Commercial Banks

Azerbaijan

PASHA Bank

PASHA Bank is one of the most popular financial institutions in Azerbaijan, as well as across the globe, famed for its sustainable model, excellent customer service and innovative products. Though the bank is based in Baku, it wants to greatly enhance its international focus, and already has 500 qualified professionals operating in 14 languages across eight nations worldwide.

www.pashabank.azArgentina

Banco Macro

As the sixth-largest private Argentine bank by deposits and lending, Banco Macro has a significant effect on the country’s fortunes. Since its beginnings in 1976, the bank has grown to acquire multiple other firms, including through a substantial merger with Nuevo Banco Suquía in 2007. This move saw the bank dramatically extend its presence within the country, adding more than 250 branches.

www.macro.com.arBrazil

Banco Bradesco

Founded in 1943, Banco Bradesco quickly expanded to become the largest private-sector and commercial bank in Brazil by the end of the 1960s. It now offers a wide range of services, including real estate finance, investment banking and consumer credit subsidiaries. The bank now supports 69 million clients in Brazil, covering every municipality in the country.

www.banco.bradescoChina

ICBC

Regarded as one of the world’s largest banks by assets, the state-owned Industrial and Commercial Bank of China (ICBC) is listed on both the Shanghai and Hong Kong stock exchanges. Now, 23 years after opening its doors, ICBC provides a comprehensive range of financial products to more than 5.7 million corporate clients, as well as 530 million personal customers.

www.icbc.com.cnAngola

BancoSol

BancoSol is one of Angola’s leading financial institutions, providing a variety of products and services to companies and individuals alike. Founded in 2001, the company had successfully opened 150 branches and 281 ATMs by December 2015. In April 2016, the bank partnered with Mastercard to offer a suite of payment solutions to Angolan citizens in a bid to drive financial inclusion.

www.bancosol.aoBelgium

KBC Bank

With 3.5 million clients in Belgium and many more across its five other markets, KBC Bank is a major financial player across Central and Eastern Europe. Internationally acclaimed for its quick reinvention following the 2008 financial crisis, KBC Bank is now focused on investing in innovative technology to meet the needs of a new generation of digital-first clients.

www.kbc.comCanada

BMO Bank of Montreal

BMO Bank of Montreal was founded in Canada as the country’s first bank in 1817 and, despite various competitors emerging over the years, has maintained a strong foothold in the sector ever since. Various mergers throughout its history have served to bolster the institution, and it now stands as Canada’s fourth-largest bank by market capitalisation and assets.

www.bmo.comColombia

Bancolombia

As Colombia’s largest commercial bank, Bancolombia continues to innovate, redefining what it means to be an industry leader and a modern financial institution. Whether it’s by rolling out a new retail design strategy across its 900 branches nationwide or through its adoption of various e-commerce solutions, Bancolombia is a financial services provider that refuses to stand still.

www.grupobancolombia.comDominican Republic

Banco de Reservas

Based in Santo Domingo, Banco de Reservas is one of the largest banks in Dominican Republic. It was created in 1941 as a pioneer in the local market, developing over the years as the country’s economy has grown. Across its 250 branches, the bank provides a wide range of services and financial solutions for small and large companies, as well as public institutions.

www.banreservas.comGhana

Access Bank Ghana

Access Bank Ghana is a relatively young institution, having been founded in 2009. However, despite its youth, the financial institution operates six business segments that offer diverse products and solutions across 52 branches. The commercial banking division of the company focuses on local corporations and SMEs that have an annual turnover of less than GHS 5m ($1.12m).

www.ghana.accessbankplc.comHungary

ING Bank Hungary

When ING Bank started out, it was one of just a small number of players in the Hungarian market. Consequently, it placed great emphasis on relationship management – an approach that it maintains to this day. Not only has this seen the bank excel in terms of client satisfaction, it has also given it real expertise in every industry it serves.

www.ingbank.huItaly

BNL Gruppo BNP Paribas

In 2006, French banking group BNP Paribas acquired BNL, strengthening its presence in Italy. Today, Italy is one of BNP Paribas’ four domestic markets, alongside France, Belgium and Luxembourg. With approximately 2.5 million individual customers and 43,000 business and institutional clients, BNL Gruppo BNP Paribas is one of Italy’s major commercial banking groups.

www.bnpparibas.itGermany

Commerzbank

A leading commercial bank with core markets in Germany and Poland, Commerzbank has operations in more than 50 countries, providing clients with a range of financial products, from retail and private services to asset and investment banking. With more than 1,000 branches, Commerzbank serves 17.5 million private and small business clients, as well as over 60,000 corporate clients.

