Commercial Banks

Austria

Raiffeisen Bank International

A leader in Central and Eastern Europe, Raiffeisen Bank International serves 17.2 million customers through a network of around 1,900 business outlets. Building on its motto of ‘New Thinking’, the bank has made significant financial achievements through a number of innovative, sustainable programs and partnerships, particularly in the field of fintech.

www.rbinternational.comBelarus

Belagroprombank

The core mission of Belagroprombank is to benefit each and every one of its clients, as well as society as a whole. No easy task, but over the course of its 26 years as an independent financial institution it has managed to embody this noble and laudable goal, winning many accolades in the process for its commitment to its large and small customers alike.

www.belapb.byCanada

BMO Bank of Montreal

With expertise ranging from auto dealerships to media companies, BMO Bank of Montreal’s impressive commercial division has industry knowledge to support a wide array of products and solutions. BMO also has a strong focus on sustainability, and has recently announced its ambition to lead its clients to net-zero emissions by 2050.

commercial.bmo.comColombia

Davivienda

Davivienda is a portmanteau of the Spanish words that translate to ‘providing a dwelling.’ Its iconic little red house logo has been synonymous with value and security since its inception back in 1973. Its modern array of financial products and tools cover a wide variety of sectors, ranging from individuals, to companies, to rural communities.

www.davivienda.comCzech Republic

Ceska Sporitelna

The bank with the longest tradition in the Czech market, Ceska Sporitelna has been serving clients, ranging from individuals to entire municipalities, since the year 1825. Its continued efforts to support the development of local communities, and not just individuals, are building an impressive legacy that is expected to last for many decades to come.

www.csas.czDenmark

Nykredit

As a bank and mortgage provider owned by its customers, Nykredit naturally takes a particularly strong focus on customer service and satisfaction. It reflects this through its pledges to customers, partners and even the entirety of Denmark. It has found great success through this philosophy, and is today the country’s largest lender by some distance.

www.nykredit.comDominican Republic

Banreservas

As the leading financial provider in the Dominican Republic, Banreservas plays a pivotal role in the country’s local economy. Indeed, it rose to the occasion this year, launching myriad programmes and initiatives that succeeded in easing the extreme financial burden faced by many of its customers during the global COVID-19 pandemic.

www.banreservas.comFrance

BNP Paribas

Having played a crucial role in the global economy for the last 200 years, BNP Paribas is now looking to secure its future for the next 200 years. To that end, the group has developed a new ‘company purpose’ which is to guarantee its success while also addressing the key society issues of the future, such as environmental and social challenges that are on the horizon.

group.bnpparibasGermany

Landesbank Baden-Wurttemberg

The full-service financial provider for corporate and retail customers, which is also publicly owned, has a specific focus on the value of trust. Success is built on great relationships, and Landesbank Baden-Wurttemberg works towards building the best relationships wherever possible to ensure support during both the good times and the bad.

www.lbbw.deMacau

Bank of China

Bank of China’s Macau Branch is one of the leading partners for small and medium enterprises in the region. Its dedication to a one-stop-shop model, while still identifying the best solutions for businesses at any stage of their journey, has won it several accolades. Its e-banking services and network of branches makes managing cash easy for its clients.

www.bankofchina.com/moNigeria

Zenith Bank

In the rapidly evolving and progressive Nigerian economy, Zenith bank offers a remarkably wide variety of financial products to suit businesses at all stages of their journey. Plus, with all the benefits that come along with joining one of the region’s largest financial service providers, business customers receive the support to grow and develop their business.

www.zenithbank.comSri Lanka

Sampath Bank

Sampath Bank prides itself as the growing force of the Sri Lankan financial services sector. Since 1986 the company has exceeded expectations year after year. It brings this philosophy to its corporate customers, and its complete suite of financial products, offered both digitally and in-person, can help businesses at any stage of their journey.

www.sampath.lkSweden

Handelsbanken

Celebrating its 150th birthday this year, Handelsbanken has an incredibly proud history of driving greater competition between the banks in Stockholm and Sweden as a whole. All these years later the values that drove the formation of the company, which are bravery, adaptability and staying close to customers, are as true now as they were then.

