Investment Banks

Brazil

BTG Pactual

A powerhouse financial company operating in the areas of investment banking, wealth management, asset management, corporate lending and trading, Brazil-based BTG Pactual is in eight countries throughout South America, North America and Europe. The group’s focus on long-term vision has made it a preferred partner among many customers, particularly discerning investors.

www.btgpactual.comChile

BTG Pactual

The Chilean arm of BTG Pactual offers all of the financial services of the group’s other national subsidiaries and with a local flavour added too. This structure allows for local service with access to an intercontinental network of products. With this expertise, the bank is a preferred partner among local businesses looking at international expansion.

www.btgpactual.clColombia

BTG Pactual

Just like the wider BTG Pactual group, the Colombia arm of the banking institution offers several wealth management, asset management, investment and trading products to its clients. BTG Pactual has only been active in Colombia since 2012, but its acquisition of local brokerage firm Bolsa y Renta now gives the company roots that go back 50 years.

www.btgpactual.com.coDominican Republic

Banreservas

Playing a crucial role in the Dominican Republic’s construction, agriculture, small business and tourism sector, Banreservas is a highly respected financial firm in the region. Given the promising economic prospects for the country, it can be expected to continue to play an important role in ongoing economic development for many more years to come.

www.banreservas.comHong Kong

Jefferies

Boasting a full range of investment banking products and services, Jefferies is well-regarded for its professionalism and effectiveness. Its recent push into Asia, building on its already impressive history in the region, has set it up with the skills and expertise to make an even bigger impression in the decade ahead than it has in its own notable past.

www.jefferies.comKazakhstan

Tengri Partners

A diversified Central Asia-based merchant banking group, Tengri Partners’ suite of services across investment banking, asset management and commercial finance covers all of the average customers’ investment banking needs. Plus, it boasts unparalleled insights into the fascinating Kazakhstani economy, giving its clients a local edge that is not available elsewhere.

www.tengripartners.comNigeria

Coronation Merchant Bank

Considered to be Africa’s premier investment bank, Coronation Merchant bank takes the unconventional philosophy of wanting to make banking invisible to its customers. By making transactions effortless, it is able to allow its customers to focus on the things that really matter to a business. It has been an extremely and notably successful strategy.

www.coronationmb.com

The beginning of the next decade

The nature of how we live has been permanently altered by the COVID-19 pandemic, but how will it change the ways we invest?How has your working life changed in the last 12 months? For many, it has meant investing in a good home office setup with a computer and webcam in a private room. Perhaps it has meant an upgrade to home internet, or a new professional focus on autonomy and freedom. But the more intriguing aspect might be what you have lost. Perhaps it is a long commute, a company car, or unproductive meetings with dozens of colleagues.

The things that we have lost, many of which are unlikely to return, are what will come to fundamentally alter the economy in the future. Some industries will decline and others will rise in response to these changing trends. Businesses jostle to figure out where they stand in the new, altered landscape, and all while trying to solidify new working arrangements for themselves. For the investment banking sector, this shift will pose significant challenges for the next decade. Not only do these trends promise to alter how their own internal structures operate, but it will lead to a dramatic shift in how investment banks select and prioritise opportunities. To succeed in this environment, businesses will need total confidence in their processes and decision-making.

Ten years of transformation Predicting the future is fraught at the best of times, but the next decade of investment banking is beginning to take shape.

