Sustainable Banks

Bahrain

Eskan Bank

Eskan Bank is a financial institution with a social agenda, working tirelessly to provide mortgages for citizens on low and medium incomes across Bahrain. Through its pioneering operations and partnerships, it has established itself as a leader in environmentally sustainable housing developments, and has thus provided a benchmark for the rest of the industry.

www.eskanbank.comBrazil

Empresta Capital

Empresta Capital sees social responsibility not as a standalone objective, but as an attitude that pervades all of its activities. The bank contributes to the social and economic development of the Brazilian population by offering credit in a practical, convenient way, and without onerous extra costs. This, in turn, helps drive employment and a fairer distribution of income.

www.emprestacapital.com.brEgypt

Arab African International Bank

Since its inception, Arab African International Bank has become a major player in Egypt’s financial industry, and is now the country’s fastest-growing bank in terms of size and profitability. It does its utmost to promote social responsibility, with programmes in place to boost health and education throughout Egypt. The bank is also committed to promoting sustainable finance.

www.aaib.comMexico

Compartamos Banco

Compartamos Banco is the largest microfinance institution in Latin America, serving more than 2.5 million clients. The bank supports sustainability through its community programmes, as well as by funding the small-scale entrepreneurs who form the backbone of the region’s local economies. It is committed to improving living conditions throughout Mexico and beyond.

www.compartamos.com.mxBolivia

BancoSol

Ever since it was formed in 1991, BancoSol has worked to support the lowest income sectors in Bolivia, providing people with a better future. The bank is also part of the Global Alliance for Banking on Values – a network of independent banks with a growing international influence – which works to promote sustainable economic, social and environmental investments in the financial sector.

www.bancosol.com.boChile

Banco de Crédito e Inversiones

Founded in 1937, Banco de Crédito e Inversiones prides itself on its customer focus. It has become one of the most influential banks in Chile, with more than 300 branches in the country. In 1999, it opened a US branch in Miami, followed by other international offices in Brazil and Mexico. Today, BCI has 10,500 employees and operates in retail banking, wholesale banking, and lending services.

www.bci.clKenya

Equity Bank Kenya

Equity Bank Kenya is a champion of the socioeconomic prosperity of the people of Africa. It plays a leading role in extending services to the financially disenfranchised, and often receives recognition from international forums and bodies for its remarkable success. The bank’s approach is based on using existing infrastructure and human capital to create new opportunities and positively impact people’s lives.

www.equitybankgroup.comMongolia

XacBank

XacBank put in place a social and environmental management policy in 2002, and has since been dedicated to pursuing a comprehensive ESG strategy. Overall, the bank follows a triple bottom line of ‘planet, people, prosperity’, and is committed to ethically responsible practices. This includes an extensive effort to engage with all stakeholders, from shareholders to local communities.

www.xacbank.mnMozambique

Banco BCI

Banco BCI began operations in Mozambique in 1996, and today it provides services to individuals and companies through its 191 agencies. As well as providing consumer, housing, vehicle, graduation, and guaranteed credit and leasing services, the bank is also actively involved in several real estate projects. Furthermore, the bank manages a network of 589 ATMs and 8,646 POS terminals.

www.bci.co.mzPeru

MiBanco

MiBanco was a founding member of the Global Alliance for Banking on Values, a network of independent banks that pursue sustainable economic, social and environmental development. Since it started its operations as a microfinance institution in 1998, sustainability has been a cornerstone of its business. It has achieved widespread recognition and praise for this approach.

www.mibanco.com.peQatar

Qatar National Bank

A respectful and sustainable approach to business has always been at the heart of Qatar National Bank’s operations. Among other projects, the bank has been active in the ‘A Flower for Every Spring’ programme, which seeks to boost environmentally friendly attitudes and practices in order to help protect Qatar’s natural habitats and wild spaces.

www.qnb.com.tnSri Lanka

People’s Bank

Since it was founded in 1961, People’s Bank has been committed to fostering a corporate culture of social responsibility. In 2016, the bank teamed up with students from the University of Colombo and the University of Jaffna to sponsor a tree-planting campaign. It has also agreed to make carbon management a key pillar and goal of its sustainability agenda.

