Private Banks

Argentina

ICBC Argentina

The Industrial and Commercial Bank of China (ICBC) may have only entered the South American market in 2012, but it has already emerged as one of the continent’s leading financial institutions. As the 13th-largest bank in Argentina, it offers a range of financial services, including mobile banking and portfolio management, across its network of 107 branches.

www.icbc.com.arAustralia

Westpac

Westpac Private Bank has received a host of awards over the past few years, earning particular praise for its business strategy and client relationship management offerings. Serving approximately 13 million customers across Australia, the bank also boasts a number of international wealth management solutions aimed at supporting individuals moving to the country from overseas.

www.privatebank.westpac.com.auAustria

Erste Private Banking

As the biggest wealth manager in Austria, with a network that spans Central and Eastern Europe, Erste has built a solid reputation for the care it provides to its private banking clients. Its bespoke recommendations are based upon meticulously detailed analyses, while its vigorous asset allocation process helps the bank to create the most optimal portfolio for every client.

www.ersteprivatebanking.comBelgium

Van Lanschot

Van Lanschot understands that every phase of a client’s life demands a different approach. With this in mind, the bank places great emphasis on the importance of anticipating each individual client’s changing needs and requirements. Constantly looking ahead, Van Lanschot is always ready to help its clients make the best decisions, both for today and the future.

www.vanlanschot.beCanada

BMO Private Banking

BMO Private Banking aims to make wealth management services as straightforward as possible. It works with a mixture of clients, from individuals and families to business owners and entrepreneurs, as well as professionals and executives, across borrowing, investing and wealth planning. For its exceptional work, the institution has won several prestigious awards.

www.bmo.comChile

Banco de Crédito e Inversiones

Banco de Crédito e Inversiones was founded in 1937 by Juan Yarur Lolas, with the aim of supporting Chile’s small businesses. Thanks to an impressive track record of sustained growth since that time, it is now the country’s fourth-largest private bank in terms of customer numbers. However, it remains a family business, with Lolas’ direct descendants now in charge of operations.

www.bci.clCzech Republic

Česká Spořitelna

During the nearly 200 years since the bank was founded, Česká Spořitelna has proudly maintained the same ethos: helping people to stand on their own two feet. Despite its 19th century roots, the Czech Republic’s largest bank is resoundingly modern, providing the latest banking services and cutting-edge innovations to its five million personal and business clients.

www.csas.czDenmark

Danske Bank

Danske Bank has been at the forefront of banking innovation for more than 145 years. Back in 1881, it provided Europe’s first safety deposit boxes, and in 2013 it became the first bank in Denmark to facilitate mobile payments. Today, Danske Bank offers its 2.7 million customers a range of cutting-edge solutions for both personal and business purposes.

www.danskebank.dkFrance

BNP Paribas Banque Privée

BNP Paribas prides itself on being a European bank with a global outlook. With more than 192,000 employees located across 74 countries, the group has had a far-reaching effect on the global private banking sector during its 17 years in operation. What’s more, following this year’s roll-out of a range of mobile services, the group’s sights are now firmly on future digitalisation.

www.mabanqueprivee.bnpparibasGermany

Berenberg

Founded in 1590, Berenberg is one of Europe’s oldest and most successful private banks, with 1,500 dedicated staff and over $47bn in assets under management. Based in Hamburg, the bank also has branches throughout Western Europe, offering expert investment and financial planning advice to a variety of high-net-worth clients, family offices and specialist SMEs.

www.berenberg.deGreece

Eurobank

In spite of the Greek financial crisis and global instability, Eurobank has gone from strength to strength in recent years. It is now the third-largest bank in Greece in terms of total assets, and boasts more than 490 branches within the country, as well as over 860 worldwide. Throughout its history, Eurobank has maintained an impressive acquisition strategy that has paved the way for its success.

