Banking Groups

Australia

Westpac

Established in 1817, Westpac is Australia’s oldest banking institution. In its two centuries of operations, it has maintained its pioneering position by building personal relationships with customers and delivering strong financial results for shareholders. Today, Westpac provides services to more than 13 million customers through its consumer, business, wealth and insurance divisions.

www.westpac.com.auFinland

Nordea

As the largest financial services group in the Nordic region, Nordea aims to make a real difference in the world. The bank has integrated sustainability throughout its operations and processes, becoming a trailblazer for the industry. The firm was one of the first in Europe to offer green loans, which give its customers the chance to finance projects with clear environmental benefits.

www.nordea.fiCyprus

Eurobank Cyprus

Since commencing operations in 2007, Eurobank Cyprus has opened a banking centre in every major city in Cyprus. With highly qualified staff on hand 24/7 and a steadfast focus on relationship management, the bank sets itself apart from the competition. Eurobank Cyprus has also cemented a reputation for excellent corporate governance via its conservative risk approach.

www.eurobank.com.cyfrance

Crédit Mutuel

French cooperative bank Crédit Mutuel is highly regarded for its dedication to customers, as well as its secure services, which have seen it named as one of Europe’s top 50 safest banks in Global Finance’s 2018 index. The bank has gained a reputation worldwide for its expertise in investments, loans and mortgages, as well as its excellent online facilities.

www.creditmutuel.frdominican republic

Banreservas

The Dominican-based group Reservas is composed of AFP Reservas, which offers pensions alternatives, and Seguros Reservas, which provides diverse insurance solutions. Other subsidiaries include Inversiones y Reservas, Fiduciaria Reservas and AFI Reservas, which offer investment, financial solutions and fund management services. The mission of the group is to support the prosperity and wellbeing of Dominicans.

www.banreservas.comCOSTA RICA

BAC Credomatic

Inclusion is at the heart of BAC Credomatic’s mission, both in terms of the banking options it provides and the employment, training and personal development opportunities it affords Costa Ricans. The bank’s commitment to social responsibility, customer service excellence and technological innovation has helped it become the largest financial group in the Central America region.

www.baccredomatic.comCHILE

Banco Internacional

Founded in 1944, Banco Internacional has grown to become a renowned financial institution well regarded for its open and direct style, flexibility, and the outstanding care and attention it gives to each of its clients.

www.bancointernacional.clBRUNEI

Baiduri Bank

Established in 1994, Baiduri Bank is now one of the largest financial services providers in Brunei. It operates across a wide range of areas including corporate banking, consumer financing and securities trading. In recent years, the bank has invested heavily in its technological capacities, providing business tools such as the Baiduri Internet Gateway System, MerchantSuite services and a mobile banking app.

www.baiduri.com.bnspain

Santander Group

Although the Santander Group is headquartered in Spain, the bank has a huge global reach, serving 144 million customers across its 10 main markets. It has become well known for upholding the values of responsible banking, and has worked hard to foster a positive corporate culture – the ‘Santander way’ – by emphasising the importance of respect, collaboration and open dialogue.

www.santander.comRussia

Sovcombank

Since its foundation in 1990, Sovcombank has grown to become one of the largest and most profitable banks in Russia. Across all its divisions, the bank promotes financial inclusion by providing digitally led, cost-efficient services to under-banked individuals and small businesses. Sovcombank is currently focused on incorporating artificial intelligence into its automated processes.

www.sovcombank.comTurkey

Akbank

Turkish institution Akbank is a major success story in the banking sector, largely as a result of its unique ability to anticipate changes and patterns in the market. It has paid particular attention to fintech trends, and with its 2018 application Akbank Direkt Mobile, has implemented user-friendly technology into the heart of its operations.

www.akbank.comNigeria

Guaranty Trust Bank

Guaranty Trust Bank (GTBank) is a multinational financial institution with an asset base of NGN 3.3trn ($9.1bn), more than 12,000 members of staff and business operations across 10 African countries, as well as the UK. Renowned for its innovative financial solutions and world-class corporate governance standards, GTBank has maintained consistent year-on-year growth since its inception in 1990.

