Private Banks

Denmark

Nykredit Private Banking

Partnership lies at the heart of Nykredit Private Banking’s success. With roots stretching back as far as 1851, the bank has become one of Denmark’s leading financial services companies by working closely with its clients to establish products that work for them. In collaboration with its 52 partner organisations, Nykredit Private Banking continues to be a pillar of strength in the Danish economy.

www.nykredit.comBelgium

BNP Paribas Fortis

BNP Paribas Fortis’ tagline, ‘the bank for a changing world’, is rather fitting in the current climate. As the COVID-19 pandemic rages on, the bank is taking exceptional measures to protect its customers and employees while offering vital services. Chief among them is its Business Continuity Plan, which aims to provide flexibility to business and private banking clients.

www.bnpparibasfortis.beBahrain

Ahli United

Ahli United was established in Bahrain in 2000 following the merger of the United Bank of Kuwait and Al-Ahli Commercial Bank. Since then, the bank has achieved a number of key milestones and is rightly proud of the commitment it shows to its one-on-one wealth management services. Its AUB Trader platform also provides unparalleled access to a number of markets.

www.ahliunited.com/bhCzech Republic

J&T Banka

J&T Banka has a simple mission: to help clients protect their assets, increase their value and pass them onto the next generation. Most importantly, though, the Czech private bank – a subsidiary of J&T Finance Group – helps clients enjoy their wealth while protecting it against economic influences, legislative changes and unexpected life events, like the COVID-19 pandemic.

www.jtbank.czGermany

Deutsche Bank Wealth Management

Deutsche Bank Wealth Management has gained an enviable reputation within the financial world by understanding that no two clients are the same. It recognises that client needs are constantly evolving, and meeting demand now also means anticipating future requests. Among a broad spectrum of services, Deutsche Bank Wealth Management offers wealth discretionary and strategic asset allocation solutions.

www.deutschewealth.comFrance

BNP Paribas Banque Privée

Although it was created through a merger between Banque Nationale de Paris (BNP) and Paribas in 2000, BNP Paribas Banque Privée’s heritage stretches as far back as 1848. Today, with assets under management of $114bn, it is the leading private bank in France. Its deep industry expertise enables it to create tailored investment strategies and maintain a strong commitment to socially responsible investment solutions.

mabanqueprivee.bnpparibasCanada

BMO Private Wealth

Professionals from one of North America’s leading full-service investment firms and Canada’s best private bank are partnered to help clients navigate the complex process of managing wealth. BMO Private Wealth’s multidisciplinary wealth management professionals take a proactive approach to help high-net-worth customers achieve their goals, with services including wealth planning, investment management and banking.

bmo.com/privatewealthBrazil

BTG Pactual

Having operated in the country for almost 40 years, BTG Pactual has become one of the biggest wealth managers in Brazil. The bank extended its global footprint in 2015, when it acquired the Swiss private bank BSI, and now benefits from a wealth of international expertise. BTG Pactual prides itself on its deep understanding of its clients and ability to personalise investment options.

www.btgpactual.comLebanon

FFA Private Bank

FFA Private Bank has witnessed continued growth since it was established in 1994. It covers areas such as private wealth management, asset management and real estate development management, as well as providing advisory services for all its clients. FFA Private Bank attributes its success to a results-driven culture and a deep focus on integrity and reliability.

www.ffaprivatebank.comKyrgyzstan

Optima Bank

For more than 25 years, Optima Bank has supported customers through a dynamic offering of banking solutions. The bank’s mission statement is centred on client wellbeing and the values of collaboration, respect and transparency. Private banking clients also get to enjoy the benefits of its VIP Centre, which offers a host of additional products and services.

www.optimabank.kgKuwait

Ahli United

Offering a comprehensive range of Sharia-compliant financial services, Ahli United has been supporting its customers for nearly 50 years. The bank is ready to cater to each individual’s needs, whether they are looking to streamline day-to-day operations or complete a major investment in Kuwait. Private banking customers can also benefit from dedicated relationship managers and advisory seminars.

www.ahliunited.com.kwJordan

Arab Bank

Arab Bank’s maxim, ‘success is a journey’, could not be more fitting. Since opening its doors in 1930 – with the backing of seven investors and 15,000 Palestinian pounds – the bank has embarked on a long road of expansion, nationalisation and development. To date, Arab Bank’s journey has seen it establish a footprint across five continents and help drive growth in the Middle East.

www.arabbank.comIsrael

Bank Leumi

As Israel’s oldest banking corporation and one of the largest institutions in the Middle East, Bank Leumi takes an active interest in the local community, helping to advance education, culture and art, as well as reduce social inequality. In recent years, the bank has invested significant sums to improve its technological offering and provide clients with cutting-edge digital services.