www.eurobank.grIndia

Kotak Mahindra Bank

Initially established as a bill discounting business in 1985, Kotak Mahindra became the first non-banking financial company in India’s corporate history to be converted into a bank. It now has one of the largest wealth management teams in India, offering personal finance solutions that range from savings accounts to life insurance policies.

www.kotak.comItaly

BNL Gruppo BNP Paribas

The BNP Paribas Group has been operating in Italy since 1967, combining a deep understanding of the national market with unique global expertise. Its private banking division, which comprises a market-leading financial services offering alongside wealth planning solutions, has more than 33,000 clients with collective assets under management of over $20.2bn.

www.bnpparibas.itKenya

Stanbic Bank

Currently the sixth-largest bank in Kenya, Stanbic Bank is committed to becoming the leading financial institution in Africa and beyond. Despite winning several accolades for its services in private banking and trade finance, the bank refuses to rest on its laurels and continues to pursue new opportunities in domestic and international markets.

www.stanbicbank.co.keLiechtenstein

Kaiser Partner

Kaiser Partner is based in Lichtenstein and has one of the strongest wealth management reputations in Europe. The organisation works with clients across the international sphere, particularly in Europe and the US. Kaiser Partner’s roots date back to 1931, but the company has expanded rapidly since then, putting holistic services at the forefront of its operations.

www.kaiserpartner.comMalaysia

Maybank

As Malaysia’s largest bank, as well as one of the biggest in South-East Asia, Maybank caters for the diverse needs of a broad customer base. Whether it’s the promotion of Sharia-compliant products through its Islamic banking arm, or its commitment to sustainable finance and environmental conservation, Maybank always has the interests of its customers at heart.

www.maybank.comMexico

Banco Ve por Más

Banco Ve por Más delivers its banking and credit services through three segments: credit transaction, brokerage and treasury. Recently, it undertook an ambitious growth plan, with the aim of developing a range of innovative new banking products and services. It also intends to put modern, digital banking at the very core of its business operations.

www.vepormas.comNetherlands

ING

Being one of the leading banks in the Netherlands, relationship management has always been at the heart of ING Bank’s operations. Clients speak highly of the bank’s bespoke and highly specialised market knowledge. This, together with its forward-looking digitalisation strategy, enables ING to provide its clients with unparalleled real-time wealth management solutions.

www.ing.comNigeria

First Bank of Nigeria

Established in 1894 as the Bank for British West Africa, First Bank of Nigeria holds the honour of being the first bank ever to be established in Africa. The bank now boasts more than 10 million customer accounts and provides a balanced range of traditional banking products, along with a collection of modern, digital solutions for investment and wealth management purposes.

www.firstbanknigeria.comPeru

BBVA Continental

While the Peruvian private banking industry is still very much in its infancy, BBVA Continental is a major contributor to the sector’s progression. By speaking directly to customers about their needs and expectations, the bank is able to offer a unique range of products, including a customised advice service for investments, risk management and business management.

www.bbvacontinental.peQatar

International Bank of Qatar

Established as the Ottoman Bank in 1956, the International Bank of Qatar is one of Qatar’s oldest banks. It offers corporate, private and retail banking solutions across a network of 34 branches, alongside a modern ATM network. During the company’s 61 years of operations, it has developed personalised private banking solutions to suit any type of client.

www.ibq.com.qaRomania

Erste Private Banking

As one of the leading wealth management providers in Central and Eastern Europe, Erste is well versed in offering private banking solutions to its 15,000 clients, who boast a combined wealth of $20.2bn. The group’s 46,000 employees operate in six different countries, and provide services to 15.8 million customers across Europe and further afield.

www.ersteprivatebanking.roSaudi Arabia

Saudi British Bank

Saudi British Bank (SABB) began life as the British Bank of the Middle East. Now, it is an associate of the HSBC Group, with more than 3,000 dedicated members of staff and capital of around $4bn. The bank offers private banking clients a range of conventional and Islamic financial instruments and products, the latter approved by SABB’s independent Sharia board.

