Investment Banks

Brazil

BTG Pactual

BTG Pactual is a public company with a diversified shareholder base. It caters for its clients through a combination of investment, asset management and wealth management services. Headquartered in São Paulo, the bank’s presence extends throughout the country, and it also has 26 offices located throughout Latin America, the US, Europe, Asia and Africa.

www.btgpactual.comBahrain

Securities and Investment Company

Securities and Investment Company (SICO BSC (c)) is one of the premier financial institutions in the MENA region, providing a select range of investment banking solutions to a host of international clients. By adopting an independent, research-led approach, SICO BSC (c) continually delivers innovative products that both cater to the changing needs of its clients and maximise shareholder value.

www.sicobahrain.comCanada

RBC

RBC’s global investment bank, RBC Capital Markets, boasts a workforce of 7,200 professionals who operate from 70 offices in 15 countries, serving a wide range of clients, from governments to asset managers. These highly trained individuals provide expert advice in raising capital, accessing markets, mitigating risks and acquiring assets across North America, Europe and the Asia-Pacific region.

www.rbc.comChile

BTG Pactual Chile

BTG Pactual Chile is the largest investment bank in the country. It operates in the asset management, wealth management, sales and trading, investments and corporate lending segments. The bank was created from a merger between Celfin Capital and BTG Pactual, and is focused on providing consultancy in financial investments and identifying new investment opportunities.

www.btgpactual.clColombia

BTG Pactual Colombia

BTG Pactual Colombia was founded in May 2013 as the result of a merger between Bolsa y Renta and BTG Pactual, the largest investment bank in Latin America. With a strong presence across the region and beyond, BTG Pactual’s branches are able to offer customers expert investment advice with the international focus that globalised clients both demand and deserve.

www.btgpactual.com.coDominican Republic

Banreservas

Banreservas is one of the Dominican Republic’s most reputable banks, and is devoted to the prosperity of its customers and shareholders. The bank strongly values commitment, leadership and excellence, and is determined to enhance the country’s economic, social and environmental development, with a number of inclusive, sustainable programmes in place.

www.banreservas.com.doFrance

BNP Paribas

BNP Paribas’ remarkable approach to customer service involves applying psychological theories to finance. This method is designed to help investors reduce their chances of making poor investment decisions based on their emotions. This insightful understanding of the risks created by behavioural bias places the bank in a unique position to attract a new breed of tech-savvy investors.

www.group.bnpparibasGermany

BNP Paribas Germany

The BNP Paribas Group has been active in Germany since 1947. However, its German investment banking branch has gone from strength to strength this past year: it holds the trust of major clients in the country, owing to its leadership in securities, equity derivatives and real estate. The bank continues to push for excellent solutions and innovative products for its clients.

www.bnpparibas.deIceland

Arion Bank

Arion Bank is the biggest investment bank in Iceland when measured on fee and commission income in corporate and financial markets. It boasts excellent service provision and holds a leading position in the Icelandic financial market in terms of return on equity. Its dominance in the domestic market is such that it managed every IPO in the country in 2015 and 2016.

www.arionbanki.isItaly

Mediobanca

Mediobanca is one of Italy’s most trusted investment banks. With more than 70 years of experience in providing reliable and tailored solutions for clients, the bank continues to provide distinctly high-quality services. It has recently succeeded in expanding its presence, with international operations now accounting for half of the bank’s corporate and investment banking income.

www.mediobanca.comKazakhstan

JSC Kazkommerts Securities

Kazkommerts Securities is the investment banking division of Kazkommerts, the largest bank in Kazakhstan by total assets under management. Known for its excellent customer service and quality delivery, it has repeatedly been recognised as the best investment company in the country. The bank also has a global presence, and its international reputation is growing rapidly.

www.kazks.kzPakistan

Habib Bank

Owing to its unique approach and innovative products, Habib Bank has built up a solid reputation for high-quality services in investment banking. Over the past year, it has closed more than 30 high-value transactions, with a total value of more than $2bn. Recently, the bank broke new ground by creating the first ever bond offering for a microfinance institution in Asia.

