Retail Banks

Kenya

KCB Bank

KCB Bank is a part of the Nairobi-based KCB Group, which is the largest financial services organisation in East Africa in terms of assets. Although the group’s roots stretch back more than 120 years, big changes have occurred in just the past few, including advances in mobile banking, a comprehensive expansion strategy and a rapid uptake of new customers.

www.kcbbank.comAustria

BAWAG Group

BAWAG Group is one of Austria’s largest retail banks, with more than 2.5 million customers. The group operates several subsidiaries, including Easybank and Südwestbank. Easybank aims to provide a simple and transparent service in current accounts, savings products and credit cards, while Stuttgart-based Südwestbank is one of the top regional banks in Germany.

www.bawaggroup.comBulgaria

Postbank

Innovation is a key focus for Postbank, Bulgaria’s fifth-largest bank in terms of assets. The company, which is a member of the Eurobank Group, is helping to drive the country’s banking sector towards a new future. In addition to its network of branches, Postbank offers modern alternative banking channels: e-Postbank, for instance, gives customers a convenient way to manage their money online.

www.postbank.bgFrance

BNP Paribas

By offering its customers a wide array of financial solutions, BNP Paribas has earned a reputation as one of the best retail banks in France. This status is maintained thanks to its steadfast commitment to digitalisation: through its progressive strategy, the bank continues to introduce the most cutting-edge tools to ensure its customers receive convenience and support 24/7.

group.bnpparibasGermany

Commerzbank

Commerzbank’s strong brand identity rests on its promise of fairness and competence, as well as its commitment to encouraging health and sport initiatives, something best demonstrated by its official sponsorship of the 2019 Women’s World Cup. The bank is a firm favourite in Germany, thanks to its comprehensive portfolio of services and prolific branch network.

www.commerzbank.deChile

Banco Bci

Founded in 1937 and headquartered in Santiago, Banco Bci provides an impressive selection of retail banking products and services. Its stellar reputation is rooted in its never-ending mission to promote greater transparency within Chile’s finance industry. Meanwhile, its commitment to a variety of green initiatives says a great deal about its forward-thinking sustainable strategy.

www.bci.clgreece

Eurobank

Eurobank has become a leading institution in the banking sector, boasting branches in Greece, Cyprus, Luxembourg and the UK, among other countries. It is renowned for its expertise in retail banking, as well as its commitment to fintech: its executives have recently set up an Innovation Centre to bolster the bank’s digital capacities and enhance the customer experience.

www.eurobank.grdominican republic

Banreservas

Banreservas has shaped the financial landscape in the Dominican Republic by providing a wide range of financial services, including commercial and corporate banking, investment banking, brokerage services, and pension management. As the only financial institution that covers all Dominican provinces through 301 points of attention and 1,502 ATMs, Banreservas has the largest network in the country.

www.banreservas.comMexico

Citibanamex

Formed by Citigroup’s purchase of the Banamex Financial Group in 2001, Citibanamex boasts 23 million clients and a host of top-rated card services. Parent company Citi’s recent drive to boost investments in its Mexican subsidiary has paid off; the bank’s newly launched mobile redesign gives customers improved access to their bank accounts along with dozens of new features.

www.banamex.comPortugal

Santander Portugal

Santander is the largest privately owned bank in Portugal in terms of domestic assets and lending, with market shares of around 18.3 percent in loans and 15.6 percent in deposits. The bank is focused on maximising the customer experience through innovative products and digital services – a strategy that resulted in an increase in customer numbers in 2018, as well as a 14.6 percent rise in net income to €500m ($558m).

www.santander.ptPoland

mBank

MBank made history as Poland’s first fully internet-based bank. Today, it continues to break the mould by charging ahead with the very latest developments in mobile and online banking. In order to maintain this leading position, mBank is focused on helping its retail customers by enhancing mobility, practising empathy and ensuring its resources are managed with efficiency.

www.mbank.plVietnam

Saigon Commercial Bank

Saigon Commercial Bank’s continued dedication to providing sustainable value for customers has led to a strong reputation for going that extra mile, building strong relationships and delivering a solution that is best suited to the needs of its customers.