www.commerzbank.deHong Kong

HSBC

Known in Cantonese as Wayfoong, meaning ‘focus of wealth’, HSBC was founded in Hong Kong in 1865. During the Second World War, the bank faced closures across Asia, but survived by moving its head office to London until the war had ended. In the late 1950s, it began to acquire other banks, and now boasts around 100 branches in Hong Kong alone.

www.hsbc.com.hkIndonesia

Bank Central Asia

Since its establishment in 1957, Bank Central Asia has offered an extensive range of banking services to small, medium and large businesses, as well as individuals. Commended for its quick recovery from the Asian financial crisis in 1997, in 2016 it overtook DBS Group Holdings as South-East Asia’s largest lender by value, with a market capitalisation of $24.5bn.

www.bca.co.idKenya

Kenya Commercial Bank

Kenya Commercial Bank is East Africa’s oldest and largest commercial bank, having been established in Zanzibar in 1896 as a branch of the National Bank of India. In 1970, the Kenyan Government acquired a majority share in the financial institution, and subsequently changed the name to Kenya Commercial Bank. The bank now operates in six different African countries.

bi.kcbgroup.comMacau

Banco Nacional Ultramarino

Banco Nacional Ultramarino (BNU) is part of the Caixa Geral De Depositos Group, which boasts an extensive global network, especially in Portuguese-speaking countries (PSCs). Based in Macau, BNU is in a unique position to support companies from PSCs wishing to enter the Chinese market. The services it provides in the territory act as a crucial platform for promoting economic exchange between the mainland and PSCs from around the globe.

www.bnu.com.moMalaysia

Maybank

With 393 branches, more than 12 million customers and a 43 percent share of the online banking market, Maybank is the leading financial services group in Malaysia. Its reputation as one of the region’s best commercial banks stems from more than size alone, however, with its commitment to sustainability and innovation also receiving widespread praise.

www.maybank.comMexico

Banca Mifel

From its early origins in 1953, Banca Mifel began operations as a banking institution in 1994. It now has more than 60 offices in Mexico City and beyond, and offers a wide range of personal banking services. The bank, which is committed to offering products and services that are adapted to customers’ needs, also serves a range of SMEs, and provides investment fund management services to various institutions.

www.mifel.com.mxMozambique

Banco BCI

With more than 20 years of experience in the market and 191 agencies overall, Banco BCI is firmly consolidated as a major commercial and investment banking player in Mozambique. Over time, commercial banking has become its main division, and the bank now offers a wide range of services, from credit and financing to the management of a payment network and real estate services.

www.bci.co.mzMyanmar

AYA Bank

Although AYA Bank only began operating in 2010, it is already well on its way to becoming one of Myanmar’s leading financial services providers. Its dedication to customer care and commitment to sustainable banking have seen the bank grow its national network to include 225 branches. As a result of this rapid growth, AYA Bank has received a range of industry awards.

www.ayabank.comNigeria

Diamond Bank

Founded in 1990, Diamond Bank is a multinational financial services provider that offers a range of products in the commercial, retail, corporate and investment banking sectors. The company has become Nigeria’s fastest-growing retail bank by sticking rigidly to its long-term vision of not just matching customer expectations, but exceeding them.

www.diamondbank.comPeru

Banco de Crédito del Perú

Banco de Crédito del Perú is proud of its commitment to both its customers and the wider world. By aiming to avoid negative social, environmental and human rights impacts in the projects it finances, the bank displays the kind of long-term, sustainable thinking that you might expect from an institution with an impressive 128 years of expertise to draw upon.

www.viabcp.comPhilippines

Rizal Commercial Banking Corporation

As the flagship company of one of the oldest and largest conglomerates in the Philippines, Rizal Commercial Banking Corporation has built an enviable reputation for its commercial services. The bank uses cutting-edge technology to provide convenience for customers, while its wide range of business loans enable local companies to access the necessary capital to achieve their potential.

www.rcbc.comPortugal

ActivoBank

ActivoBank began life as a savings bank in Lisbon, Portugal, in 1994. It now operates as a commercial subsidiary of Banco Comercial Português, and is focused on revolutionising the financial services industry in the country through technological innovation and service excellence. In particular, ActivoBank has distinguished itself for simplifying processes for customers.

www.activobank.ptQatar

Al Khalij Commercial Bank

Headquartered in Doha, Al Khalij Commercial Bank ranks among Qatar’s leading financial institutions, offering a full range of banking products to premium corporate and international customers across Qatar, the UAE and France. Listed on the Qatar Stock Exchange since 2007, the bank boasts assets of QAR 58.2bn ($16bn) and holds QAR 32.2bn ($8.8bn) in deposits.

