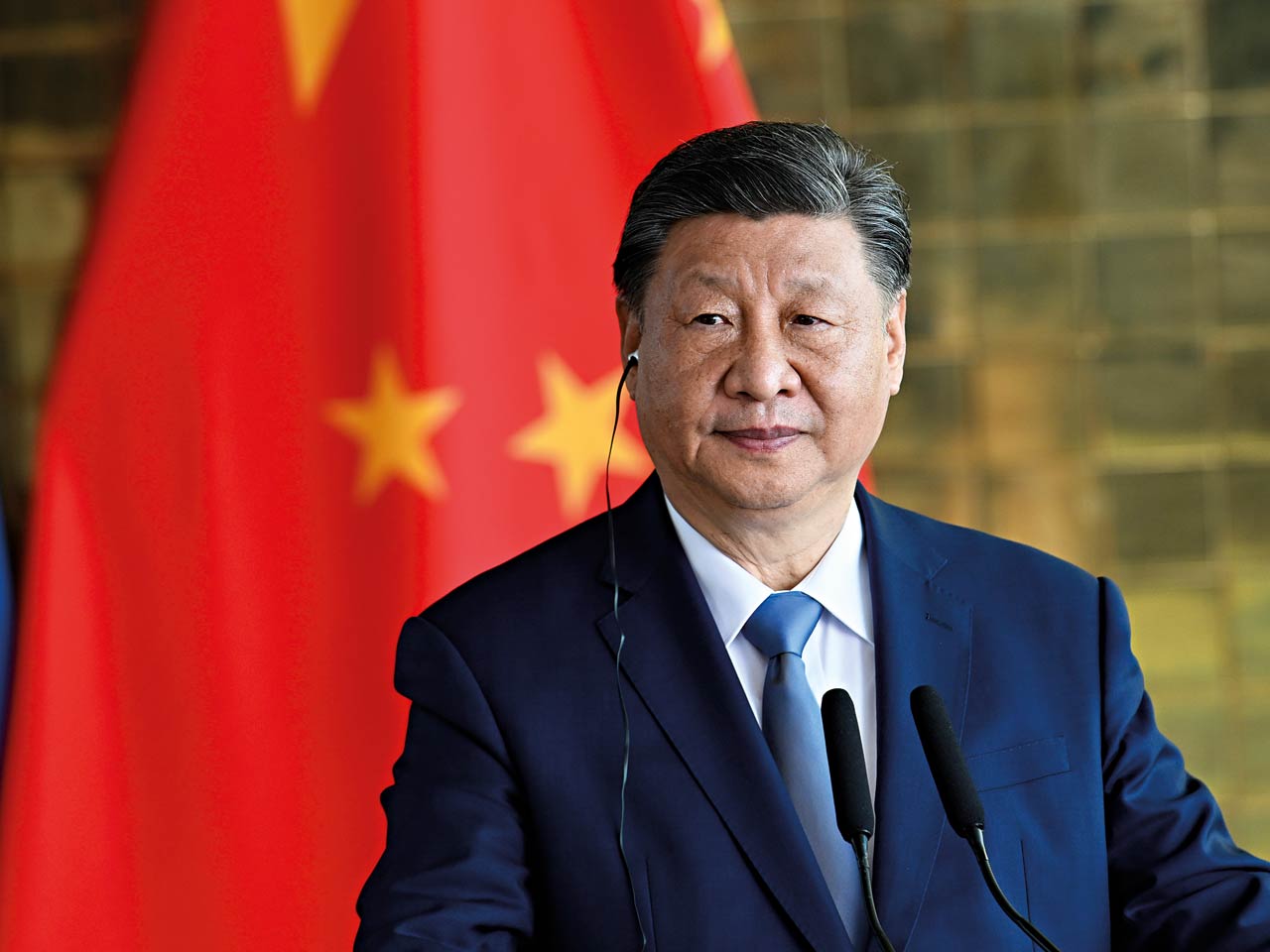

When a thunderous Russian voice announces Vladimir Putin’s entrance, the setting is typically expected to be imposing – carefully staged to project power and dominance. But this time was different. As the familiar voice echoed through the hall, the Russian president stepped onto an unexpectedly modest stage. The occasion was an international Arctic forum in Russia’s far northern Murmansk region. Held on March 26–27, 2025, the forum ran under the slogan ‘Live in the North!’ In a lengthy speech, Putin reaffirmed the strategic importance of the Arctic for Russia and emphasised its rising global relevance.