www.peoplesbank.lkNigeria

Access Bank

Access Bank initially started life as a commercial bank, but broadened its reach to include personal and business banking in 2012. It is currently one of Nigeria’s five largest banks, and is now set on becoming one of Africa’s most respected financial institutions, with a growth model that puts environmental sustainability and social responsibility on a par with profits.

www.accessbankplc.comPhilippines

Bank of the Philippine Islands

The Bank of the Philippine Islands was the first bank in the country to organise a sustainability summit, highlighting the bank’s pioneering presence in social responsibility. It has also made an important commitment to encouraging sustainability reporting, and now provides internal and external stakeholders with detailed sustainability updates alongside financial information.

www.bpiexpressonline.comSaudi Arabia

Banque Saudi Fransi

Banque Saudi Fransi has worked tirelessly towards crafting a long-term strategy for social responsibility. It has long acknowledged the importance of supporting society through the pursuit of comprehensive and sustainable development. In recent years, it has engaged in several influential social initiatives, demonstrating deep commitment to its role in promoting sustainability.

www.alfransi.com.saUAE

National Bank of Abu Dhabi

The National Bank of Abu Dhabi boasts an international network that spans 19 countries, making it one of the biggest financial institutions in the Middle East, as well as the UAE’s largest bank. Through its extensive range of services and dedicated CSR programmes, the bank is committed to playing an active role in supporting local communities wherever it operates.

www.nbad.com

Growing strong

As sustainable banking shifts into the mainstream, the standardisation of metrics promises to allow for a more objective evaluation of banks and products in terms of environmental and social impactThe sustainable banking industry is constantly changing shape, while the term itself seems to take on new meaning every year. Once confined to a niche strategy of filtering out ‘sin stocks’, such as tobacco, military or alcohol-related stocks, the concept of sustainable banking now encompasses a much wider range of approaches, and has become far more deeply embedded in mainstream finance. What’s more, it is currently gathering fresh momentum, spurred by a push from governments worldwide, as well as the ever-mounting bulk of evidence supporting the business case for sustainable finance.

