Investment Banks

Belgium

KBC

KBC declares its mission to be assisting all its stakeholders while protecting them and their finances. Formed in 1998 after the merger of three Belgian firms, the bank now has 12 million clients across multiple European markets. It principally focuses on offering integrated banking and insurance services, working with retail and business clients to grow and develop their investments.

www.kbc.comArmenia

Ameriabank

With its investment banking services including assistance in corporate finance, capital markets and mergers and acquisitions, Ameriabank is committed to helping its clients achieve their financial goals, whether they are public, private, domestic or cross-border. The bank uses its strong local knowledge to help clients throughout the investment process, unlocking value in their acquisitions.

www.ameriabank.amCanada

RBC Capital Markets

As a major subsidiary of the Royal Bank of Canada (RBC), the fifth-largest bank in North America, RBC Capital Markets has more than a century of banking expertise supporting its services. As a result, some of the planet’s most prolific corporations, investors, asset managers and private equity firms recognise RBC Capital Markets as an innovative and trusted financial partner.

www.rbccm.comFrance

BNP Paribas

BNP Paribas offers a variety of advisory, finance and treasury services, giving it a unique position in the French investment banking market. The bank pairs its local knowledge with strong global intelligence and unique digital solutions to provide financing solutions across the loan, investment-grade bond and high-yield bond markets.

group.bnpparibasDominican Republic

Banreservas

Banreservas understands that while investing is an attractive proposition for many, it can also be daunting. That’s why the bank has several support services available, including investment funds managed by teams of expert professionals. Banreservas has also played a crucial role in the Dominican Republic’s financial growth by supporting investment in a number of key industries.

www.banreservas.comColombia

BTG Pactual

Colombia’s financial sector has developed markedly in recent years, displaying greater levels of reliability and lower levels of risk. One of the reasons for this has been the actions of leading players like BTG Pactual. The bank has received a number of awards for its investment services, particularly in terms of mergers and acquisitions and its support for capital markets.

www.btgpactual.com.coChile

BTG Pactual

Despite having a presence across numerous markets, BTG Pactual treats each one with distinct importance. In Chile, the bank’s appreciation of political and social issues, as well as economic developments, has allowed it to deliver bespoke products and services. The autonomy of the bank’s operations in the country was recently praised by credit ratings agency Fitch Ratings.

www.btgpactual.clBrazil

BTG Pactual

The largest investment bank in Latin America, BTG Pactual is responsible for underwriting a significant proportion of Brazil’s IPOs each year. Since its inception in 1983, it has been run on a culture of meritocratic partnership. The bank has received multiple national and international awards and stands poised to offer investors and businesses the high-quality services they’ve come to expect.

www.btgpactual.comUS

JPMorgan Chase

JPMorgan’s investment banking arm supports a broad range of corporations and government bodies, particularly through its risk management expertise. Throughout the COVID-19 pandemic, it has continued to help organisations find a balance between preserving liquidity, accessing capital and restructuring debt during a particularly volatile time for investment.

www.jpmorgan.comSwitzerland

UBS

UBS’ investment banking services are wide-ranging and carefully thought out, from advisory services for mergers and acquisitions to products specifically catered to retail investments. Its Data Solutions platform is particularly beneficial, giving clients access to vital data that can help them make informed decisions about their investments.

www.ubs.comGeorgia

Galt & Taggart

With Georgia placing seventh in the World Bank’s Doing Business 2020 ranking, the country is undoubtedly a secure environment for any investment. Helping customers make the most of opportunities in this setting is Galt & Taggart, Georgia’s leading investment banking firm. Offering unparalleled investment management services, the company is committed to working in its clients’ best interests.

www.galtandtaggart.comThailand

Bualuang Securities

Bualuang Securities offers multiple ways for customers to try their hand at investing, including by providing vital information on the basics and advice on which investment class is best suited to each client. Maintaining innovation as one of its key values, Bualuang continually develops new tools and services to help its customers seize investment opportunities.

www.bualuang.co.thTaiwan

Fubon Financial Holdings

With total assets of $283.9bn at the end of 2019 and multiple influential subsidiaries, Fubon Financial Holdings has made a name for itself in Taiwan and abroad. Its most recent aim has been to extend its reach throughout China with a series of acquisitions, which has made it the only Taiwanese financial institution to have subsidiaries in China, Taiwan and Hong Kong.

