The 2008 financial crisis that shook the global economy still has the world on tenterhooks, while rising divergences mean monetary convergence cannot work in the EU, says economist.

Come back later for a full transcript of this video.

The 2008 financial crisis that shook the global economy still has the world on tenterhooks, while rising divergences mean monetary convergence cannot work in the EU, says economist.

Come back later for a full transcript of this video.

Peru might be a fraction of the size of Brazil, but that has not stopped this resource-rich country becoming one of South America’s most consistent engines for growth. According to data from the World Bank, Peru’s economy is set to grow by 2.9 percent this year, which compared to the 1.7 percent forecast for the Latin American region as a whole, stands as testament to the impressive strides the country has taken.

Its strong performance over the last decade has led to Lima being chosen to host the upcoming annual meetings of the boards of governors of the World Bank Group (WBG) and the International Monetary Fund (IMF) in October this year.

The 2015 WBG/IMF annual meetings will give the country the chance to showcase its economic achievements and strengthen its increasingly relevant position on the global stage. Peru’s President of the Council of Ministers, Pedro Cateriano Bellido expressed his appreciation to the WBG/IMF for recognising the country’s economic performance by bringing the event to Lima this year. “Today Peru is acknowledged worldwide as an important emerging economy, capable of hosting an event of the magnitude of the annual meetings, which will take place in Latin America after 48 years”, he said in a statement.

He went on to add that Lima is preparing itself to receive over 12,000 participants during the 2015 annual meetings and that the country is in the process of developing infrastructure that will allow the capital to become a preferred destination for other international events. “The 2015 WBG/IMF meetings in Lima will be the largest event ever to take place in the country”, said Cateriano. “It will provide local business leaders, investors, the academic community, and local social organisations with the chance to establish links with world global business and financial leaders and with civil society representatives.”

Today Peru is acknowledged worldwide

as an important

emerging economy

WBG Secretary Mohieldin has said that Peru was selected for the growing international prestige the country has won over the last two decades , due to its economic and social performance. “This designation is a clear reflection of Peru’s achievements in recent years in terms of political and institutional stability, economic soundness, investor confidence, and integration with the world economy”, he said.

Peruvian equities

One sector that has helped Peru garner the respect of the international community is its dynamic and ever-evolving financial sector. The Peruvian equities market for example, although only a small, shallow market shows great potential in supporting the country’s long-term growth aspirations.

“However, it is significantly influenced by the perception that the national economy is highly dependent on mining”, says Rafael Buckley, CEO of SURA Mutual Fund. “As a result, this market has the habit of turning volatile, along with a propensity to vagaries of the global economy, and particularly dependent on the demand for minerals.

“Given the global market situation, the Peruvian stock market is slack due to the low global growth prospects for this year and to the fact that it is a pre-election year for Peru, which could generate political unrest affecting the preferences for our stock market.”

In the last five years, there has been a significant improvement in the stock market general regulations, as well as in the Mutual Funds (SMV) specific regulations and tax system. This has resulted in a more transparent and professional market, but it has mainly promoted the creation of new funds based on new types such as international, structured, secured, flexible funds, and funds of funds.

During the first years after 2008, fund management companies focused on completing the value proposition mainly by creating defensive funds, given the risk aversion following the 2008 and 2011 crises. Then the creation of new funds increased significantly – just in the last 12 months, 21 new funds (+26 percent) have appeared – taking into account more creative initiatives involving diversification and low correlation with the local market. “Without any doubt, the government and the private sector have promoted major advances, but there is still a long way to go”, says Buckley.

“The main challenge now consists in making the funds offer available to more people by using new distribution channels and promoting long-term investment benefits.”

According to a report by BNAmericas, the investment portfolio of Peru’s mutual funds grew 13.4 percent in 2014. One reason behind the growth of mutual funds is the decreasing trend in interest rates recorded since 2008, resulting in the search for more profitable alternatives by the investors. Meanwhile the fund management companies reported consistent returns, especially in very short- and short-term funds. This is why 71 percent of all the assets under management (AUM), approximately $6.1bn, is invested in these categories.

The average Peruvian investors are generally conservative and have a poor long-term savings culture; therefore, a big percentage of their savings is earmarked for short-term deposits. Another important reason behind the increase of AUM is the significant expansion of the product range, the structured and international funds being the most popular products among investors so far this year.

“Our main objective is to generate risk-adjusted returns above the reference indexes of our funds and to make higher returns compared to the average return of our competitors’ funds”, says Buckley.

“All of this lineout with solid policies and investment and risk practices that ensure the sustainability of our business over time. Another important topic is to continue fostering in our industry the application of good social responsibility and environmental practices when evaluating investments. We do not aim to be the most profitable company every year, but we do want to consistently generate value above the funds average.”

Diverse funds

In relation to the debt market, SURA Mutual Fund manages two money market funds, two short-term debt funds, and two fixed income funds. All of these funds make investments throughout the curve of the Peruvian sovereign debt, as well as in corporate debts issued by Peruvian companies, and in short-term debt instruments (mainly in the financial sector).

It also manages one equity fund, which invests in Peruvian companies stocks, and has an investment approach focused in mining (in line with its reference index), and one equity fund which invests in companies that are part of the Pacific Alliance (Chile, Colombia, Mexico and Peru).

“Furthermore, we manage three international funds, enabling our customers to invest in North American, European and emerging markets stocks and to expose them to these markets with a tax efficient and passive management”, says Buckley. “Finally, we also manage three balanced funds that incorporate our [tactical] views.”

Investor relations

In today’s hyper-connected world there is a demand for financial organisations to take strides to improve communication with their investors. SURA aims to create spaces where it can interact with investors through Q&A sessions in different social networks, along with bi-monthly videos that allow fund managers to share information about any changes in the market and strategies used to manage their funds.

In addition, there are quarterly meetings with the media, where the company attempts to clear up any doubt about the industry in general terms (pension fund administrators – AFP, mutual funds and insurance).

“For our internal operations, we carry out programmes to bring the customers closer to our administrative staff, which raise awareness about the sales process and help them identify how to improve the service”, says Buckley. “Aside from these activities, I think the best way to keep our customers close is to advise them objectively and manage their expectations, so they can achieve their goals.

“Instead of focusing our attention into selling old returns, we are interested in dedicating a large part of the process to explain the associated risks.”

Unlike its competitors, SURA’s products can be distributed in several banks, brokerage firms, securities intermediaries, and soon in other financial institutions. Additionally, for its distribution channel it has developed unique advising processes, which are based more on managing customers’ expectations than on selling specific products.

