Banking Groups

Brunei

Baiduri Bank

One of the largest providers of financial products and services in Brunei, Baiduri Bank offers an array of world-class financial products through several subsidiaries. Baiduri Finance is the country’s leading car finance company, and Baiduri Capital caters for security traders through its modern online trading platform. The group is widely regarded as a significant financial innovator in the region.

www.baiduri.com.bnChile

Banco Internacional

Since it was originally founded in 1944, Banco Internacional has been something of an institution within the South American banking sector. The group’s diverse array of products has become well known for its flexibility, and the company is also famous for its keen attention to detail and customer service that goes well beyond what is expected.

www.bancointernacional.clDominican Republic

Banco Popular Dominicano

Since entering the Dominican Republic in the mid-1990s, Banco Popular has cemented its position as one of the most well-known and highly-regarded financial institutions in the country. The wider group includes several subsidiaries, offering investment fund administration, trust fund management, real estate sales and several other digital financial services.

www.popularenlinea.comEgypt

Banque Misr

With a proud history dating all the way back to 1920, this Cairo-based bank serves around 10 million clients in Egypt with a wide array of modern, sophisticated financial products. Beyond the 700 local branches it operates, the wider group also has offices in Lebanon, France, the United Arab Emirates, China, Russia, South Korea and Italy.

www.banquemisr.comFrance

Crédit Mutuel

Owned by its members, Crédit Mutuel is a banking group that has a focus on personalising its market-leading products. With the support of a dedicated advisor, the group's clients can take advantage of products designed for everyone from young people, to farmers, to professional associations, all provided with the peace of mind from one of Europe’s safest banks.

www.creditmutuel.frGermany

Commerzbank

Serving millions across two core business segments – approximately 30,000 corporate clients and 11 million private and small business customers – Commerzbank is responsible for transacting approximately 30 percent of Germany’s foreign trade. It does so through a wide network of international offices paired with some of the most advanced online banking technology in the country.

www.commerzbank.comGhana

Zenith Bank Ghana

Established a mere 15 years ago, Zenith Bank Ghana has achieved an awful lot in its relatively short existence. It has been a local champion for financial inclusion, and is behind a wide array of innovative banking products. It consistently embodies its ethos of leveraging technology to bring new, leading services to its growing customer base.

www.zenithbank.com.ghHong Kong

HSBC

As one of the world’s largest banking and financial service institutions, HSBC needs little introduction. Its Hong Kong office has played a crucial role in the region for more than a century, from issuing merchant sailors with banknotes to financing the manufacturing sector after the Second World War. It continues in similar leading roles today.

www.hsbc.com.hkIsrael

Israel Discount Bank

Through a variety of products designed for personal, business and private banking customers, Israel Discount Bank prides itself in its considerate and professional service. The bank is currently focused on creating shared value for families across multiple generations, for which its new products are winning the institution considerable praise and success.

www.discountbank.co.ilJordan

Jordan Islamic Bank

Offering a diverse array of financial and investment products all in accordance with Sharia-Islamic principles, Jordan Islamic Bank is seen an important institution in both the country and the region. Through its four business segments, individual accounts, corporate accounts, asset investment and treasury, the bank is able to offer complete financial solutions.

www.jordanislamicbank.comKosovo

BKT

The largest and oldest commercial bank in Albania, BKT mounted its formal expansion into Kosovo as recently as September 2007. Now, some 14 years later, the bank is continuing to find success in the region. Today it offers a complete array of financial products for individuals and businesses through a vast footprint of branches and ATMs.

www.bkt-ks.comMacau

ICBC (Macau)

A subsidiary of the Industrial and Commercial Bank of China, ICBC Macau can trace its history all the way back to 1972. ICBC is a leader, and holds the distinction of being the first organisation to issue pre-paid debit cards in Greater China. Its strong regional connections allow it to offer a comprehensive and valued set of products to its customers.

www.icbc.com.moPakistan

Meezan Bank

Pakistan’s first and largest Islamic bank, Meezan Bank holds the honour of being one the fastest growing financial institutions in the entire country. Within the bonds of Shariah, Meezan Bank boasts a variety of innovative, high-value products and services, and is committed to its vision of a fair and just society for all of the people in Pakistan.

