Retail Banks

Portugal

Santander Totta

Always keeping the end customer at the heart of all operations, Santander Totta has long been a staple of Portugal’s retail banking scene. With a wide range of products and services at hand, together with helpful tools aimed at promoting greater convenience, Santander’s Portuguese offering lives up to its worldwide reputation.

www.santandertotta.ptAngola

Banco de Fomento Angola

Banco de Fomento Angola opened its first office in 1990 in Luanda, and subsequently became a leading bank for individuals and corporate clients. The bank now operates through a network of more than 166 branches, seven service points, nine investment centres and 16 corporate centres. It provides a range of services, including deposits, loans, investment products, trade finance and guarantees.

www.bfa.aoChina

China Merchants Bank

Since 1987, China Merchants Bank has grown from a small bank with $15m in capital to a national institution, boasting a total net capital of $146bn and more than 800 branches. In recent years, the bank has made a concerted effort to expand its retail, fee-based and SME services, a move that has led to renewed strategic development within the company’s internal structure.

english.cmbchina.comEgypt

Egyptian Gulf Bank

Garnering a reputation for its staunch commitment to sustainability, Egyptian Gulf Bank has continued to grow organically through the delivery of innovative banking solutions. Now, after years of profitability, the bank has adopted a more aggressive expansion strategy, with the stated aim of becoming one of Egypt’s leading financial institutions within the next three years.

www.eg-bank.comLebanon

Bankmed

With more than 70 years of experience in the Lebanese banking sector, Bankmed is now considered among the nation’s top retail banks, providing a host of in-store and online services that ensure each customer makes the most of their money. Bankmed currently provides financial solutions across 66 branches (five of which are overseas) and has 128 ATMs throughout Lebanon.

www.bankmed.com.lbArgentina

Banco Santander Río

Banco Santander Río is the third-largest bank in Argentina. A majority-owned subsidiary of the Santander Group, its main services include retail banking, consumer and commercial loans, and processing services for businesses, individuals and SMEs. Banco Santander Río currently serves more than 2.5 million customers, of which around 155,000 are SMEs.

www.santanderrio.com.arDominican Republic

Banreservas

Established in 1941, Banreservas is now one of the largest banks in the Dominican Republic. It has expanded throughout the country and currently boasts 250 branches. The bank offers a range of customer-focused financial services, including loans, deposits and insurance. It also manages pension funds, provides securities, and sells and develops real estate projects.

www.banreservas.comGreece

Eurobank

With two retail branch networks, along with a strategic position in Serbia, Bulgaria and Romania, Eurobank stands as a highly dynamic group in the sector. Its customisable deposit and investment programmes enable SMEs to add value to their money, while its company-wide philosophy of excellent customer service ensures that client needs are always met.

www.eurobank.grMyanmar

AYA Bank

AYA Bank continues to drive Myanmar’s burgeoning economy by implementing country-first governance initiatives and best practices. The bank’s commitment to SMEs is just as commendable, as shown by its loan portfolio, which has grown by more than 60 percent each year since 2014. It was also the first bank in Myanmar to offer 15-year mortgages and online credit evaluations.

www.ayabank.comnetherlands

ABN AMRO

Using the latest technology to continually improve its omnichannel approach, ABN AMRO ensures its customers are always at the very heart of its operations. For example, the bank’s mobile app, Grip, gives individuals a breakdown of their expenditure, separated into useful categories, helping them to catalogue their transactions and set budgets at any time and in any place.

www.abnamro.nlNordics

Handelsbanken

Handelsbanken’s strategy revolves around keeping customers happy. As a result, the bank regularly comes out on top in measures of customer satisfaction. Its decentralised structure ensures that decisions are made at branch level, which means customers can expect speedy responses and smooth personal service. It is this customer-centric approach that sets it apart from its competitors.