“Without doubt, we are an innovative fund management company. The fact that we are the only big fund management company not linked to a bank makes us different. We are more focused on providing excellent results for our investors and we are creative in the design and distribution of ours products”, says Buckley.

“It is worth mentioning that for the last years we have been a benchmark for creating new products. Indeed, we have created the first funds of funds with different share packages to make the offer available to more people, as well as the first flexible funds, regional international funds, and integrated market funds.”

Overall, the Peruvian market shows great growth potential, with investors now more experienced and asking for more sophisticated products. Not only that, but the penetration of mutual funds in the market is still relatively low compared to other countries in the region regarding term deposit volume or GDP percentage. Combine this with the fact that the country as a whole is attracting increased international attention and it is likely that we will see more capital finding its way to Peruvian markets in the coming years.

The Consumer and Financial Protection Bureau is forcing Citibank North America, as well as its subsidiaries, Department Stores National Bank, and Citicorp Credit Services, to repay $700m to customers for what the US regulator describes as “unfair and deceptive practices.” According to a statement posted on the CFPB website, these practices “include unfairly billing consumers for credit card add-on products, deceptively marketing those products, and deceptive collection practices. Citibank has agreed to pay about $700m in refunds on about 8.8 million accounts.”

“Citibank has agreed to pay about $700m in refunds on about 8.8 million accounts”

Regulators found that the bank offered customers a number of debt protection add-on products that pledged to write off, balance or defer the due date of payments for customers in instances of unforeseen hardships, such as job loss, disability, hospitalisation or divorce, as well as anti-fraud card monitoring services. These products were found to be sold deceptively at the point of sale, with customers not informed of their additional costs or misled concerning a supposedly “free” 30 day trial.

The benefits of the anti-fraud monitoring services were also misrepresented. As the CFPB notes in a press release, “Citibank claimed the fraud alert service on credit card accounts would alert them of fraudulent purchases. In fact, the credit-monitoring product only provided alerts to changes in a consumer’s credit file maintained by major reporting companies, not at the transaction level.”

Further, the bank was accused of using misleading questions to obtain billing authorisations from customers to purchase add-ons, as well as using deceptive practices when collecting payment on delinquent credit card accounts, leading customers unnecessarily to pay a $14.95 fee.

Citibank must pay $479m in consumer relief to the 4.8 million customers deemed to have been affected by deceptive marketing or retention practices and $196m to roughly 2.2 million customers who enrolled in the card monitoring service, while Department Stores National Bank must provide $23.8m to the 1.8 million customers that were charged expedited payment fees on delinquent accounts. Finally, the bank must also pay a $35m fine to the CFPB’s Civil Penalty Fund.

Microsoft has turned in a record $3.2bn loss for the latest quarter, ending June 30, after having suffered a $7.5bn writedown charge recently – courtesy of Nokia’s struggling mobile business. Company sales were down also by 5.1 percent, as the impairment charge, coupled with a strengthening US dollar, dealt the world’s biggest software company its biggest quarterly loss in history.

The bad news was offset in part by growth elsewhere

The bad news was offset in part by growth elsewhere, with Surface, Xbox, Bing, Office 365, Azure and Dynamics CRM Online all racking up double-digit growth over the quarter. Chief Executive Satya Nadella went to great lengths to underline the company’s strong performance in new markets, not least in cloud computing, where results were strong but perhaps not as strong as expected. Overall, the positives were overshadowed by the company’s headline losses, and its shares took an almost four percent tumble in extended trading, despite posting an 8.6 percent gain in the quarter overall.

“We finished the fiscal year with solid progress against our strategic priorities, through strong execution and financial discipline, which is reflected in our results for the quarter and the year,” said Amy Hood, Microsoft’s Executive Vice President and Chief Financial officer in a statement, echoing Nadella’s positivity.

The chief executive stressed also that “the upcoming release of Windows 10 will create new opportunities for Microsoft and our ecosystem,” as he sought to consign Microsoft’s failings to past mistakes. The fact remains, however, that recent iterations of Windows have not been well received by critics, though the company’s decision to integrate search and gaming into the latest may yet prove a canny move.

The investment industry has been growing, and today hosts some of the most exciting prospects in the global market. In that regard, the quantitative easing policies of major central banks have buoyed the economies of global developed markets and increased their attractiveness to potential investors, whether on home soil or abroad.

“Thailand’s investment management industry has evolved over the years”, says Vana Bulbon, Chief Executive of UOB Asset Management, Thailand (UOBAMT). “Investors have become more sophisticated with increased demand for foreign investment funds. There is also a gradual shift in the appetite from fixed income to equities.” Bringing together investment expertise from a wide range of asset classes and products, UOBAMT has become one of the country’s leading fund houses.

Asia’s middle-class population is expanding rapidly (see Fig. 1), and so too is the will to invest. Meanwhile an ageing Asian population looks to preserve its wealth for the future, whether for education, healthcare, retirement, or insurance. Asia’s investment management industry has embraced the abundance of new opportunities, growing its assets under management at an extraordinary pace. In the past, financial assets were concentrated largely on a single market or with a significant home-bias portfolio. But as markets continue to mature, investors are beginning to favour well-diversified portfolios across asset classes and geography.

The fast-growing economy of Asia and the rising affluence of the middle class have perhaps been the biggest factors in shaping the investment management sector

Slow and steady growth

Thailand has become a promising market in emerging Asia. Its solid fundamentals are seeing asset management firms exhibiting double-digit annualised growth of asset under management in recent years. Driven by an economic boom in much of emerging Asia, the wealth of the Thai middle class has been growing robustly. The impact that the rising affluence of the middle-class population has on the latest developments of the industry is significant and growing. Nonetheless, Asia’s investment management industry has a number of challenges to contend with at any given point, and this is also true with Thailand.

“Following the recent two consecutive policy rate cuts by the Bank of Thailand, local interest rates are currently at a five-year low. The low interest rate environment, coupled with limited upside gains from the local equity market due to subdued economic growth, means we are going to see continued investors’ preference for foreign investment funds”, says Bulbon. “As the deposit rate in the country remains low, there is a natural search for yield across asset classes and geographies.”

Fuelled by a low-yield environment and subdued economic growth, investors are exploring foreign investment solutions. In view of this, UOBAMT has launched a number of new foreign investment funds to offer investors options to have geographical diversification in their portfolio.

Headquartered in Singapore with business and investment offices in Thailand, Malaysia, Brunei, Taiwan and Japan, UOBAM Group has an extensive regional footprint. It also has two joint ventures – China-based Ping An UOB Fund Management Company and Singapore-based UOB-SM Asset Management. “In addition, we have many strategic alliances around the world that we can tap for their local expertise to offer investors a wider range of product and investment solutions”, says Bulbon.

