Retail Banks

Jordan

Arab Bank

First established in Jerusalem in 1930, Arab Bank’s aim is to be an active partner throughout the socioeconomic development of the Middle East. Since its beginnings, the bank has created a network of 600 branches that spans five continents. Through its vast reach, Arab Bank is able to access key financial markets and underserved locations alike.

www.arabbank.comIndonesia

OCBC NISP

As Indonesia’s fourth-oldest bank, OCBC NISP has overcome tempestuous economic conditions in the country. Having now emerged from this period of difficulty, the bank’s mission is to become a world-class institution that is recognised for its care and trustworthiness. To achieve this goal, OCBC NISP has undertaken numerous projects to grow alongside the communities it operates in.

www.ocbcnisp.comBelgium

KBC

Formed as a merger between two Belgian banks and an insurance company, KBC enables its 12 million clients to plan, realise and protect their financial projects. KBC’s unique position as a bank-insurance company means it holds a long-term perspective that values sustainable and profitable growth. In this way, it has gained the trust of customers across its core markets.

www.kbc.comFrance

BNP Paribas

With 200 years of operations, 200,000 employees and a presence in 73 countries under its belt, BNP Paribas can undoubtedly be trusted to help its clients and employees achieve their financial goals. The bank is a global leader in green bonds and, guided by its ‘positive banking’ vision, invests in social enterprises that contribute to the UN’s Sustainable Development Goals.

group.bnpparibasAustria

BAWAG Group

With 2.5 million customers, BAWAG Group is one of Austria’s largest banks. The company’s simple and transparent business model is geared towards low risk and high efficiency, focused on Austria, Germany and other developed markets. With a wide range of services, including savings, lending and investment products, the firm can be relied upon to deliver quality banking solutions.

www.bawaggroup.comGreece

Eurobank

The Eurobank Group is active in six countries, with 13,456 employees as of May 2020 and total assets of €64.8bn ($71.2bn). The group offers a comprehensive range of financial products and services to its retail and corporate customers. Its philosophy focuses on providing quality services to its clients, paying particular attention to their specialised and diverse needs.

www.eurobank.grDominican Republic

Banreservas

With a mission to support the prosperity and wellbeing of all Dominicans, Banreservas understands the importance of its social and economic impact. The bank runs a number of schemes aimed at improving sustainability in the Dominican Republic’s financial sector, including promoting financial education and inclusion and the use of digital solutions that are available to retail customers.

www.banreservas.comBulgaria

Postbank

As Bulgaria’s fourth-largest bank in terms of assets, Postbank has built a considerable client base in its nearly 30 years of operations. The bank is a market leader and trendsetter in the retail sector, and has used its extensive range of products to drive innovation. The result is a well-developed branch network that operates in harmony with various modern and tech-led alternative banking channels.

www.postbank.bgNetherlands

ING

New regulations are changing the world of retail banking. ING recognises this and has adjusted accordingly, introducing a digital-first operating model in 2015. Since then, the bank has used new technology to stay up to date with changing customer demands. With 34 million satisfied clients, the company’s retail business is a global leader that is used to being one step ahead of competitors.

www.ing.nlTaiwan

O-Bank

Formerly the Industrial Bank of Taiwan, O-Bank was founded in 1999. With core values of trust, outstanding service, unity and creativity, the bank has always coordinated with national economic development strategies to help the country and its citizens achieve financial stability. O-Bank has embraced digital solutions, allowing it to provide well-rounded products that are accessible to all.

www.o-bank.comPoland

BNP Paribas Polska

BNP Paribas’ Polish branch has been operating in the country for over a century, and has been wholly owned by the French banking group since 2001. Benefitting from connections to the rest of Europe’s banking sector, BNP Paribas Polska helps all of its clients to realise their goals through a diverse range of financial solutions and products.

www.bnpparibas.plNigeria

Guaranty Trust Bank

Since 1990, Guaranty Trust Bank has delivered innovative banking solutions to a customer base that now spans across Africa and Europe, demonstrating its ability to provide first-class financial support in a range of markets. Now it is focusing on bringing positive change to its host communities through projects that aim to improve financial education and sustainability.