“Unfortunately, geopolitical competition and the struggle for influence in this region are also intensifying,” he said. Putin added that Russia is closely monitoring developments and responding by boosting its military capabilities and modernising infrastructure across the Arctic. The Arctic has ranked high on the Kremlin’s strategic agenda for more than two decades. Following the collapse of the Soviet Union, state support for the region dwindled, and in the 1990s, the Russian Arctic was largely seen as a socio-economic liability. Substantial reinvestment resumed only in the 21st century. As climate change accelerates the retreat of Arctic ice, new shipping routes and untapped resource opportunities are enhancing the region’s strategic value. Rich in rare-earth elements and home to vast oil and gas reserves – much of which remains under-explored – the Arctic has become central to Moscow’s long-term ambitions. In the wake of Western sanctions over the war in Ukraine, it holds even greater economic and geopolitical significance.

“The Arctic is economically important,” Pavel Devyatkin of the Arctic Institute tells World Finance. “A large share of Russia’s oil, gas and natural resource exports originate from the Arctic.” Around 10 percent of the country’s GDP can be traced to the region. But its significance goes beyond economics. “From a security perspective, the Arctic constitutes Russia’s entire northern border,” Devyatkin adds. “Given the growing competition with Western Arctic states, it is critical for Russia to maintain control over the area and protect those economic projects there.”

According to Russian sources, while other nations pursued maritime expeditions to discover new lands, Russian pioneers advanced steadily overland toward the continent’s northern and eastern edges. Today, the Kremlin portrays itself as a global leader in Arctic exploration. But with the Arctic now a frontier of intense competition, a critical question emerges: does Russia possess a technological edge – and if so, can it sustain it?

Sergey Sukhankin, a Senior Fellow at the Jamestown Foundation, believes that – for now – Russia maintains a technological edge over the West in the Arctic. However, he points out that this advantage is mostly limited to one area: icebreakers. “Russia’s main strength lies in its superiority across various classes of icebreakers,” he says. “This includes both civilian vessels, like the Sibir, and so-called military icebreakers – smaller ships that can be equipped with a range of weapons systems, including Zircon and other types of missiles.”

Moscow’s real Arctic superpower

Russia currently operates 42 icebreakers, including eight nuclear-powered vessels, according to Russian media. Prime Minister Mikhail Mishustin recently announced that the fleet will soon be bolstered by five additional nuclear-powered icebreakers. Among them is the Rossiya, a vessel from the ‘leader project,’ boasting a displacement of 71,380 tons and a power output of 163,150 horsepower – capable of escorting ships through ice as thick as four metres.

New shipping routes and untapped resource opportunities are enhancing the region’s strategic value

Speaking at the International Arctic Forum, Putin reaffirmed Russia’s dominance in this field, stating that the country already possesses the largest icebreaker fleet in the world. “No other country has such a fleet,” he declared, adding that Russia must continue to build next-generation vessels, particularly nuclear-powered ones, to consolidate its leadership. While the scale of Russia’s icebreaker fleet is often framed in geopolitical terms, experts emphasise its primarily commercial role. “Icebreakers are one of the greatest technological capabilities that Russia has in the Arctic,” says Devyatkin. “But they have very limited military applications. Even though sea ice is melting, icebreakers are still important for moving through the Arctic because there is still a lot of ice.”

Beyond logistics, Russia has also sought to monetise its icebreaking fleet through tourism. Nuclear-powered icebreakers now ferry travellers to the North Pole, with cruise operators marketing the experience as a unique journey through ancient ice floes. Promotional materials on Russian websites proclaim: “You will be travelling on one of the most powerful nuclear-powered icebreakers in the world, capable of overcoming centuries-old ice up to three metres thick.”