UOBAM Group’s launch of Ping An UOB Fund Management Company in 2010 represented its first step into China. Since then, the group has been growing its regional footprint and capabilities through alliances with leading industry players and the opening of new offices across Asia. It has also built successful alliances with international foreign fund managers, such as Wellington Management in the US along with BlackRock, NN Investment Partners in the Netherlands and Sumitomo Mitsui Asset Management in Japan. These alliances have transformed UOBAMT from an Asian-centric fund house into one with international expertise and network.

“With strong partnerships worldwide, we are able to tap into expertise globally to offer solutions to help our clients seize investment opportunities to meet their financial needs and goals”, says Bulbon. In 2013, UOBAMT collaborated with Japan’s Sumitomo Mitsui Asset Management (SMAM) to offer two Funds – UOB Smart Japan Small and Mid-Cap Fund (UOBSJSM) and Japan Small and Mid-Cap Fund (JSM). UOBAMT also offers alternative products such as trigger funds, which are suitable for investors who are unable to monitor the market constantly. Trigger funds have an automatic redemption feature with the principal amount and absolute target return paid back to investors at a fixed target price.

“Providing investors with the right solution at the right time is important. For example, we launched the first high-yield mutual fund in Thailand in April 2014 after SEC relaxed restrictions by announcing a regulation to allow asset managers to set up accredited investor funds for unrated or non-investment-grade bonds. With yield at record low worldwide and improved economic outlook in the US, the fund launch was a success”, says Bulbon. As for the challenges in the region, “in Thailand, we face competition from local asset management firms which benefit from large local distribution networks. However, if we look at total assets under management, UOBAM Group is one of the largest unit trust managers in the Asia-Pacific region.”

Global presence with local knowledge

Asian asset managers such as UOBAM are attracting attention from around the globe, as international names look to secure the services of Asian-focused partners in the hope that they will give them the edge over their competitors. Though the pace at which Asia’s investment management is growing has led many to believe that success in the market will come easily, local knowledge will prove paramount for any new industry players.

As part of the firm’s growing portfolio of solutions, UOBAMT’s Premier Online” platform enables investors to access the firm’s services online at their convenience. Service innovations and technology improvement is an important factor to cater to investors’ lifestyles and enhance competitiveness in the industry.

The fast-growing economy of Asia and the rising affluence of the middle class have perhaps been the biggest factors in shaping the investment management sector, though a close second is the matter of changing customer preferences. UOBAMT keeps up with the changing business environment by ensuring its operating models keep pace with the development accordingly.

As part of its commitment to provide solutions and advisory services that best suit customer needs, UOBAMT will continue to be stringent in its product selection, strengthen its financial advisory capabilities and enhance its fund distribution channels. “Our long-term goal is to become the premier regional leader in investment management and advisory services, and to be recognised for our focus on meeting our customers’ financial needs and maximising investment returns”, says Bulbon.

The market for vehicle leasing and funding has evolved in recent years to span multiple countries and various continents, offering customers more services than ever before, and new benefits through technological innovation. The financial crisis was a turning point for the industry – generally, only the largest have survived. The most financially robust and well-structured companies have been able to absorb falling vehicle resale prices and withstand fierce competition.

One such firm is ALD Automotive, Europe’s leading service provider for company car contract hire and fleet management. World Finance spoke with Gilles Momper, the group’s Chief Financial Officer and Stéphane Renie, ALD’s Sales and Marketing Director, to discuss recent trends in the industry and how ALD has been able to continue growing and expanding.

The past crisis and general market conditions have made it increasingly difficult for small and local players to remain competitive

How has the vehicle funding and management industry changed recently?

Renie: The first striking change within the industry in recent years is a very clear movement of concentration, with a greater market share for international players. The past crisis and general market conditions have made it increasingly difficult for small and local players to remain competitive.

Secondly, there has been a vast geographical expansion of the product; up until 10 years ago, it was focused mostly in mature markets, but the service has since spread to emerging fleet markets, such as Brazil, Mexico, Turkey and India.

Momper: I would say that the other main hinge in recent years is that during the financial crisis, operational vehicle-leasing players suffered an unexpected decrease of used-car prices in Europe, which generated significant losses when customers returned their vehicles at the end of the leasing contract. Since then, used car prices in Europe have never recovered to the level they were before the recession, and as such, residual value remains the main risk that we carry for our customers.

Why is ALD recognised as one of the industry’s leading service providers?

Renie: We now have a market leadership position as we manage more than 1.1 million cars across the globe and we have experienced a compound annual growth rate of eight percent for the past 10 years. The other dimension is one of geography, whereby we have the broadest presence in our industry.

We are now covering 40 markets – the mature western European markets, but also Central and Eastern Europe, the BRICs and other emerging economies. Moreover, even through difficult times, we continued to be a sustainable partner to our customers, which is partly due to a strong shareholder structure.

This also stems from our long-term approach as a business and our commitment to quality services – which make us stand out in the industry.

What benefits does belonging to a banking group entail?

Momper: Belonging to a banking group is obviously a key advantage in receiving competitive funding to support both our organic and external growth in the long term. It is also an advantage from the commercial point of view to have access to the market and promote vehicle-leasing products through the network and corporate customer base of the bank. Also, being part of Societe Generale imposes a prudent approach to ALD in terms of asset and liability management: assets and liabilities are matched in duration, currency, and type of rates. This provides extra assurance to our customers that ALD has a consistent, long-term and sustainable approach when dealing with funding.

What does ALD offer as an optimal solution for car fleet management?

Renie: We tend to think that our core product, which we call full service leasing or full operational leasing, is today more than ever the optimal solution when it comes to car fleet management. It provides a one-stop shop for our customers that encompass vehicle purchase, a financial path and operational services for a fixed monthly rental, which lasts on average 43 months.

From a financial perspective, this is a stable cost and so does not suffer from any unexpected variations, thereby making it easy for companies to budget for, while also mitigating many risks for the customer. From an operational point of view, it simplifies issues for our customers when it comes to supplier management and the quality of the services that are eventually delivered to drivers.

That being said, our approach is not monolithic; we have diverse solutions in our portfolio, such as fleet management, which now comprises 25 percent of our product offerings. We think of ourselves as being part of the service industry more than anything else, so the capability of ALD to provide these two products and a number of variations for them both, puts us in an excellent position to really fit and adapt to customer needs – today and going forward.

How can companies establish a lasting risk reduction programme?