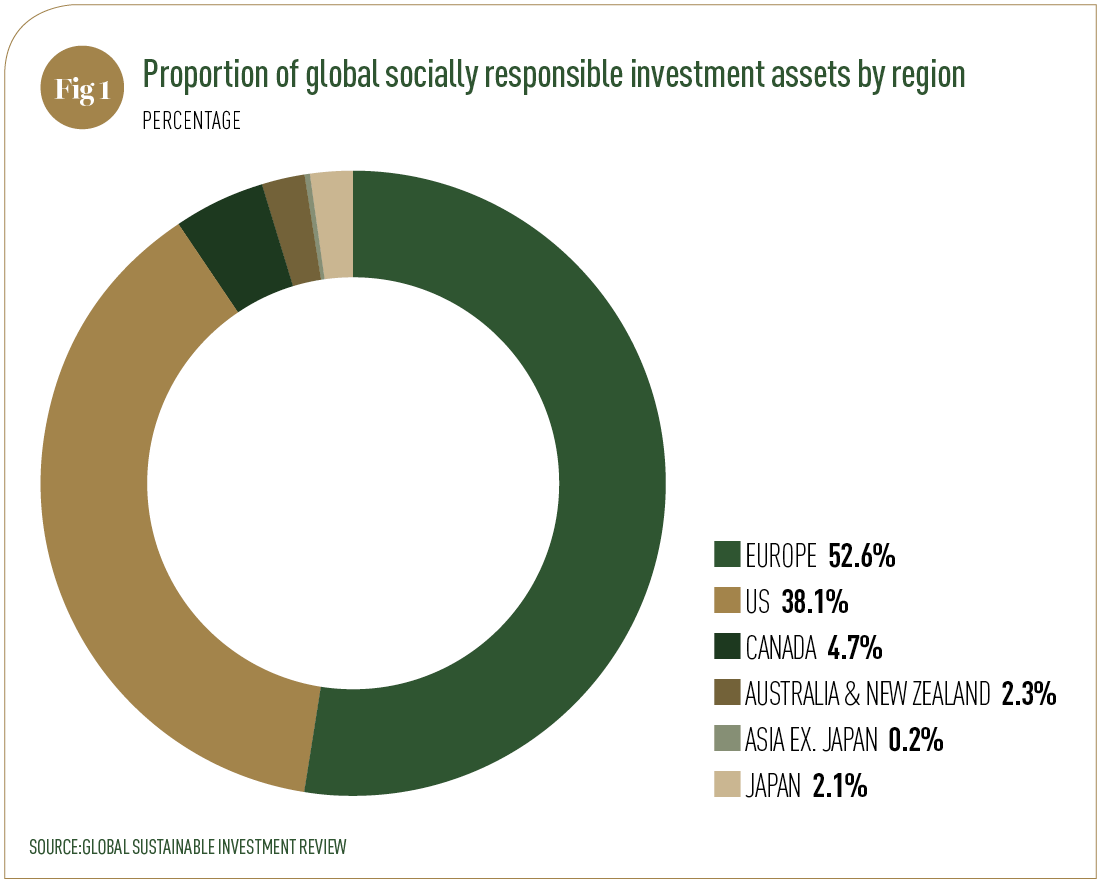

More than ever, financial institutions are taking environmental, social and governance (ESG) factors into account and offering socially responsible investment products (see Fig 1, overleaf). At the same time, the prominence of the newer guises of sustainable banking, such as impact investment and shareholder engagement, is increasing. According to a paper published by the Global Sustainable Investment Alliance, sustainable, responsible and impact investment assets totalled $22.89trn worldwide in 2016. This was up by 25 percent compared with 2014, which was in turn was up 61 percent from 2012.

However, while the amount of growth in the industry is striking, there is still a long way to go. For instance, according to an enquiry by the United Nations Environment Programme, green bonds still form less than one percent of total bond issuance, despite marked growth in recent years. Moreover, as it stands, only between five and 10 percent of bank loans are considered ‘green’ by existing national measures.

Measuring up As the industry matures, it has become vital to focus on some standardised techniques for measuring the non-financial aspect of sustainable banking strategies. In recent years, some useful developments include the fine-tuning of common standards for sustainable investments and the launch of ratings indexes that focus on ESG factors, such as the Dow Jones Sustainability Index and the MSCI family of ESG indexes.

And yet, values-based banking is a complicated endeavour. It is extremely difficult to pinpoint a set of universally agreed principles for sustainable banking, and more difficult still to compare separate banks’ performances. Not only is the definition of a sustainable investment highly subjective, its environmental and social impact is profoundly difficult to quantify and verify. This is exacerbated by the fact that the necessary data often remains undisclosed. Of particular concern is that while the volume of ESG assets is growing substantially, investment managers often fail to disclose specific information about how ESG factors are incorporated into their decisions.

