Private Banks

Belgium

ABN AMRO

With a belief that private banking is built on long-term relationships and mutual trust, ABN AMRO works hard to engage with its clients’ changing needs. Its wealth management professionals supply innovative financial solutions, agile services and prudent risk management, while a multi-domestic banking model lets the bank combine an international presence with involvement in the local community.

www.abnamro.beLiechtenstein

Kaiser Partner

Kaiser Partner is one of Europe’s leading wealth advisory groups, with roots that go back to 1931. Based in Vaduz, the capital of Liechtenstein, the organisation offers its expertise to individuals, their families and associates on how to protect and grow their wealth. Kaiser Partner has clients in more than 20 countries, around 200 employees and $25bn of assets under administration.

www.kaiserpartner.comItaly

BNL-BNP Paribas

With over a century’s experience of the Italian banking sector and impressive global knowledge that comes from its parent group’s presence in 72 countries, BNL-BNP Paribas is able to provide a truly tailor-made service to its clients. BNL’s private banking arm manages assets in a unique 360-degree manner, covering the customer’s personal, professional and family needs.

www.bnpparibas.itgreece

Eurobank

The Eurobank Group is active in six countries and offers a comprehensive range of financial products. With specialised business centres and award-winning electronic channels, its philosophy focuses on high-quality service. The group holds a strategic position in retail and business banking in Bulgaria and Serbia, and offers distinguished wealth management services in Cyprus, Luxembourg and London.

www.eurobank.grfrance

BNP Paribas Banque Privée

BNP Paribas Banque Privée is the number one private bank in France, with €98bn ($109bn) of assets under management. Its international network, BNP Paribas Wealth Management, is a leading global bank and the largest private bank in the eurozone. With a presence in Europe, Asia and the US, the bank engages in corporate philanthropy, supporting the arts and environmental initiatives.

www.mabanqueprivee.bnpparibasCzech republic

Česká Spořitelna

Česká Spořitelna is on a mission to lead society to prosperity. It believes it can do this by empowering businesses and individuals with the best financial tools. The bank offers loans, mortgages and investment advice, as well as providing products and services to SMEs and large corporations. As a result of its wide scope, Česká Spořitelna is particularly highly regarded in the Czech banking market.

www.csas.czCanada

BMO Private Wealth

BMO Private Banking and BMO Nesbitt Burns have come together to become BMO Private Wealth. Professionals from one of North America’s leading full-service investment firms and World Finance’s Best Private Bank, Canada, are now one team, committed to helping clients navigate the complex process of managing their wealth.

www.bmo.com/privatebankingbrazil

BTG Pactual

Brazil’s BTG Pactual provides a variety of services across the investment banking and asset management sectors. Based in Rio de Janeiro, it has become the largest investment bank in Latin America, as well as the country’s sixth-largest bank. Its executive team prides itself on integrity and commitment to customer needs. For its strong performance, BTG Pactual has won a series of awards.

www.btgpactual.comSingapore

DBS Private Banking

DBS Private Banking is known for its cutting-edge work in the digital banking space. With its iWealth platform, customers can trade equities and invest in funds directly through an app using a personalised profile. A new robo-advisory service is also helping to automate banking processes. Since it was founded 50 years ago, DBS has set the agenda for the banking industry throughout Asia.

www.dbs.com.sgThe Netherlands

Triodos Bank

Since its founding in 1980, Triodos Bank has worked to show that banks can be champions of social responsibility by providing customers with sustainable financial products. Triodos argues that any amount of money can be used to drive positive change in society and the environment. The bank has more than 700,000 customers, and in 2018 it charted a 17 percent rise in sustainable lending.

www.triodos.comPoland

BNP Paribas Bank Polska

BNP Paribas Bank Polska provides a comprehensive offering to its private banking clients, protecting and growing their wealth through an array of investment and advisory services, including asset management, property planning and tax advice. The bank’s mission is to offer responsible financial solutions to support clients and the local economy alike.

www.bnpparibas.plUAE

Julius Bär

When it was founded in the 1890s, Julius Bär positioned trustworthiness and integrity as the most important aspects of its corporate philosophy. These values are just as important today. The bank continues to place its clients at the centre of every business decision, using established networks, tools, expertise and solutions to help customers meet their personal and financial goals.