www.sabb.comSingapore

Maybank Singapore

The Maybank Group supports more than 22 million customers worldwide, with an international network of 2,400 offices across 20 countries. It began its operations in Singapore in 1960, and today manages 21 branches and more than 27 ATMs across the state. Maybank Singapore has a strong people-first culture, and takes particular pride in the quality of its staff.

www.maybank.comSouth Africa

Investec

Starting life in 1974 as a small finance company, Investec has grown into an international organisation that manages more than $194bn in client assets. Its areas of expertise include asset management services, specialist banking solutions for high-net-worth individuals and corporations, and investment management services for private clients, charities and trusts.

www.investec.comSpain

BancaMarch

Though headquartered in Majorca, BancaMarch is the leading bank in the Balearic Islands and has a significant presence across the entire region. The institution provides advice related to a variety of banking products, as well as offering asset management services. In 2010, it came top of an EU banking stress test exercise, and has continued to demonstrate strong governance in the years since.

www.bancamarch.esSweden

SEB

SEB was founded in 1856 as Stockholms Enskilda Bank, making it the very first private bank in Stockholm and one of Sweden’s first commercial banks. In Sweden and the Baltic states, private banking is still at the core of the bank’s operations, though in the wider Nordic region and Germany, corporate and institutional clients are SEB’s primary focus.

www.sebgroup.comThailand

Kasikorn Bank

Established in 1945 with only 21 employees, Kasikorn Bank has since grown to become one of Thailand’s leading financial institutions. Its main focus in recent years has been promoting sustainable development through customer-centric services. Its Green DNA programme aims to enhance innovation and guide Kasikorn towards a future as one of the world’s most sustainable private banks.

www.kasikornbank.comUAE

National Bank of Abu Dhabi

With the largest market capitalisation of any bank in the UAE, the National Bank of Abu Dhabi is already a key player in the Middle East. Possessing industry expertise in real estate, aviation, petrochemicals and many other sectors, few would bet against the bank achieving its aim of becoming the number one financial institution in the east-west corridor.

www.nbad.comUkraine

OTP Bank

OTP Bank entered the Ukrainian market in 1998, and has since built up a reputation as a reliable, sustainable and responsible financial institution. The range of services that it offers both its business and individual clients, including remote banking, insurance, asset management and investment financing, has seen it pick up a host of accolades and awards.

www.otpbank.com.uaUS (East)

Brown Brothers Harriman

Brown Brothers Harriman (BBH), established in 1818, has grown from a small financial firm in Philadelphia into a global giant. The organisation works across a wide range of financial activities, from investment management to private banking. Additionally, BBH runs its own philanthropic programme to promote education and provide basic necessities for those in need.

www.bbh.comUS(West)

Bank of the West

First established as the Farmers National Gold Bank in San Jose, California, Bank of the West has expanded its once-humble operation into a vast network of distinct financial units, offering a range of commercial, wealth management and private banking services. Now, with more than 140 years of experience, Bank of the West ranks among the US’ largest private banks.

www.bankofthewest.com

Sink or swim

Wealth creation remains challenging, but that hasn’t stopped high-net-worth clients from increasing their expectations. Private banking firms must incorporate new technology and rework their mindsets in order to stay afloatFew could argue that 2016 was anything but a tumultuous year for the banking industry. However, the real problem with the two major events that took place during the past 12 months – namely, the election of Donald Trump and the result of the Brexit vote – is that, for the immediate future, it will be very difficult to foresee exactly how they will play out. The UK’s negotiations to leave the EU will be drawn out and complicated, while Trump has demonstrated erraticism at its finest. Given this precarious climate, most major financial decisions are now burdened with doubt and uncertainty. In 2017, this prompted a host of new demands from private banking clients, who are looking for ways to protect and grow their wealth at a time where there appear to be few options available for doing so. This demand is pushing private banking firms to new heights and forcing them to find innovative ways to assist clients, in spite of the ongoing challenges.