www.alkhaliji.comSaudi Arabia

Saudi British Bank

As an associate member of the HSBC Group, Saudi British Bank is able to draw on more than a century of commercial experience. With offices in the commercial centres of Jeddah and Riyadh, as well as across the Middle East, the bank is perfectly set up to help Saudi interests flourish abroad, as well as assisting foreign companies that wish to do business in the kingdom.

www.sabb.comSouth Korea

Shinhan Bank

With more than 18 million customers and 900 branches nationwide, Shinhan Bank is one of the leading financial services providers in South Korea. The bank is committed to delivering value for its clients, while simultaneously working to create a better world. For this reason, it values ethical standards and social responsibility just as highly as financial growth.

www.shinhan.comSri Lanka

Sampath Bank

Now celebrating its 30th year of operations in the Sri Lankan banking sector, Sampath Bank is the country’s third-largest commercial bank in terms of assets, with a branch network spanning 225 locations. Renowned for its innovative solutions, Sampath Bank has a reputation for delivering first-to-market products. The bank continues to explore new ways to reach the unbanked population.

www.sampath.lkThailand

Siam Commercial Bank

From its humble beginnings as an informal pilot project designed to establish a national financial system in Thailand, Siam Commercial Bank has become the blueprint for all modern Thai banks. Now, more than 110 years after its formation, it continues to rank among Thailand’s largest financial institutions, providing a comprehensive range of commercial and corporate banking services.

www.scb.co.thUAE

Emirates NBD

Formed in 2007 through the merger of Emirates Group International and the National Bank of Dubai, Emirates NBD combined the banking prowess of the UAE’s second and fourth-largest banks. It now employs more than 9,000 people representing 70 nationalities, making the bank one of the largest and most diverse employers in the entire UAE.

www.emiratesnbd.comUS

Bank of the West

Since opening its doors in 1874, Bank of the West has continued to expand its operations through a combination of organic growth and strategic acquisitions. With a presence in 23 US states, Bank of the West is now one of the nation’s largest financial institutions, but still takes pride in upholding the principles of community and inclusivity upon which it was founded.www.bankofthewest.com

www.emiratesnbd.comVietnam

Saigon Commercial Bank

Since starting its operations on January 1 2012, SCB has become one of Vietnam’s leading joint stock commercial banks, and now operates 230 branches across the country. With a keen focus on sustainability, driving economic growth and creating prosperity, SCB continues to improve the quality of life for both customers and employees alike.

en.scb.com.vn

Relationship reboot

In an industry dogged by low interest rates and stagnant growth, commercial banks are boosting profitability through innovation and intelligent cost-cutting strategiesThe economic shocks of the past twelve months have created a challenging business environment for commercial banks. As longstanding low interest rates continue to drive down profit margins on loans, banks must be vigilant about minimising costs if they are to stay lucrative. Customer demands are also changing rapidly, forcing commercial banks to fundamentally restructure in order to offer greater levels of customer service alongside a wider range of customised products. What’s more, 2016 also saw a further tightening of financial regulations, prompting banks across the globe to prioritise compliance and adopt a more in-depth view of risk in 2017.

Put simply, the challenges facing the commercial banking industry are numerous and significant, but the sector has responded impressively to a low-growth environment over the course of the past year. Through careful restructuring and consolidation, prudent banks have managed to balance investments in innovation with cost-cutting efforts, remaining profitable under testing circumstances.

Innovative banks always see challenges as opportunities, and the market turbulence of the past year has therefore proved rewarding for the sector’s leading players. The industry has changed dramatically in a short space of time, but this long-overdue transformation will undoubtedly stand commercial banks in good stead in 2017 and beyond.

Prioritising profits The stubborn low interest rates and slow growth environment of the past few years have led to significant competition in the banking industry, and have driven down profit margins for all financial institutions. Meanwhile, the aftershocks of the 2008 financial crisis and the somewhat stagnant global economy are further encouraging banks to turn to cost cutting in order to stay profitable.

However, a relentless focus on trimming payrolls and reducing costs is not necessarily a formula for long-term success. Indeed, harsh budgeting efforts risk damaging business confidence in banks, and can ultimately prove detrimental to the customer experience. As such, it is vital that commercial banks take a more balanced approach, focusing on improving operational efficiency in a way that also benefits the customer.

Over the past year, many commercial banks have looked to reduce costs by boosting staff productivity. Instead of ruthlessly laying off employees or slashing salaries, productivity improvement creates a motivated workforce and an enhanced customer service experience, benefitting workers and business clients alike.

