Banking Groups

Antigua

BOI Bank

Since its inception in 1994, BOI Bank has been a leading provider of financial services. Despite being based in Antigua, its executives pride themselves on their flexible, mobile approach, often travelling to meet clients. The bank has significant reach in Latin America and the Caribbean, where it is renowned for its professionalism and commitment to security and confidentiality.

www.boibank.comAzerbaijan

PASHA Bank

As the leading bank in Azerbaijan in terms of capital, PASHA Bank has proven itself to be one of the most intelligent and innovative institutions in the region. The business currently serves key non-oil sectors of the economy, such as transport and agribusiness, as well as working in investment, trade finance and asset management.

www.pashabank.azBrunei

Baiduri Bank

Brunei’s Baiduri Bank is recognised for its excellence across numerous financial spheres, including retail banking, securities trading and wealth management. Among its many achievements, the bank was the first in the state to offer in-store and in-mall banking seven days a week. The bank also regularly provides financial support for national child development programmes.

www.baiduri.com.bnChina

ICBC

Established in 1984, the Industrial and Commercial Bank of China (ICBC) is now the most valuable bank in the world by market capitalisation. With assets in excess of RMB 24.1trn ($3.6trn), the joint-stock company has continued to diversify its business structure through stable development, leading the Chinese banking sector in the promotion of financial reform and innovation.

www.icbc.com.cnArgentina

Banco Macro

Banco Macro is the second-largest domestically owned private bank in Argentina, with expertise in investment, loans, insurance, debit and credit products, among other specialities. It is able to maintain excellent relationships with customers through a thorough knowledge of their needs. Banco Macro also works hard to support local communities, entrepreneurs and SMEs.

www.macro.com.arBolivia

Banco Mercantil Santa Cruz

With a history that stretches back more than a century, Banco Mercantil Santa Cruz’s reputation as Bolivia’s most robust financial institution is largely secure. This past year was no exception, with the bank retaining its position as market leader and securing an increase in net income in spite of a difficult economic landscape and complex regulatory environment.

www.bmsc.com.boChile

Banco de Crédito e Inversiones

Banco de Crédito e Inversiones, which is based in Chile, provides specialist banking services to individuals, entrepreneurs, entities, real estate companies and large corporations. It is renowned throughout Latin America for its expertise across numerous financial areas, though the bank operates mainly through the specialist segments of retail and wholesale banking.

www.bci.clCuraçao

Banco del Orinoco

Banco del Orinoco has one of the strongest reaches of any bank across Latin America and the Caribbean, though its executives do their utmost to reach clients across the entire globe. Among its chief achievements, the bank boasts excellent customer service, with committed and highly trained staff, as well as personalised banking products to suit all client needs.

www.bancodelorinoconv.comCyprus

Eurobank Cyprus

Since its inception in 2007, Eurobank Cyprus has grown at a rapid rate. The bank now operates eight full-featured bases across the country, and boasts a strong capital base as well. Eurobank Cyprus’ custom-made solutions, which are inherently flexible, set it apart from its local rivals, as do its highly trained personnel, who are on hand 24/7 to assist clients.

www.eurobank.com.cyEgypt

Arab African International Bank

As a provider of retail, corporate and investment banking services in Egypt, Arab African International Bank has become renowned for its reliable, streamlined approach. It began as a joint venture between the Central Bank of Egypt and the Kuwait Investment Authority, and has since established itself as a gateway for businesses looking to establish operations in Egypt.

www.aaib.comGhana

Zenith Bank Ghana

With a deeply committed focus on new technology, Zenith Bank continues to function as a trendsetter in Ghana’s banking industry, which in turn is also helping to increase financial inclusion among the Ghanaian population. Zenith Bank was the first bank in the country to launch an app-based mobile banking service – the wildly popular Z Mobile.

www.zenithbank.com.ghJordan

Jordan Islamic Bank

Since its establishment in 1978, Jordan Islamic Bank has specialised in Sharia-compliant financial services, acting with the interests of both customers and shareholders in mind. At the same time, the bank has invested intelligently in new financial technology, in order to bring its dependable, traditional offering into the modern age.

www.jordanislamicbank.comDominican Republic

Banco Popular Dominicano

Founded in 1963, Banco Popular Dominicano is a private bank in the Dominican Republic, perhaps best known for its dedication to community engagement. The bank has a strict corporate governance model, and works to support science, the arts, telecommunications and education. It currently runs more than 50 initiatives a year to promote responsible and sustainable social investment.

