Commercial Banks

Belgium

KBC

KBC’s commercial banking arm offers an extensive range of products for businesses of any size. Every company with a KBC account is assigned a dedicated business partner who will get to know the organisation and the specifics of the market it operates in. This valuable resource saves the client time and money, allowing them to focus on the activities their own customers value most.

www.kbc.comGermany

Commerzbank

Boasting one of the densest branch networks among private banks in Germany, Commerzbank has taken a leading role in supporting the country’s private, small-business and corporate clients. Its extensive portfolio of financial services is precisely tailored to its customers’ needs, while its subsidiaries – Comdirect (Germany) and mBank (Poland) – offer dynamism in the online banking market.

www.commerzbank.deCambodia

ABA Bank

Offering a wide range of tools to SMEs, microbusinesses and individuals, ABA Bank is Cambodia’s leading private financial institution with 78 branches and 354 ATMs nationwide. The bank, which opened its doors in 1996, has significantly strengthened its position over the past 20 years, leveraging the experience of parent company National Bank of Canada to develop its digital platforms.

www.ababank.comArmenia

Unibank

In 2015, Unibank became the first Armenian bank to issue shares through an initial public offering. In the years since, it has actively developed the country’s banking sector, establishing strong relationships with retail businesses and promoting the growth of Armenian SMEs. Unibank now serves more than 400,00 clients via 48 branches and continues to mature at an impressive rate.

www.unibank.amBelarus

Belagroprombank

With more than 40,000 corporate clients and 1.6 million retail customers, Belagroprombank is one of the largest banks in Belarus to have implemented an ISO 9001 quality management system. The bank, which has operated as an independent financial institution for more than 26 years, prides itself on its high level of customer service and support of the Belarusian agro-industrial sector.

www.belapb.byFrance

BNP Paribas

BNP Paribas has long advocated the need for a responsible and sustainable economy – one that adheres to the UN’s Sustainable Development Goals and takes societal challenges into account. As such, the group takes a keen interest in addressing fundamental issues, such as environmental degradation, local development and social inclusion, and advises clients according to the highest ethical standards.

group.bnpparibasDominican Republic

Banreservas

Banreservas is the largest Dominican bank by assets and, consequently, has played a pivotal role in the development of the nation’s financial services sector. Owned by the state, it continues to promote financial inclusion across the Dominican Republic and has steadily reduced the proportion of citizens classified as either unbanked or underbanked.

www.banreservas.comCanada

BMO Bank of Montreal

For more than 200 years, BMO Bank of Montreal has been led by a single objective: to boldly grow the good in business and life. In more recent times, this has meant anticipating the rapidly changing needs of its customers, and harnessing the power of digital technology and data to provide the most innovative solutions in the Canadian commercial banking sector.

www.bmo.comSingapore

United Overseas Bank

United Overseas Bank was founded on the principles of prudence, enterprise and determination. These three pillars have guided its growth ever since, leading the bank to deepen its presence across Asia and further afield. Having developed an extensive regional network comprising more than 500 offices, the bank is able to confidently address the cross-border needs of its clients.

www.uobgroup.comNorway

Nordea

As a result of the open dialogue it shares with all of its stakeholders, Nordea has developed a set of unique values that guide its every decision. The company’s purpose is to help customers achieve their goals, all while working for the greater good. By encouraging collaboration across the organisation, Nordea has become a trusted partner in Norway and more widely.

www.nordea.comMontenegro

CKB Banka

The banking industry is very important to the Montenegrin economy. CKB Banka understands this and, as a result, its operations focus on using the newest technology to offer high-quality products in the commercial banking sphere. Since it was founded, the bank has channelled its resources towards projects that create new opportunities for the country’s financial sector.

www.ckb.meNetherlands

ING

A global bank with a strong European base, ING takes a keen interest in exemplary customer service and the empowerment of people in both life and business. The Amsterdam-headquartered bank serves approximately 38.4 million customers across 40 countries, offering a host of wholesale and retail products, such as specialised lending, tailored corporate finance and equity market solutions.

www.ing.nlMacau

Bank of China, Macau Branch

Established in 1950, Bank of China, Macau Branch is firmly rooted in Macau’s financial history and has become one of its leading banks over the past 70 years. As of late 2019, the bank has 36 sub-branches with over MOP 738bn ($92bn) in assets under management. Local expertise and a focus on social mobility are among the bank’s guiding principles.