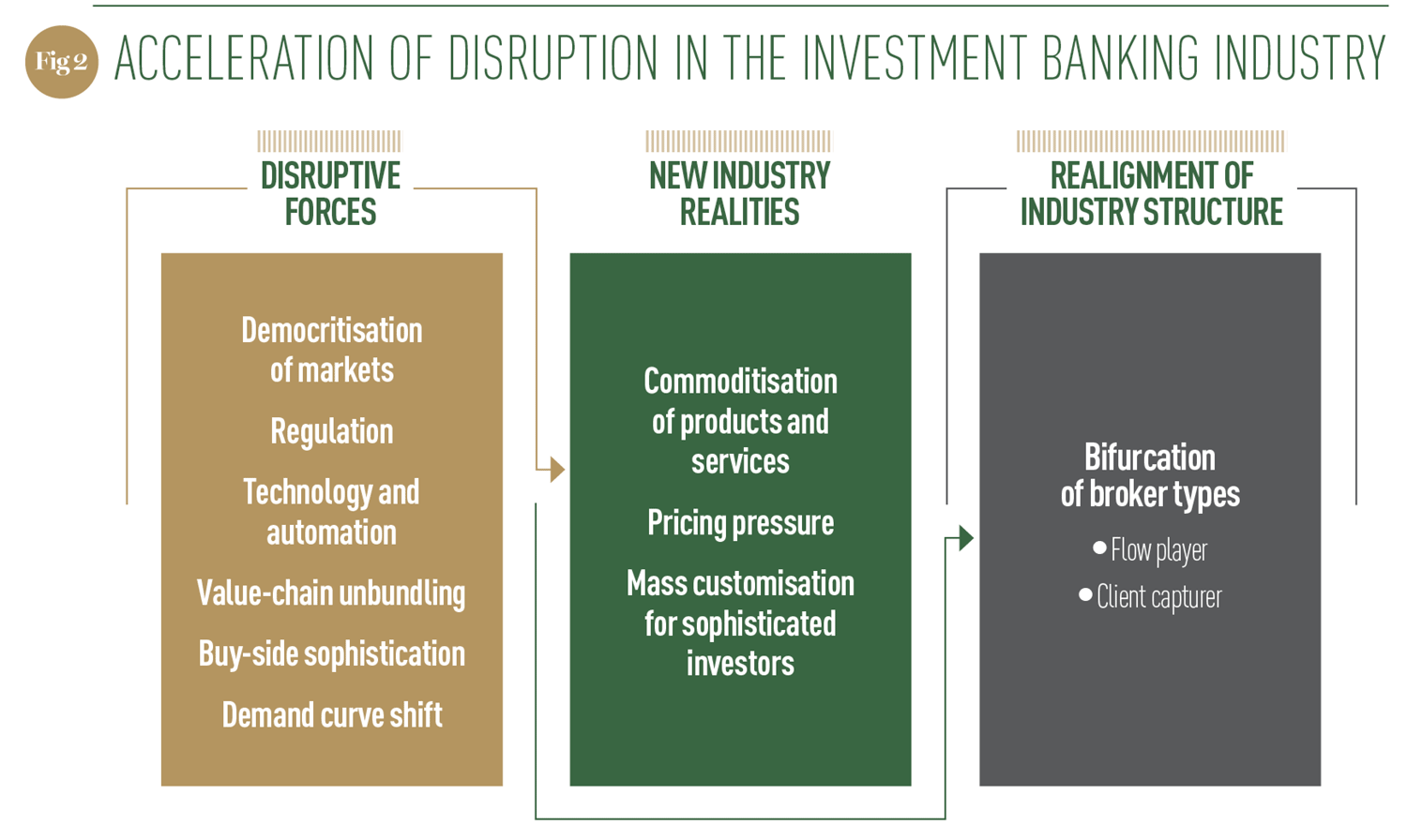

Deloitte’s recently published Bank of 2030: The future of investment banking report lays out the challenges that investment banks are currently facing, and what others can be expected in the future. In particular, falling equity prices, liquidity stress, evolving regulations, pricing pressure and increased client sophistication are cited as significant factors. Market democratisation, new technologies and a shift to remote working environments are also expected to have an impact.