www.hbl.comSaudi Arabia

SaudiMed

Riyadh-based SaudiMed is an investment firm committed to continual growth in order to keep meeting the ever-changing demands of the global financial sector. With the aim of becoming one of Saudi Arabia’s leading financial services companies, while also helping to advance the local economy, SaudiMed is making its mark on the country’s thriving banking scene.

www.saudimed.com.saSpain

Haitong

Haitong provides exceptional investment banking services through its Spanish investment division, with leading expertise in both local and international markets. The bank provides a broad range of financial products, and its highly skilled and motivated teams ensure it is one of the foremost providers of services in research, derivatives, capital markets, structured financing and M&As.

www.haitongib.comSri Lanka

CAL

CAL’s client-centric approach and comprehensive understanding of capital markets has earned it a leading position in the Sri Lankan investment banking industry. One of the core pillars of the bank’s strategy is ‘relationship over transaction’, which ensures the bond of trust between the bank and its clients is strong. This allows CAL to make bold decisions and explore new frontiers with confidence.

www.capitalalliance.lkUAE

Abu Dhabi Commercial Bank

Based in the UAE, Abu Dhabi Commercial Bank’s investment banking division specialises in asset-based finance, advisory services, structured finance, and capital and sukuk markets. Its excellent track record has earned it a well-deserved reputation for providing efficient end-to-end solutions for large corporations, governments and diversified family enterprises.

