Private Banks

Austria

Erste Private Banking

Within the Erste Group, Erste Private Banking brings together all the personal services that are expected of a private bank, bolstered by the full capabilities of a major, modern banking group. Erste uses these resources to offer innovative and tailor-made solutions to help customers achieve their unique and specific goals, whatever they may be.

www.ersteprivatebanking.comBelgium

KBC Private Banking

What sets a private bank apart? Confidential advice? Future planning? The best digital tools? KBC Private Banking considers all of this and more to develop the complete personal relationship with clients that is needed for holistic financial planning and advice. It is why the bank boasts a nine-out-of-ten satisfaction rating from its customers.

www.kbc.beBrazil

BTG Pactual

With wealth management services ranging from investment funds and alternative investment products to payment and portfolio solutions, BTG Pactual is able to provide a complete suite of products to its clients. While based in New York and Miami, its wealth management department has affiliate offices located across eight countries, making it a preferred choice among global travellers.

www.btgpactual.comCanada

BMO Private Wealth

Formed out of a merger between BMO Private Banking and BMO Nesbitt Burns, BMO Private Wealth has emerged as one of North America’s leading full-service investment firms. Combining the best of wealth planning with wealth management, the company takes a holistic approach to helping clients achieve their long-term wealth goals.

bmo.com/privatewealthDenmark

Jyske Bank

Jyske Bank takes a remarkably different approach to private banking. Informal, unpretentious and personal, it prides itself on offering simple and straightforward advice. However, this does not mean it is lacking in sophistication; it has a full array of financial products and services designed to meet and exceed the expectations of any client.

www.jyskebank.comFrance

BNP Paribas Banque Privée

With an extensive history of banking excellence, BNP Paribas Banque Privée takes a particular focus on long-term goals for its customers. Whether a client is running a business, providing for their loved ones or managing a complex portfolio of financial assets, the bank’s highly-skilled advisors work as partners on their customer’s wealth journeys.

www.mabanqueprivee.bnpparibasGermany

Berenberg

Founded by the Berenberg family in 1590, Berenberg is officially the world’s oldest merchant bank. The fact that it has found success for more than 400 years is telling enough, but its selection of wealth management, asset management, corporate, real estate and other financial products place it at the forefront of modern private banking.

www.berenberg.deGreece

Eurobank

Amid the wider Eurobank Group, Eurobank Private Banking provides personalised services to individual customers. With access to all the divisions and subsidiaries of Eurobank, a customer’s private banker can tailor specific solutions to fit their profile. And with customers being provided a single point of contact, all decisions are built on long-term mutual trust.

www.eurobank.grItaly

BNL BNP Paribas

A subsidiary of BNP Paribas since 2006, Banca Nazionale del Lavoro (BNL) is Italy’s sixth largest bank and a major provider of financial products for both personal and business customers. As a member of the wider BNP Group, it is able to offer significant international reach alongside its well-regarded local service, which helps it stay ahead of the competition.

www.bnpparibas.itLiechtenstein

Kaiser Partner

Award-winning and family owned, over the last 40 years Kaiser Partner has developed a strong reputation for its both its personalised services and commitment to sustainability. Its pioneering ‘Wealth Table’ model sees the bank participate as an independent expert for all of a client’s financial decisions, not just where liquid assets are invested.

www.kaiserpartner.bankLiechtenstein (Best multi-Client Family Office)

Kaiser Partner

Many financial advisors look at growth in wealth as the single greatest measure of success, however for high-net-worth individuals this is not necessarily the best measure. Recognising this, Kaiser Partner works to embody a person’s values in their investment decisions; a philosophy that has led the group to tremendous respect.

www.kaiserpartner.comMonaco

CMB Monaco

It is said that it takes many hands to build a house, and it takes many more to maintain it. That’s why CMB Monaco has several highly-specialised departments to meet its client’s needs. Its highly-regarded private bank department is staffed by dedicated multilingual and multicultural bankers to meet, and exceed, its clients’ diverse and complex needs.

