Fintech fortunes

As the founder of Europe’s most valuable fintech, Nikolay Storonsky is at the helm of a digital-first bank pushing back against the traditional grain. But as Revolut’s valuation soars, can he walk the line between agile start-up and global banking powerhouse?

In the mid-2010s, Europe’s fintech sector was booming. A novel band of financial technology companies were rewriting the script on everything consumers thought they knew about banking. Buzzy names with swelling valuations stole the spotlight from traditional lenders – in fact, in the second half of the 2010s, fintechs raised record capital. Venture capital funding grew from $19.4bn in 2015 to $33.3bn in 2020, according to a report by McKinsey & Company.

In recent years, the feverish rush to fintech has cooled slightly. But one company that remains as ambitious today as it was in its exhilarating early years is Revolut, the app-based bank and current holder of the title of Europe’s most valuable fintech. Revolut has successfully made the leap from start-up to unicorn to profit-turning institution. In 2024, its profits more than doubled to £1bn, and more recently customer numbers have surged to 65 million. It is clear that Revolut CEO and co-founder Nikolay Storonsky is doing something right.

Founded in 2015, Revolut started its days as a pre-paid card with free currency exchange. After years of experimentation in new verticals, alongside steady growth of the bank’s main operations, Revolut now offers everything from cryptocurrency trading to in-app eSIMs for travellers. Indeed, Storonsky has stated he wants to create the “Amazon of banking.” While Revolut has taken a ‘jack of all trades’ approach, the caveat is that Storonsky expects to be master of all.

While Revolut’s success so far is undeniable, global banking domination is not a given. Banking licences have not been easy to come by, and, as with many ambitious, fast-growing tech companies, ex-employees have complained of an excessively demanding workplace culture. What’s more, after a secondary share sale bumped the firm’s valuation up to $75bn over the summer from $45bn the year before, some critics are calling Revolut’s price tag into question.

Yet Storonsky continues to set his sights high, targeting continued innovation in new verticals and plans for geographic expansion, too. Does he have what it takes to build the world’s leading financial services provider?

A start-up is born

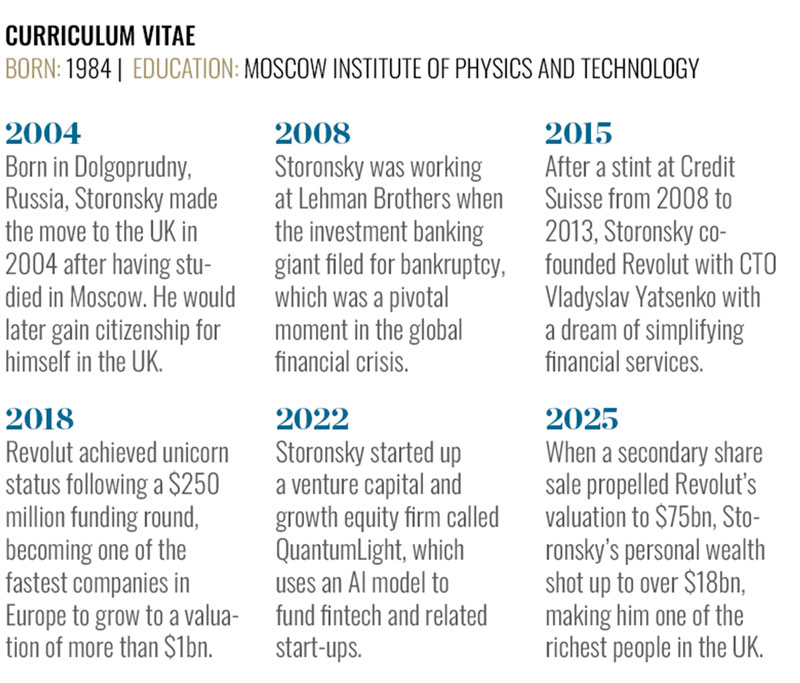

The collapse of Lehman Brothers in 2008 sent shockwaves across the global financial services sector. For Storonsky, it had a significant, personal impact. Born in Russia, Storonsky moved to the UK in 2004 with a degree in general and applied physics from the Moscow Institute of Physics and Technology and a degree in applied economics and finance from Moscow’s New Economic School. There, he soon began working for the lender as a derivatives trader. When Lehman Brothers filed for bankruptcy, Storonsky was stunned. “It was a big and powerful investment bank, so the announcement came as a shock,” he told CNBC. “We were told without much warning, and it seemed to happen quite quickly.”

