Commercial Banks

Most Innovative Savings Bank, Greece

Eurobank Ergasias

The Eurobank Group is active in six countries and boasts total assets of €58bn ($65bn). Through organic growth, it has expanded to become a leading force in the Greek banking sector, offering sophisticated products and well-rounded services. Its vision is to be Greece’s most human-centric bank by building long-lasting relationships, providing access to cutting-edge digital capabilities and delivering tangible value.

www.eurobank.grHungary

ING

With an estimated $993bn in total assets, ING is one of the world’s largest and most prestigious banks. Across the 40 markets in which it operates, the bank applies the same values-based ethos to its customer offering. In Hungary – a growth region for the firm – ING is focused on becoming a full-service lender that empowers all its customers, from individuals to SMEs and corporations.

www.ingbank.huBelgium

ABN AMRO

Three decades of operational excellence have secured ABN AMRO a reputation as a mainstay of European banking. While retaining a sense of pride in its illustrious history, the Belgian lender is also focused on the future: each of its banking products are designed to contribute to a more inclusive, circular and sustainable society. This purpose is encapsulated in its mission statement: ‘banking for better.’

www.abnamro.beFrance

BNP Paribas

Having played a key role in the development of Europe’s financial landscape, BNP Paribas is now one of the continent’s most distinguished banks. Internationally, it serves customers in more than 73 countries. A pioneer in green bonds and sustainable finance as well as commercial banking, in 2017 the French lender contributed more than $5.6bn to non-profit organisations and social enterprises.

group.bnpparibasGermany

Commerzbank

With a 150-year-old reputation for banking excellence, it’s no surprise that Commerzbank remains a true industry leader in Germany and across Europe. The institution’s extensive resources, which include two cutting-edge online banks and a comprehensive branch network, allow it to meet an array of customers’ commercial demands.

www.commerzbank.deChile

Banco Bci

Banco Bci has always strived to be more than an archetypal bank. Its unerring belief in sustainable banking practices and its desire to create real prosperity across Chile set it apart from the crowd. The bank combines this refreshing social awareness with an enviable commercial acuity, as evidenced by its successful track record in assisting entrepreneurs and fledgling start-up businesses.

www.bci.clDOMINICAN REPUBLIC

Banreservas

Banreservas is recognised for its ability to combine socially responsible practices with a commercially insightful business model, and for having the largest customer base in the country. The bank’s network of around 2.9 million users is served by 294 physical branches. Additionally, Banreservas has made great efforts to benefit SMEs through the financing of thousands of loans.

www.banreservas.comCANADA

BMO Bank of Montreal

Serving customers for 200 years and counting, BMO is a highly diversified financial services provider. BMO provides a broad range of personal and commercial banking, wealth management and investment banking services to more than 12 million customers, and conducts business through three operating groups: Personal and Commercial Banking, BMO Wealth Management and BMO Capital Markets.

www.bmo.comSweden

Handelsbanken

Sweden’s Handelsbanken stands out in the Nordic region for having the most satisfied customers of all its major banks ever since 1989. This impressive record was achieved by empowering each branch to build relationships and operate on a personal level with customers. The bank’s financial success, meanwhile, has been a result of its continued focus on areas where it can realise strong profits.

www.handelsbanken.comMacau

Bank of China

The Bank of China’s Macau branch not only provides stellar commercial banking services to local customers, but also drives regional development through its investment projects. The bank enjoys a dominant position in the region, capturing 40 percent of business across Macau’s financial services sector while its 1,600 employees represent 25 percent of the area’s banking workforce.

www.bankofchina.com/moNigeria

Zenith Bank

With the recent growth of Nigeria’s non-oil sector came a brighter economic landscape. The financial industry has capitalised on this shift, with leading commercial bank Zenith Bank in particular driving impressive change. By focusing on new technologies, financial inclusion and creating better conditions for local communities via sustainable initiatives, Zenith Bank has become a role model within the sector.

www.zenithbank.comThe Netherlands

ING

Founded almost 300 years ago, ING now provides banking services to more than 37 million customers each year. While the bank continues to expand internationally, it retains a strong sense of its mission, which centres on financially empowering its customers. In the Netherlands – its core market – ING is focused on harmonising its digital offering to improve the user experience.