www.juliusbaer.comNigeria

First Bank of Nigeria

As one of Nigeria’s premier banking brands, First Bank of Nigeria provides a comprehensive range of financial services, including personalised private banking solutions. The bank’s aim is to create new growth opportunities for its clients across both local and international markets. It is also making use of technological developments to further enhance its offering.

www.firstbanknigeria.comSweden

Carnegie Private Banking

Carnegie has a history that stretches as far back as 1803, making it one of the oldest banks in Sweden. Of particular note is its private banking arm, which prides itself on providing some of the most attractive offers in the local market. Carnegie achieves this by hiring the brightest talent in the area: with an expert team on hand, the bank is able to always maintain a sharp focus.

www.carnegie.seTurkey

TEB Private Banking

Through its variety of products and services, TEB Private Banking has been creating longstanding relationships based on mutual loyalty since 1989. The bank offers investment alternatives that can be tailored to match customers’ risk preferences, assets and savings. TEB’s client-centric business structure has made it a role model within the Turkish private banking sector.

www.tebozel.comMonaco

CMB

Created in 1976, Compagnie Monégasque de Banque (CMB) is one of Monaco’s finest institutions, regarded for its tailored approach to clients. It has three core areas to its business – private banking, investment management and financing – and is renowned for its first-rate customer care, as well as for actively promoting the professional development of its employees.

www.cmb.mc

Changing customer expectations

Thanks to shifting demographics and technological advancements, private banking clients are more discerning than ever. As they are also more likely to switch providers, private banks must enhance the value they offerThe past few years have been characterised by a multitude of changes in the private banking and wealth management industries. Of particular note are the demographics of investors, ranging from older cohorts to women to Millennials. Meanwhile, a shift in global wealth – from North America to the Asia-Pacific region – has also been witnessed. In this period of transition, private banking firms must remain mindful of emerging trends in order to capitalise on market opportunities as they appear.

Thanks to new technologies, innovative business models and disruptive players, consumer behaviour has transformed. People have changed how they shop, what drives their decision-making and, ultimately, what they buy. Consequently, more clients are now willing to increase their spending on financial services and advice. That said, what they value most within this area continues to evolve to this day.

As established organisations and innovative new entrants alike navigate these changes, there are numerous challenges to overcome. In 2019, some industry players stand out for their ability to adapt and advance as quickly as the market demands. We celebrate the private banking firms that continue their operations with such a forward-thinking approach in this year’s World Finance Banking Awards.

Seeking greater value Clients are the heart of the private banking industry, but with their preferences and needs changing so quickly, it’s more important than ever for wealth managers to be proactive and pre-empt clients’ evolving demands. This is particularly vital with so many disruptive new players in the market, including those of the big tech variety.