www.leumi.co.ilHungary

OTP Bank

As the largest bank in Hungary, OTP Bank pays special mind to financially supporting activities that contribute to the country’s social values. Its private banking service in particular is tailored to customers demanding high-level, socially responsible services that are customised to their individual needs, including account management, investment and fund management, and loan facilities.

www.otpbank.huItaly

BNL BNP Paribas

BNL’s history stretches back to 1913, when it was founded under its original name of Istituto Nazionale di Credito per la Cooperazione. It was brought into the BNP Paribas network in 2006, strengthening the group’s presence in Italy. Thanks to the acquisition, coupled with BNL’s far-reaching heritage, BNL BNP Paribas brings together cutting-edge products and a wealth of expertise.

www.bnl.itGreece

Eurobank

Eurobank has become a major player in Greece’s private banking sector. One of its subsidiaries, Eurobank Asset Management MFMC, ranks number one in mutual fund and institutional asset management in Greece, according to data from the Hellenic Fund and Asset Management Association. Drawing on its international network, Eurobank is perfectly placed to help clients invest in global markets.

www.eurobank.grBest Multi-Client Family Office, Liechtenstein

Kaiser Partner

Managing a family’s wealth is a complex undertaking, especially in periods of uncertainty. A long-established family business, Kaiser Partner prides itself on being a responsible and strategic partner in such times, helping families live the life they want today and secure their legacy for tomorrow.

www.kaiserpartner.comLiechtenstein

Kaiser Partner Privatbank

A family-owned private bank, Kaiser Partner Privatbank has succeeded on the basis of its strong values. With clients from all over the world, the bank focuses on providing a service that is both flexible and reliable. Decades of experience in investments, with a focus on capital preservation and sustainability, distinguish the early adopter of the UN Principles for Responsible Investing.

www.kaiserpartner.bankNetherlands

ING

Increasingly, customers are looking beyond traditional investment channels to see if they can do something meaningful for wider society. ING’s multidisciplinary approach to banking and its self-developed Forward Planning tool have helped countless individuals to bank with a purpose, enabling them to achieve their life goals along the way.

www.ing.nlMonaco

CMB

CMB is a leading private bank that boasts unrivalled financial stability. Since its foundation in 1976, CMB has focused on providing quality private banking services to meet clients’ needs with a one-stop shop approach. CMB’s offering is structured around private banking, investment management and financing, and comprises a wide range of investment products and tailor-made services.

www.cmb.mcPoland

BNP Paribas Bank Polska

Since it was founded in 2015, BNP Paribas Bank Polska has provided businesses with solutions to fund their operations in the Polish and international markets. Not only has the bank built strong links with local communities, it also has a deep focus on Poland’s long-term development, specialising in financing agriculture, the food economy and regional infrastructure.

www.bnpparibas.plMalaysia

CIMB Private Banking

Malaysia’s CIMB Private Banking offers a full suite of wealth management solutions to high-net-worth individuals, all delivered through a single point of contact. The bank’s regional network, which spans Singapore, Indonesia and Thailand, enables it to cater to clients’ onshore and offshore needs. CIMB’s investment philosophy prioritises the enhancement and preservation of customers’ wealth.

www.cimbprivatebanking.comNew Zealand

ANZ Bank

ANZ Bank’s private banking arm works in partnership with clients to develop a financial strategy that will help them achieve their personal goals. The bank’s highly qualified financial advisors are on hand to challenge the usual wealth management process in order to bring the best services to customers, while a network of specialist providers ensure any demand is met.

www.anz.co.nzPortugal

Banco Finantia

By offering a range of private banking solutions, including portfolio management, the purchase and sale of securities, and a selection of investment options, Banco Finantia has gained a reputation for delivering a top-quality, professional service. With more than 30 years’ experience, the bank understands how to build long-term relationships so clients can achieve their financial goals.

www.finantia.comTaiwan

Cathay United Bank

Formed from a merger between World Chinese Commercial Bank and Cathay Commercial Bank in 1975, Cathay United Bank has become one of Taiwan’s largest private banks, with more than 165 branches and assets totalling TWD 2.88trn ($96.1bn) as of December 2019. The bank has continued to grow by adopting an aggressive expansion strategy, making numerous purchases and expanding the scope of its services.

www.cathaybk.com.twTurkey

TEB Private Banking

When TEB Private Banking was established in 1989, it was the first private banking practice in Turkey. Now, with more than 20 years of experience working with high-net-worth clients, the institution prides itself on its sophisticated, highly targeted products. It achieves a deep level of customisation thanks to its single-contact principle, which means every client has an agent dedicated to them.