www.cmb.mcPoland

Bank Pekao

Bank Pekao knows the true power of wealth; that it can help dreams come true while also having a positive impact on the economy at the same time. Because of this, it focuses on the four pillars of customers, growth, efficiency and responsibility in all that it does. Embodying these values in its private banking products has led to its notable successes.

www.pekao.com.plSweden

Carnegie Private Banking

Occupying a crucial role in Nordic business for more than 200 years, Carnegie has managed to embody excellence in all areas that it has set its focus on. As the leading investment and private bank in the region, it takes a forward-facing perspective on investments with the dual purpose of generating returns and being part of a brighter tomorrow.

www.carnegie.seSwitzerland

Pictet

Boasting a near mythological status among the financial elite, Pictet is at the very pinnacle of the Swiss private banking arena. Its dedicated wealth management services, built on the three pillars of wealth solutions, investment solutions and banking solutions, have won it respect, success and many accolades, with more on the near horizon.

www.group.pictetTurkey

TEB Private Banking

As the first private bank in Turkey to offer several mobile applications to its clients, TEB Private Banking is seen as something of a pioneer in its field. The organisation is also supported by BNP Paribas, so clients can easily access a wide variety of financial products and services from other subsidiaries throughout Europe, which is hugely beneficial.

www.teb-kos.com

The drumbeat of recovery

With economies recovering from the COVID-19 pandemic far more quickly than anyone expected, private banking customers are eager to identify opportunities that line up with their prioritiesOne year ago, the world looked like a very different place. Waves of lockdowns were shutting down international business and travel, and people across the globe were enduring harsh restrictions. The efforts to contain the COVID-19 virus were entirely necessary, but the random and sporadic implementation left many struggling to respond to changes both on personal and professional levels. No matter who you are or what your situation was, it was a time for deep introspection.

Fast forward to today and you have a world where the end is in sight. Never before in human history has a vaccine been developed so quickly and distributed to so many people. With a greater percentage of the globe’s population receiving the vaccine every day, people are now re-entering the world with a new set of values and priorities. To those with significant investment portfolios, many are looking at a vastly different economic landscape with an entirely new perspective.

To meet the expectations of these clients, private banks will have to adopt new products and policies reframed around this new, post-Covid world. For many, this will be a continuation of the advisor-client relationship they have spent many years building, and a natural evolution of doing business. For others, it means a complete rethinking of how they operate. Either way, only the most dynamic and responsive companies will find success in 2021 and beyond.

Identifying future trends The core challenges of private banking and wealth management have remained consistent for many years now. The key trends from Deloitte and Efma’s 2016 Wealth Management and Private Banking report are still largely applicable today. There are significant wealth opportunities across borders, and a thorough understanding of regulatory requirements is needed to successfully tap into them. Relationships between advisors and their clients need to be timely, multi-channel and globally focused. Products should be outcome-oriented and closely tethered to business development.

But how does all this apply to a post-Covid world? Analysts are beginning to look at and identify the trends that will come to shape the future. Citi’s The New Economic Cycle: Investing in a Post-COVID World report identifies four key ‘unstoppable’ trends: Digitalisation, the Rise of Asia, Greening the World, and Increasing Longevity. While these trends have certainly been developing for some time, the pandemic has provided the world an early taste of what is to come.