www.scb.com.vnTurkey

Garanti Bank

Garanti Bank began operating back in 1946. Today it’s the second-largest private bank in Turkey, with consolidated assets of around $84.3bn and more than 5,000 ATMs throughout the country. The bank prides itself on being a frontrunner in the market in terms of innovation: this is best demonstrated with the seamless omnichannel experience it offers to its 15.8 million customers.

www.garanti.com.trMyanmar

AYA Bank

AYA Bank has grown to become one of the biggest banks in Myanmar since its establishment in 2010. As of January 2019, it runs more than 240 branches throughout the country, offering a wide range of retail products to customers far and wide. AYA Bank is a proud member of the UN Global Compact, demonstrating its commitment to best practices in corporate governance.

www.ayabank.comnigeria

Guaranty Trust Bank

Guaranty Trust Bank (GTBank), one of the most respected banks in Nigeria, has won the Nigerian Stock Exchange President’s Merit Award on numerous occasions. Its board is committed to social responsibility, having embedded a robust code of corporate governance into the bank’s framework. GTBank also encourages transparency and open discourse among its employees at all times.

www.gtbank.comsri lanka

Sampath Bank

In addition to providing a large number of financial products and services, including loans, credit cards and corporate finance, Sampath Bank has injected considerable investment into technology in recent years. Its SMS banking allows customers to bank on their mobile phones, while the Sampath Mobile Cash app enables people to send money to anyone in Sri Lanka through their smartphone.

www.sampath.lk

Fintech rocks the banking sector

Competition in the retail banking industry is heating up, with technology firms offering new options for financial services. In the year ahead, digital innovation and customer experience will be critical to successOver the past decade, huge changes have swept through the retail banking industry. In the aftermath of the 2008 global financial crisis, regulatory standards were bolstered, while innovative fintech companies introduced customers to an entirely new way of banking.

Today, the economic outlook for the sector is promising. According to Deloitte’s 2019 Banking Industry Outlook, retail banks’ net interest margin and loan growth rate both rose across all regions in the first half of 2018, with the industry’s total net interest margin reaching its highest level in four years. As ever, advances in technology are pushing retail banks to provide more – and better – products and services to their customers, with artificial intelligence (AI), machine learning and blockchain technology all helping banks boost their efficiencies. However, alongside this increase in technology comes a rise in cybersecurity threats.

Now, disruptive fintech and non-bank technology firms are widening the gulf between rapidly growing, innovative companies and ageing legacy giants. Faced with more options, customers’ expectations are higher than ever.