www.tebozel.comSweden

Carnegie Private Banking

Carnegie is one of the oldest brands in Sweden, having been founded in 1803, and with more than 600 employees, it is also one of the leading investment banks in both Sweden and Denmark. Its private banking clients benefit from the first-class knowledge and excellent communication that make its financial advisory services some of the most esteemed in the Nordic region.

www.carnegie.seUS

Raymond James

Proud to have been leading the way in American private banking since it opened its doors in 1962, Raymond James uses its expertise to tackle the complexities of the financial world in a way that benefits its clients. The bank’s specialised financial advisors design custom wealth management strategies that are tailored to each individual client’s wealth objectives.

www.raymondjames.comUK

Coutts

Providing modern banking services underpinned by tradition, Coutts’ private banking arm offers choice and flexibility to clients. Its network of experts boasts powerful insight and enviable connections, opening up many new financial opportunities to Coutts’ exclusive client base. As more complex fiscal issues surface, private bankers team up with specialists to ensure customers’ wealth remains protected.

www.coutts.comSingapore

Bank of Singapore

As the Singapore-based private banking arm of OCBC Bank, Bank of Singapore brings its clients the bespoke solutions and intimacy of a boutique private bank while also providing the wide range of resources on offer from its parent company. Known as ‘Asia’s global private bank’, is also the only Asian private bank to be given an Aa1 credit rating by Moody’s.

www.bankofsingapore.comSpain

CaixaBank

Although CaixaBank’s history is a short one, the Spanish financial services company has become an influential player in its home market thanks to a socially responsible, long-term banking model based on quality, trust and specialisation. The bank prides itself on equipping customers with the best tools and advice, promoting financial wellbeing and empowering citizens to make their dreams a reality.

www.caixabank.comSwitzerland

Pictet

Led by five guiding principles – partnership, entrepreneurial spirit, long-term thinking, independence and responsibility – Pictet seeks to build robust partnerships with clients, colleagues, companies and communities. The group, which has offices in 28 financial centres around the world, currently boasts $537bn of assets under management and an operating income of CHF 2.63bn ($2.72bn).

www.group.pictet

Moving with the times

The world of private banking and wealth management has had to cope with significant technological changes and major demographic shifts. Both developments are helping to create a more sustainable industryThe year ahead is likely to see the continuation of long-term shifts that have been taking place in the private banking space for some time. The sector has changed markedly over the last few years, notably in terms of customer expectations and digital transformation. One of the things that private banks and wealth management firms must stay abreast of is the rise of a new type of high-net-worth individual (HNWI), for whom simply making money is not enough. Increasingly, investments must be underpinned by ethical principles, with environmental, social and governance (ESG) factors playing a more prominent role in many individuals’ portfolios.

In addition, private banks must be particularly cognisant of macroeconomic factors in these turbulent times. At the start of the year, a pervading sense of optimism persisted, with many markets enjoying steady, if unspectacular, growth. The COVID-19 pandemic means that, like all industries, the banking sector is currently navigating its way through uncharted territory. Only the most shrewd banks are likely to make it through the crisis unscathed.

The ones that do will benefit from sensible investments in new technologies. Artificial intelligence (AI), reinforced by better data analytics, will enable banks to improve the onboarding process and develop stronger relationships with their clients. Open application programming interfaces, robotic process automation and collaborative endeavours with financial and regulatory technology firms will also prove fruitful.

As financial institutions adopt these new digital innovations, they must tread carefully, even as they making bold decisions. In 2020, private banks will need to find the right balance in an uncertain economic environment. The ones that can walk this fine line are the organisations we have honoured in this year’s World Finance Private Banking Awards.

A lot to consider Far from being purely profit-driven, today’s HNWIs care deeply about where their money is being invested and what it is funding. Private banks and wealth management firms must be aware of this if they are to meet client needs. According to a recent FTSE Russell survey, more than half of all asset owners globally are currently implementing or evaluating ESG considerations in their investment strategy. Sustainable assets are no longer simply nice additions to tack on to a portfolio – they are essential.