Economic incentives are particularly effective, with several commercial banks now offering staff bonuses that are directly related to individual performance, rather than to overall institutional performance. Such incentives instantly put employees in a more productive mindset, as they provide a real motivation for reaching earnings targets.

Alongside these incentives, commercial banks are also increasingly looking to boost productivity through better supervision and feedback. Motivated employees feel supported by their employer, and it is therefore vital that workers regularly receive meaningful and constructive feedback on their performance. Visual aids such as performance charts and scorecards also help to define expectations and set realistic goals for employees.

In addition to improving productivity, commercial banks can also effectively cut costs by fully embracing technology. The banking sector is currently undergoing something of a digital revolution, with new technologies fundamentally changing the relationship between businesses and financial institutions. From mobile banking apps to digital wallets, it is now easier than ever to move money while on the go.

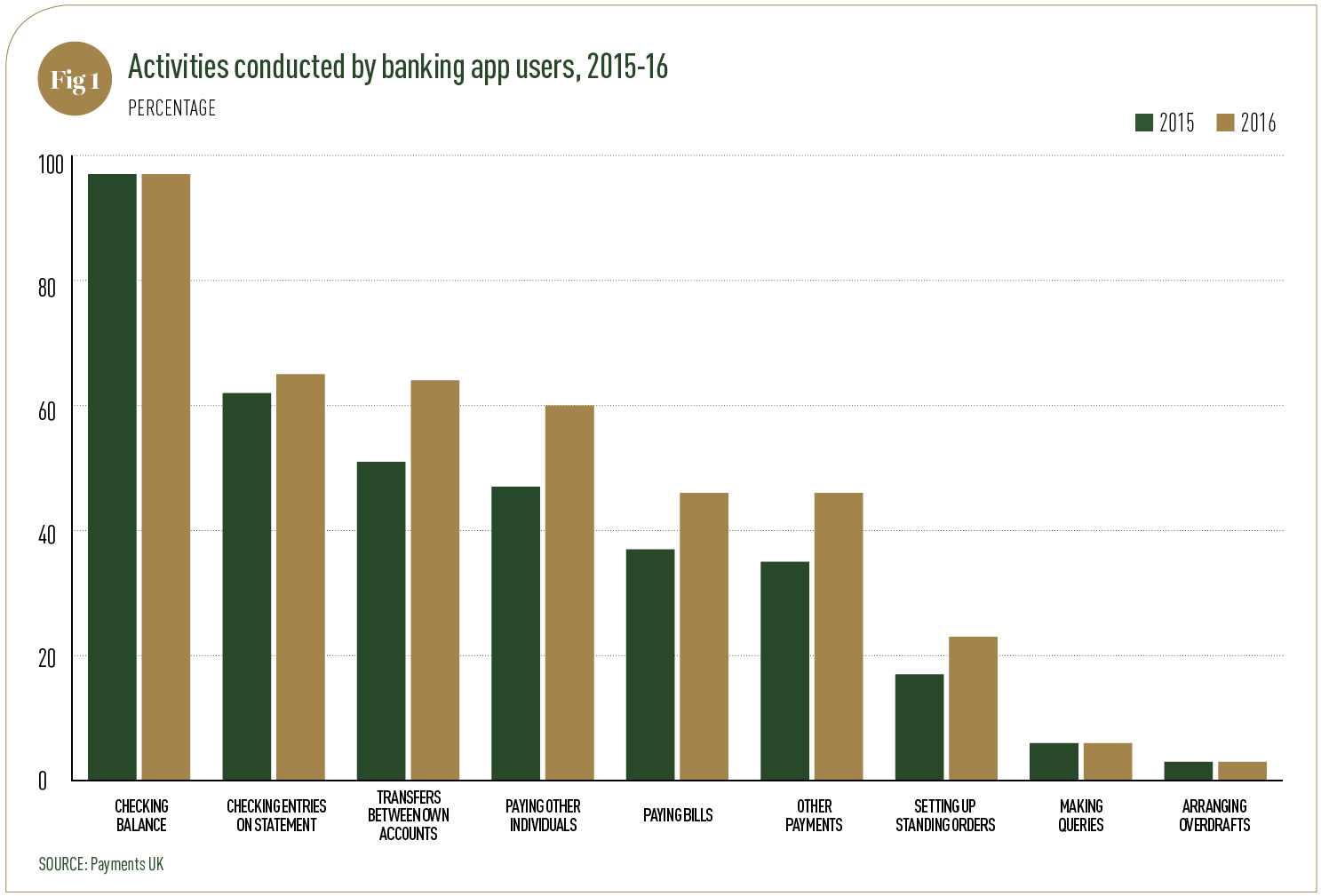

More customers than ever now use mobile banking apps, and for an increasing variety of services, (see Fig 1). Such apps enable customers to apply for personal loans and credit cards remotely, without any need to visit a high street branch. This is not only more practical and efficient for consumers, but also speeds up processes for banks themselves. What’s more, the use of electronic documents further boosts efficiency by allowing multiple steps of a transaction to be completed simultaneously. In addition to saving time, electronic documents also save paper, and are an effective way for banks to reduce basic costs. By automating core processes and introducing new technologies, banks can cut costs while actually improving the customer experience for businesses.