www.fubon.comGermany

Commerzbank

One of Europe’s leading banking institutions, Commerzbank offers a variety of financial solutions to private, small-business and corporate clients. The bank is known for its superior global and local knowledge, with its team of relationship managers and product specialists able to give personalised advice to customers based on their unique investment needs.

www.commerzbank.deGreece

Piraeus Bank

With 11,000 employees serving 5.5 million customers across Greece, Piraeus Bank boasts an impressive market share and expertise that it uses to provide expert financial advice and services. In particular, it offers a wide range of investment opportunities, including treasury bonds, mutual funds, strategic life goal investment, and the in-branch purchase and sale of gold bars.

www.piraeusbank.grNigeria

Coronation Merchant Bank

With approximately 202 million people, Nigeria accounts for about half of West Africa’s population, meaning there are a number of untapped investment opportunities available. Coronation Merchant Bank works with a range of stakeholders to help clients achieve the best returns, and has become well known for its commercially focused but sustainable business ventures.

www.coronationmb.com

The calm before the storm

The spike in trading triggered by the COVID-19 pandemic has been a short-term boon for investment banks. Nonetheless, many large players must slash costs in anticipation of a deep global recessionThe coronavirus pandemic has driven economies around the world to the brink of collapse, with lockdown measures triggering huge capital outflows, mangling supply chains and bringing economic activity to a near standstill. The IMF has predicted an unprecedented global recession, one that will set the world on a course for uncertainty well into 2021.

In some respects, this financial turmoil has been a boon to investment banks. Data from research firm Coalition shows banks’ revenues from fixed income, currencies and commodities witnessed their strongest first quarter since 2015 – rising 20 percent to $22.7bn – as the pandemic drove traders to rapidly buy and sell shares.

But this trading spike is only likely to bring short-term relief to investment banks. More broadly, banks look set for a period of belt-tightening as the COVID-19 crisis exerts serious pressure on earnings. One report co-authored by Oliver Wyman and Morgan Stanley predicts that, even in an optimistic scenario where the economy experiences a rebound in six months, investment banks could be on track for a 100 percent decline in profits this year. Many banks are freezing hiring as a result.