Banking has historically avoided disruptions by technology, but that is all about to change on a big scale

Storonsky told the Financial Times in an interview that the crisis not only cost him around half a million pounds, but it also taught him the value of backing every decision with data and logic. After moving to Credit Suisse, where he worked from 2008 to 2013, Storonsky began to hatch an idea to simplify financial services through an easy-to-use app that would reduce fees when spending in different currencies. In 2015, he co-founded Revolut with British-Ukrainian Vladyslav Yatsenko, a software developer who cut his teeth at UBS and Deutsche Bank, and who remains the company’s chief technology officer today.

Outside of Revolut HQ, similar innovations in financial technology were unfolding. The global financial crisis shook consumers’ confidence in the biggest banks, leading to an upswell in support for a new generation of tech-forward digital banks – not only Revolut, but also Germany’s N26 and Fidor, Brazil’s Nubank and America’s Chime. These firms promised convenience, improved user experience and the agility needed to chop and change their services as required. Many of them were founded by the very employees who were left high and dry after the collapse of Lehman Brothers – and who, like Storonsky, dreamt of something better. As he told CNBC, “A number of successful entrepreneurs rose from the ashes who were pretty disillusioned with the financial system.”

Bet on it

Following its launch, Revolut experienced rapid growth. In 2018, Storonsky announced a cash injection of $250m that propelled the fintech’s valuation to more than $1bn, making it Britain’s first digital bank unicorn – and one of the fastest tech companies in Europe to reach unicorn status.

Even then, he hinted that Revolut was nowhere near finished. “Our focus, since we launched, has been to do everything completely opposite to traditional banks,” he said in a statement at the time. “We build world-class tech that puts people back in control of their finances, we speak to our customers like humans and we’re never afraid to challenge old thinking in order to innovate.

“Banking has historically avoided disruptions by technology, but that is all about to change on a big scale,” Storonsky said, taking aim at the banking establishment. His vision for an alternative global banking system – one where, “Anyone in the world can just download the Revolut app and set up a local bank account to access any services they need,” as he told Business Insider in 2017 – is grounded in an approach that ensures the company never stands still. This is most evident in Revolut’s engine for growth in new verticals: its ‘new bets’ division.

‘Move fast and break things’ is the Mark Zuckerberg-coined ethos that tech companies have long lived and breathed, and Revolut is no different. The lender is known for its ability to quickly launch into new revenue streams – everything from mobile phone plans to an air mile points offering.

These have the potential to become quick moneymakers for the business, with cryptocurrency trading being a case in point. The division helped to boost Revolut to its first annual profit in 2021 as retail traders jumped at the chance to join in the crypto boom. “Nikolay Storonsky’s leadership of Revolut highlights how speed and adaptability can really define success in fintech,” Ed Gibbins, co-founder and CEO of ChaseLabs, an AI sales development system, told World Finance. “His approach reflects a deep understanding of tech disruption: launch quickly, scale globally, and then refine using real user feedback. This ability to treat global markets as testing grounds means Revolut can adapt features faster than rivals and align its offerings closely with consumer demand.”

Each ‘new bet’ at Revolut begins with a small team of around 10 people led by an employee with a strong entrepreneurial background, as reported by Sifted earlier this year. With a budget of around £2m to £3m, they work to build experimental products on tight timelines of just 18 months, though many have been launched even more quickly.

By moving faster than traditional banks, and even many challengers, Revolut has built a reputation for agility that resonates with tech-savvy consumers, Gibbins explains. “The strategy of rapid feature deployment and constant iteration allows the company to test ideas across markets and double down on what works. This cycle of innovation and responsiveness has enabled Revolut to outpace competitors and strengthen its position as a leading player in global fintech,” Gibbins said.

If a new bet makes money, it’s scaled up; if it doesn’t, it is either tweaked, scaled down or ditched. To date, 45 ‘new bets’ have been approved, with some of these still in the development pipeline, a Revolut spokesperson told Sifted. They described the unit as operating “on a venture capital-inspired model.” Storonsky is no stranger to VC. In 2022, he started up his own VC firm, QuantumLight, which uses an AI model to fund fintech and related start-ups.