www.handelsbanken.seTurkey (Most Sustainable Bank)

Industrial Development Bank of Turkey

Given its history as a privately-owned development and investment bank, TSKB is acutely aware of the power of money. Because of this, it aims to imbue its corporate social responsibility values across its vast array of corporate banking, investment banking and consultancy services that it delivers through its wide and increasing network of branches.

www.tskb.com.trUnited States

Bank of the West

The US subsidiary of BNP Paribas, Bank of the West has a particular focus on the positive impact it can have in the world. Its focus on environmentally sustainable investments, plus a diverse leadership team, gives it a unique perspective on the finance industry. This is in addition to the full assortment of financial products customers expect.

www.bankofthewest.comVietnam

Sai Gon J.S. Commercial Bank

Sustainability is a term that is used a lot in banking, but the professional conduct of Sai Gon J.S. Commercial Bank truly reflects it. With a background in fast financial growth, advanced technology, diverse products and leading service, it has developed systems designed to support social and financial success for many years to come within Vietnam.

www.scb.com.vn

On the shoulders of giants

With the line between commercial and personal banking products becoming more blurry by the day, business customers are asking more of their financial partners‘Uncertainty’ was perhaps the most overused word in 2020, but it accurately captured how most people felt about the state of the world. During a global pandemic, with unexpected developments affecting almost every facet of work, businesses were forced to contend with dozens of challenges they simply did not anticipate.

The commercial banking sector walked alongside their clients every step of the way. In a world where the process and cost of doing business was suddenly altered, potentially forever, companies of every size and sector had to reconsider both their operations and finances. For the banks providing the financial services to these businesses, the situation demanded rapid, dynamic responses, all while monitoring how they themselves were impacted.