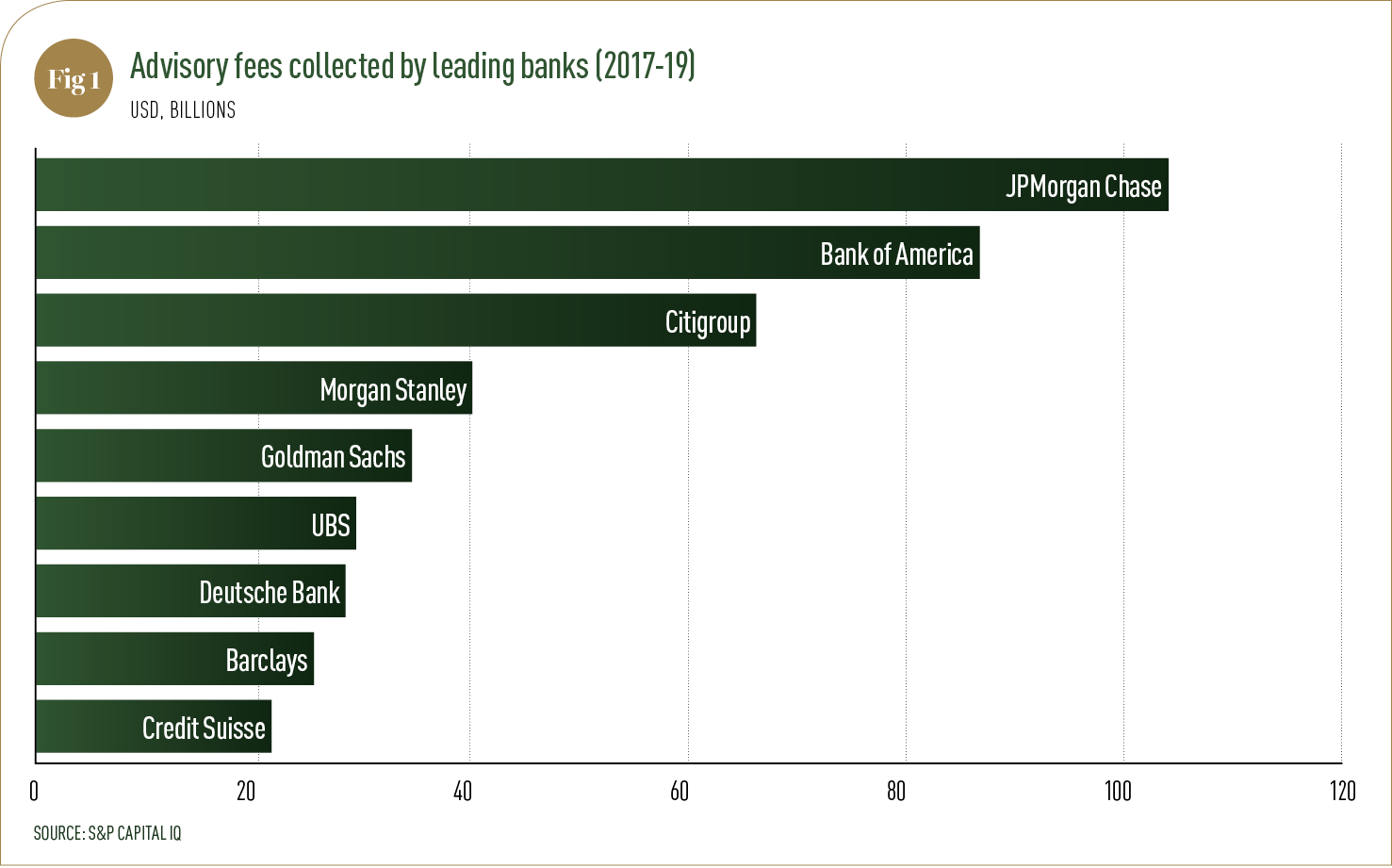

Adapting to the new normal According to S&P Global, European institutions are likely to be hit the hardest. Lenders such as Deutsche Bank – which was already struggling to stay profitable due to billion-dollar fines, increased market competition and significant restructuring – will have little protection to absorb a wave of defaults. Amid this pessimistic outlook, it’s US investment banks such as JPMorgan Chase and Goldman Sachs that find themselves in the best position.

US lenders outstrip their European counterparts in terms of profitability and revenue. What’s more, the Fed has taken aggressive steps during the pandemic to boost liquidity and keep financial markets operating, including buying at least $500bn of US Treasury securities and over $200bn of agency mortgage-backed securities. Many investment banks in the US will likely use the crisis to take further market share from smaller European lenders.

Like all companies, investment banks have had to take measures to limit the spread of the novel coronavirus. This has presented problems for lenders: for example, trading activities are critical » for market functioning, but they can’t be carried out remotely because of compliance regulations. Goldman Sachs has responded to this issue by assigning some employees a fixed location where they can trade while placing others on teams that alternate weekly between working from home and in one of its main offices.

Ensuring that operations can continue with as little disruption as possible – all while keeping staff safe – will be crucial to investment banks’ success in the coming months. So far, companies like JPMorgan have raised capital through virtual roadshows, while overseas business trips have been replaced by video calls. Video communications provider Pexip, for example, became the first company to use a fully virtual initial public offering to get listed on the Oslo Stock Exchange. Given the savings that banks can make by conducting roadshows virtually, this trend may become part of the new normal even after the crisis has ended.

Better together According to financial data company Refinitiv, mergers and acquisitions (M&A) professionals were optimistic for what 2020 held at the end of 2019, predicting a 7.4 percent rise in market growth. That optimism came crashing down after the outbreak of the novel coronavirus: Refinitiv found that M&A levels in the US fell by more than 50 percent in Q1 2020 compared to 2019, while global dealmaking dropped by 28 percent. Surprisingly, Europe saw the value of M&A deals rise by just over half to $232bn, although this can partly be explained by the Russian National Wealth Fund’s purchase of Sberbank for $39bn.