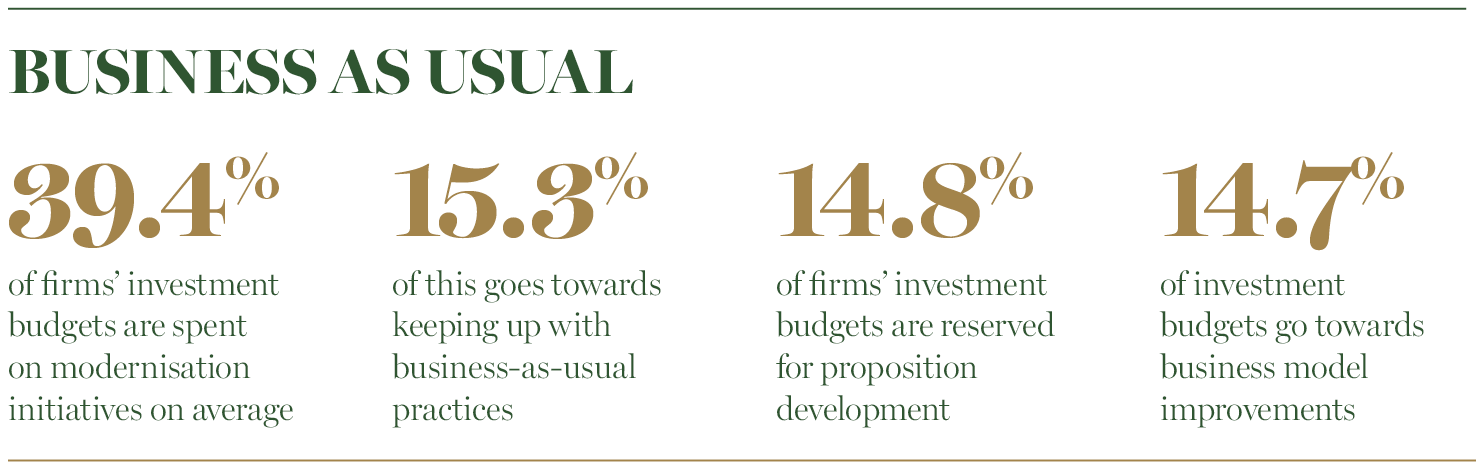

Keeping the lights on In Capgemini’s 2017 report Top 10 Trends in Wealth Management, the number one trend identified was “business-as-usual taking up a significant share of [the] investment allocation of firms”. After the huge disruption the 2008 financial crisis caused in the industry, ongoing changes in regulations and compliance requirements have generally increased sector overheads. At the same time, clients are becoming more diverse and making a greater variety of demands. One trend that has emerged in particular, and is continuing to grow, is the desire for social impact investing. Nowadays, more and more private banking clients want to make sure their money is not only increased, but also put to good use.

In a way, this trend has partly been driven by technology. As new systems emerge, a new wave of private banking clients is demanding both more transparency from banks and a more hands-on role in actively managing their own money. As such, clients seek a very personal service and access to their accounts all day, every day, for any minor tweak to their portfolio they may wish to make. Most respond poorly to feeling like they have been left in the dark. The days when a client was content to leave it to the experts are long gone.