www.adcb.com

Future assets

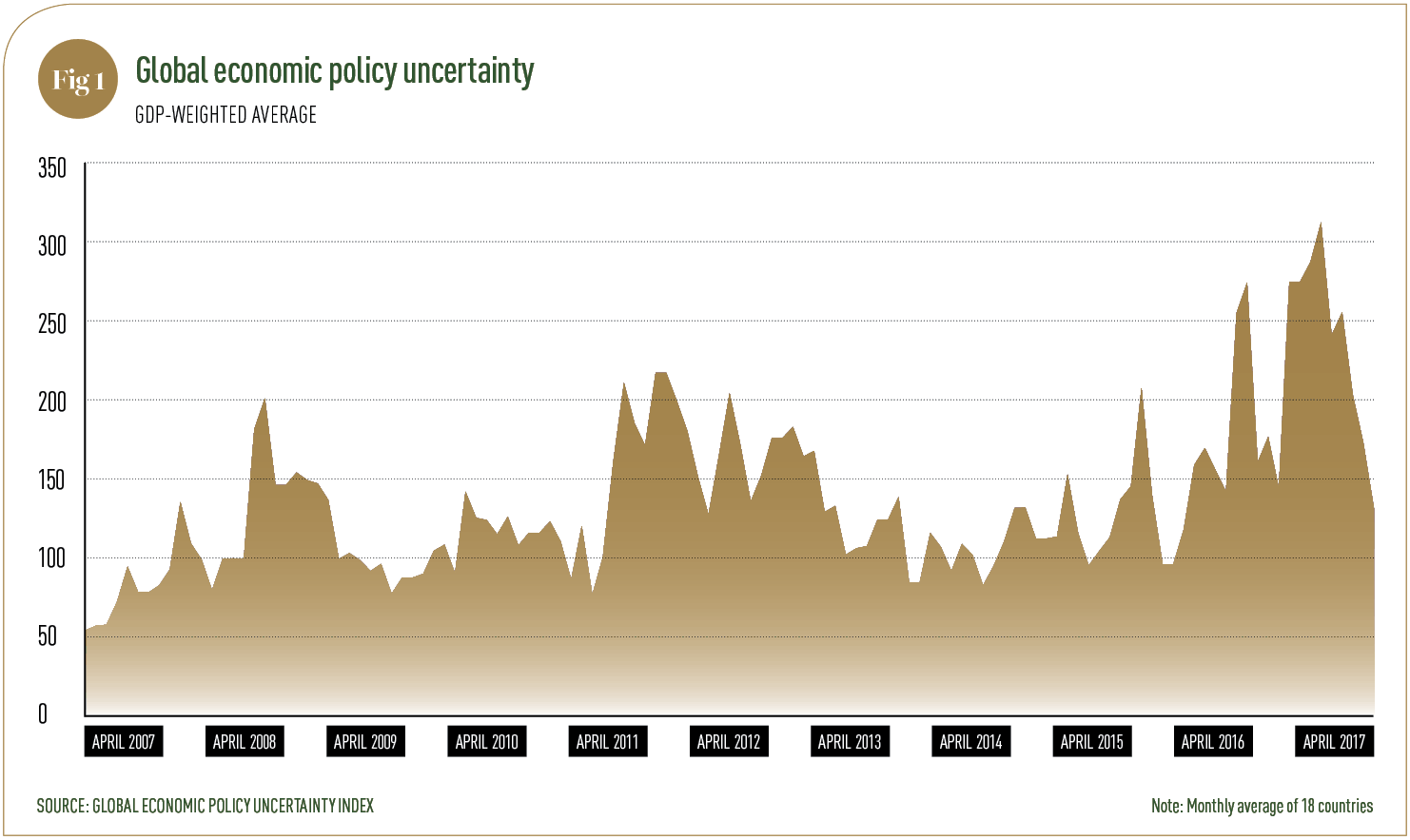

Though the macro environment remains stalled by tough regulation and low interest rates, investment banks are on the cusp of some fundamental technological breakthroughsOver the past few years, a series of political shocks has substantially blurred the global economic outlook, while any sort of anticipated global recovery has been frustratingly slow to play out. Indeed, according to PwC’s June 2017 Global Economy Watch report, levels of economic uncertainty recently hit their highest point in decades, even exceeding those at the time of the 2008 financial crisis (see Fig 1).

The report draws on the Global Economic Policy Uncertainty Index, which, among other things, is influenced by the extent to which forecasters disagree over their predictions. Faced with such high levels of uncertainty, the investment banking sector is now being forced to adapt its strategies to a new kind of global climate.

A combination of consistently low interest rates and strenuous regulation has gradually taken its toll on the sector’s profitability. In particular, the fixed income, currency and commodities (FICC) sector has seen severely reduced revenues. According to a report by McKinsey, FICC made up just 46 percent of revenues for the biggest 10 banks in 2015, a huge drop since 2010, when it accounted for 61 percent. Looking ahead, the implications of Brexit and the regulatory changes proposed by Donald Trump in the US are yet to play out, with potential for further disruption looming ahead.