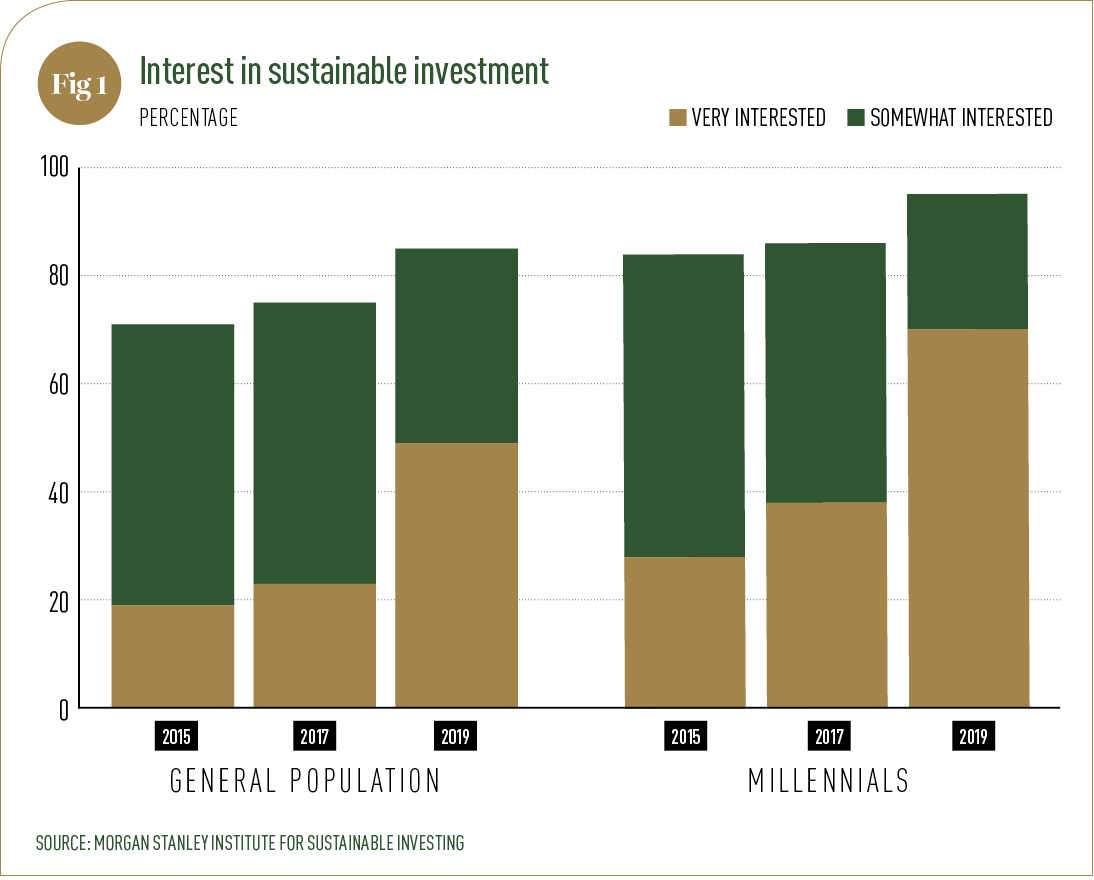

A new cohort of investors is partly responsible for the uptake in assets that display good ESG credentials. Millennials, who are making up an increasing proportion of HNWIs, tend to place more emphasis on the social impact of their investment than the general population, which is driving up the popularity of ESG funds considerably.

Another change that private banks must be mindful of is a desire for an omnichannel experience. Younger clients in particular are likely to be in possession of several bank accounts, which they access via a multitude of methods. They expect their bank to be able to collect and assimilate information from disparate sources before delivering holistic customer service. FIS’ PACE Report 2019 found that 97 percent of consumers consider a smooth, easy customer experience to be an important factor when choosing a bank.

Of course, with so much data flying about, it isn’t always easy for private banks to deliver an omnichannel experience. Sometimes, a back-to-basics approach can help. In Singapore, for example, United Overseas Bank has integrated its online and branch services into a single wealth creation journey, boosting client confidence.