www.handelsbanken.seQatar

Commercial Bank of Qatar

Commercial Bank of Qatar has turned a profit every year since it was founded in 1974, reflecting its reliable approach to business. Recently, it has diversified through strategic partnerships with the National Bank of Oman, United Arab Bank and Alternatifbank. It has received several awards for its products and services for SMEs, as well as for its customer service.

www.cbq.qaTurkey

Garanti Bank

Founded in 1946, Garanti Bank is now the second-largest private bank in Turkey, with consolidated assets totalling $95.7bn. With approximately 19,000 employees working across 948 domestic branches, seven international branches and three representative offices, Garanti Bank provides services to more than 14.5 million customers worldwide.

www.garanti.com.trNigeria

Guaranty Trust Bank

Since its inception in 1990, Guaranty Trust Bank (GTBank) has delivered consistent year-on-year growth, driving financial inclusion through the implementation of a number of innovative tech-based services. Now regarded as one of Africa’s leading financial institutions, GTBank’s operations extend across the continent, serving more than 10 million customers at home and abroad.

www.gtbank.comPoland

Bank Zachodni WBK

Formed in 2001, Bank Zachodni WBK is the third-largest bank in Poland in terms of assets and branch network. Now a member of the Santander Group, the bank leads the market in the implementation of innovative mobile banking solutions, pioneering the introduction of cardless ATM withdrawals and contactless payments in Poland.

www.bzwbk.plSri Lanka

Sampath Bank

Sampath Bank, which celebrates its 30th year of operations in 2017, charges itself with a heavy responsibility when it comes to retail banking. Seeing the sector as a vehicle that drives economic inclusivity and development, the bank is committed to educating the public about financial management and, in particular, how to use credit cards responsibly and effectively.

www.sampath.lkUAE

Union National Bank

Union National Bank, headquartered in Abu Dhabi, is one of the top domestic banks in the UAE. Over recent years, it has worked to extend its reach, moving into Egypt through the acquisition of Alexandria Commercial and Maritime Bank. It was also the first bank in the UAE to venture into China, where it has since established a successful representative office.

www.unb.com

New kids on the block

Technology has completely altered consumer demands, with established retail banking brands left floundering as agile start-ups corner the market with niche offeringsFor a long time now, it has been difficult to get people excited about retail banking. The only real factors that contributed to an individual choosing one bank over another were a slightly better rate, convenient branch locations, or the recognition of an old and trustworthy name. While there were enough such differentiators to provide decent competition between banks, none were particularly inspiring for the average customer.

Fortunately, banking is now undergoing a remarkable transformation. Banks are no longer just about their geographical footprint; even more relevant these days are the unique, special and easily accessible services they offer. For customers, this means apps. Essentially, why go to a branch when you can just tap your mobile phone?