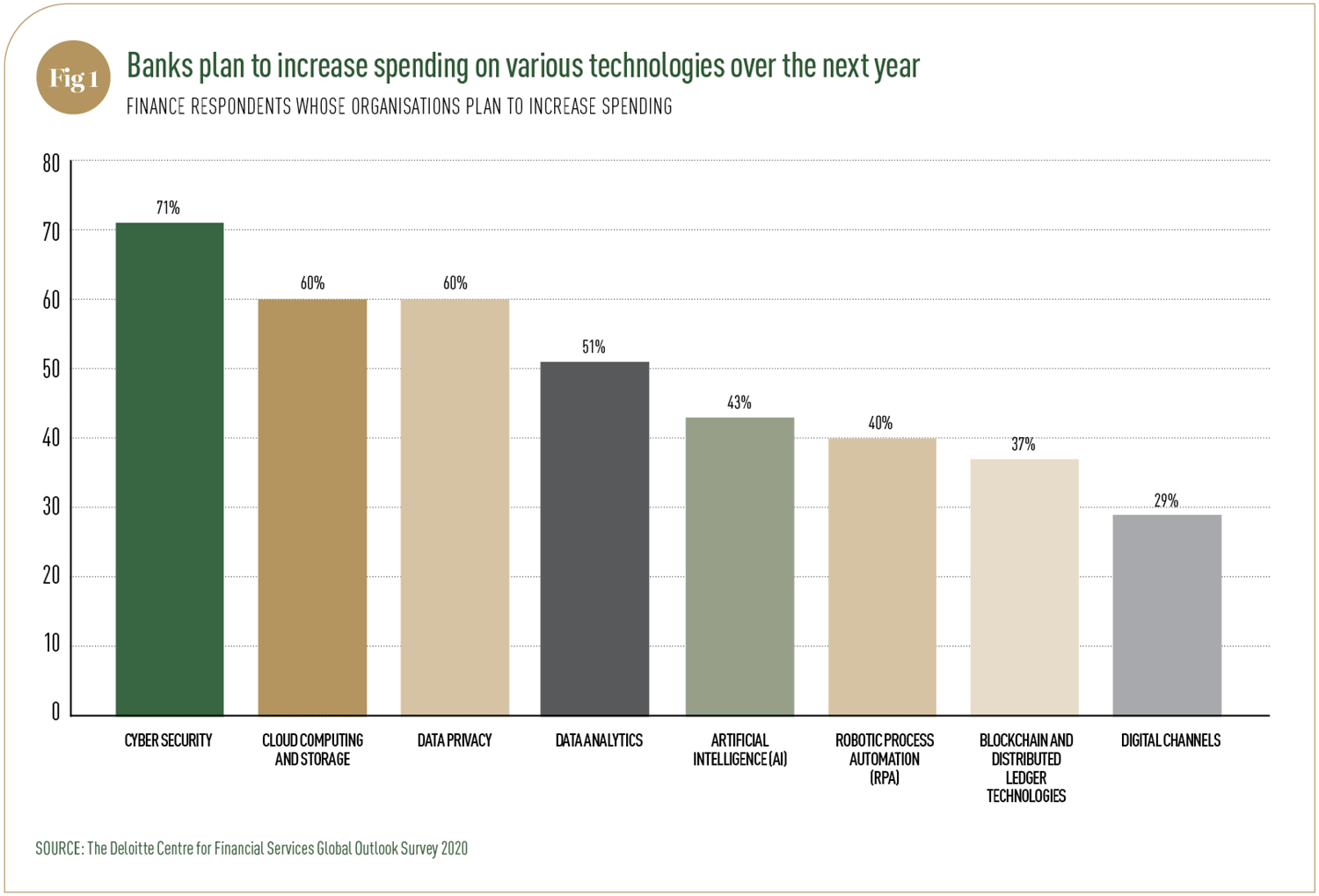

But despite the challenges, the greatest business impact of the COVID-19 pandemic might have been the acceleration of transformations that were already under way in the sector. Commercial banking products were already being transitioned to fully integrated digital systems; the pandemic simply accelerated the timeline (see Fig 1). For the banks that were already well on this journey the pandemic was an ideal opportunity to justify redoubling their efforts on digital. Those with the vision and foresight were left in a much better state than those without.

Arriving at the platform One particularly pertinent concept in the commercial banking sector is the idea of ‘banking as a platform’. At its core, this reframes the role of a bank from providing core products and services to a fully integrated aspect of their client’s business. Rather than try to build out distinct digital infrastructure and tools themselves, banks instead provide a platform that other products and tools connect with. This is a fundamental part of the modern information technology sectors (Apple doesn’t make every app on the iPhone, for example) but it is becoming increasingly important in all aspects of the economy.

This presents some unique challenges in the commercial banking space, but businesses are beginning to adapt. According to Deloitte’s preview of its The Future of Commercial Banking Showcase, there are three main themes that will begin to shape the future of commercial banking.

The first is the narrowing of the gap between commercial and retail banking products. Outside of the job, chief financial officers and accountants are regular, every day banking customers benefitting from the significant improvements currently being seen in the retail banking space. New apps, dynamic products and ever-increasing expectations are driving the consumer market to incredible new heights in terms of speed, flexibility and personalisation. It’s impossible not to compare products within the personal market to business offerings, growing expectations across the board.

Another is the changing nature of how businesses operate. An increasingly important element of successful businesses is being dynamic and flexible. The ‘move fast, break things’ mentality has become the norm in the current business environment, particularly as opportunities now tend to disappear just as quickly as they appear. To make the most of these opportunities when they do present themselves, businesses need similar flexibility from their service providers to rapidly adapt to their changing needs.

Lastly, the ever-changing skillsets of the workforce is altering how business is done. Employees are being equipped with a greater variety of skills, and with the increased capability to do more they are asking for better tools and systems. Combined, all these factors mean commercial banking products need to be more adaptable and personalised to each individual business.

Putting it in to practice Materially, what does all this mean? Flexibility and innovation have been touted for years and are often quite fairly dismissed as meaningless buzzwords. However, the successful implementation of these styles of thinking are leading to actual, material changes in processes and policy.

Capgemini’s Commercial Banking Top Trends 2021 report highlights some specific examples in action. Tinkoff, a Russian digital-only bank, has recently developed a full-scale outsourced call centre that purely caters to small and medium-sized enterprises in an attempt to improve its customer experience. This specific, dedicated investment is a dramatic development for a relatively new and small player in the market, but emphasises the value of creating dynamic systems to meet customer needs.