Momper: I would say that operational vehicle leasing in itself is a risk reduction option – as Stéphane was saying – customers pay a fixed monthly rental, which protects them against any residual value risk or maintenance risk, on top of not having the cost and burden of dealing with complex operational matters for non-core activities. We also offer a consistent and compliant platform, which provides comfort for international groups that have subsidiaries in countries that are located far away from their headquarters.

How does ALD facilitate value management for customers?

Momper: The economy of scale acts as the main driver of value creation for our customers – our size and growth matters to us, but it also matters to our customers as they benefit from our procurement power. We are buying more than 230,000 cars and 1.2 million tyres per year worldwide, which contributes greatly to decreasing operational costs.

Renie: Beyond the quantitative side of value creation for customers that Gilles described, there is also a qualitative aspect to the work we do. Another part of our job is to provide consultancy for our customers regarding the best ways to optimise their fleet management policies that can lead to savings – this is very much part of our core services.

How is ALD driving innovation within the industry?

Renie: When you think of innovation, you immediately think about technology, and clearly technology in our industry can be a major transformation factor. When it comes to client-facing solutions, we want to be ahead of the game in terms of interaction with drivers and fleet managers by providing client and driver portals, which can be accessed from anywhere in the world. This platform encompasses everything they need to know about their relationship with ALD on a given vehicle, or more broadly on their entire fleet.

Similarly, we have rolled out an app in over 30 markets for drivers to optimise their search for the closest location where they can have their vehicle serviced, thereby simplifying the job of maintaining their car. There is also another angle, which is creating new products to address new needs, such as the new mobility product field, in which we try to think of alternative solutions to test the standard company car assigned to a given individual for a whole year.

We have a lab in the Netherlands, which has a specific mandate within the group to test and learn new mobility solutions – that is the way we drive innovation internally and hope to be at the forefront of the market.

What role do strategic partners play within ALD’s business model?

Renie: We have strategic partnerships in areas of the globe that we do not cover with direct affiliates. That’s particularly true for North America where we have an alliance with Wheels, which is a top three player in the North American leasing and fleet management industry. We also have associate companies in South Africa, Australia, New Zealand and Ireland. The purpose of these strategic partnerships is to provide for customers within our portfolio that require a global solution. We have noticed that this trend is increasing; many more customers want to optimise the service from a global standpoint, instead of just regionally, which was previously the case.

What regions does ALD operate in and which markets offer the greatest potential for growth on a global scale?

Momper: We currently operate in 40 countries and we have just opened a subsidiary in Chile and a branch in Kazakhstan last year. Our approach has always been to open subsidiaries or branches wherever our international customers are established – of course this also depends on the fleet potential.

In terms of further growth, there are still many countries, even in Europe, where operational vehicle leasing has great room for expansion, especially on the SME market. This is even the case in France and South Europe. Regarding the rest of the world, for the time being, we are experiencing the highest percentage of growth in Brazil, Mexico, China, India and Russia – although, our absolute fleet numbers remain the highest in Western Europe.

The new rules approved by the Federal Reserve will see the eight largest banks in the US forced to increase their capital buffers to protect against future loses. The increased buffers will, according to a Federal Reserve press release, “range from 1.0 to 4.5 percent of each firm’s total risk-weighted assets.” This increased buffer will be on top of the already effective seven percent required by Basel III.

The exact rate of the surcharge increase for each bank is to be determined individually

The exact rate of the surcharge increase for each bank is to be determined individually, taking into account the interconnectedness, cross-jurisdictional activity, substitutability, and complexity of each institution, as well as “a measure of the firm’s reliance on short-term wholesale funding.”

The increased buffer requirements will be phased in as of January 2016 and will become fully effective by January 2019. Because the exact requirements will rely on data from banks that is subject to change over time, the exact figures may change when the new rules come into effect. At present, however, the collective sum of the new requirements should amount to $200bn.

The banks in question, labelled as global systemically important banks by the Federal Reserve, include: Bank of America Corporation; The Bank of New York Mellon Corporation; Citigroup, Inc.; The Goldman Sachs Group, Inc.; JPMorgan Chase & Co; Morgan Stanley; State Street Corporation; and Wells Fargo & Company.

“A key purpose of the capital surcharge is to require the firms themselves to bear the costs that their failure would impose on others,” Janet Yellen, Chair of the Federal Reserve, is reported as saying in the press release. “In practice, this final rule will confront these firms with a choice: they must either hold substantially more capital, reducing the likelihood that they will fail, or else they must shrink their systemic footprint, reducing the harm that their failure would do to our financial system. Either outcome would enhance financial stability.”

PayPal was warmly received by investors on its highly anticipated return to trading, after it split from its long-time partner eBay on July 17. Celebrating a new start as an independent, publicly traded company, the digital payment processor’s shares leapt 11 percent, 12 years on from its first days alongside eBay, with its market value in and around the $50bn region.

While PayPal was welcomed by investors, eBay’s stock fell as much as 4.7 percent on the first day of trading

“We embark on this new chapter with great confidence in our future. We’ve entered a time of unprecedented change that will revolutionise the role that money plays in people’s lives,” said PayPal’s CEO Dan Schulman in a public statement. “Right now, every aspect of commerce is being rewired on a global basis. The convergence of mobile technology and cloud computing is unleashing incredible opportunities to transform how people move and manage money, and how merchants and consumers interact and transact.”

Independent of its long-term partner, PayPal will embark upon the task of seizing market share from its smaller rivals, Apple and Square chief among them. Beginning in 1998, PayPal did much to drive the adoption of e-commerce, and the online and mobile digital payments market has since created an e-commerce market worth $2.5trn, according to E-marketer.

While PayPal was welcomed by investors, eBay’s stock fell as much as 4.7 percent on the first day of trading, as it struggles to come to terms with its stop-start e-commerce business. Whereas eBay is looking to secure a solid footing in its existing market, PayPal is looking to entirely new ones, and the mobile payments market promises to revolutionise the world of commerce.

“The potential for mobile technology to transform money extends beyond commerce. The vast majority of the world’s seven billion people lack access to even basic financial services,” says Schulman. “This makes the simplest transaction – receiving a paycheck, paying bills, sending money to a loved one – inconvenient and expensive. But in a world where five billion people have mobile phones, we also see an incredible opportunity to make a significant difference in people’s lives by putting the full range of financial services directly in their hands through their mobile devices.”