Customers come first A decade on from the global financial crisis, consumer confidence has still not fully recovered. The crisis drastically changed the way banks are perceived by the businesses that use them, leaving many clients feeling betrayed. Winning back this lost trust has been an immense challenge for commercial banks, prompting many financial institutions to put the customer first for the first time in their history.

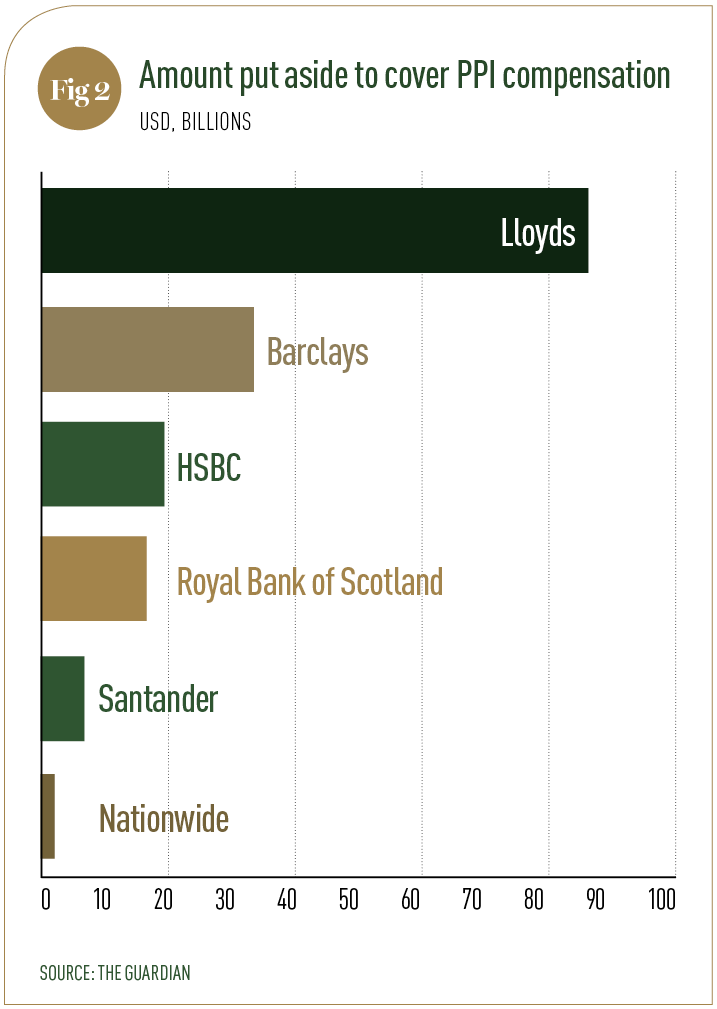

Prior to the crash, banks around the world were chasing revenue by offering complex products that consumers often did not need and could not understand. This profit-first culture led to the rampant mis-selling of payment protection insurance (see Fig 2), sub-prime mortgages and loans, which ultimately ended in disaster. Clearly, such a product-centric strategy is unsustainable, and commercial banks have accordingly begun to abandon these complex products in favour of a more customer-centric approach.

By listening closely to the demands of corporate and business clients, and offering relevant advice and support, banks are now building closer and ultimately mutually beneficial relationships with their customers. From dedicated, round-the-clock customer service teams to state-of-the-art fintech products, banks are going above and beyond to satisfy consumer demands. It may still take some time to fully repair the relationship, but this customer-focused strategy is undoubtedly helping to rebuild a solid level of trust in the industry.

With businesses beginning to show renewed confidence in their banks, the future now looks bright for the commercial banking sector. Despite a challenging international economic climate, this customer-first approach has seen some innovative banks thrive despite mounting odds, overcoming low interest rates and turbulent markets to enjoy a profitable 2017.