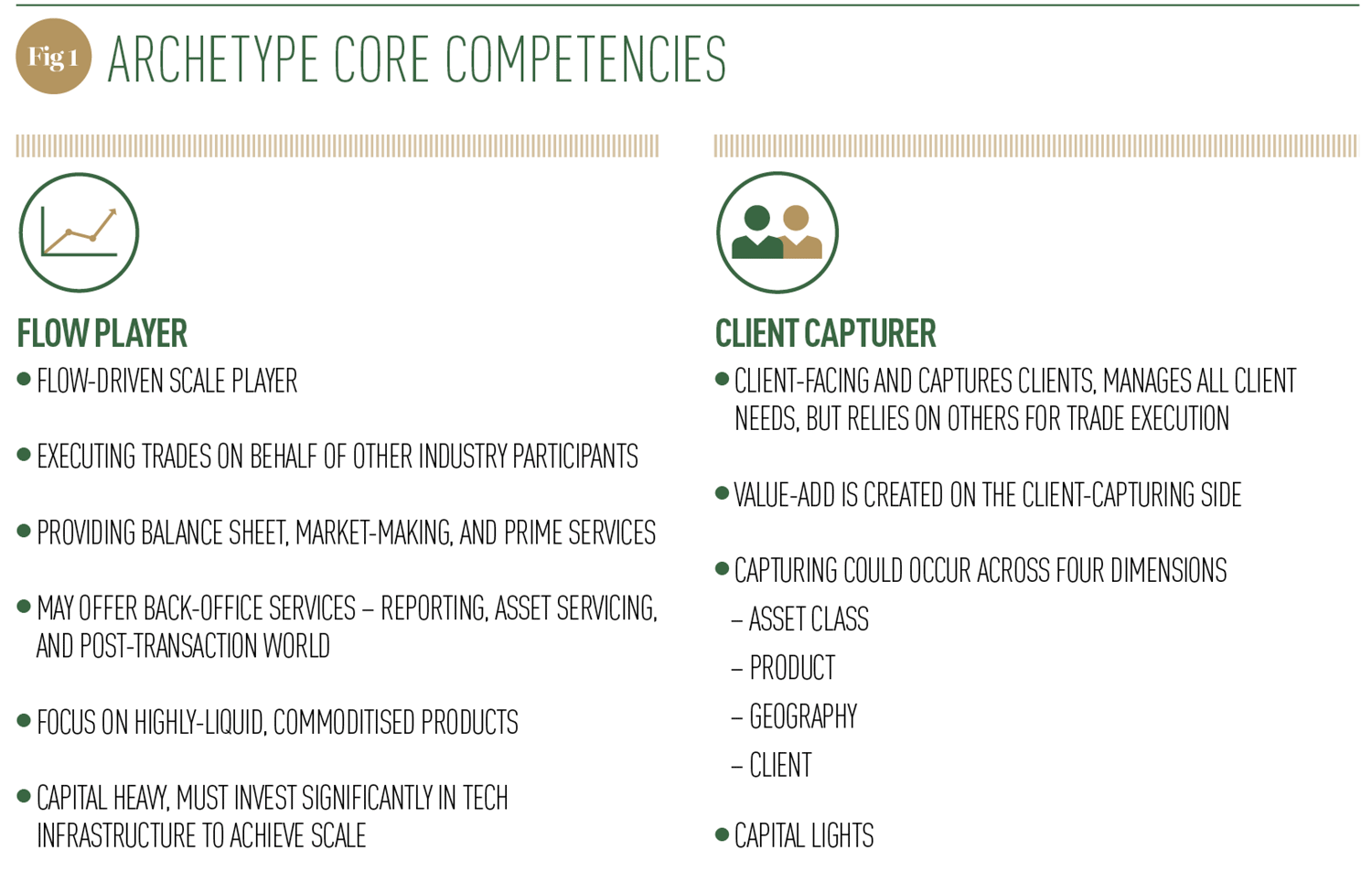

Combined, all of this is predicted to create a substantial change in how investment banks do business. According to Deloitte, investment banking is likely to shift from a full-scale, all-in-one model to two distinct streams; ‘client capturers’ and ‘flow players.’ Client capturers have a forward-facing business, and will be experts at identifying and managing client needs. These investment banks offer unparalleled customer service and products designed to appeal across assets classes, geographies and demographics. However, these businesses will be capital light, and rely on others in the industry to complete trades and transactions on their behalf. Flow players, on the other hand, will offer a very different set of functions (see Fig 1).

Operating as a service within the market, they will complete trades and transactions on behalf of the rest of the industry. They will function more as a back-office service, offering the fundamental services that underpin the wider market. They will be focused on highly liquid, commoditised products and have a significant investment in technology and IT infrastructure to perform this function quickly and efficiently.

Deloitte predicts that this will lead to a connected flow model, where interconnected businesses will be able to meet client needs through a network for partners. Some investment banks will focus on producing dynamic products for clients, while others handle the technical backend systems that power these products. Deciding which role to play in this new dynamic looks set to be the challenge that is presented to today’s leading investment banks.

New markets All these challenges are occurring in an environment that is very different to what has been seen in the past, but the wider sector is currently in a strong position to meet these changes head on.

Oliver Wyman’s Corporate & Investment Banks: Striving to Sustain Returns annual report, compiled by Morgan Stanley, states that a decade of structural changes in the markets and investment banking sector have resulted in efficient balance sheets that were capable of surviving the pandemic. What’s more, the groups’ report concludes that these returns are sustainable, provided banks continue to make the right decisions.

In particular, the report’s writers see a shift to ‘Transaction Banking’ as a source of stable business, deeper client relationships and a clear function. Focusing on this particular segment has the potential to continue the significant returns that have already been seen. Successfully capitalising on this will be dependent on how banks restructure themselves (see Fig 2). In particular, the most successful banks will have deep, rich digital tools that integrate with client ecosystems. Because client needs are so varied, the decision banks face may be between specialising on a few particular factors, or scaling up to offer a greater number of systems.

Either way, it will mean a significant change in a relatively short amount of time, particularly with the additional decision of whether to focus on outward or inward facing processes. Large banks have the financial resources to tackle these changes, while smaller ones might be able to execute a shift more nimbly. It is abundantly clear that there is no one size fits all solution. The banks best equipped to navigate this complex situation are the recipients of this year’s World Finance Investment Banking Awards.

The winners have demonstrated years of success built on strong fundamentals, and have the capacity to stay the course for the transformative decade that lies ahead. They have all shown confidence in their decision-making, and the ability to follow through and achieve their results.

While the future may look uncertain to some, the winners in this year’s awards look set to define what ongoing success looks like.