www.gtbank.commyanmar

AYA Bank

Since its establishment in 2010, AYA Bank has grown rapidly to become Myanmar’s second-largest financial institution, providing banking services to 1.4 million customers. As a member of the UN Global Compact, it is committed to maintaining high standards of corporate governance and sustainability. AYA Bank continues to adapt to Myanmar’s changing economy by expanding its digital services.

www.ayabank.commacau

ICBC (Macau)

Driven by innovation and technological development, ICBC (Macau) leverages its strengths to provide private banking, pension funds, corporate e-banking, wealth management services and a host of other products and services to its clients. By tailoring its offering to each customer, the bank is able to create unparalleled value for individuals and businesses alike.

www.icbc.com.mojordan

Jordan Islamic Bank

Jordan Islamic Bank offers a wide range of products and services and, since its founding in 1978, has gained a reputation for its commitment to sustainable finance. Among its recent initiatives, it has agreed to build a renewable power station to provide clean energy to its branches, as well as committing to using energy-saving LED units to reduce its consumption.

www.jordanislamicbank.comGHANA

Zenith Bank (Ghana)

Before Zenith Bank (Ghana) was established in 2005, banking options in the country were extremely limited. Zenith has since revolutionised Ghana’s commercial financial landscape, introducing mobile and internet banking for the first time and building a network of strategically located branches. Today, the bank is renowned for its technological prowess and commitment to service excellence.

www.zenithbank.com.gh

Banking hits a digital crossroads

Following a lengthy recovery from the 2008 financial crisis, banking groups are now looking to address the next challenge on the horizon – the digital transformation of the financial landscapeA decade on from the global financial crisis and banking groups have much cause for optimism. Lessons have been learned, and the industry is now more robust and resilient than it has been for years. With greater transparency and better management, banks are enjoying a period of increased stability, boasting healthy profits and returns on equity. Despite this largely positive outlook for banking groups, post-crisis recovery has varied globally, with some regions taking a little longer to regain their financial footing: stringent regulations, tax cuts and prudent policymaking have helped to spur US banking groups forward, while European institutions have recovered at a slower rate.

Having weathered this storm, banking groups are now turning their attention to the next big challenge in their future. From artificial intelligence (AI) to biometric data, technological advances have been reshaping the financial landscape for many years, and the rapid rise of fintech start-ups is propelling the industry towards a digital crossroads. According to a recent survey carried out by Accenture, fintech start-ups now account for 33 percent of global financial services revenue, indicating that these digital-first, non-traditional players are here to stay. As the technological arms race heats up, traditional banking groups simply cannot risk falling behind their younger, tech-fluent counterparts.

A failure to modernise will prove costly, but for forward-thinking banking groups, new technologies also present a lucrative opportunity for growth. This year’s World Finance Banking Group Awards offer an insight into this rapidly evolving industry while celebrating the sector’s most innovative players.