Still, beyond their commercial and even tourism uses, the Kremlin views these vessels as central to its strategic goals in the Arctic. By enabling year-round navigation through Arctic waters, icebreakers support Russia’s ambition to transform the Northern Sea Route (NSR) into a major global trade artery – one that could ultimately rival traditional shipping lanes such as the Suez Canal.

Strategic asset or symbolic display?

Russia’s ambitions in the Arctic are not limited to its formidable icebreaker fleet. During a recent ceremony, Putin hailed the launch of the Perm nuclear submarine – armed with Zircon hypersonic cruise missiles – as a significant milestone in the advancement of the Russian Navy.

“Yasen-M-class submarines are equipped with modern navigation, communication and hydroacoustic systems. They carry high-precision weapons and are fitted with robotic equipment,” the Russian supreme commander-in-chief said. However, some experts remain sceptical about the strategic utility of such weaponry in the Arctic context. Sukhankin argues that, while dangerous under specific conditions, these systems are unlikely to be deployed without triggering full-scale conflict. “In most scenarios, this type of weaponry is more dangerous than it is useful,” he explains. “Its deployment would likely mean an all-out war between Russia and NATO.”

Even within Russian military discourse, the likelihood of conventional warfare in the Arctic remains low. “When Russian strategists talk about potential conflict in the region, they usually refer to hybrid tactics rather than open confrontation,” Sukhankin notes.

The Kremlin also boasts of developing extreme cold-resistant drones capable of operating in harsh Arctic conditions. In parallel, Russia started working on robotic systems to mine the Arctic Ocean floor. In a surprising and ambitious development, Russian media reports that the country is now exploring the use of nuclear submarines to transport liquefied natural gas (LNG). According to these reports, Russia has begun designing nuclear-powered submarines to export LNG from the Arctic to Asia, aiming to significantly reduce shipping time along the NSR.

Sukhankin notes that this idea dates back to the early 2000s, when elements within the Russian business and political elite sought to impress Putin. “The concept was eventually shelved because it could not withstand basic scrutiny from a security standpoint,” he says. “How can you store the necessary volume of LNG on a submarine in the first place?” Sukhankin asks. “If you run the numbers on break-even costs, it simply does not make sense. What kind of submarine would you build? Russia does not have the capacity to build such vessels – and no one would build them for Russia either.”

He adds that it remains unclear whether this initiative is a genuine project or merely another attempt by Russian elites to curry favour with Putin. “At this point, it’s difficult to tell whether this is aimed at a domestic audience or designed to impress internationally,” he concludes.

Putin’s call for Arctic cooperation

In a modest hall in Russia’s Murmansk region, Putin opened his speech not by celebrating Russia’s achievements, but by stressing the urgent need for renewed collaboration with various countries.

“Russia is the largest Arctic power. We have advocated and continue to advocate for equal cooperation in the region,” Putin said. “Moreover, we are ready to work not only with Arctic states, but with all those who, like us, share responsibility for the planet’s stable, sustainable future and are capable of making balanced, long-term decisions,” he added.

Devyatkin points out that Russia has a centuries-long history of operating in the Arctic and possesses deep expertise in resource extraction and navigating the region’s harsh environment. However, he emphasises that cooperation with other Arctic states remains valuable, as these partnerships bring in capital, advanced technologies, and access to export markets.

Some analysts argue that there may be a strategic calculation behind the Kremlin’s cooperative rhetoric. While Russia has demonstrated an edge in certain technologies and weaponry, doubts remain over its ability to sustain systemic production and long-term growth. “Russia’s own internal domestic capabilities to modernise are quite questionable,” says Sukhankin. Accordingly, Russia is seeking greater collaboration to advance its technological ambitions in the Arctic region.

Each time Russia announces the production of new drones, nuclear submarines, or other vessels, alarm grows over Moscow’s apparent lead in this strategic competition. Yet, according to Sukhankin, this perception is deliberately cultivated. “This is exactly what Russians want. If you read the basics of what Russians are writing about information psychological warfare, this is exactly what they mean,” he says.