Olumide Oyetan on Africa’s potential | Stanbic IBTC | Video

World Finance interviews Olumide Oyetan, CEO of Stanbic IBTC Asset Management, on growth in Africa

Related:

Transcript

Stanbic IBTC Asset Management, a member of the Standard Bank Group, is a leading provider of integrated financial services based in Nigeria. Discussing some of the opportunities for investment in the region is Olumide Oyetan, CEO of Stanbic IBTC Asset Management.

World Finance: First, introduce us to Stanbic IBTC: what do you offer your clients, and what makes your services unique?

Olumide Oyetan: Stanbic IBTC is an integrated financial services group, so what we try to do is to offer end-to-end financial services.

I work in the asset management business, so what we focus on is managing monies on behalf of retail clients and institutional clients. For the retail clients what we do is we try to manage them through the collection of mutual funds that we have – and we have about 7 mutual funds, we are the largest provider of mutual funds in Nigeria currently.

And then for the institutional clients, what we try to do is to understand what they are trying to achieve, and then we create a segregated portfolio, understand their risk tolerance, and try to ensure that we educate them on what we are doing.

With respect to what makes us unique, I think as a group, to my mind, we are the only group in Nigeria that offers end-to-end financial services currently in Nigeria. So for instance, from banking services, to wealth management businesses, to trustees, to custody of assets, we do it all. And so a client with us can have their whole financial or investment needs or requirement fully handled.

“The thing about frontier markets in Africa is that the sort of investors it attracts are people that know what they’re looking for”

World Finance: Now some countries in Africa are still considered fragile states: where do you see the safer opportunities to invest on the continent?

Olumide Oyetan: I think that generally – apart from say, South Africa, which has fairly mature and deep financial markets – most markets on the African continent are considered frontier.

I think the bigger stock exchanges are in South Africa, then Egypt, Nigeria… and of course because of what’s happened in Egypt in the last couple of years, so Nigeria’s about par. But I think the thing about frontier markets in Africa is that, first of all the sort of investors it attracts are people that know what they’re looking for. So they are sophisticated. They also understand that the markets are not as deep, so it takes time to build a sizeable investment, and once you do that, you have to wait for a long time.

Unlike in Europe or in the US where you can build sizeable positions within minutes and online almost instantaneously, there is a bit of a challenge doing that in Africa. I think with respect to investing, what people have to consider is that Africa has changed, and it’s offering very high returns, so for investors that are comfortable taking the risk, they usually make a lot: a disproportionate amount of returns over the long to the medium term. But you have to be in there for the medium to long term.

World Finance: Nigeria plans to reposition itself as a market leader in the cocoa industry, what has been done to achieve this and what does it mean for investors?

Olumide Oyetan: Cocoa used to be one of our major exports in the 60s and early 70s until we discovered crude oil in commercial quantity. What that has done is that it has relegated every other sector, especially the agricultural sector which constitutes about 40 percent of GDP. So what we’ve seen is that now the agricultural minister – who is seen as a reformist and a progressive thinker – is trying to fix the whole value chain for agriculture and has identified that within the northern parts of Africa, cocoa can still be produced and exported in commercial quantity.

I think the challenge that we’ve also noticed is that there are very few large scale farmers in the country and, you know, what the ministers tried to fix is access to credit, access to agriculture input such as fertilisers, and just to ensure that the yields are attractive and that the farmers are incentivised to actually produce this commodity, and they ensure that storage and route to market is also made accessible.

“I think the major challenge, has been infrastructure”

World Finance: So optimism for investors, but what do you see as the challenges to growth in Africa?

Olumide Oyetan: I think the challenge, the major challenge, has been infrastructure. What you find is that it’s difficult to move goods or services within countries or regions. I think breaking those barriers would make everybody better off, because trade actually makes people richer.

I think other challenges that you have in Africa is that we have a few countries that have newly elected democratic governments, and there is that danger of them slipping back just because some people do not like the outcomes of election. But what we have seen is that most of the pair countries are now coming and saying, no, people should have the right to choose, and when you then choose, hopefully the government is a lot more responsible.