Revolut’s agility and its comprehensive offering are key selling points among customers. “Revolut’s rise has been driven by a clear focus on tech-savvy consumers who expect more than traditional banking can deliver,” Michael Foote, founder of Quote Goat, an insurance comparison tool, told World Finance. “By combining everyday money management with trading and payments inside one app, the company positions itself as a lifestyle tool rather than a conventional bank. This multifunctional approach has given it strong appeal among younger customers who value speed, convenience, and variety without juggling multiple providers.”

As of September 2025, Revolut said it had surpassed 65 million customers worldwide. Its success has driven financial winnings for Storonsky, too, who is thought to own around a 25 percent stake in Revolut. According to Forbes, he has a net worth of $7.9bn.

Growing pains

While Revolut can boast growing customer numbers and profits, the firm’s financial success may disguise challenges that have dented its reputation. For example, Revolut’s aggressive corporate culture has come under intense scrutiny in recent years, with some former employees claiming they were set unachievable targets, forced to do unpaid work and put under enormous pressure.

For many years, the company’s tough culture was an open secret. “We are not about long hours – we are about getting shit done,” Storonsky explained to Business Insider in 2017. “If people have this mentality, they work long hours because they want it.”

The company has thousands of reviews on Glassdoor, an employer review site. Even with an overall rating of 4.0, as of October 2025, reviewers frequently mention a lack of work-life balance and management’s prioritisation of targets above all else. However, many reviewers appear to recognise that while the environment at Revolut is not for everyone, some thrive in its high-pressure conditions.

“No one is sitting there telling them they have to work long hours,” Storonsky continued telling Business Insider. “They are really motivated, really sharing the vision of where we want to go and as a result, they work long hours – they work at least 12 or 13 hours a day. All the key people, all the core team. A lot of people also work on weekends.”

Since that interview, Storonsky has claimed that changes have been made. “We are a different company than we were two to three years ago,” he said in a 2019 interview with Reuters. “We have learned lessons.” But in 2023, still seeking to address the feedback, the firm assembled an internal team to track whether its employees were being ‘inclusive,’ ‘approachable’ and ‘respectful,’ the Guardian reported, encouraging a more ‘human’ approach.

Francesca Cassidy, editor of Raconteur, a business news website, questioned whether change would really be effective if it wasn’t happening from the top. “Storonsky wants Revolut to be the ‘Amazon of banking.’ In pursuing this objective, he works tirelessly and expects much the same from his colleagues. With such a dedicated, driven character at the helm, it is little wonder that Revolut’s culture has developed as it has,” she wrote in an opinion piece.

Yet the company’s plans to revamp performance reviews and launch a recognition and reward programme, “do little to address the high-performance culture that seems to be the source of much of the negative feedback,” Cassidy wrote. “How can employees be expected to pour their energy into being pleasant, collaborative colleagues if they are overworked, under stress and burnt out?”

In addition to a thorny working culture, Revolut has for years battled with a slow approval of its full UK banking licence. In 2018, the company gained its EU banking licence through Lithuania, but after a three-year application process that finally resulted in approval in July 2024, Revolut’s full UK banking licence was still being held up by regulators’ concerns at the time of publishing. The Bank of England has highlighted concerns over the start-up’s ability to maintain its risk management controls in line with its rapid international expansion, the Financial Times revealed.

Storonsky has admitted that not prioritising securing a full UK banking licence in Revolut’s early stages, and instead going all-in on growth, was a rare misstep for the business. A full UK banking licence will allow Revolut to offer a broader range of financial products and services. For example, it will finally be able to enter the UK lending market, allowing it to compete more directly with traditional banks in areas like mortgages and savings accounts.

Equally as importantly, the approval could open the door to further licences in countries including the US, Australia and Japan. It could also be seen as a stepping stone to the company’s stock market flotation, which is likely to be in London or New York.