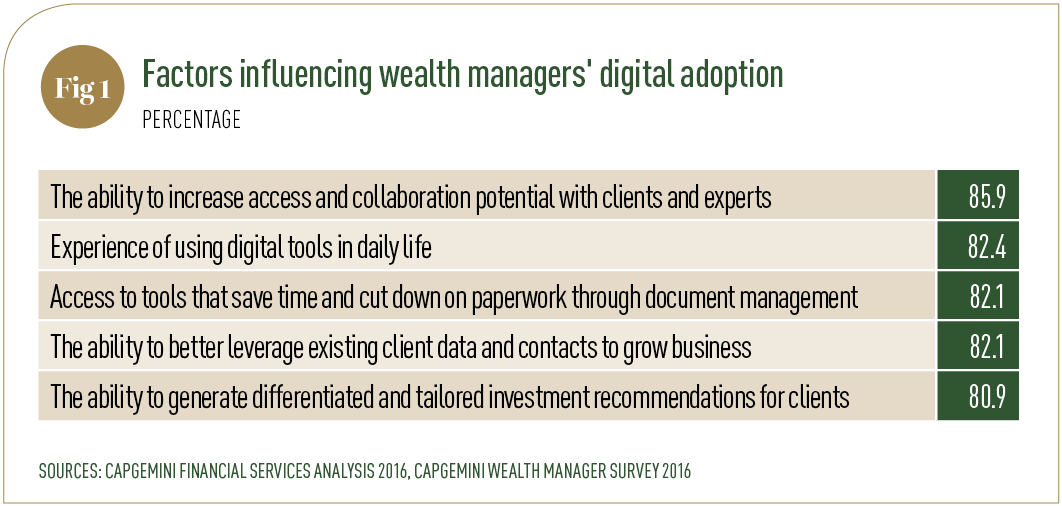

To meet these new requirements, many firms are investing in fintech in order to get an edge over their competitors. Multiple factors have led to this adoption of digital platforms (see Fig 1), and these efforts are taking a number of different forms, including modern apps and revamped back-end systems.

One growing trend is the use of robo-advisors in the sector. These are artificially intelligent systems that can guide clients towards more successfully managing their own money. Interestingly, this kind of technology could also act as an important step towards attracting younger customers. According to PwC’s 2015 Wealth Management Infrastructure Survey, 46 percent of wealth managers believe that robo-advisors will become a critical tool for engaging Millennials. That said, with this greater focus on digital systems and innovative tools comes a number of risks, including cyberattacks. As the number of digitalised banking processes increases, so does the risk of an attack. At present, however, many private banks are still underprepared for what exactly a large-scale cyberattack entails.

In 2016, ransomware attacks temporarily crippled institutions as large as the UK’s National Health Service and the National Bank of Ukraine. If a private banking institution suddenly found all of its computers locked down with data encrypted, or saw leaks of sensitive information relating to its clients, it would never recover from the reputational damage. To prevent this from happening, a greater focus on cybersecurity is an absolute must for 2017, and will define spending in the sector for many years to come.

Shifting landscape In a sense, many of the difficulties the world faces can be reduced to a dissatisfaction with globalisation. And, as more protectionist and isolationist policies emerge across the world, it is reasonable to expect that global trade will continue to decline. In light of this and the associated risks, both clients and wealth managers are beginning to increase their focus on the fundamentals of domestic economies.

Naturally, the opportunities they present will vary. The US, for example, is expected to outperform other developed markets with strong consumer spending and investment growth, while the high growth rates of emerging markets could be offset by protectionist concerns. Russia and Brazil in particular have a bright outlook, as both are expected to finally emerge from their prolonged slumps.

One thing to bear in mind for those shifting their focus to domestic economies is the increased policy divergence that has continued into 2017. While the US Federal Reserve has already raised interest rates this year, and is expected to do so again before long, others are pushing ahead with easing policies. The European Central Bank, for example, keeps buying government bonds, and the Bank of Japan has reasserted its commitment to an aggressive stimulus programme until the country’s inflation rate exceeds two percent.

Although such factors inevitably create risks and challenges for the private banking sector, they also provide opportunities for those that are nimble, forward thinking, and open to change. Specifically, industry players must be willing to adapt to new technology, cater to the Millennial mindset, and shift in accordance with changing political and policy landscapes. Consequently, private banking teams that are prepared for the volatility of 2017 and beyond could well reap the rewards of a difficult period.