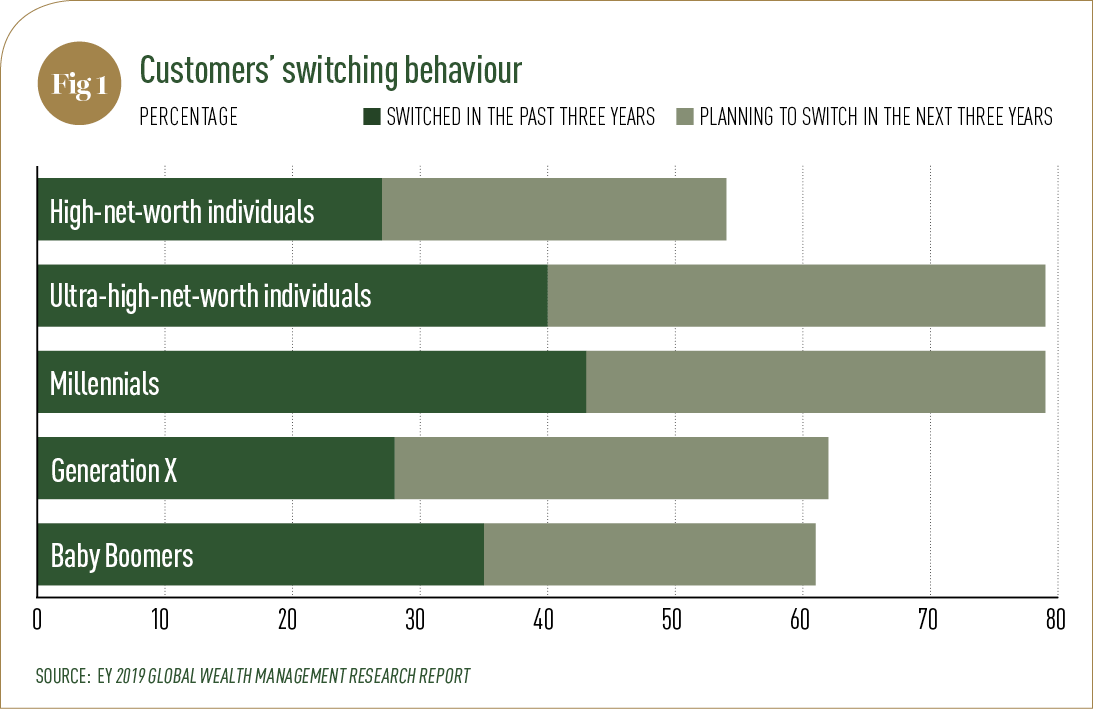

As a result, clients are now more inclined to switch providers in order to better suit their preferences and capture greater value. This is especially the case during important milestones in their lives and as their wealth increases, as clients feel more secure in switching. The 2019 Global Wealth Management Research Report by EY said of this: “The increasing digitalisation of wealth management activities and the rise of self-service offerings have made clients more empowered and willing to switch providers or shift assets for value.”

According to the report, around one third of clients are planning to switch wealth management providers in the next three years. This behaviour is most common among the youngest and wealthiest private banking clients: ultra-high-net-worth (UHNW) individuals are the most likely to make a switch, with 39 percent saying they plan to move during this time frame (see Fig 1). Furthermore, Millennials are considerably more likely to change providers than Generation X or Baby Boomers.

In their search for a better deal, more clients are forming relationships with multiple wealth management providers. By doing so, they are able to identify suppliers that can help them fulfil specific needs. Today’s private banking client is also more likely to experiment with different products from different providers in order to seek the most value overall – this has resulted in the average client now maintaining relationships with around five different types of private banking providers. Again, UHNW clients are the most likely to split their assets among a larger number of providers.

A Millennial, for example, may have a current account with one bank that offers no fees, a brokerage with an online provider that offers the most convenience, a savings account with another financial institution that offers high yields, a retirement account with a full-service bank, and a series of micro-investments with a nimble fintech firm. Wealth managers are thus charged with the mission of balancing these diverse interests with their clients’ needs. By educating – and thereby empowering – them, private banks can build greater trust and play a bigger role in managing their clients’ wealth.

The rise of chatbots Clients today want more help and advice regarding their wealth planning. At the same time, they also want personalised and connected solutions, which they value far more than generic products and services.

In the current technological age, it is no surprise that cutting-edge tools play an increasingly important role in providing a bespoke, seamless experience. One way to stay ahead, according to Capgemini’s Top-10 Trends in Wealth Management: 2019, is to use client data to capture “deep customer insights”. In doing so, private banking players can identify key demands and change their services to align with them.

Meanwhile, Deloitte’s Innovation in Private Banking and Wealth Management report states that the majority of wealth management clients prefer digital channels for communication when it comes to simple transactions, with 58 percent preferring mobile technologies in particular.

Clients are also beginning to show a preference for voice-enabled assistants, or chatbots, when it comes to receiving financial advice. This is due to the immediate and user-friendly nature of such interactions. Thanks to the advancing sophistication of machine learning technology, chatbots are becoming increasingly effective at answering queries, placing orders, monitoring transactions and performing screening functions. This additional support is helping human advisors become more efficient in their daily work, while also allowing them to spend more time with their clients.

In light of this current trend and the upward trajectory it exhibits, it is important for private banks to reconsider how they plan to interact with their clients in future. As noted in EY’s report: “This may mean reallocating budgets from websites to voice-enabled tools sooner rather than later.”