www.popularenlinea.comFrance

Crédit Mutuel Group

The success of Crédit Mutuel in terms of customer and member satisfaction – even in the face of new competition in the market – can be attributed to its unique mutual model. Sticking to its roots, the bank constantly seeks new ways to strengthen the harmony of the overall group, while still valuing the individuality of its 19 federations and six federal banks.

www.creditmutuel.comIndonesia

Bank Rakyat Indonesia

Founded in 1895, Bank Rakyat is one of Indonesia’s oldest and largest banks. Its primary focus is local SMEs – an important financial driver for a growing country looking to establish itself more firmly on the world stage. The bank also pioneered microfinance within Indonesia, and has been the country’s most profitable bank for an impressive 11 consecutive years.

www.ir-bri.comLebanon

Bankmed

Founded in 1944, Bankmed has garnered a reputation for its unwavering commitment to customer service, and now leads the market in Lebanon. Through a number of technological investments and innovative products – including iris recognition technology and the award-winning Be My Guide app – Bankmed offers solutions that continue to meet and exceed client expectations.

www.bankmed.com.lbMacau

ICBC Macau

As the largest locally registered bank in the state, ICBC Macau holds itself responsible for promoting economic development and diversity in Macau. The group offers its broad range of clients a variety of specialist products, and it is the only bank in the special administrative region with a licence for both asset management and custody services.

www.icbc.com.moMalaysia

Maybank

Maybank has one of the most impressive reaches across the South-East Asian banking network, with a presence in Malaysia, Singapore and Indonesia. In addition, the organisation has an international network of more than 2,400 branches in 20 countries. It was also ranked in the Forbes Global 2,000, a list of market-leading companies in June 2016, in recognition of its excellent work.

www.maybank.comMexico

Banorte

Formed from a series of mergers between some of Latin America’s leading pension funds, Banorte is one of the largest commercial banks in Mexico by assets and loans. Now working alongside the Mexican Government to improve the country’s private pension system, Banorte is setting the benchmark for responsible investment, innovation and transparency in Mexico.

www.banorte.comMyanmar

CB Bank

Established in 1992, CB Bank has become one of Myanmar’s principal financial entities, boasting the largest network of ATMs and POS machines in the country. As the first bank in Myanmar to manage Visa and Mastercard transactions, as well as to introduce mobile banking, CB Bank has significantly contributed to the modernisation of Myanmar’s financial services.

www.cbbank.com.mmNigeria

Guaranty Trust Bank

Employing more than 10,000 people across Africa, Guaranty Trust Bank (GTBank) is one of the continent’s leading financial institutions, providing a range of traditional and digital banking services to more than 10 million customers. Headquartered in Lagos, GTBank is Nigeria’s largest bank by market capitalisation, and boasts an asset base in excess of NGN 3.16trn ($8.6bn).

www.gtbank.comPeru

Banco de Crédito del Perú

Founded in 1889, Banco de Crédito del Perú is the oldest and largest bank in the country. Its solid growth throughout the decades can be attributed to a steadfast commitment to its clients’ success. The bank provides specialist support for SMEs, including frequent blog updates that offer instrumental advice to help growing businesses reach new heights in a financially sustainable manner.

www.viabcp.comPhilippines

Rizal Commercial Banking Corporation

Having been in operation for more than 50 years, Rizal Commercial Banking Corporation has built up an impressive reputation across the Philippines and South-East Asia. The bank currently ranks among the largest private domestic institutions in terms of assets, and provides both corporate and individual customers with a huge variety of services through its different strands.

www.rcbc.comQatar

Qatar National Bank

Qatar National Bank – the country’s largest financial institution – boasts the honour of being the first Qatari-owned commercial bank. It is also one of the MENA region’s key players, and recently acquired Turkey’s Finansbank to consolidate this position. Last year, the bank moved into Vietnam and Myanmar, with a mind to further expand operations into Asia in the near future.

www.qnb.comSaudi Arabia

Samba Financial Group

Samba Financial Group (formerly Saudi American Bank) began life as a branch of Citibank in Jeddah, in 1955. It has since grown to become a dominant player in the Middle East’s private, personal and business banking sectors, with major branches in Dubai and Qatar, as well as a presence in Asia through its operations in India and Pakistan.

www.samba.comSingapore

OCBC

Located in Asia’s financial hub, OCBC offers a broad range of services and products. While holding a dominant position in its domestic market, OCBC also enjoys its station as the top foreign bank in Malaysia, along with a strong presence in China and Indonesia. This footprint is a huge plus-point for its clients, many of which are multinationals with global ambitions.