www.meezanbank.comSaudi Arabia

Riyad Bank

With a strong focus on corporate and retail franchise, Riyad bank is considered to be one of the largest financial institutions in the Kingdom of Saudi Arabia and the Middle East. It is known for playing a leading role in arranging syndicated loans across the oil, petrochemical and infrastructure projects in the region, of which there are plenty.

www.riyadbank.comTurkey

Akbank

Founded in 1948, Akbank is one of the largest banks in Turkey. Offering a wide variety of retail and corporate banking services, the organisation has pioneered digital banking products in the country. It plays a major role locally, and in 2020 the bank provided loans totalling almost $40bn to support the local economy during the most difficult of years.

www.akbank.comUK

Barclays

London is at the forefront of the financial system, but even among giants Barclays still stands out from the competition. Incredibly, it has played a pivotal role in the UK’s financial history since the 17th century. Its historic achievements include the UK’s first cash machine, debit card, and many other modern conveniences that are now taken for granted.

home.barclays

Learning from adversity

The COVID-19 pandemic has taught us many things. The lessons for the world’s banking groups will permanently change how business is done. Banking groups will need to navigate complex technological and regulatory challenges moving forwardThe whole world has been tested by the pandemic on a personal level. But from a business perspective, the true test has been on the resilience of systems. Crisis and risk managers have speculated about worst-case scenarios for decades, with many developing complex plans and strategies designed to mitigate the worst impacts of a disaster.

While few expected an event on the scale of what we are currently experiencing, hopefully a crisis management plan that was at least somewhat applicable was at the ready. For the world’s banking groups, the situation presented innumerable challenges. With infections and restrictions spreading at uneven rates around the world, international organisations faced tremendous difficulty in maintaining continuity. Both banks and their customer segments were affected very unevenly, posing vastly different challenges for different divisions.

And, that is all before banking groups started to manage their own, internal difficulties. The truly successful banks were able to marry their ongoing digital transformations with their pandemic crisis response strategy. With the resilience of organisations and their way of doing business substantially tested, some took the opportunity to accelerate transformations that were already underway. As the world returns to some form of normality, banking groups will be making careful considerations as to what stays and what goes in light of the emerging trends.