www.bankofchina.com/moUS

Bank of the West

With enviable industry expertise at its disposal, Bank of the West provides first-rate commercial banking services to a wide variety of clients. Offering fraud prevention advice, treasury management services and access to local and global operations through its parent company BNP Paribas, Bank of the West’s passion and know-how make it an ideal commercial banking partner.

www.bankofthewest.comSri Lanka

Sampath Bank

It’s fair to say the Sri Lankan economy has taken a substantial hit in recent years, with financial institutions struggling to generate long-term gains and credit rating agencies warning of further downgrades. Amid this uncertainty, Sampath Bank has come to the fore, fostering individual and organisational development across the country and helping Sri Lankans to capitalise on economic opportunities.

www.sampath.lk

Here comes the change

With competition increasing and customer demands shifting, commercial banks have been left with little choice but to up their game. This means an overhaul of legacy processes and investment in digital solutionsCommercial banks have decided that the days of paying lip service to digital innovation are over – it’s time to get real. While a number of financial institutions have embraced customer relationship management solutions and mobile applications, the underlying infrastructure has remained largely unchanged for decades.

Once upon a time, the reluctance to innovate wouldn’t have provided much cause for alarm. Banks were entrenched as part of everyone’s daily lives, and many customers couldn’t be bothered to move their assets to a new organisation when most of them were offering broadly the same terms. Those days are long gone.

Fintech firms are now disrupting the entire industry. Retail banks have been quick to partner with them, but commercial banks, where business relationships are a bit more functional, have not displayed the same urgency. It is unlikely that they will hold out for long: according to a Lloyds Bank Financial Institutions Sentiment Survey of more than 100 senior decision-makers across the financial services sector, 46 percent expect their investment in fintech to increase over the next 12 months.

What’s more, many commercial banks have decided that, fintech or not, it is time they invested in more innovative digital solutions. Given that modern clients expect convenience, reliability and data-driven insights, having a leading digital ecosystem is now a necessity for every bank.

New kids on the block Blockchain first rose to fame as the underlying technology behind bitcoin, the cryptocurrency that was supposed to herald the beginning of the end for long-established financial businesses. This meant that, at first, the technology doesn’t seem like an obvious fit for commercial banks.

However, much of the discussion around blockchain has now moved beyond cryptocurrencies and into other business areas. For banks, blockchain-based solutions can help simplify processes while improving reliability. For example, cross-border trading can be complex, involving numerous challenges relating to the interoperability of data and real-time communication. Last year, the Bank of Thailand announced it would be leveraging blockchain technology to smooth out » some of these issues in partnership with the Hong Kong Monetary Authority.

By driving higher levels of trust and transparency, using blockchain technology would allow commercial banks to conduct more accurate risk profiling around cross-border trade financing while improving overall efficiency for banks and their clients. Regulatory hurdles will have to be overcome, but this space is also moving fast. Smart contracts and cryptographic signatures may not be too far away.

