiatives to enhance the skills of young Saudi nationals.

www.alawwalbank.comVietnam

SCB

Saigon Joint Stock Commercial Bank (SCB) was established in 2011 and currently stands as one of the top five leading joint stock commercial banks in Vietnam. The institution has consistently performed well in terms of its financial returns and has earned a reputation around the globe for its excellent services. It’s safe to say SCB’s commitment to customer care knows no bounds.

www.scb.com.vn

Technological evolution

The shifting financial climate has finally made its mark on the commercial banking sector, with the development of new technologies prompting more changes than ever beforeWhile the banking scene has altered drastically in recent years, this transformation has been more evident in some areas than others. Retail banking stands out as an obvious example of the former, with regulatory, technological and structural shifts aplenty. Commercial banking, on the other hand, has had something of a quieter time – until now. Undoubtedly, the onset of new technologies has played a defining role in this evolution, while new regulations are also making their mark on the commercial banking sector.

The first port of call for many institutions is the overhauling of back-end processes. Through digitalisation and automation, commercial banks are beginning to streamline their operations, which, in turn, is enabling them to make better decisions and track performance more effectively. To make this shift possible, collaborations with small fintech firms are increasingly prevalent – especially where client experience is a key focus. Ultimately, 2018 is seeing the commercial banking sector evolve at its fastest rate for many years.

Overhauling the back end Outdated legacy systems and paper-based manual processes are among the biggest challenges facing commercial banks at present, particularly as they limit the ability for such institutions to react swiftly to changing market conditions. Manual systems not only limit development: they are also responsible for higher costs and rates of error, as well as inconsistent results. These are outcomes institutions can ill afford in an increasingly competitive commercial banking space.

Over the past year or so, commercial banks have been making considerable efforts to improve their agility and efficiency in order to counteract such issues. Consequently, by standardising back-end operations, they are able to provide a much faster and smoother experience for their customers. This will be crucial as an increasing number of clients become digitally minded; the demand for immediate answers and real-time solutions across a variety of channels has become more pertinent than ever.

A forward-thinking digital strategy also helps with scaling, which is crucial for banks seeking to expand their product portfolio or market space. Further, as digital processes enable instantaneous documentation exchange and automated credit analysis, savings can be passed onto trade finance and corporate credit clients, affording institutions greater opportunities for expansion.

Unsurprisingly, some of the biggest players in the commercial banking space have already introduced digital solutions to improve processes for corporate clients. In October 2017, for example, Bank of America Merrill Lynch introduced ‘multicurrency netting’, a platform that centralises intercompany payments. Through this tool, multinational corporations are able to reduce both the number and total value of payments that occur between companies that regularly invoice each another, saving time and money.

Going to market Since the global financial crisis, institutions have become more prudent in terms of their lending practices. This shift has been accelerated by new regulations that require banks to maintain less risky balance sheets than those prominent in the days leading to the 2008 collapse. Combined, these trends have left the market ripe for those new players willing to meet the demand for fast and flexible credit.

Consequently, new technology has enabled lending through online marketplaces – or, in other words, data-driven platforms that connect borrowers with lenders and investors. Given the nature of such vehicles, customised requirements come part and parcel, adding further to their popularity. The use of data also enables firms to move from predictive to prescriptive analytics, which, in turn, speeds up the decision-making process. As for the marketplace itself, operations that are run via online platforms do not require the same level of resources in terms of staff and physical infrastructure, helping to improve profit margins. And aside from the obvious benefits – namely speed and effectiveness – Capgemini’s Top-10 Technology Trends in Commercial Banking: 2018 report predicts that the ongoing low-interest environment will encourage institutions to invest more in marketplaces, given the better returns they offer.

Another trend we are now seeing in commercial banking is the change in participants in online marketplaces. While earlier platforms were primarily focused on peer-to-peer lending, today there is far greater institutional participation on both sides of the coin. Further, as described in the Capgemini report: “The scope of loan types has gone beyond personal loans to short and long-term funding of various [business] loans, such as term loans, lines of credit [and] equipment financing loans.”