www.ing.nlVietnam

SCB

Despite only being founded in 2012, Saigon Commercial Bank (SCB) has wasted little time in cementing itself as one of the leading joint stock commercial banks in Vietnam. The institution is renowned for its exceptional customer service and world-class commercial acumen in both domestic and foreign markets. With such a solid foundation, the bank is set to maintain an impressive growth trajectory.

www.scb.com.vnPortugal

ActivoBank

Since its creation as an open-all-hours phone banking service in the mid-1990s, ActivoBank has been synonymous with technological innovation. The bank continues to streamline and modernise its commercial processes in order to bring efficient online banking to its customers. Its cutting-edge mobile app allows lightning-quick account set-ups, card issuances and seamless mortgage support.

www.activobank.ptUS

Bank of the West

With enviable industry expertise at its disposal, Bank of the West provides first-rate commercial banking services to a wide variety of clients. Offering fraud prevention advice, treasury management services and access to local and global operations through its parent company BNP Paribas, Bank of the West’s passion and know-how make it an ideal commercial banking partner.

www.bankofthewest.comSRI LANKA

Sampath Bank

Sampath Bank’s commercial credit division uses cutting-edge technology to provide financial solutions to commercial customers. It offers diverse products that are designed to meet the varying needs of its clients, regardless of their size, industry or consumer base. The team’s dedicated relationship managers employ traditional Sri Lankan service to create a mutually beneficial affiliation.

www.sampath.lk

Convention meets innovation

In order to keep pace with fintech firms, neobanks and changing customer demands, commercial banks will need to broaden their portfolios by investing in new technologiesWith the financial crisis receding further into memory, the banking sector as a whole appears to be on relatively stable ground. Commercial banks, however, still have a number of hurdles to overcome. In particular, they have to grapple with a highly competitive marketplace, vying for clients with emerging neobanks and new fintech operators.

Corporations possess different needs to individual customers, and commercial banks have been slow to realise this. The technology that enables banks to collect powerful insights into their customers, along with ways in which they can better serve them, is now available; traditional commercial banks will come under increasing pressure to use these new digital assets to grow their customer base.