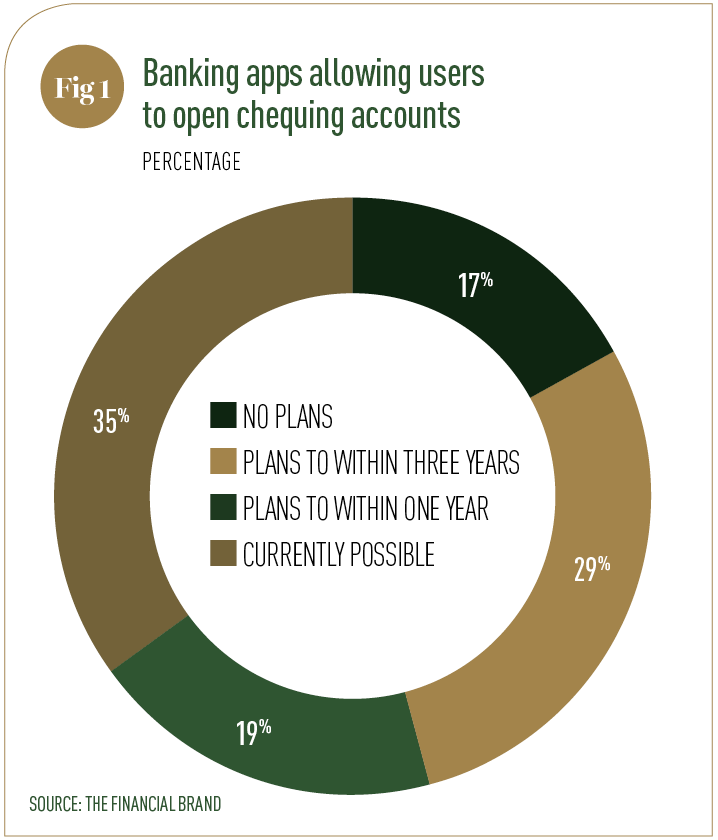

That said, in the years since apps became a necessity for banks, the focus has shifted to the particular services they can provide (see Fig 1). For banks that are many years old, this often means undertaking substantial upgrades behind the scenes to ensure the capacity is there to power new systems to meet demand. This is a frightening reality for retail banks. Many have built their foundations on decades-old infrastructure, and so upgrading to a new system is neither cheap nor straightforward. A complete overhaul of computer systems, while simultaneously ensuring that all necessary regulations are met, could never be an easy task. Given the current direction of the retail banking market, however, there may not be much choice.