www.ocbc.comSouth Korea

Woori Bank

Since its establishment nearly 120 years ago, Woori Bank has been at the forefront of South Korea’s drive towards a more modern and inclusive banking system. The bank’s well-balanced business portfolio includes SMEs and large corporations alike, and its success has largely stemmed from its ability to maintain a strong relationship with each individual client.

eng.wooribank.comSri Lanka

People’s Bank

With a network of 347 local branches, the state-owned People’s Bank serves customers throughout the whole of Sri Lanka, and is on a mission to be named the country’s top financial services provider. It is the bank’s dedication to giving something back to the local community, however, that really sets it apart and allows it to connect with Sri Lankan society on a deeper level.

www.peoplesbank.lkTaiwan

Mega International Commercial Bank

Mega International Commercial Bank was formed in 2006 from a merger between the International Commercial Bank of China and Chiao Tung Bank. It now has 107 branches to its name in Taiwan alone, in addition to 22 branches, five sub-branches and five representative offices abroad. The group’s focus for 2017 has been to further strengthen its international presence.

www.megabank.com.twThailand

Bangkok Bank

In the 73 years since it was founded, Bangkok Bank has garnered a reputation as an industry pioneer keen to embrace new technologies and explore untapped markets. In addition to being Thailand’s largest commercial bank, it also has a significant international presence, with subsidiaries in 15 countries, including branches in New York and London.

www.bangkokbank.comTurkey

Akbank

Akbank is one of the largest banks in Turkey. Founded in Istanbul in 1948, the bank has a wide range of expertise across a number of different financial instruments and sectors. In addition to its professional activities, the bank actively invests in the theatre, contemporary arts and environmental projects, taking a strong interest in Turkish society as a whole.

www.akbank.comUAE

Union National Bank

Union National Bank is a market leader in both the UAE and the wider region, thanks to its bold approach to growth. Indeed, it was the first UAE bank to establish a representative office in China, and also has branches in Qatar, Kuwait and Egypt. With a range of conventional and Sharia-compliant products, the bank is set up to serve any and all personal, business and private banking clients.

www.unb.com

Embracing groupthink

In spite of global economic uncertainty and slow growth, technological innovation is giving banking groups the opportunity to thrive – provided they’re brave enough to take the chanceOver the course of the past year, the world has experienced a flurry of political, social and economic upheavals. Events such as the US presidential election, the Brexit vote and India’s unprecedented demonetisation scheme have created an uncertain international business climate, with a rise in protectionism and anti-globalisation sentiment now posing a real threat to economic growth. As a result of these disruptive events, the banking sector has been forced to contend with extreme market volatility, forcing banking groups around the world to rapidly adapt to a new economic environment. As the banking industry adjusts to these political shocks, it is also dealing with its own internal transformation. Technological advances have begun to change the face of banking, with fintech emerging as the biggest trend of 2017. From blockchain technology to big data, the sector has undergone significant digitalisation, with more large and mid-sized banks incorporating such systems into their everyday operations than ever before. What’s more, fintech solutions are advancing at an incredible rate – those that cannot quickly adapt will ultimately be left behind in this digital race. However, although digital banking options are proving increasingly popular among customers, banking groups must ensure that their strict security standards are maintained in this technological age. Balancing these two sides will be the making of those banking groups that will become market leaders in a few years’ time.