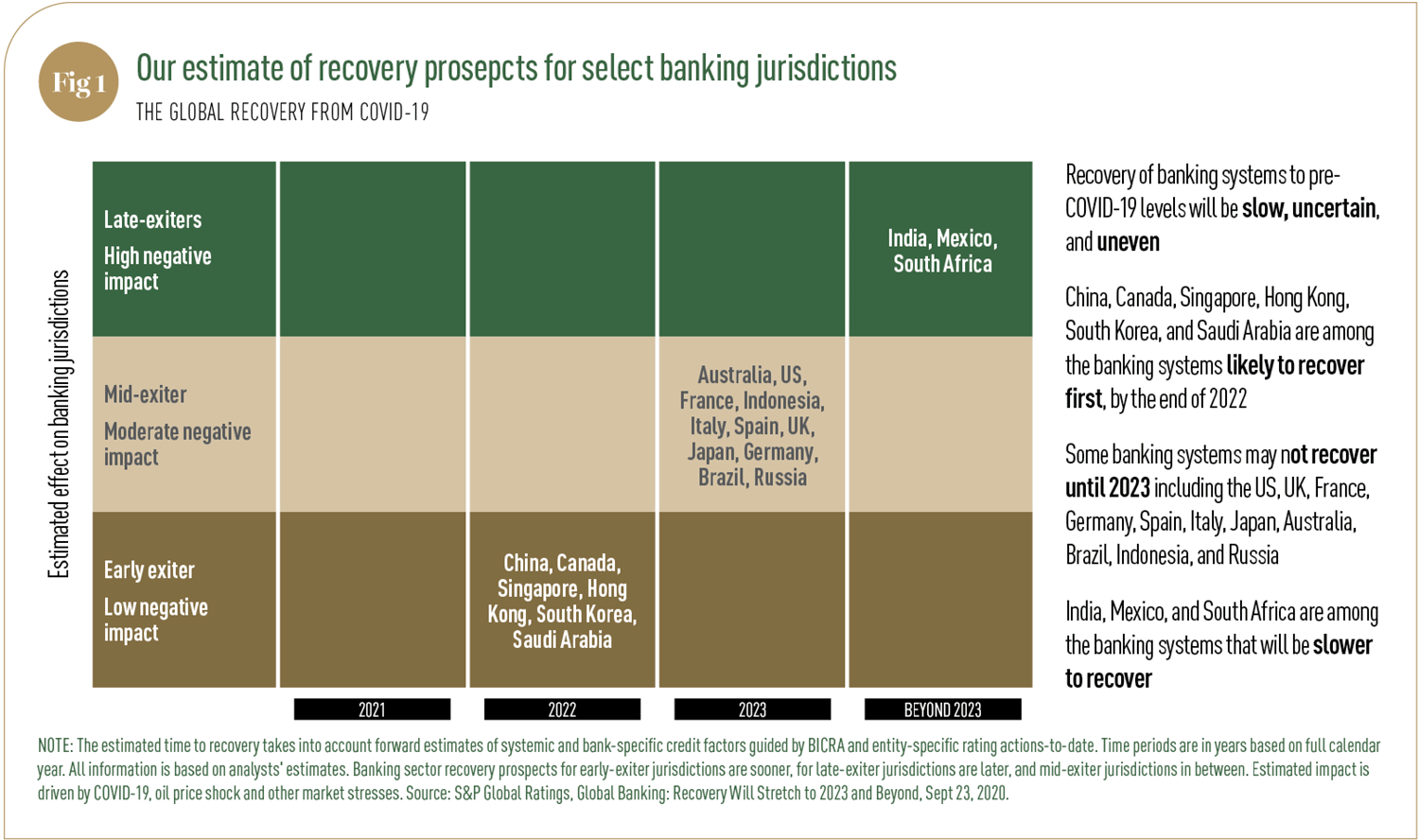

Full steam ahead Despite the widespread efforts to curb COVID-19 and vaccinate the world’s population, global immunity is a long way off and companies will have to manage ongoing disruptions for many years to come. IHS Markit predicted several key trends that will come to shape global banking in the months and years ahead. Many are related to the lingering effects of the pandemic. When lockdowns first began to sink their teeth into the economy, governments across the world made substantial efforts to ease burdens where they could. Loan payment moratoriums and the easing of other forms of reduced regulatory compliance got many through the pandemic, but as people look to recovery, policies will begin to change focus. Government budgets are most likely to direct their attention to the worst hit and slow recovering sectors of the economy. Tourism, particularly international tourism, is one such example. This substantial shift in policy will affect particular divisions of various banking groups. The lingering effects of the pandemic are likely to have an impact on how banks are regulated. In a challenging economy, it would be reasonable to expect that lending standards would be tightened. There are some exceptions to this, with IHS Markit expecting Asia, thanks to its relatively limited number of COVID-19 lockdowns, to experience a fast economic recovery (see Fig 1).