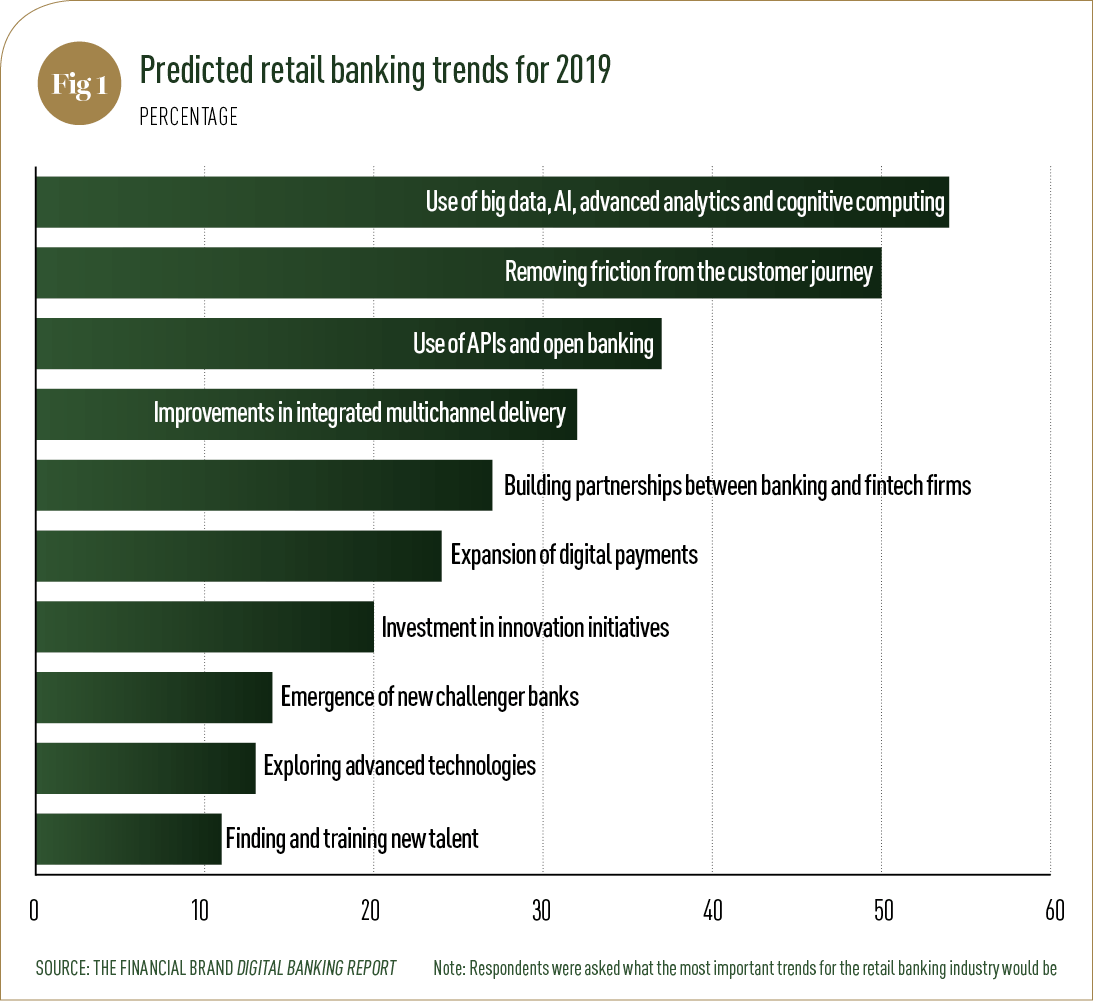

Make or break The continued digitalisation of the retail banking sector will be a major driving force of change in the year ahead. In a survey for its latest Digital Banking Report, the Financial Brand found that more than half of respondents ranked the use of big data, AI, advanced analytics and cognitive computing as the top trend for 2019 (see Fig 1). The survey also said bankers’ views on the importance of innovation had “far exceeded what was projected” in 2018.

But although the industry understands how disruptive new technologies will continue to be, many firms have been slow to act. Today, adopting digital technology is no longer a mere option – it’s a necessity. In fact, as tech giants such as Amazon, Google and Alibaba enter the financial services industry, the implementation of innovative technologies could make or break an incumbent bank.

Research by Capgemini found that low regulatory hurdles have attracted tech giants to the payments market, where they can offer convenient services to their huge customer bases. Capgemini noted that these companies’ offerings were “not necessarily meant to replicate banking offerings” – instead, they are “designing value propositions that often eliminate the need for standard banking products”.