www.gtbank.comTurkey

Garanti BBVA

Operating in every segment of the banking sector, Garanti BBVA’s retail arm benefits from the company’s stability and breadth of experience. Principles of transparency, clarity and responsibility drive the bank to deliver quality services and customer satisfaction, while a sustainable growth strategy means it is well placed to continue leading the Turkish retail banking industry.

www.garantibbva.com.trMacau

Bank of China, Macau Branch

Boasting a long history of serving China’s citizens and developing the country’s financial services sector, the Bank of China has massively transformed since it was founded in 1912. Today, the company has a global presence, operating in 57 countries across a range of fields. The Macau arm is working alongside the Chinese Government to meet the goals of its national rejuvenation programme.

www.bankofchina.com/moSri Lanka

Sampath Bank

Sampath Bank is empowering citizens in Sri Lanka to take their financial security into their own hands by creating a company culture that promotes learning, both for customers and staff. The company’s products are designed to help customers manage their wealth, with its offering including a range of accounts, cards, loans and digital solutions to suit any lifestyle.

www.sampath.lkPortugal

Santander Portugal

Santander Portugal’s business model rests on three key principles: local scale and global scope; a customer-centric approach; and diversification. These principles underpin every aspect of the bank’s operations, allowing it to achieve lasting growth that doesn’t compromise on corporate social responsibility. Notably, the bank has been able to grant university scholarships in the local community.

www.santander.ptVietnam

Sai Gon J.S. Commercial Bank

Given strong backgrounds in financial potential, fast operational growth, advanced technology and diverse products of high service quality, SCB is believed to be on a steady path to becoming one of the most versatile and modern retail banks in Vietnam. Besides providing full financial packages to meet all customers’ demands, SCB continues to provide benefits for partners and shareholders alike.