OakNorth Bank in the UK has developed an AI-powered system to offer financing to businesses. Instead of dealing with and waiting on slow, in-person systems, regulated and considered AI-powered processes are able to meet the expectations of demanding business customers by automatically assessing and approving loans.

Other AI systems are being used for a multitude of tasks, such as identifying money laundering and creating dynamic alert systems to business customers about their financial health. Banks have been undergoing this transformation for several years, but as customers begin to notice tangible benefits the demand for these systems is beginning to accelerate. No longer will customers tolerate anything less than best-in-class service, be it customisation or enhancements to conventional banking services.

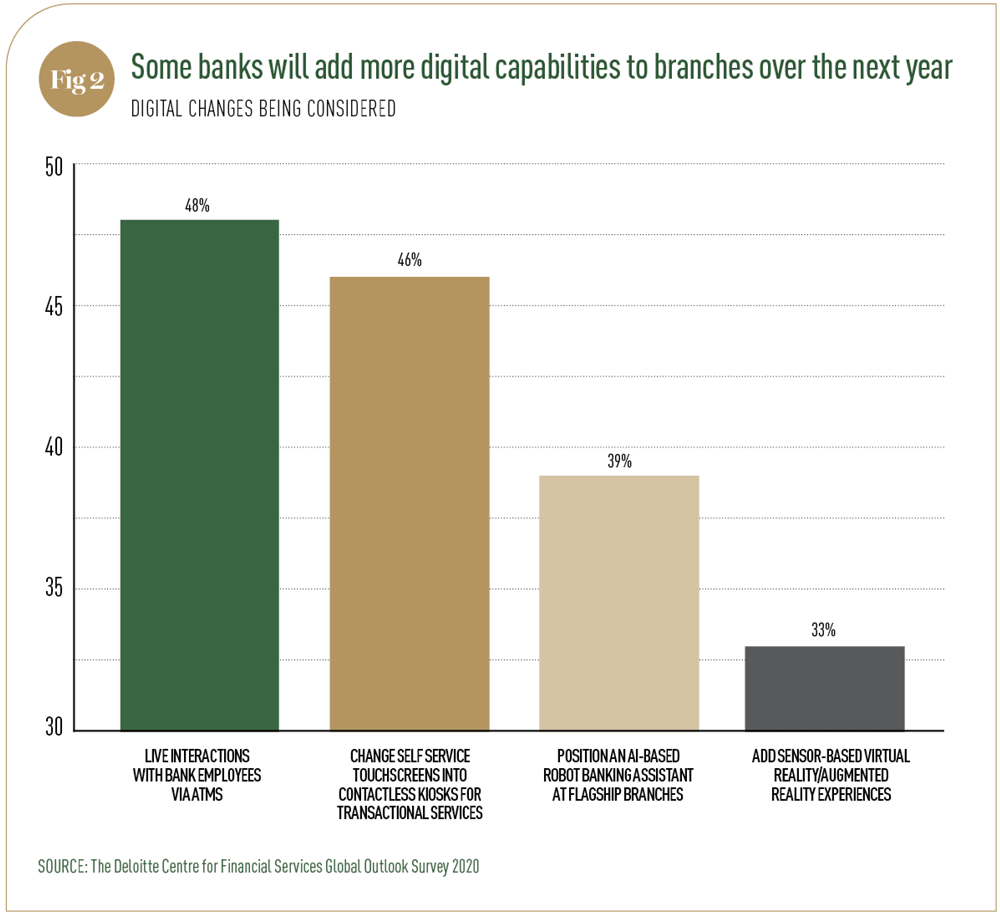

To succeed, banks will need to develop end-to-end digital experiences, extended ranges of products, establish robust ecosystems and adopt advanced architecture (see Fig 2). Plus, they will need to combine them to improve customer services beyond current expectations. The banks that have been doing this for years, and are now dramatically improving to meet higher expectations, are the winners in this year’s World Finance Commercial Banking Awards. The winners are demonstrating the best levels of digital practice and establishing the benchmarks that all other banks will be judged against in the coming years.

They are developing systems and processes, not just products, which are facilitating businesses to achieve and excel in the modern, dynamic business environment.