Some analysts are hopeful that dealmaking activity can bounce back more quickly than it did following the 2008 financial crash, but this all depends on the pace at which markets can recover. In the meantime, there are opportunities to be snapped up by strategic bankers: experts predict that we could see a wave of dealmaking activity within the healthcare sector as companies race to develop treatments for the disease. In the immediate aftermath of the crisis, there could also be significant movement as companies look to fix their supply chains and transform their operations.

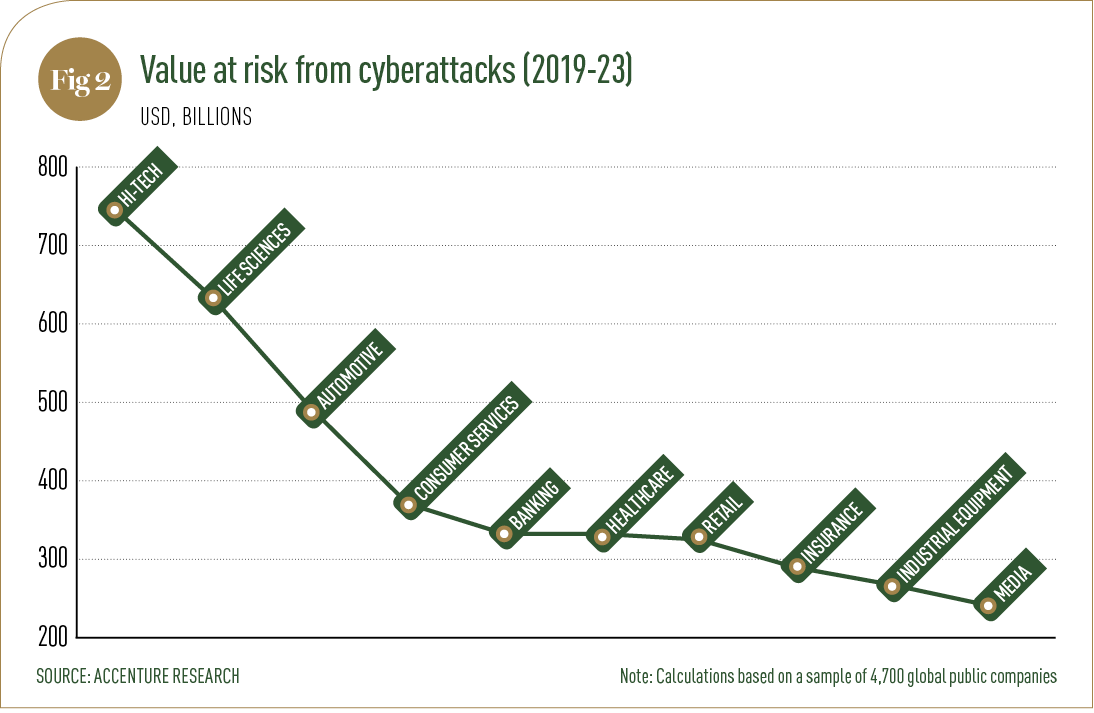

Taking a virtual leap It has become increasingly clear over the years that cybersecurity should be a key priority for banks. Accenture estimates that cyber risks could cost the banking sector $347bn over the next five years, but with so many bank executives and traders now working from home, the risk of fraud and cyberattacks is especially high. Now is the time to run control tests and ensure cybersecurity measures are robust enough to withstand the attempts of opportunistic hackers.

The pandemic has also highlighted a key issue that many investment banks are yet to address: outdated infrastructure. The technology systems of many banks were put under pressure in March due to unusually high trading volumes. The more tech-savvy banks, meanwhile, have reaped the benefits of having new systems in place before the pandemic struck. In 2018, Morgan Stanley rolled out an artificial-intelligence-based platform for personalised engagement with clients called the Next Best Action system. In the first two months of the pandemic, this tool was used more than 11 million times.

According to a report by the Boston Consulting Group entitled Global Risk 2020: It’s Time for Banks to Self-Disrupt, banks must prioritise technological transformation to ensure they respond to the coronavirus crisis effectively: “By using artificial intelligence, machine learning and other advanced technologies and practices, they can improve bank steering, deliver predictive, real-time insights, and execute faster and more efficiently.” Technology, it seems, will prove a vital asset for investment banks as the crisis develops.