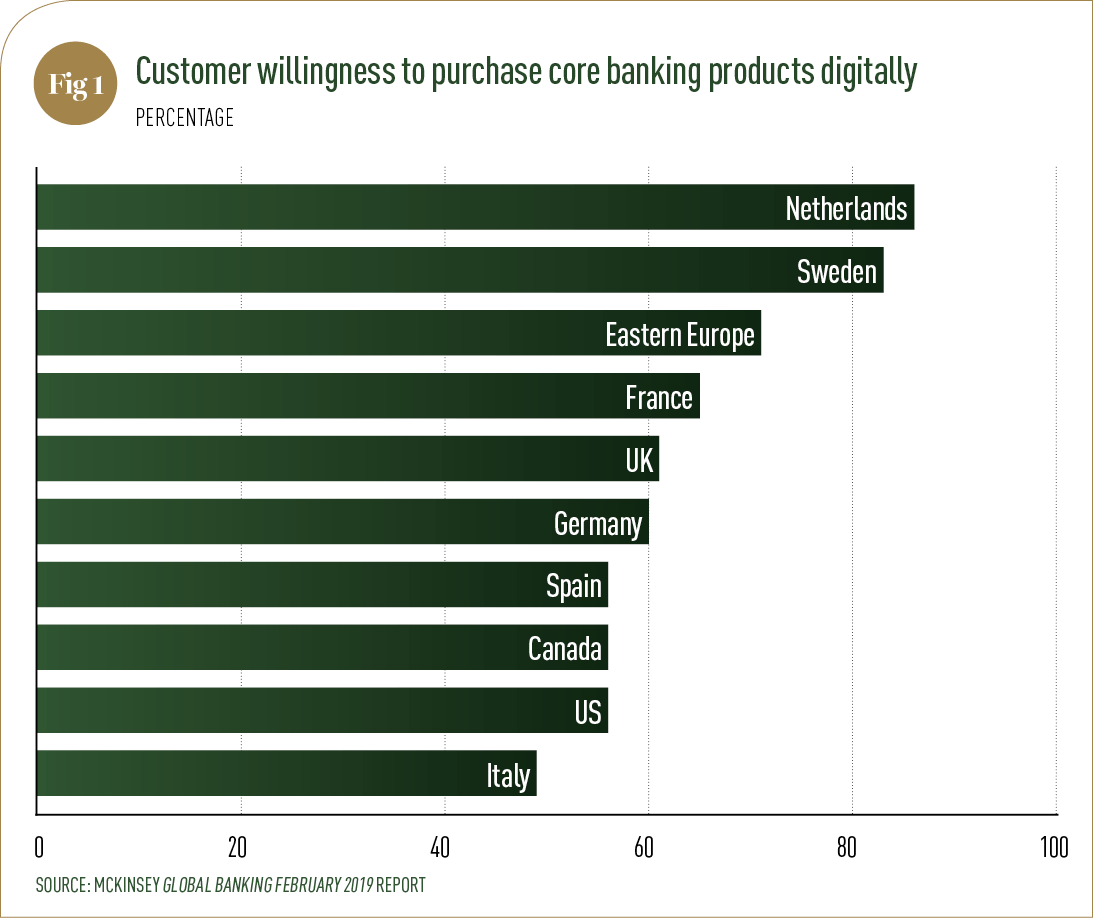

Throughout 2019, many commercial banks will be left with a difficult decision to make: plod along with their legacy systems and face a slow death as digitally focused clients move to more agile rivals (see Fig 1), or risk investing in the new technologies that could potentially save their businesses.

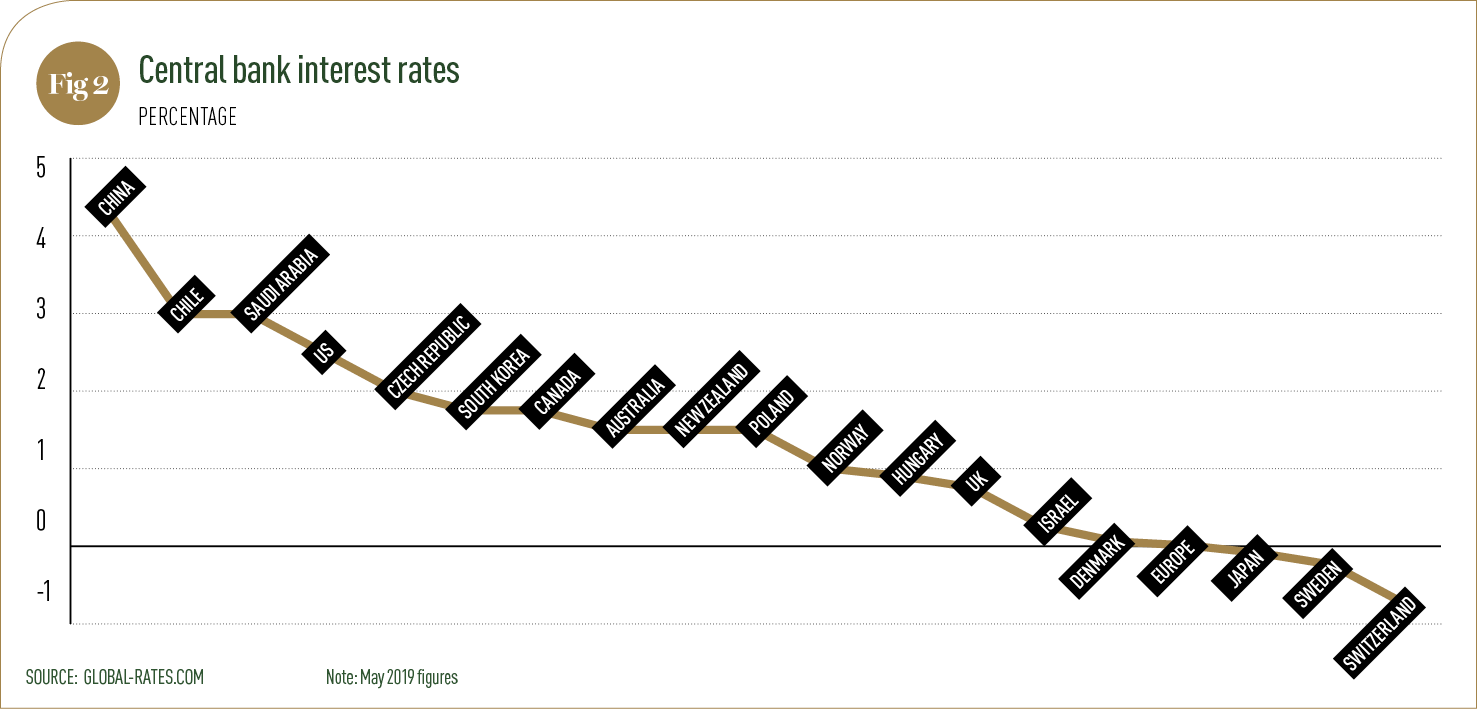

Building relationships With long-term low interest rates placing downward pressure on bank profitability throughout the West (see Fig 2), many financial institutions are looking to diversify their revenue streams. Throughout the rest of 2019, it is probable that commercial banks will shift their focus towards non-lending services in order to minimise their reliance on interest rate spreads.