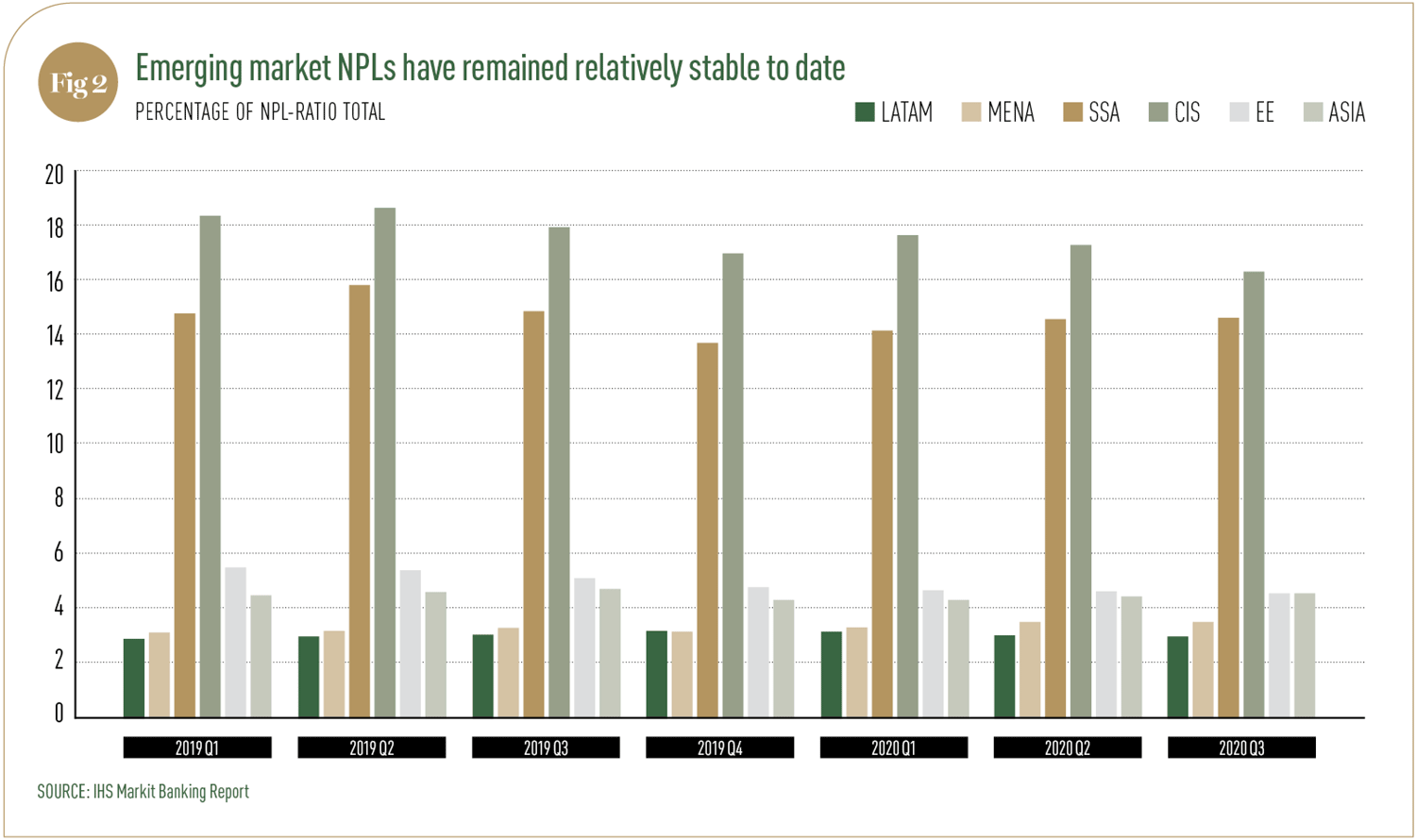

However, throughout the rest of the world the provision of credit could be expected to slow. A potentially surprising figure is that in 2020 non-performing loans remained relatively stable around the world (see Fig 2). This is most likely due to stimulus and economic policies, so this may not continue for much longer. Of particular interest are the issues that banking groups may face that are not as obvious as broader macroeconomic forces. One such challenge is the move to remote working. Much of the attention from the media and business has been on what this will mean for day-to-day operations, but there is also the emergence of new security threats. Suddenly, with many people working from home on their own, with personal computers, there is a significant opportunity for hacking or other data breaches. Also, with customers accessing their finances from home instead of in-person at a branch, a banking group’s online security for customers has been put under extreme scrutiny. A lost hard drive or stolen laptop may not end up amounting to much, but banking groups’ IT departments will need to be vigilant to any and all potential threats.

New rules While these changes mainly focus on the short and medium term, longer term there are inescapable regulatory changes the world’s banking groups will need to contend with. EY compiled some of the major forces in its 2021 Global Bank Regulatory Outlook.

The Biden administration has signalled that climate change will be front and centre of its COVID-19 recovery and economic agenda, even going as far as to suggest that trade policies might soon be linked to a country’s climate mitigation efforts. To any banking group deciding the businesses it will cater for, as well as any expansions to its own operations, climate impact will be a leading factor. Fitting today’s regulatory framework, while also considering how policies may tighten in the future, will be a major conundrum for future planners.

The threat of data loss from employees working from home has already been discussed, but there exists a wider regulatory challenge for banking groups. Technology and data have provided a wealth of new opportunities, but privacy concerns around how they are used has been concerning global regulators for some time. For banking groups that utilise customer data, particularly across borders or between different parts of the group, the highest standards will be of the greatest importance to ensure they avoid any and all reputational damage. Additionally, both the environment and technology will be on the mind of regulators when assessing prudential risk.

Ultimately, the list of risks that an organisation might face, and that might threaten its future, has become a lot longer. The banking groups that will succeed in this environment are the winners of this year’s World Finance Banking Groups awards. The victors are the banking groups that have shown leadership and vision in the face of incredible adversity, and will navigate the complex regulatory environment ahead with ease.

The future may be uncertain, but the groups listed will be able to manage whatever is thrown at them.