Iceland was close to collapse in 2008, but it somehow managed to navigate the treacherous economic waters to become one of the top economic performers in Europe in terms of growth. Its financial sector was blamed for the country being hit so severely by the economic crisis six years ago, but unsurprisingly, it has also played a big role in rebuilding the overall strength of the economy ever since. According to the IMF, progress has been made in improving the financial stability framework, but it admits that gaps remain. Banking sector buffers are strong, but the organisation believes that there are a number of uncertainties surrounding the unwinding of crisis legacies, while legal risks, including challenges to CPI indexation, remain high.

The Central Bank of Iceland (CBI) and the Financial Supervisory Authority (FME) have made significant gains in improving macro-financial and supervisory stress tests, but there is still much work to be done in relation to bank supervision and the creation of financial safety nets. The national government recognises that its ownership of the core-banking sector must be normalised and put back into the hands of ‘fit and proper’ owners. One of the biggest challenges moving forward is for Iceland to reintegrate its financial markets with the rest of the world by removing its capital controls. While these controls were initially put in place to provide a level of stability for the country’s economy, and still do, now that the financial strength of the country has improved the tight controls are hampering growth.

The major challenge for the Icelandic economy at large is the abolition of the capital controls

Overall, the financial sector has weathered the economic storm effectively and reformation efforts, along with banks shifting focus to more sustainable banking models, have provided Iceland with a solid foundation for growth. In light of the news, World Finance tracked down Tryggvi Tryggvason, Head of Asset Management at MP banki to find out how the banking industry has changed since the economic crisis and what the future holds for the sector in the coming years.

Can you tell us briefly about Iceland’s banking industry and how it has changed in recent years?

The banking industry in Iceland, as well as the economy at large, is on a slow but steady road to recovery. After the financial crisis the Icelandic financial system dissipated. Basic banking business decreased significantly and lending to customers slowed to a fraction of what it was before the crisis. Many economists say that the Icelandic banks are too focused on the past, and not doing enough to make new loans and build a business for the future.

The three major commercial banks have also been criticisd for being conservative about continuing to optimise and downsize their operations, leaving their cost base high. At the same time MP banki has been focused on growing its business and developing the business model to limit cost and build a sustainable banking model for the future.

What are the major challenges and opportunities for banking in Iceland today?

The major challenge for the Icelandic economy at large is the abolition of the capital controls. The CBI has announced that it will make a significant move towards lifting capital controls in the next few months. This brings both challenges and opportunities for the banking industry in Iceland. Opportunities also lie in optimisation of the banking industry in Iceland through downsizing and mergers.

How has the bank turned around its operations?

The bank has strengthened its position significantly in the last two years through restructuring and cost-cutting measures. The bank implemented a rationalisation plan in 2013 to adjust the cost base to a smaller equity base than initial plans had assumed. The rationalisation measures included sale of non-core assets and a redundancy plan. As a result administrative expenses decreased by almost ISK600m ($4.55m) between 2013 and 2014. The bank returned a profit of ISK335m ($2.54m) after tax in 2014 despite considerable redundancy cost in the second quarter of 2014, compared to a loss of ISK477m ($3.61m) in 2013.

We have managed to reduce the cost base of MP banki and at the same time improve quality and increase financial strength. The capital ratio has grown to 17.4 percent at the end of year 2014 from 10.8 percent at the end of 2012. The capital ratio is high and significantly above the banks own internal capital assessment as well as regulatory requirements.

The bank is well prepared for implementation of additional CRD IV regulatory capital buffers in the near future. It is rewarding to see the result of that plan and an ongoing profit for the second half of 2014 and beginning of 2015.

To what extent has MP banki’s strategy changed in recent years, and why?

Our rationalisation measures and changes in strategy were based on the bank’s revised growth plans. Our strategy shifted to simplifying the bank’s business model with a firmer focus on segmentation and specialised banking services.

The change in strategy mostly affected our banking services with little or no effect on our asset management and markets units. These changes have increased the net profit considerably.

How important was the sale of the bank’s Baltic pensions business in the turnaround?

We are very happy to have supported the successful development of the business. It was a strategic decision to sell the bank’s Baltic pensions business at that time. MP banki today does not have a strategy to grow in the Baltics and there is very limited synergy with other parts of our businesses. The development of the business had been very successful; the company was at an attractive stage in its lifecycle and had therefore become attractive to other investors.

The sale contributed to our turnaround but did not have a critical affect. The banks operations have returned a profit every month in the second half of 2014 and the first quarter in 2015.

Tell us about the performance of the bank’s asset management business, and how it differs to others in the region

We have been able to generate excellent risk-adjusted returns to our clients through the years. The strategies are actively managed and the goal is to achieve outperformance in comparison to benchmark. Investment policy for each strategy is flexible. This is the main driver for outperformance. It gives us the opportunity to add value and outperform. A considerable part of our assets under management (AUM) are invested domestically. This market is small and illiquid.

Our ability to act in the local market and make portfolio changes swiftly without impacting prices is also a major advantage. The emphasis on strategic view plays an important role for performance. An investment committee holds weekly meetings in which decisions are made on asset allocation and advice given on strategic and tactical views. Fundamental analysis on bond and equity market is the basis for strategic view in addition to our report on micro– and macroeconomics in the economy as a whole. Momentum, technical analysis and arbitrage are the basis for tactical view. The role of the fund manager is to run strategies according to investment committee advice and find opportunities for tactical allocation.

Why did MP banki’s asset management business prove so successful in 2014?

MP Asset Management has been the cornerstone of MP banki’s operation and has an established reputation. We offer a variety of investment strategies in domestic and foreign markets. Being a well-known asset management house in Iceland, our main objectives are to serve our clients to our utmost and maintain our trustworthy relationship. The most important frame of reference for our clients is decent returns with respect to their risk appetite.