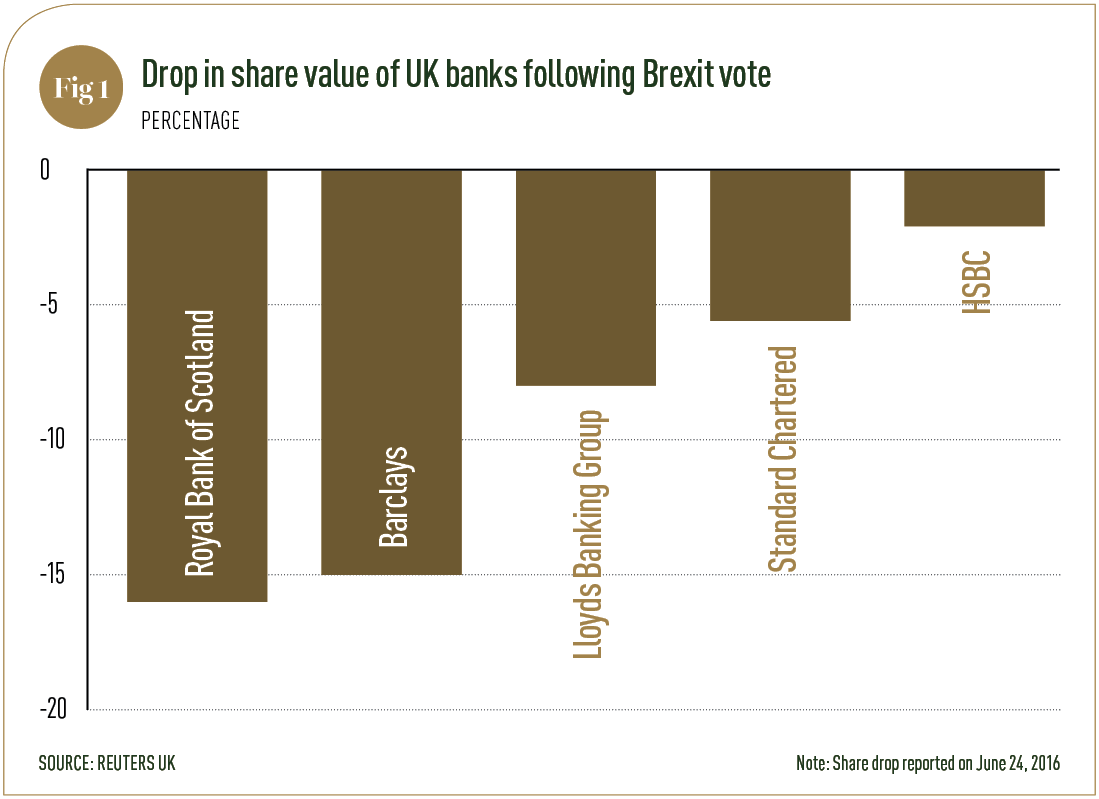

Test of mettle We are now living in an era of heightened political, economic and fiscal uncertainty, with market volatility fast becoming the new norm. Banks across the globe have been battered by Brexit, and this unfortunate trend looks set to continue as the UK attempts to negotiate its exit from the EU. Shares in leading banks plunged by up to 20 percent on the day after the referendum (see Fig 1), and while some banks have since managed to recover, others are still struggling to make back their losses.

What’s more, Brexit may well trigger a mass exodus of banking jobs from London, with many global banks already setting up new EU headquarters outside the UK’s veteran financial centre.

According to Brussels-based think tank Bruegel, London could lose more than 10,000 banking jobs and 20,000 roles in financial services as the UK prepares to leave the single market, delivering a devastating blow to the nation’s economy.

Frankfurt is fast emerging as an attractive destination for banks looking to relocate, with Morgan Stanley, Goldman Sachs and Japan’s Nomura all announcing that they would be shifting some operations to the German city. Similarly, Dublin is now welcoming an influx of banking talent, with Bank of America recently choosing the Irish capital as its post-Brexit base for EU investment banking. Relocation may prove to be a prudent move for banking groups, as the UK is widely expected to lose its financial passporting rights when it eventually leaves the single market. Meanwhile, on the other side of the Atlantic, there is a similar level of market uncertainty, as President Trump continues to diverge from the Obama administration’s financial stance. Following his election victory in November 2016, Trump has laid out an ambitious economic plan which aims at raising US growth to more than three percent. In order to achieve this goal, he has proposed a series of large-scale tax cuts, in addition to a $1trn investment in infrastructure and a $10trn budget cut.

As a fervent critic of banking regulation, Trump has also vowed to roll back the extensive Dodd-Frank Act, which was created in response to the 2008 global financial crash. Although this legislation was designed to protect consumers from financial misconduct, the Trump administration now argues that such rules are stifling banks’ ability to perform efficiently, and are therefore limiting the nation’s economic growth. While US bankers are not expecting a complete repeal any time soon, the Trump presidency may still provide some regulatory relief to Wall Street’s major banking groups.

Fintech future Any discussion of the modern banking industry simply isn’t complete without a mention of the ever-growing role of technology. Digital advances are rapidly reshaping the financial landscape, and over the past year the banking sector has experienced a remarkable acceleration in digitalisation. Blockchain technology is now a mainstream reality for banking groups, with global financial institutions investing more than $1bn in the technology over the course of 2016.