www.scb.com.vn

A test of resilience

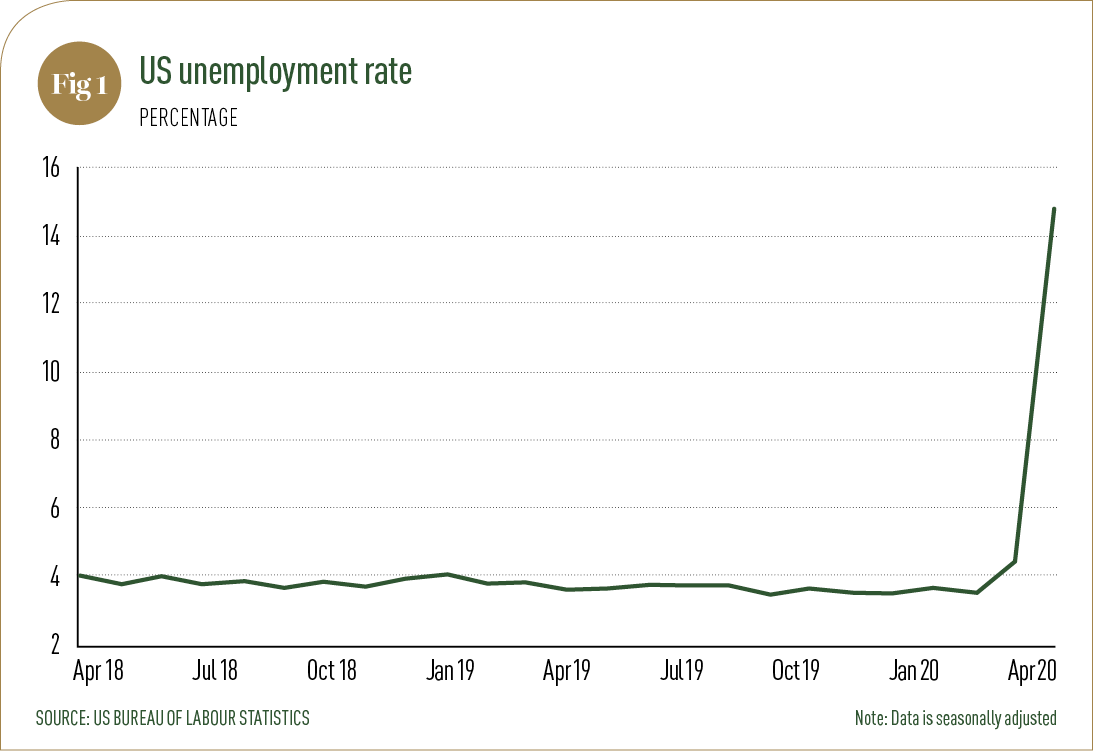

The coronavirus pandemic has left retail banks vulnerable to a wave of unpaid loans. They must seek out government support and embrace digital transformation to keep supporting customers through this financial turmoilThe COVID-19 crisis has put pressure on retail banks to meet the needs of households and businesses through the continuing provision of credit – for the sake of the financial system, these banks must still be able to lend. But like many businesses, banks have seen their earnings take a hit due to the impact of lockdown measures. Overall consumer spending has taken a nosedive, denting transaction-based revenue. Long periods of low interest rates, inflexible costs and higher loan losses are also set to eat into banks’ profits.

The biggest threat facing financial institutions, however, is the wave of defaults expected from retail customers as rates of unemployment and bankruptcy surge. At the end of Q1 2020, Barclays reported that credit impairment charges had risen almost fivefold to £2.1bn ($2.6bn) compared to the same period last year. According to management consultancy Kearney, one in eight retail banks will face losses this year due to the novel coronavirus.

To cope with future loan losses, banks are putting aside billions of dollars’ worth of impairments. Banco Santander, the eurozone’s largest retail bank, has set aside an additional €1.6bn ($1.75bn) to deal with an expected surge in defaults. The largest US banks, meanwhile, have collectively set aside $25bn for credit losses in Q1 2020.

Digital drive As the slowdown deepens, many banks will see their liquidity buffers come under pressure. In the US, the Office of the Comptroller of the Currency recommended banks stay above the minimum requirements for capital and liquidity buffers, but consider moving closer to minimums. Around the world, central banks and governments warn that banks must not exhaust their provisions and impair their ability to lend during the pandemic. To this end, they’ve provided banks with extraordinary support, the likes of which has not been seen since the Second World War.

But only time will tell whether this support will be enough. The pandemic has prompted many retail banks to trigger their business continuity plans and rapidly transform their day-to-day operations. The crisis will push banks’ adaptability to the limit, and could transform the retail banking landscape as we know it. The coronavirus has made it clear that online banking is no longer optional – it’s imperative to any bank’s survival. While some branches have been able to remain open – particularly in South Korea, where testing is widespread – many have had to close to safeguard the health of both staff and customers. Even the exchange of cash is seen by many as a potential conduit for infection, putting pressure on banks to accelerate their contactless payment solutions.

Early in the crisis, many Asian banks quickly recognised the need to invest in their digital channels. In February, Singapore’s DBS digitalised 11 common trade financing processes and offered clients 50 free fast transactions a month to curb the need for the physical handling of cheques. China’s Ping An Bank, meanwhile, introduced the Do It At Home campaign to offer contactless and smart services. In just two weeks, more than three million customers had made 11.67 million transactions.