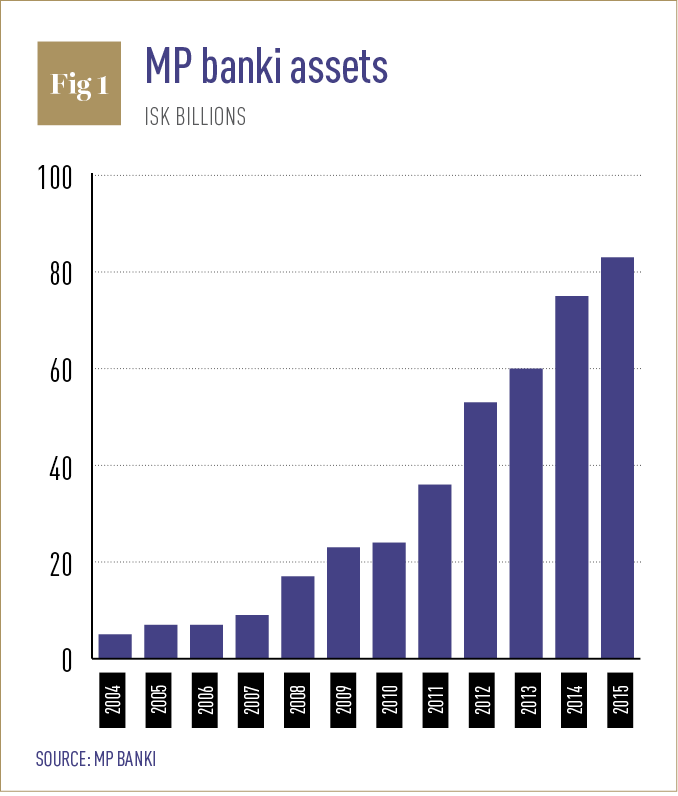

AUM are continuously and solidly increasing (see Fig. 1) as well as our range of products. The increase is attributed to both net inflow of AUM and capital growth. In 2014 we were able to generate excellent return for the portfolios. In addition, a lot of effort has been made to develop more efficient and transparent IT and risk-management systems, which entails that our time is better used to serve our clients. Transparency, access and quality of information are vital for our credibility and ongoing relationship with our clients. MP Asset Management has improved substantially its comprehensive automatic information disclosure to customers.

What plans do you have for the future?

The focus is to offer comprehensive solutions for individuals and institutional clients in major asset classes such as fixed income, equities and real estate – both in local and international markets. Our asset management business has grown continuously with inner and external growth. We expect that trend to continue in the near future. The goal is to continue to grow the asset management business. In 2012, MP banki bought two asset management companies – Alfa Securities and Jupiter Capital Management – and has announced merger talks with Straumur Investment Bank. The bank’s [goal] is to be a leader in the convergence of the smaller financial institutions in Iceland.

Ghanaian regulators are taking a more robust stance with the country’s banking sector – but Daniel Asiedu, MD and CEO of Zenith Bank Ghana, says the industry is better off with the tougher rules. He explains the role banks must play to keep the country growing, and how Zenith Bank Ghana has repositioned itself in light ofthe new regulations.

World Finance: As regulators take a far more robust stance towards a Ghanian banking sector, an industry player tells us whether these changes are for the positive or negative. Daniel Asiedu of Zenith Bank Ghana joins me with his thoughts.

So, let’s first talk about economic growth prospects. We know that next quarter is going to bring a slowdown, right? So in the larger picture, tell me: where does the banking sector fit in?

Daniel Asiedu: When you look at the growth trend in the Ghanian economy up to 2013, 2013 closed at a growth rate of about 7.3 percent. Last year it dropped to four percent, and then this year it’s projected to close at 3.9 percent. So you could say that the economy’s growth has been sliding. And this has been attributable to inflation, depreciation of the cedi, and the energy crisis.

Having said that, of course, when you look at how growth has been projected – and next year we are looking at a growth rate of about 6.4 percent, and then that should rise to about 7.8 percent in 2017. Inflation currently is about 16.9 percent, and that has been projected to close the year at 12 percent, and then next year we are looking at a rate of about 10.2 percent.

And so, when you put all this together, you will see that the future looks bright. And as an industry, what role can we play?

What we have to do is to look at the productive sector and support it aggressively. We have to also look at the companies that are exporting, and also support them.

So this is a time that we – as a financial institution playing the intermediary role – must be visible in our support for the government, so the economy can be put on the growth path.

World Finance: Now in terms of government intervention, we know that regulation has been ramped up in your country, so tell me: how has that had an impact on the banking sector? Would you say a net positive or negative?

Daniel Asiedu: Basically, regulation all over the world has been stepped up; and our country has not been left out.

And that’s because we all know the impact or the implication of non-proper regulation: we know what’s happening in the world.

When you look at it from that perspective, you’ll agree with me that it’s made banking a bit tough. However, the net effect is that we are better off. Customers now have more confidence in the industry; the international community – especially correspondent banks – have a lot of confidence in us; the system is more transparent; and so you have nothing to worry about.

World Finance: So Daniel, you know: as these regulatory changes are implemented, your bank – any bank – is going to have to reposition itself. So how have you done that?

Daniel Asiedu: Let me start by saying that, as a bank, before even regulation was stepped up, we have been built on a culture of compliance and very strong controls.

You will see that most of the things we do are things that have been designed as a result of the experience we have acquired over time. So that whatever we do, we have in the back of our minds that we need to ensure that the system is quite tight.

In west Africa we’re the first bank to be licensed by Visa to do acquiring, and for Visa to give you that platform? It should tell you the comfort they have in your system.

We’ve had calls to partner with regulators – the Bank of Ghana – for some of the systems they intend to roll out. And when the National Risk Assessment Committee was set up, we as staff of Zenith Bank were nominated to represent the banking industry.

So, we think that we’re on the right path, because we’ve positioned the bank along those lines.

World Finance: OK, excellent. Now, of course, there’s always improvements that can be made. If you could speak directly to central bank governors, what other regulatory adjustments would you make?

Daniel Asiedu: You agree with me that the environment is quite turbulent, and things are changing. Nothing is dynamic. And so even though we may have system processes in place, we need to constantly update them.

I think that as we move along, and as events unfold, the regulators look at how things are done, and come up with other ways and better ways of ensuring that the system is better off.

So sitting here, I would not be able to – but I know the central bank will continue to work in the industry, in the interests of all players.

World Finance: OK – now, when you talk about optics when it comes to Africa as a whole – combatting terrorism is a sticky situation. Tell me, how can the banking sector see improvements be made in terms of how this issue is tackled?

Daniel Asiedu: Let me start by saying that I think we all need to realise that there is a problem. There is a problem with money laundering, there’s a problem with financing of terrorism. And we may not be experiencing it directly in Ghana, where I’m from, but all over the world it’s happening. And if action is not taken very soon, it’s going to affect us in our market.

And so the earlier we all position ourselves, the better. And I think as an industry we need to support the government; as an industry we need to be proactive; we need to appreciate what the government is doing. And so we must all have systems and processes to make sure that we support government to achieve this particular objective of ensuring that we stop from breaching the environment.

World Finance: OK. And are you instilled with confidence that this is indeed what will happen? That this sort of troubling period is one that the banking sector, the continent as a whole, will be able to eventually move on from?

Daniel Asiedu: We have an association – which incidentally I’m the treasurer of – and when we go for our meetings, these are some of the things we discuss.