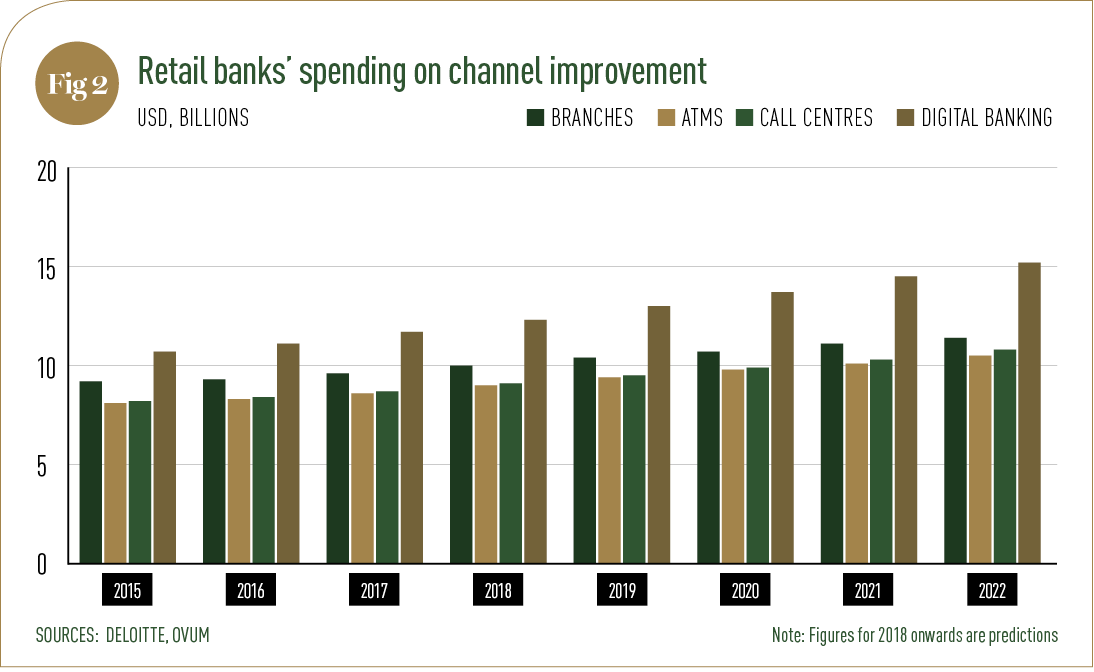

These companies also pose a threat to traditional banks due to their excellence in customer service, which is raising the bar for banks. In a recent global survey, Deloitte found that banking consumers had a stronger emotional connection to technology brands such as Apple, Amazon and Google than they did to their banks. With many incumbent banks struggling to reconcile the merging of digital services with physical branches (see Fig 2), Deloitte suggested they could learn something from the way big tech firms “blend experiences from the physical and digital worlds”. This may result in more retail banks seeking a slice of the fintech market by launching their own digital banks or forging partnerships with established companies.

Legacy banks can also improve the customer experience by utilising an incredibly powerful tool: data. By collecting and evaluating data from consumers, banks can offer personalised products and services that capitalise on new insights. However, banks must consider new regulations establishing data protection rights, such as the EU General Data Protection Regulation or California’s Consumer Privacy Act, 2018, which are likely to become more widespread. At the same time, increasingly common open banking measures are complicating matters by requiring banks to make customer data accessible by third-party companies in order to boost innovation.

Prioritising resilience As technology reshapes the retail banking industry, it is more important than ever that institutions manage security threats and keep their core systems up to date. Legacy infrastructure has long been an issue for the industry, but as new technology is implemented, Deloitte said: “[Relying] on a patchwork of archaic systems can pose significant risk.”

Modernising core infrastructure is now a large part of the banking sector’s overarching digital transformation. Without a robust system, banks will struggle to successfully implement new technologies such as AI, blockchain and – eventually – quantum computing. As such, this will remain a big focus in 2019.

Several banks are ahead of the game, having already embarked on modernisation plans or reduced their reliance on legacy systems. Don Bergal, Chief Marketing Officer at Avoka (now Temenos), told the Financial Brand: “What started as a trickle last year will become a steady stream, as banks of all sizes announce they are ripping out their 25-year-old core systems in a continued effort to become more modern, non-siloed digital banks.”

But adopting new technology comes with its own dangers, largely in the form of cyberattacks. In the UK alone, the Financial Conduct Authority found that the number of cyberattacks against financial services firms increased 80 percent between 2016 and 2017. Capgemini, meanwhile, noted that new open banking regulations could make banks even more vulnerable to such attacks.

Consumers rely on banks to keep their personal information safe. Lenders must therefore ensure that digital security is a priority as they bring in new products or services in order to keep that trust – and their reputations – intact. Thankfully, banks have recognised this issue; in a 2018 survey, Capgemini found that cybersecurity was the top area of focus for digital investment among banks. Along with robust data management systems, innovation in identity, facial and voice recognition software will help strengthen security in the coming years.

Customer-first approach Above all, the ultimate challenge for retail banks in 2019 will be improving the customer experience. In 2014, a PwC survey of C-suite bankers found that 61 percent of respondents believed a customer-centric business model would be very important by 2020 – at that time, though, only 17 percent said they were ‘very prepared’ for this. Today, executives see the customer-first approach as being even more significant: according to the Financial Brand’s survey, eight in 10 respondents mentioned improving the customer experience as a top priority, up from 72 percent in 2018.

In the years ahead, customer satisfaction will be influenced by how a bank responds to the industry’s biggest challenges, including introducing digital innovations, creating a robust core system and ramping up security. With a growing number of traditional banks, fintech companies and tech firms seeking to win over customers, the leaders of the pack will be the institutions that prioritise the experience of ordinary consumers.