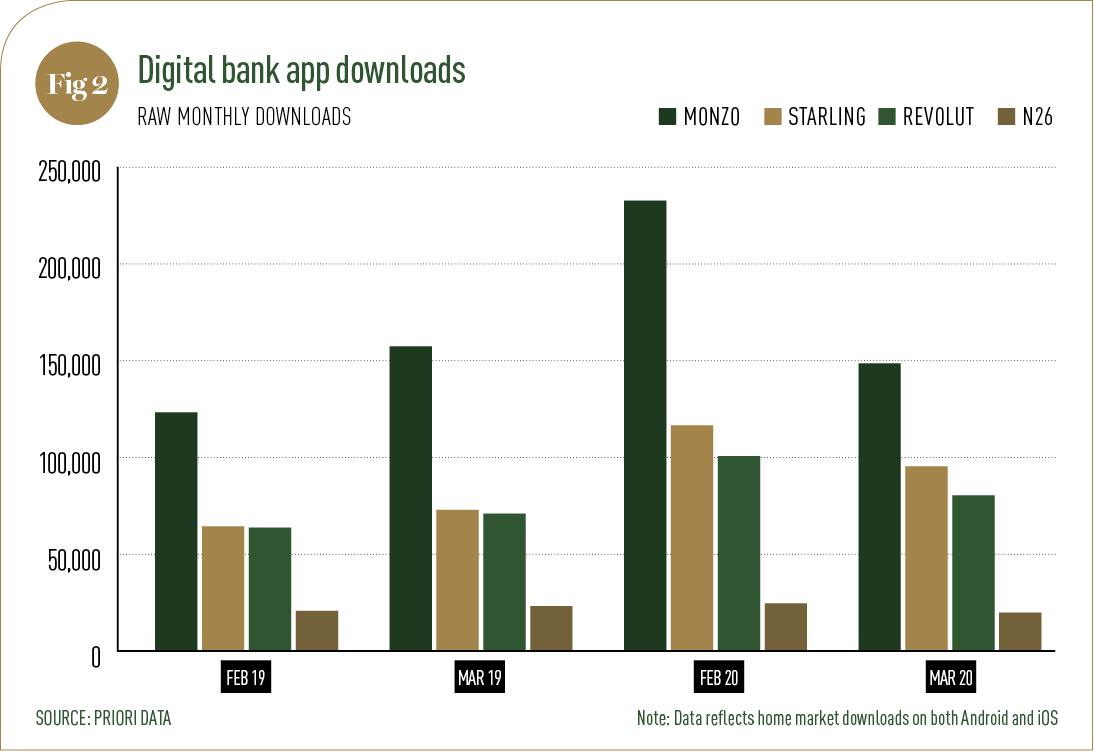

Fraud prevention Despite the closure of physical branches, the pandemic does not seem to have driven consumers to find refuge in digital banks. According to an analysis by Priori Data, Monzo, Revolut, Starling and N26 saw their growth rates drop by between 18 and 36 percent in their home markets in March, with downloads also taking a hit. This was despite hopes that challenger banks might attract new audiences during lockdown. That said, the pandemic is still likely to accelerate technological transformation among retail banks as the risks of relying heavily on physical branches becomes increasingly clear.

Unfortunately, the push to get customers online has created a window of opportunity for fraudsters, who are exploiting public fears around the financial turmoil to obtain passwords, banking details and other sensitive data. As a result, banks have had to step up fraud prevention measures: in the UK, Barclays, HSBC and Royal Bank of Scotland have all launched social media campaigns to highlight the risk of fraud. Similarly, US lenders such as United Bank, Citizens Bank and Fifth Third Bank are reminding customers to protect their personal information during the pandemic. To engage customers and make them more vigilant, some banks in China have even introduced nudging mechanisms to frequently notify customers of bill payments, deposits and spending activity. But it’s not just customers that banks need to protect: they must also look out for their employees. Remote workers represent a significant cybersecurity threat, with remote access often coming at the expense of security and leaving the company vulnerable to cyberattacks. For that reason, banks that have treated cybersecurity as a priority in the past will likely reap the rewards during the crisis. In 2019 alone, CaixaBank invested over €50m ($54.7m) in information security, while 98 percent of employees participated in a course on cybersecurity.

Protecting customers A humanitarian crisis of this scale puts pressure on banks to support their clients through what will, for large numbers of people, be a time of great financial hardship. Many banks have taken measures to support their customers’ finances, such as increasing credit card limits, cancelling overdraft fees and granting mortgage and credit card repayment holidays.

It’s support mechanisms like these that will hopefully prevent a repeat of 2009, when the public vilified lenders for their role in the 2008 financial crisis. Retail banks have a difficult balance to strike, however: they can’t risk lending indiscriminately, so banks must establish a COVID-19 credit policy to cope with the spike in loans.

Banks have also been taking steps to help customers beyond their financial needs. China Merchants Bank, for example, added new features to its app, giving customers access to food delivery, online learning and ridesharing services. The app includes a ‘special zone’ that provides real-time pandemic data, online counselling and a designated hospital search. If there is one lesson that retail banks should take away from the 2008 financial crisis, it’s that putting customers first will help ensure longevity.