It’s important that the industry positions itself to tackle some of these problems head-on, to support government. Government cannot do it alone. We are the players of the industry, and the government can only push it from the regulation point of view. We must implement – and it’s important that we support government.

World Finance: OK! Daniel, thank you so much for joining me today.

Daniel Asiedu: You’re welcome; thanks for having me here.

Economist tells World Finance that despite the direct threat the RMB poses to the dollar, entrenched and growing trade ties between the US and China will continue.

Come back later for a full transcript of this video.

Since the early 1970s there has been an increasing trend for airlines around the world to rely on operating leasing as an alternate means to managing their financing and fleet requirements for commercial aircraft.

Under an operating lease structure, the airline commits to a long-term lease agreement for the aircraft from a lessor (typically between six to 12 years), with all related operating expenses borne by the airline. At the end of the lease term, the aircraft lease can either be extended for a further period, or the aircraft is returned to the lessor in compliance with the provisions in the lease agreement, which typically relate to the aircraft’s maintenance condition. In the latter case, the lessor will transition the aircraft to another operator, or when the aircraft has reached the end of its useful life, sell it for parts in the spares market.

Given the prevalence of operating leasing, the benefits over aircraft ownership have been clearly recognised by airlines

Given the prevalence of operating leasing, the benefits over aircraft ownership have been clearly recognised by airlines. Operating lessors control a large portion of the Airbus and Boeing original equipment manufacturer (OEM) order books. Sometimes airlines have difficulty purchasing directly from the OEMs as the order backlog means they are sold out for many years. Airlines will also often approach lessors with regards to leasing solutions. In addition, operating leasing provides attractive fleet flexibility to airlines since aircraft are leased for fixed terms resulting in no residual value asset risk for airlines. Operating leasing is also attractive to bank lenders as it reduces the lending risk profile for them with the operating lessor ‘sandwiched’ between themselves and the operator. Operating leases also improve cash flows for airlines, in that pre-delivery payments to OEMs for lessor orders are borne by the lessor. Security deposits during the lease term are smaller than the equity contributions required for a financing. Given that most lessors are able to draw financings cheaper and from a more diversified pool of debt sources than many airlines, it is no surprise that the percentage of commercial aircraft under operating leases amounts to almost 50 percent of the worlds total commercial aircraft fleet today (see Figs. 1 and 2).

Investor interest

Private equity investors have long been attracted to the investment rationales of operating lessors. For example, Cerberus Capital Management, a US based private equity firm, invested in Dutch-based commercial aircraft lessor AerCap, which it took public in 2006. AerCap has subsequently grown to be the largest aircraft lessor in the world through the acquisition of International Lease Finance Corporation (ILFC) from AIG. Cerberus successfully completed its exit from the investment in 2012. Aircastle, another publicly traded commercial aircraft lessor, was founded by private equity firm Fortress Investment Group in 2004 and taken public in 2006. In 2006 Terra Firma, a UK based private equity firm, acquired AWAS for $2.5bn in cash plus the assumption of liabilities from Morgan Stanley. In 2007 Terra Firma then further agreed to purchase Pegasus Aviation from the US private equity firm Oaktree Capital Management, and combined AWAS and Pegasus to create the new AWAS, then the world’s third-largest aircraft leasing business. More recently, Avolon Aerospace Leasing, a lessor founded in 2010, backed by private equity firms Cinven, CVC Capital Partners and Oak Hill Capital Partners, successfully took the business public in December 2014.

So why is private equity so enamoured with investing in this space? One of the principal attractions for the aircraft leasing space is that the sector serves a growing airline industry with an attractive aircraft capacity supply and demand dynamic. Air traffic has historically doubled every 15 years and is, according to research by The Airline Monitor, projected to have an average annual growth rate of 4.8 percent for the next 20 years, thereby doubling traffic again over the next 15 years. Air traffic has exceeded GDP growth by approximately 1.9 times over the past 40 years and the sector has been very resilient to external shocks.

World air traffic recovered to a long-term trend only a year after a drop in 2009 and it took only three years for traffic to recover from the events in 2001. The reasons that have contributed to this traffic growth have been the expansion of urban populations, the rise of a global middle class, the rise of low cost carriers and greater globalisation and cross-border economic activity. This increase in travel demand has continuously increased the demand for aircraft capacity.

What is also attractive to private equity is that from a supply side perspective, the industry is dominated by only two major established players, Airbus and Boeing, with smaller players like Brazil’s Embraer, Canada’s Bombardier and France’s ATR competing in the market for turboprop aircraft and smaller jets. Suppliers such as Russia’s Sukhoi, China’s COMAC and Japan’s Mitsubishi have entered the market with small jet offerings but are expected to take several decades before becoming serious competitors to the established players on a global scale.

Growth within growth

Investors are investing in a growth industry within a growth industry. Driven by air travel demand, the latest Boeing and Airbus forecasts show that the commercial aircraft fleet is expected to more than double over the next two decades from its current level of roughly 20,000 commercial aircraft. Retirements of aircraft at the end of their economic lives (approximately 25 to 30 years) and their replacement by more fuel-efficient types further drives the demand for new aircraft production.

In a rising fuel price environment, replacement demand for fuel inefficient aircraft is strong. Whereas fuel cost as a share of total operating expenses was in the mid teens in the years 2003/2004, it has now risen to a stable 30 percent share, further driving replacement demand for older aircraft. Even in an environment with lower fuel prices, this trend is expected to continue. The introduction of more fuel-efficient new technology aircraft will de-risk the negative effects on airlines’ operations in the event of a fuel price spike.

Another attraction from an investor’s perspective in this space is that the two largest suppliers to the industry are relatively constrained in terms of their production capacity. Changes to production, whether it is an increase or decrease, is difficult given the long lead times involved and their supply chain capacity constraints. Extensive production backlogs on the most popular models allow Boeing and Airbus to manage their production levels as regional or individual customer demand shocks can be evened out by reallocation of order slots to other customers.

Private equity investors haven taken into account what are significant hurdles to entry into the aircraft leasing space, given that the businesses are very capital intensive with acceptable returns only provided on a levered basis. Private equity investors are familiar with different leverage options making them natural investors in the aircraft leasing space. They often apply a diversified debt funding mix to the lessor with funding ranging from the standard bank financings to export credit supported loans or even the US capital markets.

Investors are also drawn to this industry by the fact that investments in operating lessors are in long-lived assets. The value of these assets is relatively predictable. It is also supported by the solid fundamentals given the attractive supply/demand dynamic around aircraft capacity. Relatively predictable new aircraft production levels and a steady outlook in terms of growth and aircraft replacement demand drives such a dynamic. There is volatility in aircraft values, driven by supply/demand and competitive factors. However that volatility is mitigated when looking at aircraft values on a lease encumbered basis, where the lease cash flows and aircraft residual values mitigate a pure asset value view.