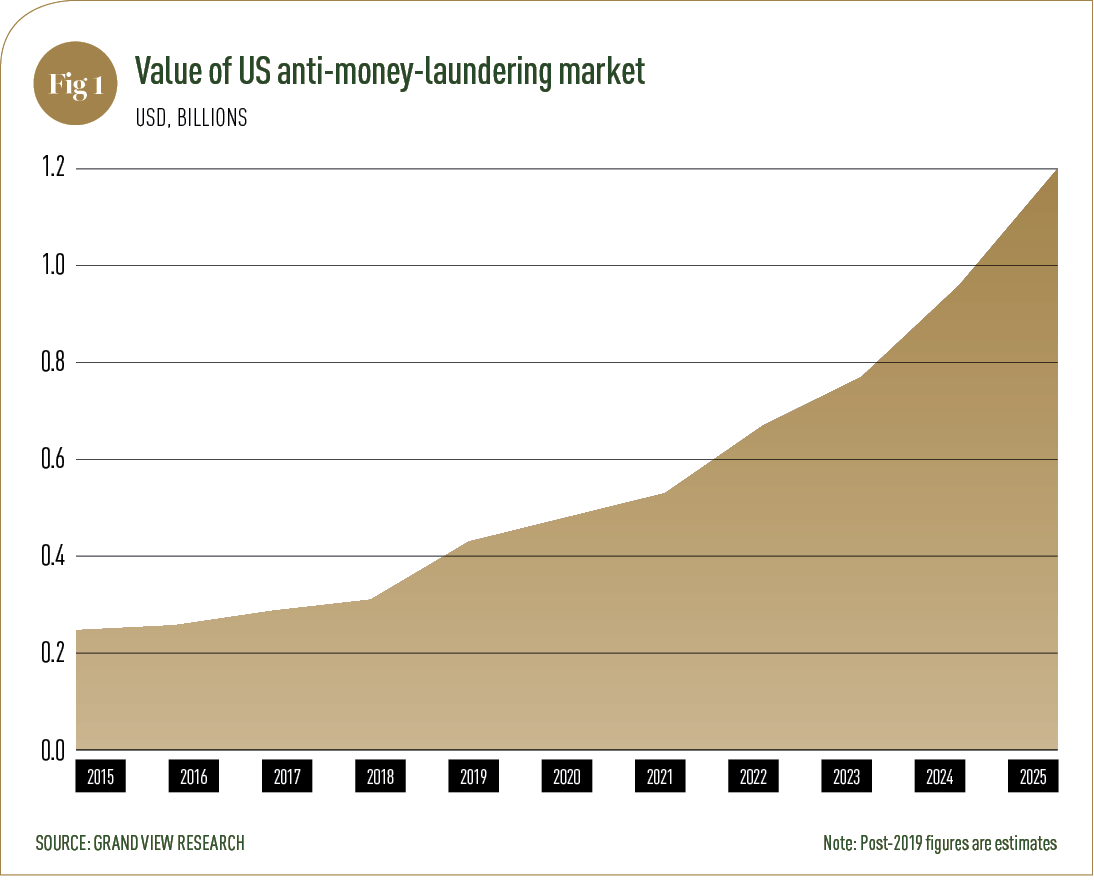

Alongside blockchain, automation is also likely to be employed more heavily by commercial banks in 2020. Artificial intelligence (AI) can help banks achieve compliance with anti-money-laundering regulations, particularly surrounding Know Your Customer issues. With between $800bn and $2trn laundered each year according to the United Nations Office on Drugs and Crime, AI in banking could help bring this figure down. The size of the US anti-money-laundering market increases every year, making this a key area of opportunity.

In fact, while new technologies are often thought of as security risks, AI could deliver huge benefits for commercial banks in this area. Using AI to highlight unusual customer behaviour or anomalies is a proven method for tackling fraud, and one that is being employed by an increasingly large proportion of commercial banks.

Leaving a legacy Despite the fact that digitalisation has been talked about within the banking sector for a number of years, it has been deployed inconsistently. One of the issues holding some organisations back is the preponderance of legacy architecture. According to an IBM report authored in 2017, a staggering 92 percent of the world’s top 100 banks still relied on legacy mainframes and related systems at the time. Despite the significant amount of digital innovation that has disrupted the financial sector in recent times, the back-end IT infrastructure used by many commercial banks remains past its sell-by date. The reasons behind such inertia are simple: legacy systems are cost-effective (they have already been purchased), reliable (they’ve worked for a number of years), and resilient (if it isn’t broken, why fix it?). But this approach leaves banks stuck in the past, averse to both risk and innovation.

One method of infrastructure modernisation that is being trialled by some commercial banks is digital decoupling. This involves breaking up their core architecture into individual components before making them available as separate services, usually through application program interfaces. This helps to circumvent some of the resistance to overhauling legacy systems.

Shifting operations While banks used to reluctantly invest in multi-year, large-scale modernisation projects, today the pace of innovation has increased so much that such an approach would prove foolhardy. By the time the new infrastructure is in place, it could very well be outdated. Evolutionary architecture that has been built with change in mind is becoming increasingly common.

Migrating to the cloud is one way for commercial banks to test the viability of digital decoupling. Compared to on-premise IT, cloud computing offers a number of benefits, from lower costs to increased reliability. One of its main advantages, however, is that it is easily updated to suit changing consumer demands and shifting industry trends.

Financial institutions around the world are already moving their processes to the cloud, showing that previously held security concerns around the technology are abating. Last year, South Africa’s Standard Bank chose Amazon Web Services to handle the mass migration of all its business units to the cloud, including personal banking, wealth management, corporate investment banking and insurance. Around a similar time, HSBC announced it had transitioned its global liquidity reporting processes to Google Cloud.

With the cloud, banks can easily scale up or down resources without having to purchase expensive upgrades or leave systems underutilised. Updates can also be provided automatically by their cloud service provider, ensuring that the latest technology and security protocols are always in place.

As commercial banks move through 2020, cloud computing is just one of several developments that they will need to remain aware of. Other innovations around blockchain, AI and cybersecurity are all worth considering as well. World Finance’s best commercial banks of 2020 are firms that have been able to seamlessly adopt these new solutions while maintaining a reliable and secure service for their customers.