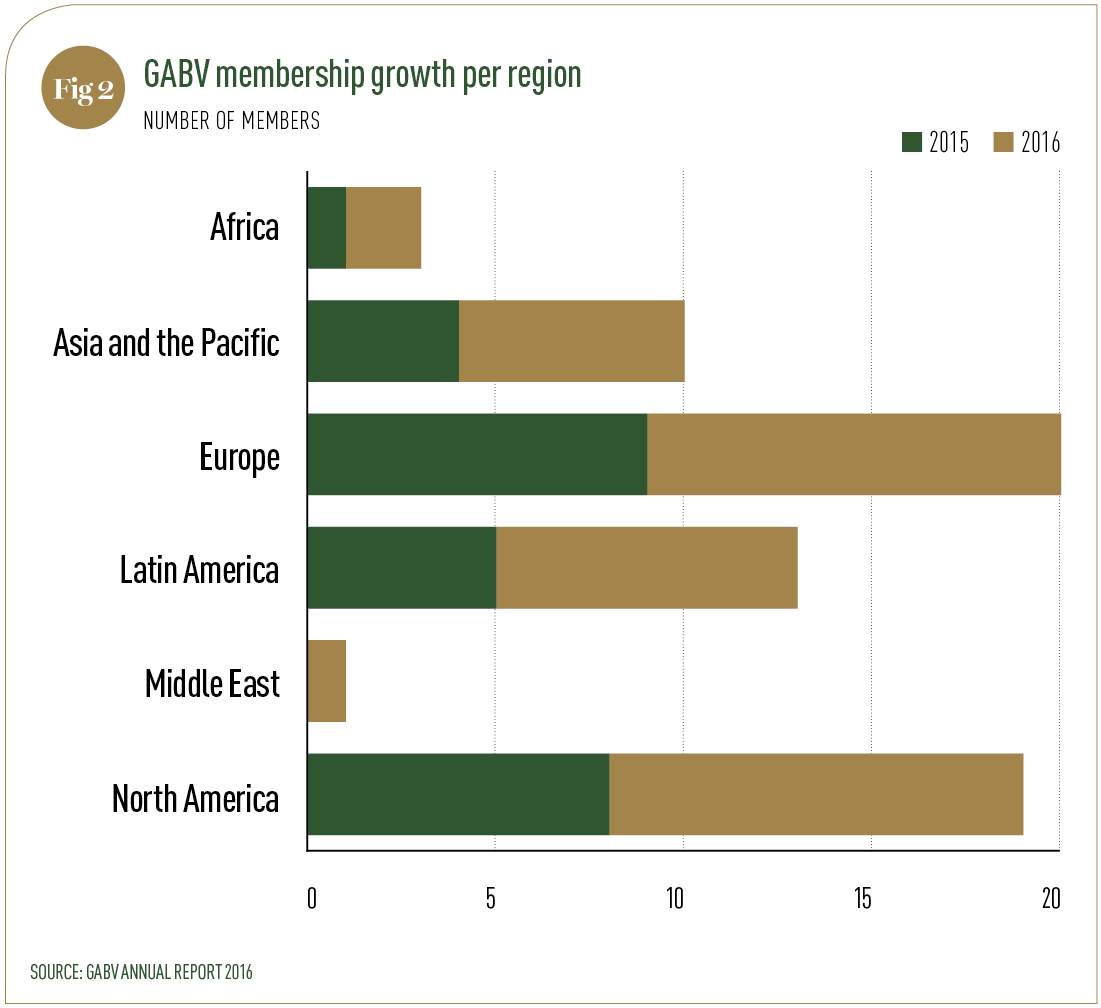

This year has seen an important development, however, with the launch of a new bank sustainability scorecard by the Global Alliance for Banking on Values (GABV). This developed system has been in the making for several years, and marks an important step in the effort to create a metrics tool that provides a common approach to reporting the economic, social and environmental impact of banks. The principles that the GABV invokes in its scorecard can be summarised as a ‘triple bottom line’, under which firms must deliver on both environmental and social positives, without sacrificing their financial viability. The scorecard combines basic requirements such as transparency with both quantitative and qualitative measures relating to banks’ impact in promoting environmental and social causes.

By creating a tool that measures the impact of a bank’s sustainable practices, the scorecard will enable a scenario in which its sustainability performance can be judged against that of other banks. This, in turn, could guide individual financial institutions towards better understanding how they can create a positive impact through their day-to-day decisions.

In the long run, the GABV sees the scorecard becoming an industry standard for assessing any given bank according to its alignment with environmental and social values (see Fig 2). Such a tool could have the effect of placing substantial pressure on the banking sector as a whole to better promote positive causes.

Fuelling growth “Increasingly, people are becoming aware of the interdependence of the real economy, social cohesion and our natural ecosystem, something values-based bankers have long understood, and which is at the heart of the business model,” noted the GABV’s 2016 annual report. Indeed, a focus on the sustainability of investments is moving from exception to rule in the banking sector, with customers becoming evermore conscious of the moral implications of their investments and often demanding a change in approach.

An increase in awareness is also prompted by technology. The internet ensures that ordinary customers can tap into a wealth of information regarding the sustainability of their investments, forcing banks to cater to a new kind of customer. A model example is the recent launch of the investment app Grow, which is one of a rising number of robo-advisors that monitor investments for their wider societal effects, as well as financial returns.

Bold steps This year has also seen growing international momentum behind the sustainable finance effort. This is illustrated by the content of a recent G20 dialogue paper, which called for greater institutional support for sustainable banking. The paper, entitled Fostering Sustainable Global Growth Through Green Finance, underscores the importance of a coordinated effort to spur the private sector into channelling more funds towards green investments. The effort, according to the paper, will require the involvement of all actors in the financial system, not only including banks and institutional investors, but also insurance companies, central banks and financial regulation authorities.

Several bold policy measures to back such a shift have been put forward, including new methods for supporting markets for green bonds and securitised products. The paper also proposed ideas for the creation of disclosure guidelines for environmental and financial risks, and advocates greater knowledge sharing in the field. Translating these G20 propositions from proposals to practice will require both time and effort, but the industry looks set to embrace many such changes in the coming years.