Philippe Wallez on private banking | ING Belgium | Video

World Finance interviews Philippe Wallez, CEO of ING Private Banking Belgium, on the current trends in private banking and wealth management in Belgium

Related:

Transcript

ING Belgium was formed when Banque de Bruxells and Banque Lambert, both founded in the 1800s, merged in 1972. Philippe Wallez, CEO of Private Banking at ING Belgium, talks about ING’s success in the country, the latest trends in private banking and wealth management, and its dedicated service for family business owners.

World Finance: Tell us why you think ING has been so successful in Belgium?

Philippe Wallez: It’s mainly due to one key element, which is the fact that we are the number three private bank in Belgium, but we are integrated within a universal direct bank: ING Belgium. So, we can take full opportunity of all synergies to offer to our clients a fully fledged financial service offer.

And especially we have the synergy with the retail banking, where we can detect opportunities to provide the best advice for our clients. The fact also that the 250 bankers in my team are spread over the territory: they are in the regions. So your banker is never far from you, they are always close to you.

Also we have a synergy with the small and medium sized enterprise department, where we can have a common approach towards owners of companies and top executives, in order to really give global wealth advice for private and company purpose.

These are the main reasons, and of course the last reasons are the fact that within ING Belgium we can offer all types of product. Cash solutions, not only investment solutions; lending and credit solutions, not only investment solutions. So we can offer all type of solutions.

“In private banking, we see a strong development of digital, online services”

World Finance: And it’s a competitive market; how are you different from the other private banks?

Philippe Wallez: The most important part is probably our approach towards companies, called the family business approach, where we detect that there is a special need for owners of family-owned companies towards the business cycle of their company, to have special advice in wealth.

We also have, through this approach, a specific partnership with the successor. So, for when you need to give your company, or to sell your company, we call that the Successor Academy, where we have a special training programme for the successors. So that’s one key aspect.

A second, totally different aspect, is the fact that we have been the founder of the Art Society. And the Art Society, simply said, is a network for wealthy people, passionate about contemporary art.

And I would add a third element, which is quite important as well, is the fact that we recognised that within private banking, wealthy people also have special needs towards financing for real estate. And we developed a special mortgage centre, dedicated for private banking, where actually we can give advice for mortgage by phone, which is unique in Belgium for private banking, and highly successful. These are, for example, three aspects where we are different.

World Finance: Now, you offer specific advice to family business owners; tell us more about this.

Philippe Wallez: Yeah, you have to know that 70 percent of companies in Belgium are family-owned, representing about half of the riches produced in Belgium. So the family network of business is extremely important in Belgium.

So, we recognised that, and what we decided to do is, hand in hand with the mid-corporates departments, look to all the needs of the owners, from the start of the company until the end. And from a private banking perspective.

So we offer wealth management advice, for personal, private wealth, as well as for company wealth. And another element which is quite important for the owners of these family-owned companies is that we are also the exclusive partner of the family business network, which is a platform network for successful family business companies, so they can meet each other, exchange ideas, exchange information, exchange advice; this is really the way we are working with them.

“70 percent of companies in Belgium are family-owned, representing about half of the riches”

World Finance: If we turn to the wealth management sector in Belgium in general, what are the trends we’re seeing at the moment?

Philippe Wallez: There is one key trend that we observed in Belgium, but also in other markets. This is the move from cash to investment. So, there is a move to investment, there is a renewed interest of clients to invest in equities. Of course, we have to respect risk profile of clients, and it’s a question of good asset allocation. There is a need for reallocate assets.

Another trend which is probably particular to Belgium, is what we call the wealth repatriation. So, there are more and more clients willing to repatriate their wealth in Belgium. This is of course stimulated by government rules.

Another aspect which is probably also more particular in Belgium is the fact that real estate stays very attractive as investment. And the last one is perhaps more surprising, but we clearly see clients willing to invest in what we call real assets. Real assets being, for example, arts, cars, houses… it can even be land. The price of land has been increasing due to that move to real investment in real assets.