One of the areas that commercial banks should prioritise is risk management. This is a high-margin business unit and one that is likely to be in great demand over the coming years. For example, new risks are emerging all the time, whether they concern cybersecurity or financial contagion. Commercial banks would be wise to adopt the latest technologies and business modelling programs in order to get to grips with these threats.

Banks will be able to offer these non-lending services more effectively if they gather as much relevant information as possible about their customers. Data will become increasingly crucial for commercial banks looking to improve their relationships with clients, and for those that are keen to better understand their consumers’ needs.

Understanding their customers will enable banks to offer superior advisory services and improve their effectiveness at cross-selling. It will also help them formulate entirely new services that fill an untapped niche in the market. These services will be of particular importance if – as seems to be the likeliest outcome – a low-interest environment persists.

Working together Although the retail banking sector has been quick to embrace new digital solutions, commercial financial institutions seem to have been caught slightly off guard. This is partly due to the fact that the needs of business clients are often more variable than those of retail customers: a one-size-fits-all mobile app may go down well with individuals, but it probably won’t be suitable for numerous firms operating across disparate industries.

One of the major commercial banking trends to look out for in 2019, therefore, is how financial institutions will attempt to provide more customised digital services to their customers. In order to do so, banks will have to open themselves up to collaboration with their clients and become more willing to integrate their value chains.

The first stage will centre on assessment. Commercial banks will need to analyse the market landscape to determine industry needs and client expectations. If they do so successfully, they are likely to find that many of their customers require digital and automated solutions to help with their everyday financial tasks, such as processing payroll information.

In order to deliver the customised solutions that each client is demanding, commercial banks may decide to adopt cloud computing on a grander scale. Alternatively, partnerships with agile fintech firms are expected to become increasingly commonplace as a way of providing more bespoke services: Spain’s Bankia, for example, works alongside fintech firm Eurobits to manage the billing process for more than 33,000 SMEs.

These collaborations also provide benefits for the banks themselves. According to a 2019 survey conducted by ING and Illuminate Financial, 87 percent of banks have used fintech solutions to lower their operational costs, while 67 percent agreed that they had improved regulatory compliance.

However, banks are likely to find that integrating their internal systems with those used by outside partners also comes with challenges. Securing data flows in a more integrated ecosystem can be difficult, particularly against a rising tide of cyberattacks. Better risk assessment, therefore, will be essential for commercial banks as they continue to modernise.

Trusting intelligence With commercial banks set to hold large amounts of data in 2019, it is vital they have the technology required to make the best use of it. Artificial intelligence (AI) can help financial institutions make sense of the data they collect, whether it is structured or unstructured.

AI can also help protect commercial banks and their customers from financial misdeeds. By analysing massive amounts of data, AI can identify complex criminal activities while simultaneously eliminating false alerts. In particular, machine learning could hold the key to detecting fraud, bolstering anti-money-laundering practices and improving Know Your Customer checks.

Customer engagement is another area where commercial banks stand to benefit from AI deployments. Chatbots and virtual assistants provide cost and efficiency improvements that are advantageous for banks and clients alike. Swedbank, for example, recently revealed that its chatbot service, Nina, handles 40,000 customer interactions every month. On average, it successfully resolves more than 80 percent of issues.

Rather than going on gut feeling alone, AI provides insights backed up by detailed analysis regarding the best ways to increase conversion rates and boost revenue. Singaporean bank Lazada utilises AI technology to streamline the credit approval process for SMEs, with many other organisations now deriving similar benefits. As AI solutions become more powerful and the amount of data available to commercial banks increases, further opportunities will no doubt present themselves.

As commercial banks move into 2019, there are many emerging trends they will need to stay abreast of. In particular, they should consider expanding their services and streamlining their existing processes. Data – and the technology required to collect, store and analyse it – will prove crucial for this. The winners of the 2019 Commercial Banking Awards are just some of the firms that have already shown promise in this area.