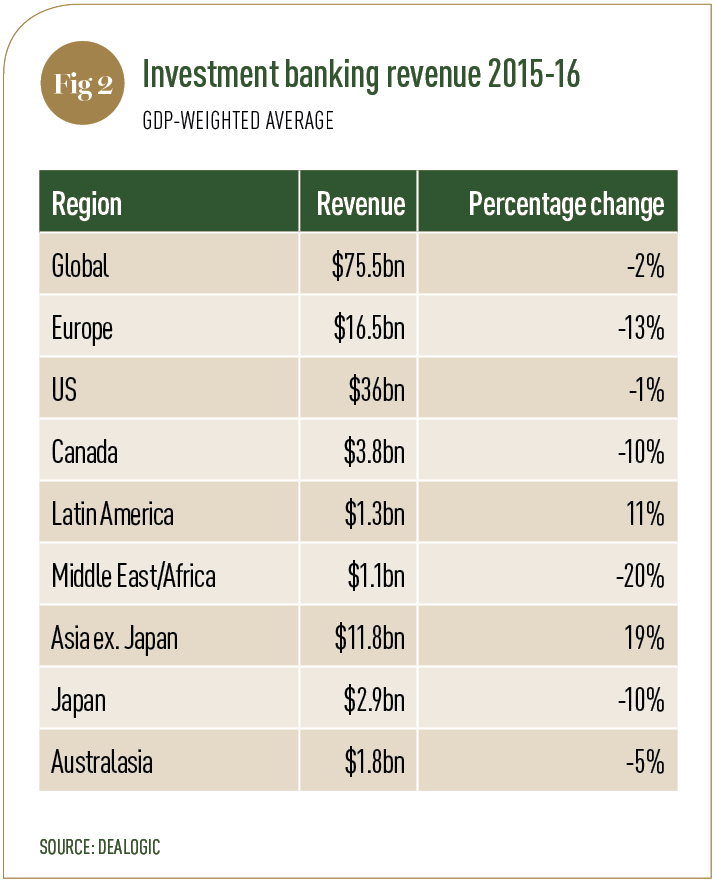

A year in numbers Data from Dealogic revealed that revenues from the global investment banking sector slumped by two percent in 2016, compared with the previous year. The decline was particularly pronounced in Europe, which witnessed a concerning 13 percent drop in revenues over the same timeframe (see Fig 2, overleaf). This is largely due to the continent’s careful regulatory requirements and a turbulent external environment, clouded further by concerns over China and dwindling commodity prices.

While Europe’s investment sector has struggled to reach sustainable profitability levels since the introduction of far-reaching post-crisis regulations, the US has fared relatively well. Despite being faced with the same external environment, the US experienced a mere one percent drop in revenue over the same period. Asia, on the other hand, has seen even steeper declines than Europe, with revenues down by a staggering 24 percent. On a global level, equity capital markets suffered the most, with profits down 25 percent worldwide. Meanwhile, revenues from mergers and acquisitions, debt capital markets and syndicated lending actually increased, albeit by a small amount.

But this is just one side of the coin; as ever, the investment banking industry is constantly reacting to new challenges and finding ways to reinvent itself. In particular, technological forces are rewiring the sector and bringing about huge opportunities for growth and increased efficiency. Furthermore, a gradual improvement in economic conditions looks set to continue, though it is unlikely that even increased interest rates will do much to spark an immediate upturn in fortunes.

Indeed, though sustained growth is not immediately on the cards, the sector has fared relatively well so far in 2017. By August, revenues were up year-on-year by four percent in Europe, 16 percent in the US, and nine percent globally.

Puff to profits With revenues squeezed, only those investment banks that are able to embrace the fast pace of technological change will be able to keep ahead of the competition. Indeed, a McKinsey study calculated that digitalisation and related cost efficiencies could lead to a two to three percent increase in return on investment over the course of three years.

Furthermore, when it comes to developments such as artificial intelligence (AI) and blockchain, the potential for savings is even greater. While it is easy to become lost in hype and hyperbole, these transformative technologies are starting to translate into genuine practical applications, and their future role in the investment landscape is beginning to take shape.

The coming year will certainly see advancements in the industry’s understanding of blockchain technology, which is currently teetering on the edge of practical implementation. Blockchain, also known as ‘distributed ledger technology’, is able to cut through a multitude of back-office inefficiencies, and thus has the potential to dramatically reduce costs, as well as ensure more reliable and efficient transactions. Increasingly, banks are forging large-scale collaborations in order to identify and explore the best ways to harness the technology. Banks are also fuelling the uptake of the technology through partnerships with blockchain start-ups and the creation of incubators and innovation labs, with a number of prototypes and potential-use cases being explored across the industry.

Does compute Another exciting trend in the sector is the rise of the robo-advisors. Automated investment advice is becoming increasingly viable as a result of rapid improvements in programming technology, and it is even being enhanced in some cases with AI. As a result, a series of new online robo-advising platforms have begun to emerge, challenging the established sector, but also giving traditional investment houses a path to a future that could otherwise leave them in the dust.

This is not to say that the sector will find itself being run entirely on algorithms any time soon, particularly as digital investment advisors so far occupy just a small portion of the market. Furthermore, many argue that a hybrid robo-human approach will more likely define the investment management industry of the future.

This said, a study by Business Insider’s research unit recently projected that robo-advisors will manage $8trn in global assets by 2020, which would amount to 10 percent of the world’s assets under management. In either scenario, one thing is for sure – the banking industry is transforming before our very eyes, and the investment branch of the market is soon to become more efficient and accessible than ever before.