World Finance: So finally, tell us about your future vision, and the planned developments at ING.

Philippe Wallez: Oh, there are many projects and plans in the pipe, but I would certainly stress one very important one within the strategy of ING Belgium. We want to be the best direct bank, and also in private banking, we see a strong development of digital, online services. So, we already have a very an app for daily banking, and we are developing an app for private banking, specially focused on reporting.

But we clearly see more investment in the future, because of the need for clients to do for themselves, whatever they want. Online, through smartphones and tablets. So, we are heavily investing in this direction.

World Finance: Philippe, thank you.

Philippe Wallez: Thank you.

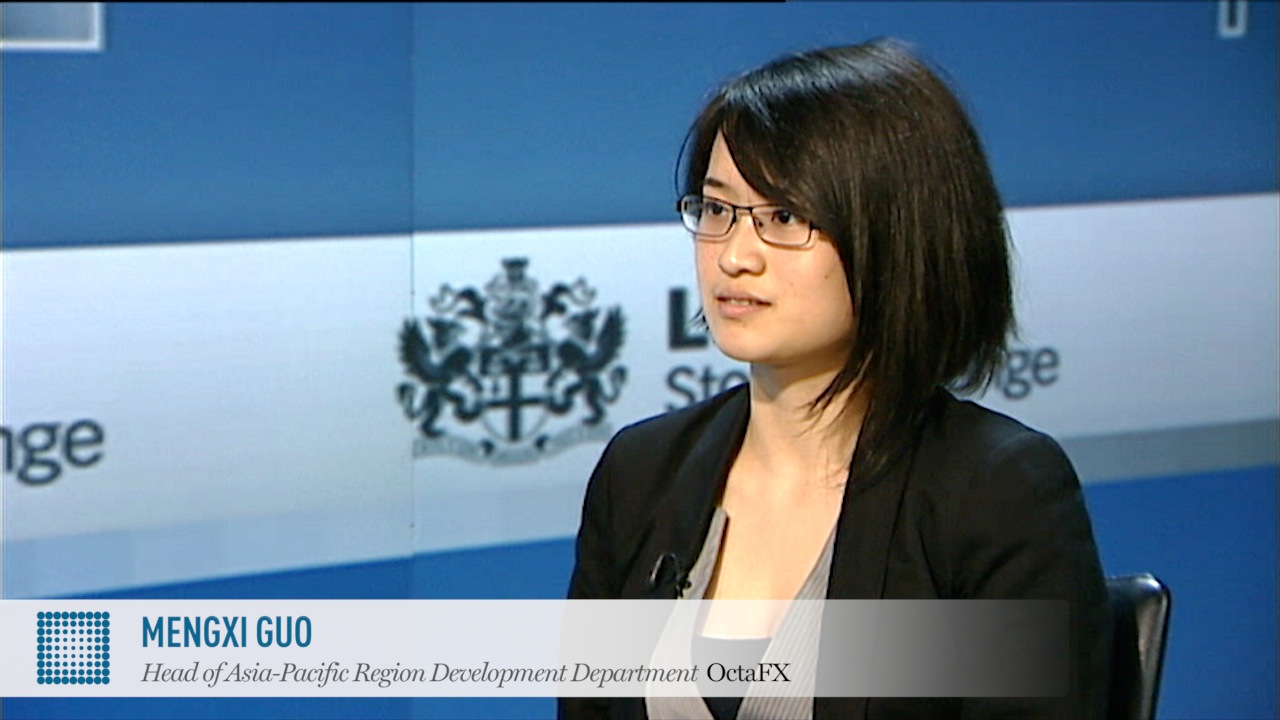

Mengxi Guo on the changing landscape of forex | OctaFX

Mengxi Guo on the changing landscape of forex | OctaFX