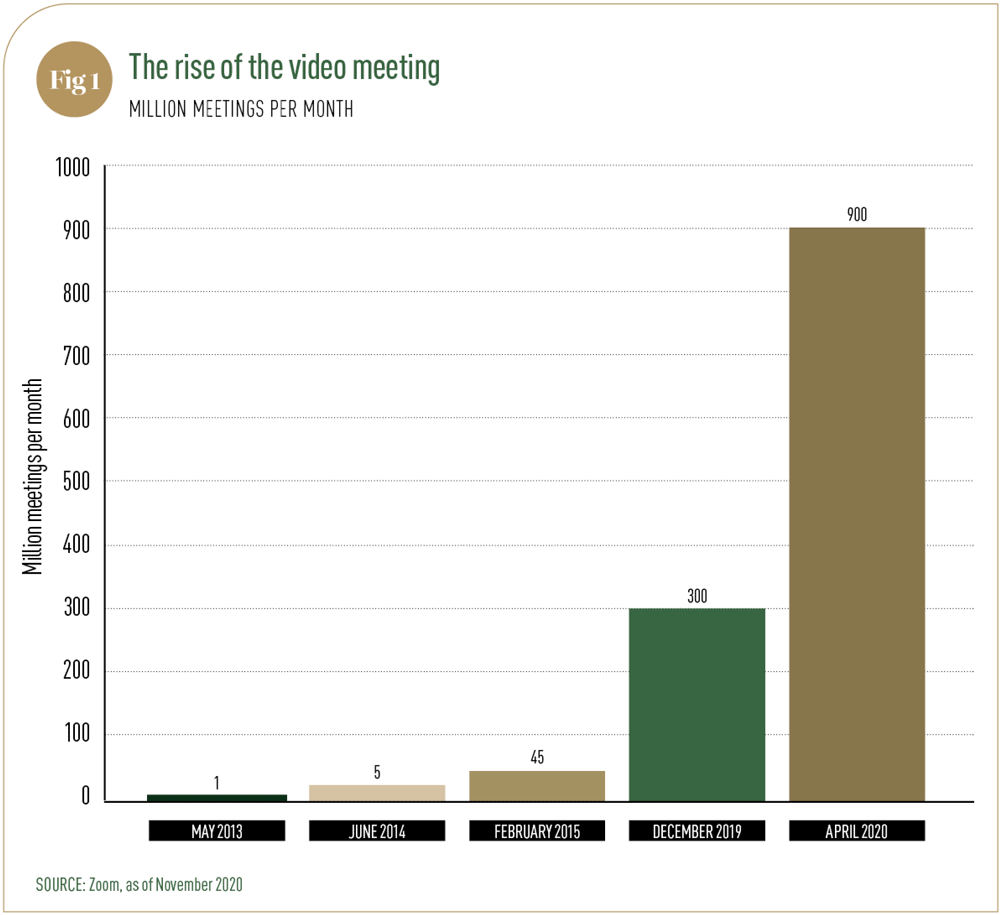

Digitalisation refers to the increasingly interconnected world we find ourselves in, something that has become abundantly clear during the pandemic. COVID-19 would only have had to come along a few years earlier and the world’s digital infrastructure might not have been sufficient to handle the load that was placed upon it (see Fig 1). With businesses temporarily going online, the value and necessity of new technologies like 5G, fintech, e-commerce and cyber security is more apparent than ever before. Any business connected to these fields has the potential to be a significant investment opportunity.

The financial rise of Asia has also been continuing for years, setting up a potential global duopoly between the US and China in terms of economic competition and demand. A change in US president has done little to alter ongoing tensions, and competition looks set to intensify. Investors will have their sights firmly set on both regions for new opportunities.