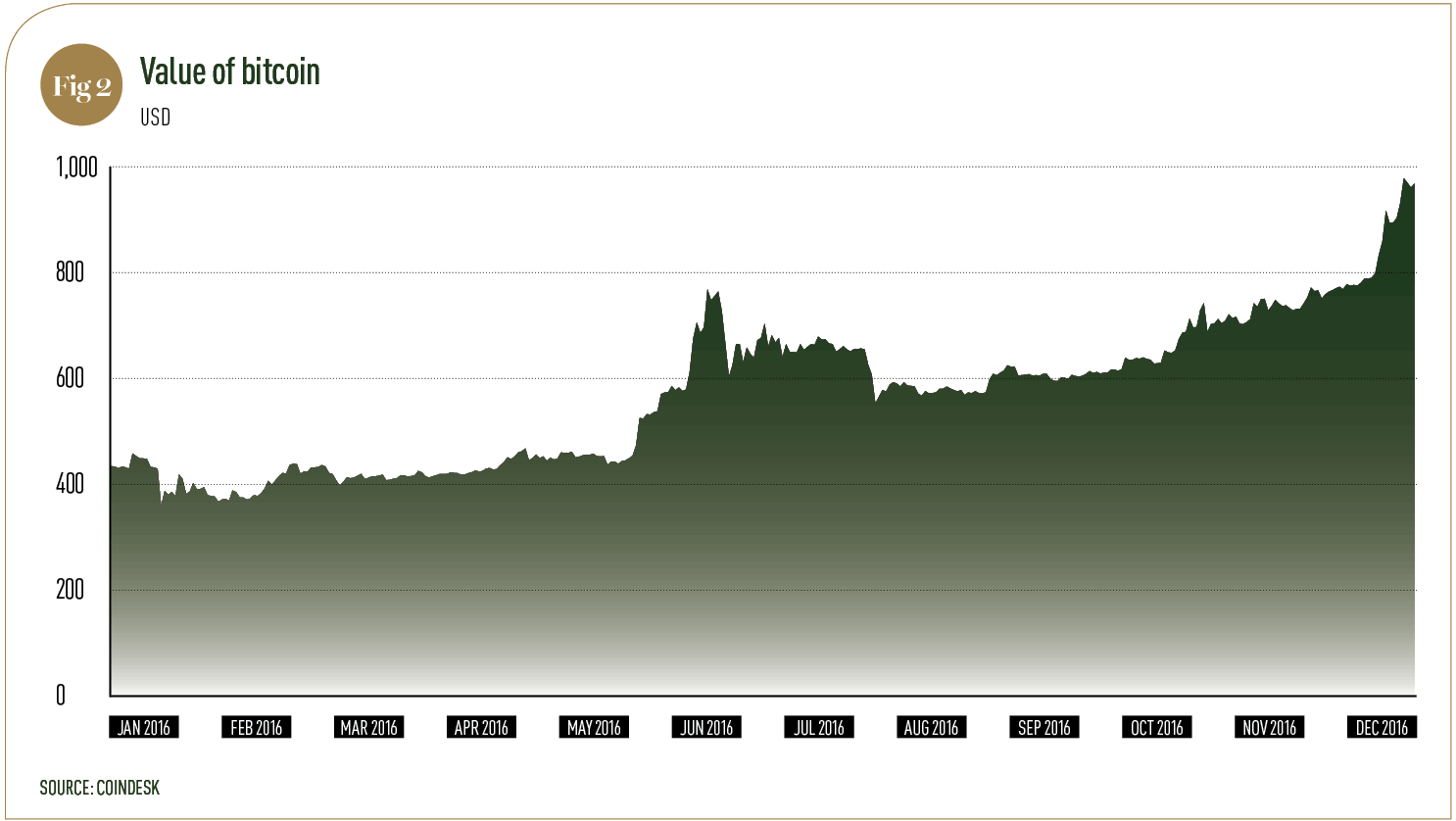

Bitcoin – the most famous blockchain-based digital currency – more than doubled in value to emerge as the best performing currency of 2016 (see Fig 2), encouraging further investment in blockchain technology among banking industry experts. Indeed, many of the world’s leading banking groups are now working together to create their own blockchain currencies, with Deutsche Bank, Santander, UBS and BNY Mellon aiming to commercially launch their ‘Utility Settlement Coin’ as early as 2018.

Thanks to rapid improvements in artificial intelligence (AI) and advanced machine learning, chatbots are becoming a key feature in many modern banks today. As banking groups strive to place customers at the heart of their operations, chatbots enable banks to effectively deliver a high standard of personalised customer service to clients who do not have time to visit a high street branch. As AI technology improves, chatbots offer users an interactive yet private communication channel, ensuring a greater level of security than traditional banking apps. These highly advanced machines can instantly answer queries and help customers manage their money remotely, giving consumers the personalised service they require. By adopting the latest AI technology, banking groups are able to create chatbots that combine intimacy with automation, enhancing the overall customer experience and allowing banking groups to thrive in spite of a difficult macro environment.