I think other challenges you have in Africa is just recent quality of education, access to basic school education is actually important. The final challenge that comes to mind about Africa or doing business in Africa is just policy consistency. Sometimes from government what we now see – and if we take Nigeria as an example – is that we try to break down as many barriers for people when they come to invest with us. And you know, in the financial markets or where there is foreign direct investment, you do even give tax holidays for FDIs, and I think that’s why you are beginning to see a lot of interest and a lot of money come into Africa, in the form of foreign direct investment.

World Finance: And so what is Stanbic, and your own business line, doing to accommodate these challenges?

Olumide Oyetan: We see ourself as a gateway to the African markets, and what we try to do to resolve some of the challenges is to work with the governments or the regulators, policy-makers, and try to tell them what they can do to impact society or for the country as well.

So we see ourselves as… you know, our roots are in Africa and our prosperity is in Africa, so as much as possible we try to ensure that we are partnering with the critical stakeholders. So it could be trying to project manage a port, a railway facility, advising on a privatisation mandate, so things will that will make meaningful impact and we can only be as successful as our clients or as the society we are in.

World Finance: Olumide, thank you.

Olumide Oyetan: Thank you very much.

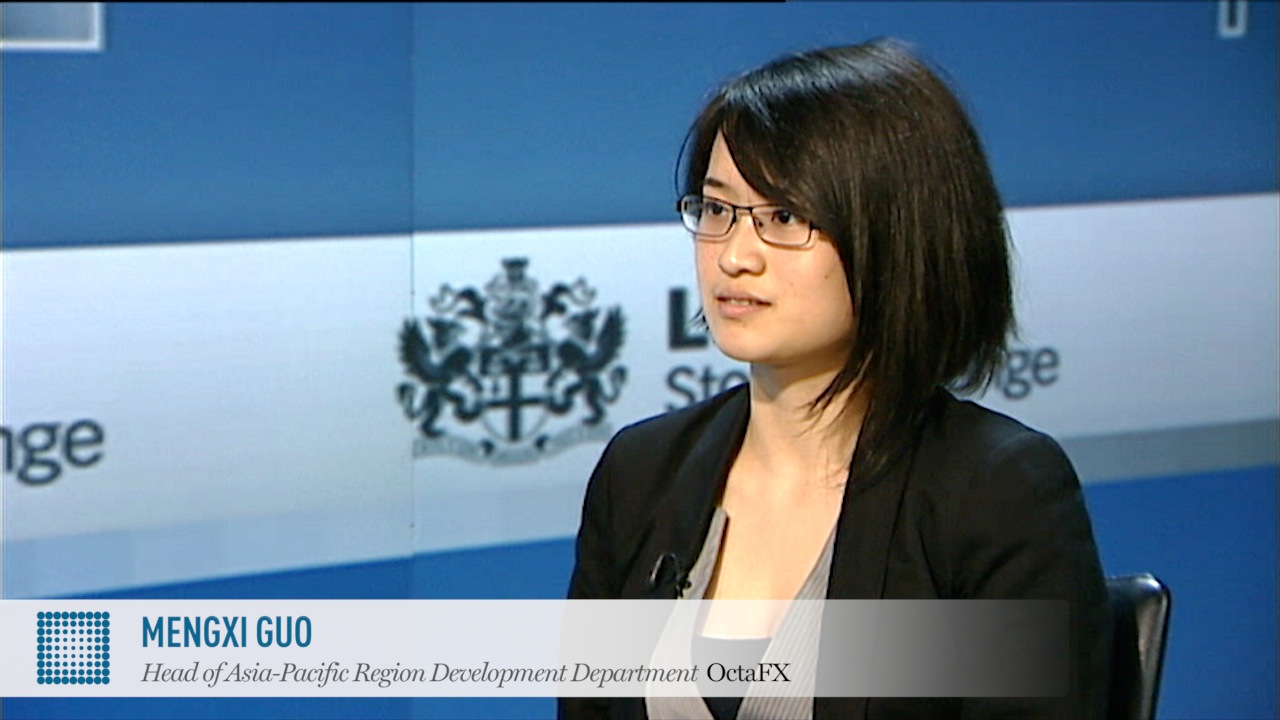

Mengxi Guo on the changing landscape of forex | OctaFX

Mengxi Guo on the changing landscape of forex | OctaFX