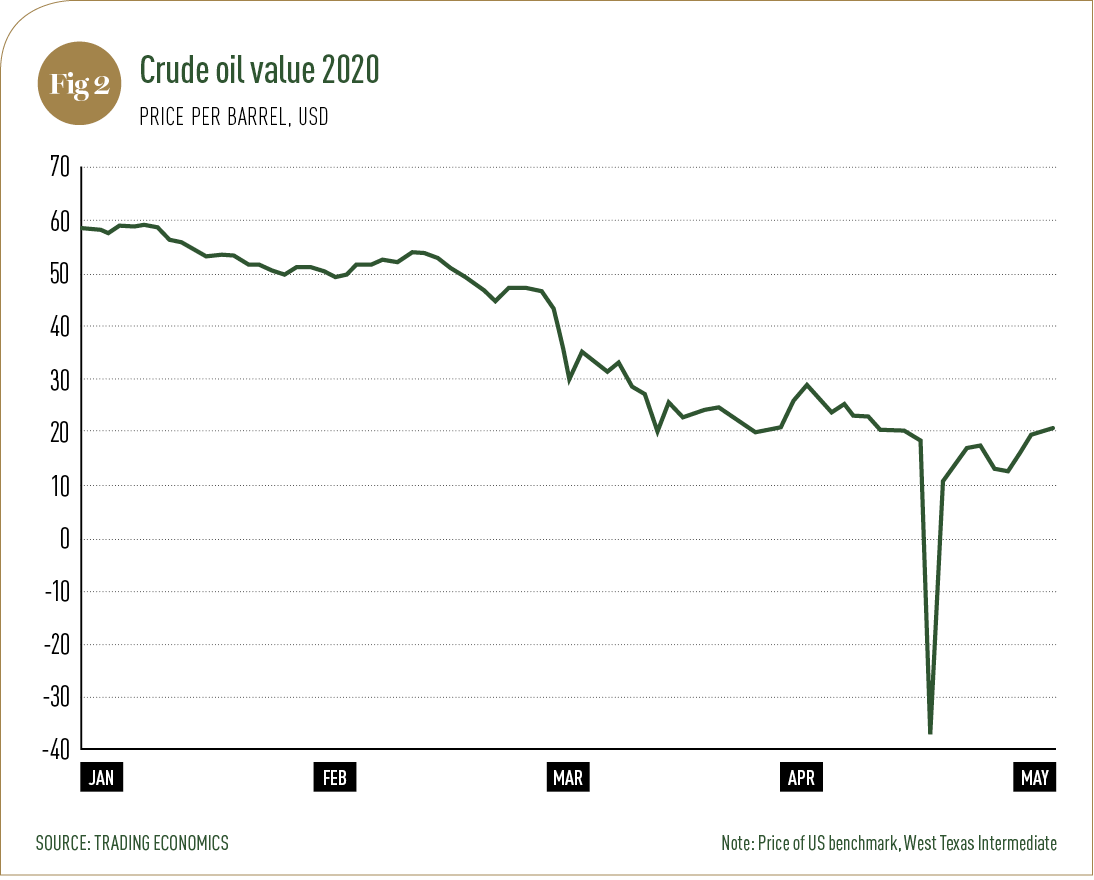

Though catering to customer needs is important, private banks cannot afford to neglect wider macroeconomic developments. Thus far, 2020 has been a year of economic turbulence, and this will undoubtedly be felt by HNWIs. What once seemed like a sound investment may have suddenly plummeted in value, as was the case with crude oil, which hit negative prices for the first time in history in April (see Fig 2). The best private banks do not allow themselves to suffer from myopia: client needs are important, as are regional developments, but staying in touch with national and international trends is just as essential.

Appreciate the individual One of the biggest shifts that has taken place in the private banking world is a demographic one. Customers are increasingly likely to be digital natives, which has implications for the kinds of products and services they expect from their bank. Over the next 10 years, a predicted $8.6trn of wealth will change hands, much of it finding its way into the bank accounts of younger individuals. Private banks and wealth management firms may be comfortable managing the expectations of Baby Boomers, but they will now have to do the same for Millennials and Generation Z.

But not all of them are up to the task. Research conducted by Fenergo, a leading provider of client life cycle management solutions, found that 90 percent of wealth management firms remain without a digital client self-service channel for onboarding. As a result, robo-advisors are set to revolutionise private banking firms throughout 2020 and beyond. They will provide algorithm-led financial planning for HNWIs, offering efficiency benefits for banks and clients alike. By 2025, the robo-advisory market is expected to manage $7trn of assets.

Ironically, however, even as AI-powered bank advice becomes increasingly important, customers will demand higher levels of personalisation. While technology can help with this, particularly regarding data collection, human members of staff will remain essential. Last year, JPMorgan Chase and Bank of America each opened some 400 new branches in the US. Particularly when large sums of money are being discussed, individuals may still prefer speaking to a wealth manager face to face.

Nevertheless, technology will continue to prove useful for improving the relationship between private banks and their clients. The 2019 Global Financial Services Consumer Study by Accenture broadly identified four core customer personas: pioneers, pragmatists, sceptics and traditionalists. Banks can use these definitions as bases from which to develop their products and services, without erroneously thinking that any single client will fit neatly into these groups.

Ultimately, private banks need to see individuals as unique. The World Finance Private Banking Awards highlight the private banks that are doing just that – delivering a personalised service that still takes into account wider social, economic and technological developments.