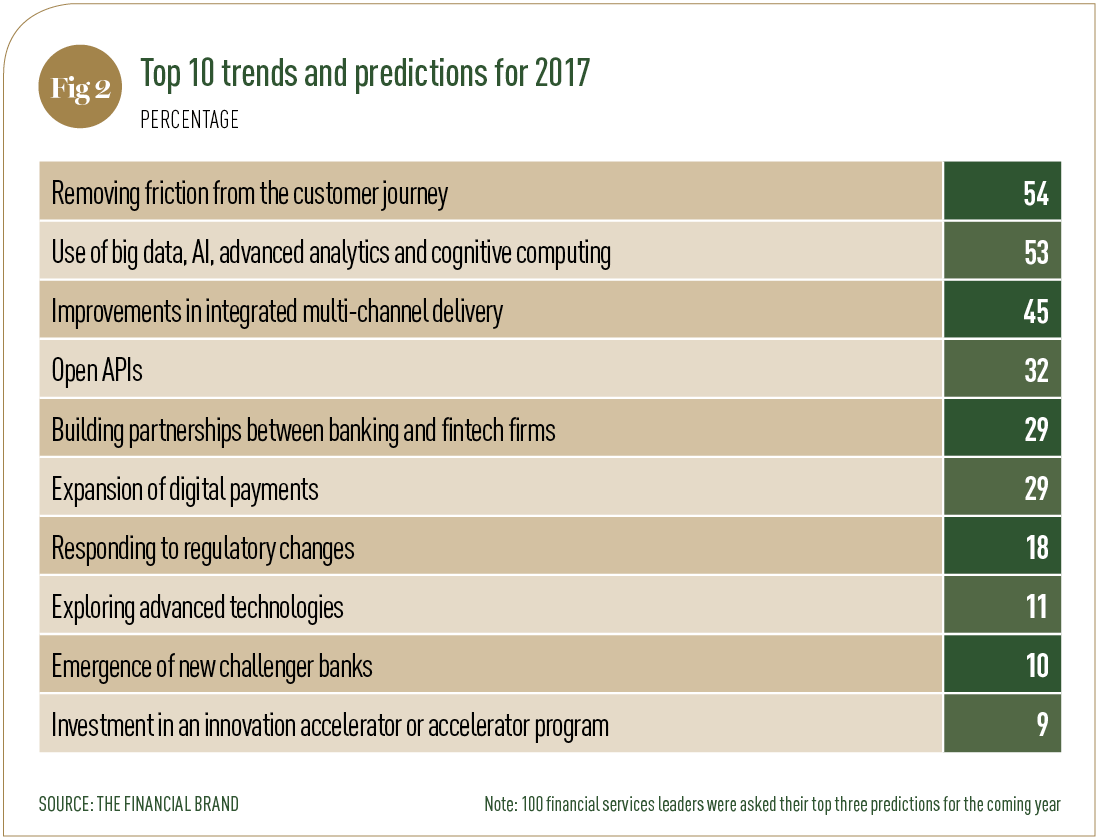

Digital warfare At the end of 2016, The Financial Brand published its annual Digital Banking Report, which revealed some surprising trends that banks will have to take note of in the near future (see Fig 2). After surveying 100 financial services leaders for their top three predictions for the coming year, the focus on digital services was extremely clear. Removing friction from the customer journey was listed as the number one priority. Second was the use of big data, artificial intelligence, advanced analytics and cognitive computing. Third was creating improvements in integrated multichannel delivery.

There is one overarching theme in all of these priorities: personalisation. While convenient, many of the banking technologies currently in place lack the personal quality that customers come to expect when making important financial decisions. The cliché of the older customer who complains that new technologies are too complex and difficult to understand has a grain of truth behind it – online banking systems could be a lot more functional and smartly designed than they currently are.

Presently, brick-and-mortar branches are still a necessary part of many customer operations. However, thanks to big data, banks now have the tools to provide better-designed services. With the combined learning from all of their customers, banks are now customising their products and services on an individual client basis. In the very near future, digital services may become indistinguishable from the in-branch experience.

As financial services integrate themselves fully into the digital experience, banks are now looking for more ways to offer unique services that set them apart from competitors. This leads onto the fourth-biggest trend predicted in the report: open application programming interfaces (APIs). In the previous year’s report, APIs barely warranted a mention, but the subsequent shift has been swift and significant. In essence, APIs provide a secure pathway for companies to access and make use of another’s information and systems. For example, very few companies have the resources needed to build their own digital map of the world but, fortunately, Google is willing to grant them access to the Google Maps API.

For banks, this presents significant opportunities. By opening up APIs, bank customers could have a world of possibilities unlocked for them. Budgeting software could be updated automatically, and financial information could all be bundled in a single place. What’s more, banks themselves have a lot to gain behind the scenes. For example, robust APIs can make meeting regulatory requirements a breeze, as regulators can be supplied with direct access to up-to-date critical information.

In with the new This sudden opening up of technology and greater focus on systems has provided an opportunity for agile start-ups to emerge, throw their weight around, and ultimately disrupt the banking status quo. What these organisations look like is incredibly varied. Some aspire to offer the full-featured level of service of a traditional bank. The UK bank Monzo, for example, offers a full current account, complete with a contactless debit card and mobile banking app that boasts features such as real-time balance updates and financial management. Interestingly, Monzo has no branches, but instead puts all of its focus on a digital service that makes the traditional branch look somewhat redundant.

Others are carving out specific niches in the industry, offering highly specialised features like an account specifically designed for freelancers to help calculate the tax they owe, as they owe it. Many of these fintech start-ups are still in their earliest incarnations, and will have a long way to go before they earn the confidence and trust of customers. Still, given such a narrow focus, they have an opportunity to outmanoeuvre larger, more cumbersome organisations.

That said, there are some functions, such as depositing cash, that cannot be done on a smartphone. To fix this, a piece of technology that in 2017 celebrated its 50th birthday may soon undergo a drastic change in the roles it fulfils: ATMs could soon do a lot more than just dispense cash, offering any number of traditional banking services for instances when an app is simply not enough. This corresponds with the strategy of many retail banks today, which sees them reduce the number of branches they have open. As such, it’s easy to imagine a future in which a customer walking into a bank is met only with computers and very few, if any, staff.

Technology, in this sense, will continue its strong march towards revolutionising the retail banking industry. Many opportunities and challenges are thus set to open up in the near future, as institutions – both old and new – attempt to navigate this new reality and find what might become a significant edge over others in the space.