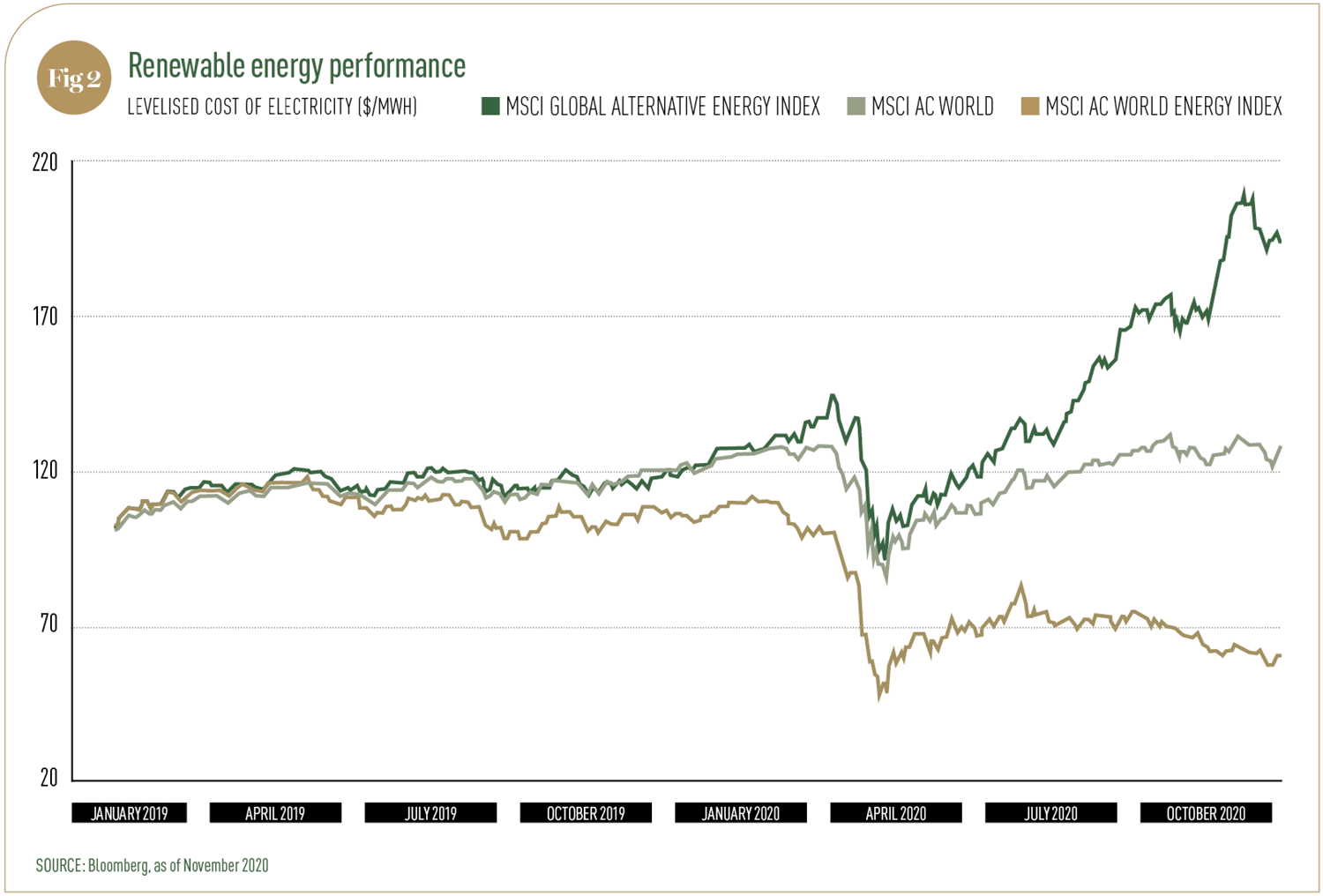

'Greening the World' relates to the incredible change in energy policy we are experiencing. The shift away from fossil fuels is rapid and inevitable, and will represent the greatest shift in energy production since the development of mainstream electricity usage. It is also a shift that is being driven by the market, not just by policymakers (see Fig 2). The cost of renewable energy is falling by the day, and businesses are beginning to see the financial incentive of going green, as well as the improved public approval such a change brings.

Finally, increasing longevity refers to the healthcare progress that is being driven by both improvements in healthcare technology and demand from the world’s aging population. Both the capability and necessity of the wider healthcare sector have been made apparent by the COVID-19 pandemic, and many of the changes that have been made in the last year are here to stay. Combined, these four core trends are expected to drive significant investment in the coming decade.

A long-term plan However, the challenge for private bankers will be reflecting the priorities of their clientele across these four areas. The year of the pandemic has been a significant time for personal growth, and finding a way to achieve growth while reflecting a customer’s priorities is not an easy task.

According to JPMorgan’s Outlook 2021 report, a goal-focused outlook is recommended, particularly in a world where there are significant opportunities being presented in a rapidly recovering economy.

“We believe this young recovery could last for years. But before you act on this kind of optimism, make sure you have a solid, long-range investment strategy that aligns with the goals you have for yourself and your family. Planning holistically is the only way you can truly build and keep full confidence in your investment portfolio,” the report reads.

While clarity of purpose will help, only the leading private banking institutions will be able to achieve it. The banks that have shown they can respond to customer needs and achieve these goals are the recipients of this year’s World Finance Private Banking Awards. The winners are those that have the capacity and service needed to successfully capitalise on the new business landscape, while embodying their customers’ new priorities in life.