Storonsky’s side hustles

While Storonsky has global ambitions for Revolut, his focus isn’t narrowed to the digital bank alone. QuantumLight, his venture capital firm, this year announced the close of its inaugural $250m fund. Created with an aim of backing ‘exceptional’ founders across AI, web3, fintech, software as a service (SaaS) and healthtech,

QuantumLight is further evidence of Storonsky’s obsession with data. The VC is described as, “on a mission to bring scientific precision to venture capital.”

“Our ambition is to build the world’s best systematic venture capital and growth equity firm,” Storonsky said in a statement. QuantumLight is also a handy promotional vehicle for Revolut. The business releases public ‘playbooks’ that promote Revolut’s expertise in order to help founders replicate its successes.

Its most recent launch was Hiring Top Talent. Co-authored by Storonsky, the playbook is designed to share the operating principles Revolut developed to ‘systematically scale world-class teams.’ It promises to offer a ‘blueprint’ for implementing the structured recruitment approach behind Revolut’s ‘hiring engine’ that helped the company scale to more than 10,000 employees in just 10 years.

“Our goal is to make the invisible operating systems behind iconic companies like Revolut visible and replicable,” said Ilya Kondrashov, CEO of QuantumLight. “Founders shouldn’t have to reinvent the wheel when it comes to building high-performing teams. By sharing these tools and frameworks, we’re helping scale-ups move faster from day one.”

Beyond venture capital, Storonsky has also shown a penchant for the finer things with Utopia Design, a luxury travel company that Forbes revealed he had quietly set up in 2023. Building on a personal passion for kite surfing, the project includes high-end luxury villas in destinations including the Dominican Republic, Brazil and Barcelona.

While these passion projects have the potential to line Storonsky’s pockets, his main moneymaker continues to be Revolut. In fact, he is said to have set up a multibillion-dollar payout if he can catapult the fintech’s valuation to $150bn, the Financial Times revealed. The deal, similar to one approved by Tesla’s board for Elon Musk, would offer Storonsky shares in Revolut, paid out in stages, that could be equal to a further 10 percent stake.

Next stop: global domination

Back in 2019, Storonsky said Revolut’s success would hinge on whether it could gain enough customers. “The whole idea was we provide the product for free, then we cross-sell other services. So we just need to have large customer numbers,” he said in an interview with CNBC.

This year, he set out his aim to hit 100 million retail customers globally by mid-2027 and to enter more than 30 new markets by 2030, becoming “the world’s leading financial services provider.”

“Our mission has always been to simplify money for our customers, and our vision to become the world’s first truly global bank is the ultimate expression of that,” Storonsky said. Alongside the announcement, Revolut noted that it had earmarked $500m to accelerate its operations in the US. The company’s US CEO confirmed reports that it is looking into whether to apply for its own banking licence in the US or acquire a US bank, which would allow it to expand more quickly.

Overall, Revolut is investing $13bn over the next five years in its global expansion – which continues apace. The firm’s launch in Mexico is expected in early 2026, and an opening in India is also on the cards in the not-distant future. A new global tech hub in the Philippines was set up to support operations in Australia and New Zealand, where Revolut is seeking to obtain banking licences. The company is also beginning to make its first push into Africa, with South Africa in its sights, and it has received an in-principle licence in the UAE to facilitate an expansion into the Middle East. Reports have even surfaced that Revolut is mulling a move into China.

Meanwhile, Revolut’s ‘new bets’ unit is likely to continue cooking up new financial products to explore, but what those will be, exactly, is less clear. In September 2025, a company announcement revealed that the main areas of focus would include AI and private banking. However, if Storonsky’s plans to continue opening in new markets is successful, these new verticals may need to be tailored to the countries in which they are launched, as regulatory requirements could vary region to region. While this could create opportunities for unique products, it also has the potential to take the wind out of the division’s sails as more red tape arises.

“Nikolay Storonsky’s strategy has centred on rapid global expansion and aggressive feature rollout,” Foote said. “The combination of constant innovation and international reach has set the business apart, showing how fintechs can compete with traditional banks by being faster to market and more responsive to customer demand.”

Despite Revolut’s boundless appetite for growth and its achievement of profitability, there are still worries in some corners that the company’s $75bn price tag is too high. However, if Storonsky can pull off his ambitious plans for global expansion and continue to bring to market exciting new products, there is no doubt he will silence the critics.