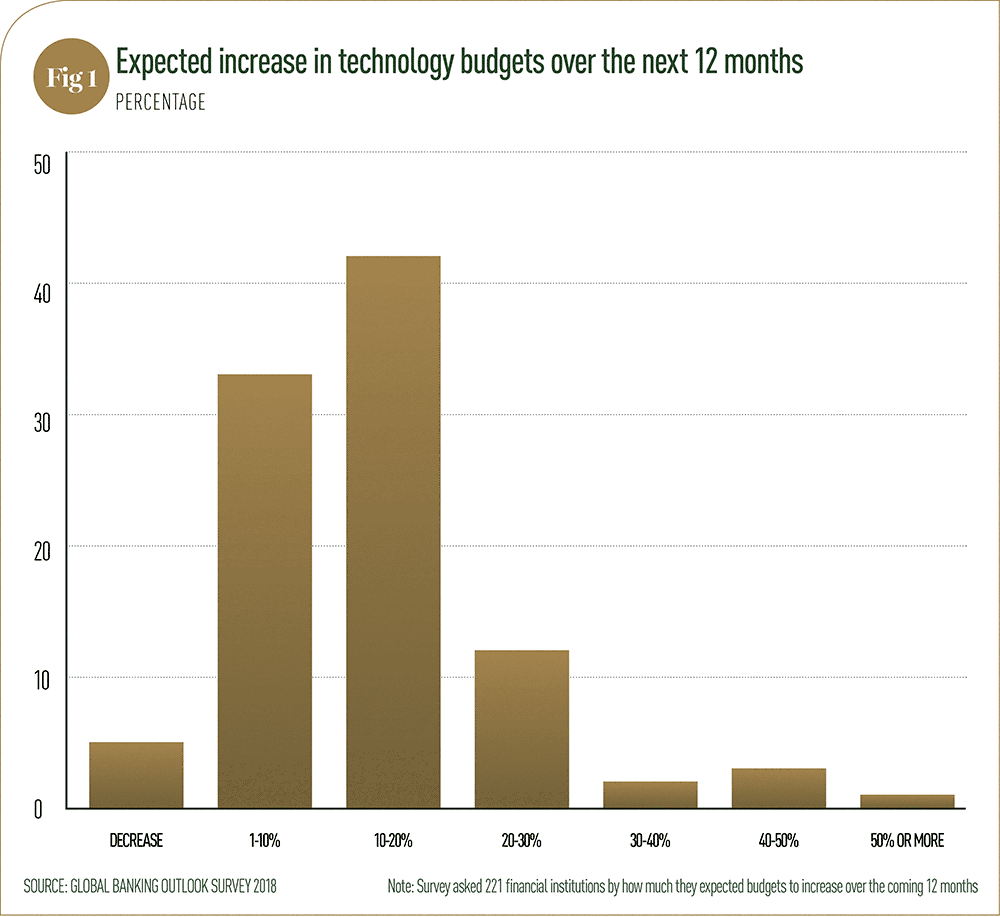

As these changes take place, innovative marketplace firms are continuing to push the envelope, pioneering new credit models that permit automated processing with well-calculated risks. As such, the appeal of using cutting-edge technology to foster greater efficiency and transparency, as well as higher returns, is set to grow exponentially (see Fig 1). Naturally, there are several hurdles to overcome given how new these systems are, but even so, online marketplaces are expected to become well-established players in the coming years.

Blockchain solutions Of the many things to have transpired since the financial crisis, a lack of uniformity and centrality in commercial banking is a feature that has become all too apparent. Specifically, there has never been a single platform upon which all stakeholders can conduct transactions swiftly, conveniently and securely. Given the siloed nature of the banking industry, interinstitutional processes have long been sluggish, expensive and prone to errors. And although considerable resources are spent to meet regulatory requirements, these systems are still vulnerable to fraud and breaches.

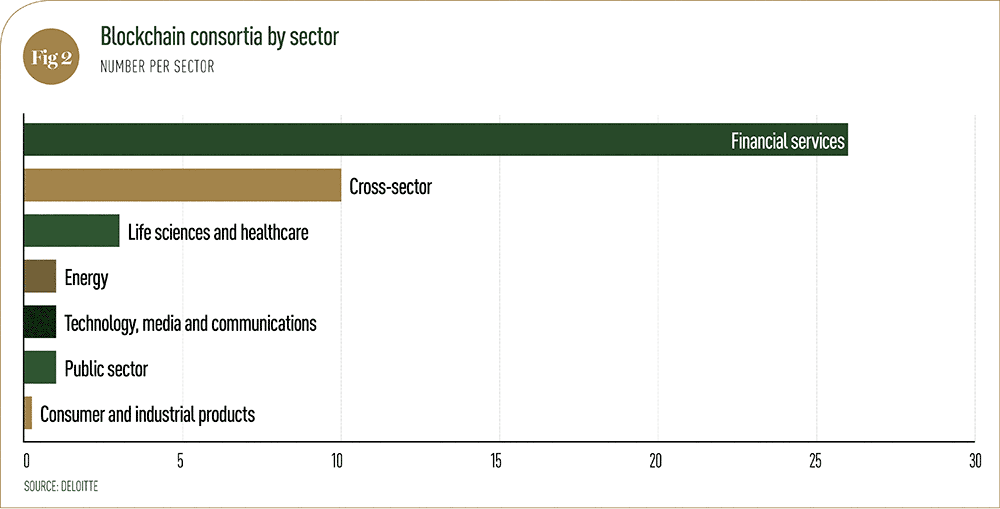

But that was before, and a new era is already underway thanks to one advancement in particular: blockchain. Numerous blockchain consortia now exist (see Fig 2), with hundreds of members between them. This uptake by players both big and small confirms that the advantages offered by the technology simply cannot be ignored, particularly given the ever-pressing need to reduce fraud, costs and communication delays, while simultaneously improving transparency, compliance and trust.

As indicated by the sweeping trends detailed previously, new technology is the biggest driver of the commercial banking sector’s evolution. While changes are already afoot in the sector, we can expect more in the coming years as technology progresses further still. The transformation seen elsewhere in the industry has finally made its way to commercial banking, to the benefit of corporate clients everywhere.