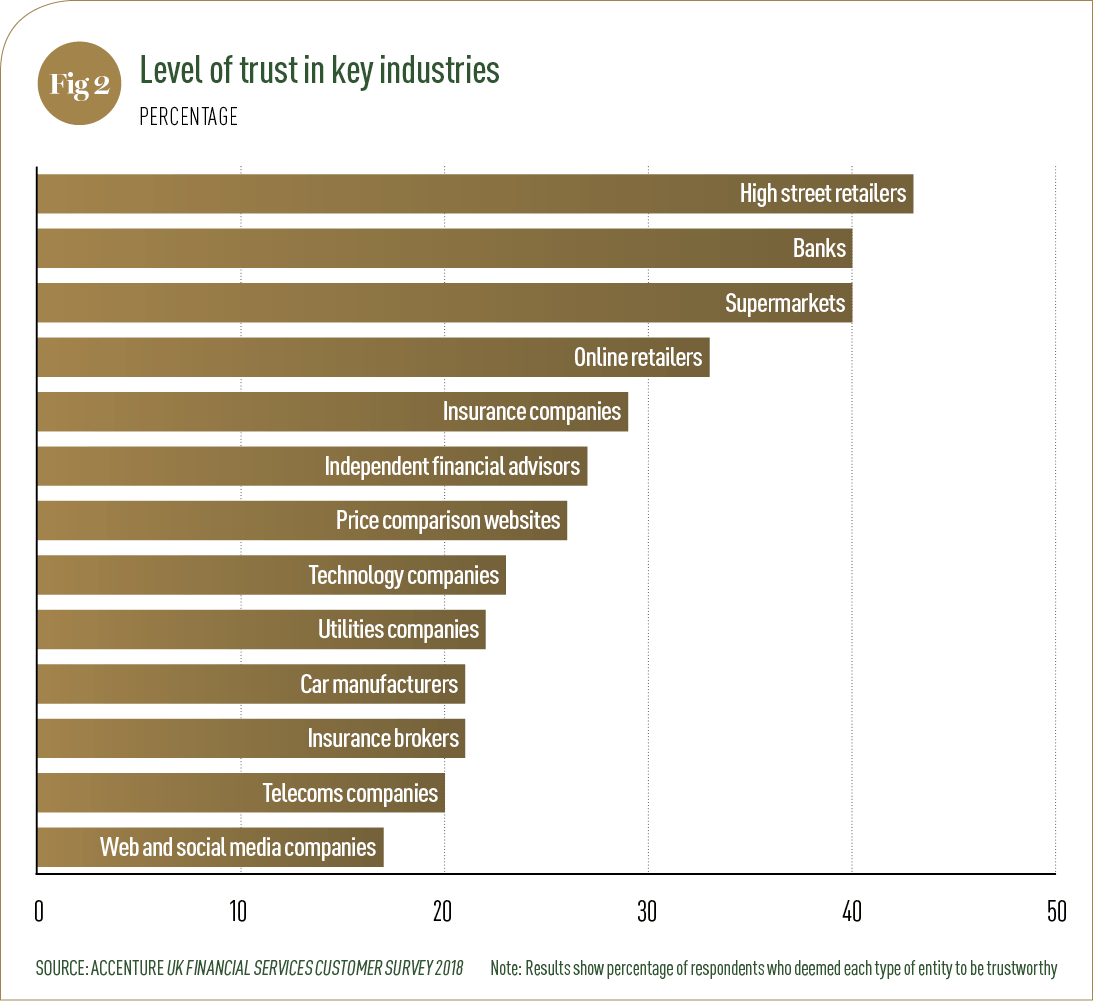

In order to hold on to current clients – a tricky feat, given the low levels of consumer trust and loyalty across multiple industries (see Fig 2) – while also attracting increasingly discerning new customers, wealth managers must make a hoard of changes. But through a better understanding of what today’s clients value most, private banks can offer more effective financial advice, and in turn cement their place in an increasingly competitive marketplace. The World Finance Banking Awards highlight the private banks that are doing just that – taking a proactive, forward-thinking approach that prizes customer satisfaction above all else.