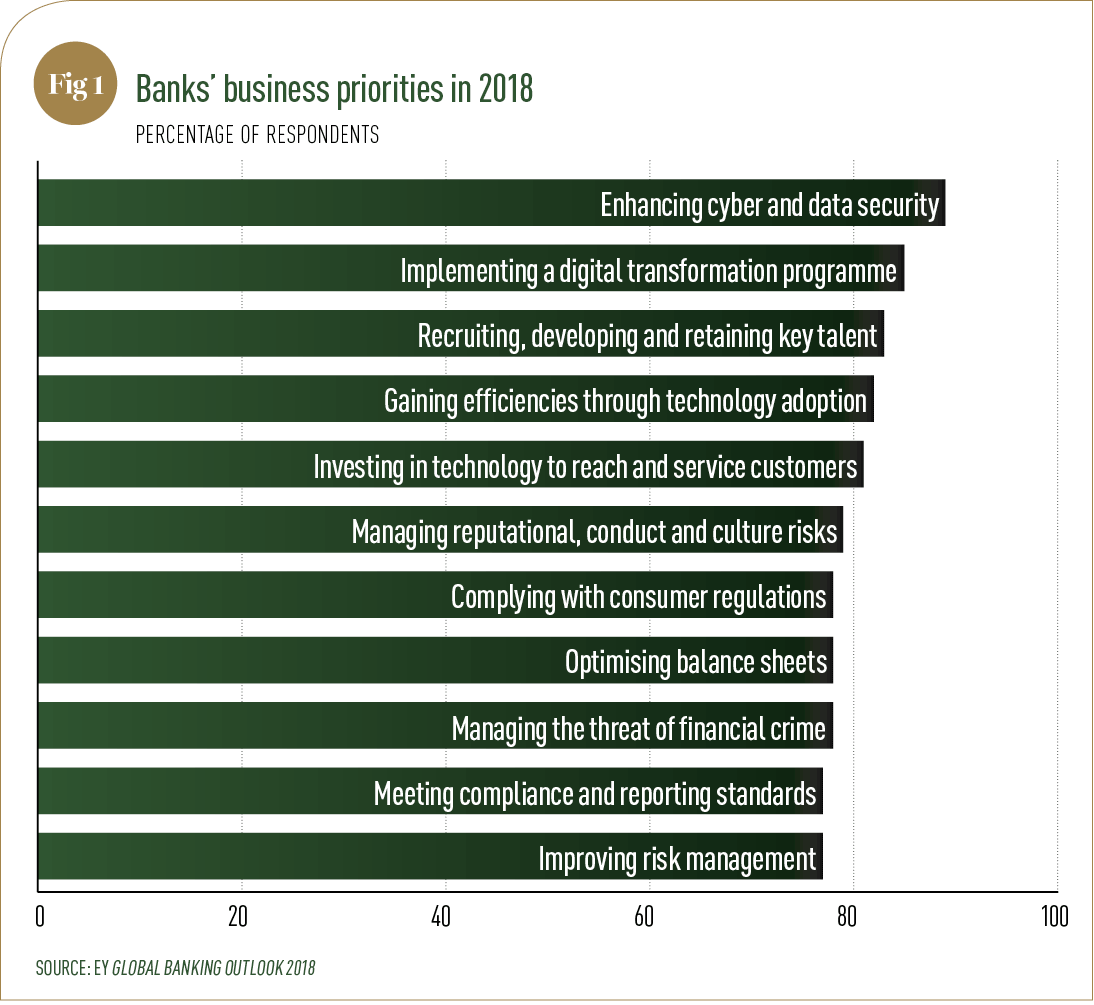

Technological tipping point In order to stay competitive and profitable in the digital age, banking groups must put technological innovation at the heart of their operations. According to EY’s Global Banking Outlook 2018, 85 percent of banks around the world cited ‘implementation of a digital transformation programme’ as a business priority last year (see Fig 1), demonstrating an industry-wide awareness of the importance of technological expansion. Increasingly, as fintech start-ups expand their foothold in the financial services sector, banking groups have accepted that their future digital strategy might involve collaborating with their fintech peers. Rather than attempting to keep up with their digitally innovative competitors – or, worse, investing heavily in risky new technologies – many banking groups are now forming strategic partnerships with digital upstarts, non-banks and other payment platforms.

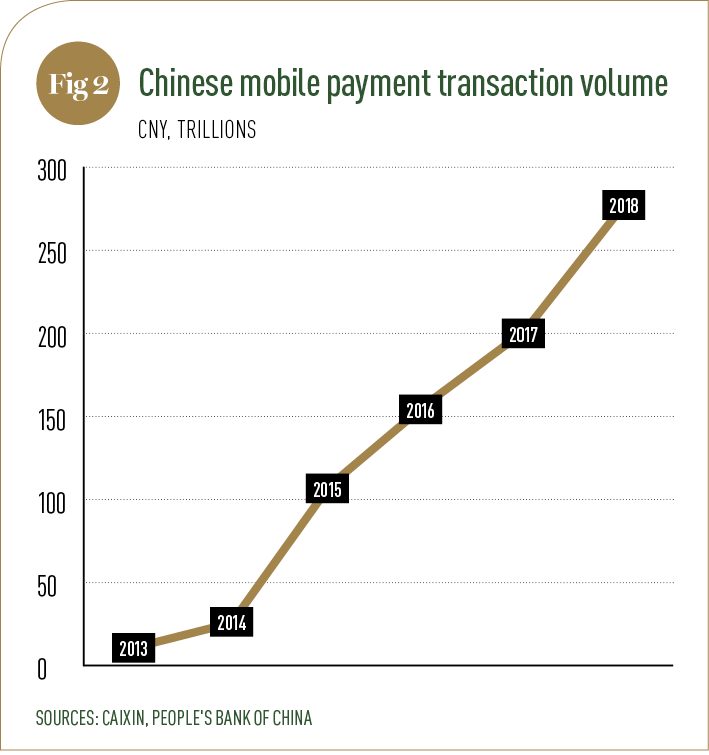

In April 2019, China’s state-owned China Construction Bank and the Hong-Kong-listed Bank of Gansu announced their partnership with tech giant Tencent. Rival firm Ant Financial has also signed deals with several leading Chinese banks, including a 2017 partnership with China Construction Bank to improve online credit card insurance. With the mobile payments market having boomed since 2013 (see Fig 2) and fintech titans Alipay and WeChat Pay each boasting more than one billion regular mobile payment users, China’s banking groups have shown great prudence in opting for collaboration over competition.

As fintech continues to disrupt traditional banking markets across the globe, we are likely to see similar partnerships emerging between banks and fintech start-ups in the coming months. By working alongside tech-savvy upstarts, banking groups will be able to better address their own technological needs, in addition to expanding their digital portfolios and bringing on board the very best products and services.

Whether through external partnerships or internal innovation, banking groups must prioritise data management as part of their digital transformation. Effective data management helps banking groups better understand and serve their clients by using extensive analytics to develop personalised offerings that enhance the customer experience in every area of operations – be it fund management, financial planning or insurance. It is therefore only through efficient data analysis that banking groups will experience the greatest return on their digital investments, making data management a priority for any forward-thinking financial institution.

Cyber risks But with countless banking groups investing in new technologies, the issue of cybersecurity must be addressed. Digital transformations of financial institutions can certainly deliver ample benefits, but they can also introduce new vulnerabilities and security risks. As such, banking groups are walking a tightrope – they must harness data and use it effectively, but they must also ensure privacy and security for customers.

In May 2018, EU policymakers ushered in a new era for data privacy with the introduction of the EU General Data Protection Regulation. In response to this sweeping piece of legislation, banks across Europe have updated their privacy policies and are reassessing how they use and store their customers’ personal data. However, as customers become more aware of data protection and privacy issues, meeting compliance requirements is simply not enough for banking groups. Instead, they must comprehensively reassess how they are gathering, processing and sharing clients’ data, and strike a balance between technological innovation and security. What’s more, with the proliferation of new technologies such as AI and biometric identification, the issue of privacy is only set to become more complex.

In order to alleviate customer fears over privacy issues, banking groups must put cybersecurity at the heart of their businesses going forward. Risk management is essential for emerging areas such as AI and algorithms, and banks must ensure that any early threats are detected and dealt with effectively during the design stage. However, while new technologies can potentially introduce their own security risks, they can also be used to identify issues in other areas, such as financial crime and money laundering. By employing advanced technologies such as robotics, AI and machine learning, banking groups can more effectively manage risks in these crucial areas.

As banking groups modernise and evolve, their successes will be largely defined by their digital strategies. The top banking groups in this year’s World Finance Banking Awards are innovators in their industry and are helping to drive the sector towards an exciting future.