Similar to investments in real estate, large chunks of equity from investors can be deployed efficiently and quickly, with the most prevalent narrow body aircraft costing upwards to $50m and widebody aircraft prices starting from the low $100m per aircraft. However security lies in the fact that the assets can be moved from one operator to the next, should that be required at the end of a lease be it scheduled or unscheduled. The worldwide mobility of aircraft to different airlines around the world provides tremendous risk mitigation to the investor.

Aircraft leasing businesses are capital-intensive operations and the forward orders with Airbus and Boeing carry significant cash drag through the associated pre-delivery payments. In addition, there is placement risk for the aircraft, interest rate risk and financing risk that need to be managed. For that reason, many lessors tend to focus on sale-lease back transactions or trades from other lessors where all of these risks can be mitigated since the aircraft are already on lease to an operator and financing requirements are near term with very limited interest rate risk exposure.

Track record

Even though the investor focus draws comfort from the underlying asset values, private equity investors tend to invest in businesses and management teams rather than pools of assets themselves. This approach is largely based on the realisation that the aircraft leasing business is a relationship business, where airline and supplier relationships allow for the best realisation of value in transactions.

Private equity firms have now branched out into other aviation leasing areas, such as helicopters, as shown by the $375m of equity capital that funds associated with MSD Capital, Soros and Cartesian Capital Group have committed to helicopter lessor Waypoint Leasing. The attraction for private equity investors to the aircraft leasing business will likely remain strong given the solid fundamentals around asset values, the favourable and predictable supply and demand characteristics of aircraft assets and the long-term steady returns that lessors have provided throughout various industry cycles.

Most importantly, a positive track record by private equity investments in the aircraft leasing space has been established with several successful investment liquidations, whether private or into the public space. Private equity certainly has an important role to play to capitalise the aircraft lessors that are playing the economic cycles and investments in diverse aircraft assets in various ways. We should certainly be looking for more activity by private equity in the space.

Japan does not have the best track record when it comes to exercising good corporate governance. In fact, it has long been viewed by investors as a “global pariah” for its poor treatment of corporate shareholders, according to George T Hogan, a former sell-side equity analyst in Tokyo and contributor for Investopedia.

But the Japanese Prime Minister Shinzō Abe and his cabinet are looking to improve their country’s less than desirable image and undo some of the negative sentiment expressed by overseas investors, chiefly by introducing a new corporate governance code.

The government is hoping the new system of rules will improve investor confidence, as well as help to make its equities market more attractive to foreign capital. The only problem is that for the new code to be successful it must go up against a cultural cornerstone of the Japanese economic system; one that has dominated the country since the middle of the 19th century, known as keiretsu.

It appears that, at the very least, poor corporate governance forces overseas investors… to exercise an extra degree of caution

While this structure of corporate governance can be traced as far back as the 1600s, it has gradually changed over many decades in order to suit the needs of Japan’s ever-evolving economy. Nowadays, the modern iteration of keiretsu sees corporations or corporate groups all centred on a bank, with each company possessing very close cross-shareholdings. What this means is that while the individual holdings of a company in one of the keiretsu group companies might be quite small, the aggregate of the entire group’s cross-shareholdings can be quite significant. This creates a number of issues that are positive for some stakeholders and problematic for others.

“If you’re an employee and what you are looking for is a stable environment where you are unlikely to be laid off, especially in tough economic times or when the company you work for is hurting financially, then it can be viewed as a relatively good thing”, says Hogan. “But if you are a shareholder, and particularly if you are a minority shareholder, an investor, not one of these cross-shareholding shareholders, then you can really have your rights trampled on.

“It can feel like the companies are not paying enough attention towards generating an adequate return on the investment you have made by buying their shares”, he says. “You seem to be put behind all other stakeholders in the chain.”

And while former sell-side analysts admits that US businesses have flaws of their own, they tend to pay a lot more lip service to shareholders than their Japanese counterparts. Not only that, but should investors in the US feel dissatisfied, then they have a number of options at their disposal. These include the right to appoint board members and officers or participate in a hostile takeover in order to ensure the company is acting in their best interests and maximising profits.

That is not to say that such options are not available to shareholders in Japanese companies, but its long-lasting corporate governance rules can make it difficult to express dissatisfaction with management in a meaningful way because minority shareholders tend to take a back seat.

“Minority shareholders or shareholders outside of the [keiretsu] group can be viewed as more of a nuisance, rather than a constructive contribution to how the company can be more effectively managed or made more profitable”, says Hogan.

Insulated world

The keiretsu structure and how it insulates companies from outside forces is apparent in numerous case studies, but the one that Hogan outlines in his article for Investopedia best highlights this unique characteristic in action.

Back in 2005, Rakuten – Japan’s answer to Amazon – tried to takeover one of Japan’s largest TV broadcasters, Tokyo Broadcasting System Inc. (TBS). At the time the network appeared unwilling to consider a bid under any condition or at any price. Its management was even prepared to dilute the online retailers’ 20 percent stake in the company to almost nothing in a last ditch attempt to stop the takeover from happening.

From the get go, Hiroshi Inoue, then president of TBS, expressed distaste at even entertaining the idea that the online retailer would become its affiliate. “It’s like you have a house of your own and, suddenly out of nowhere, someone comes up and tells you he wants to marry your daughter because he has purchased 20 percent of your land”, Inoue told journalists at a news conference.

The interesting point about TBS is it is one of six major nationwide television networks, which all have a lot of cross-shareholdings.

“Tokyo’s key TV stations cover seven prefectures in the Kanto region – home to the most wealthy segment of the nation’s population”, Minoru Sugaya, a professor of media communications at Keio University in Tokyo told The Japan Times. “Five private broadcasters control the lucrative market and they don’t want newcomers.”

And so, when Rakuten attempted to enter this market it was easy for TBS to rally all of their shareholders (which include these private broadcasters), and even though Rakuten was willing to pay a massive premium, the group companies stepped in and voted it down.

Scaring away investors

Examples like this do not exist in isolation and, from a shareholder perspective, especially one from say the US, where they have become accustomed to a different corporate governance structure, it has the potential to dissuade otherwise interested investors.

“I remember quite vividly receiving a comment from one of my clients – I had a very negative view of Rakuten while I was covering them – but one of my clients really liked them and he went through all the reasons why he liked them”, says Hogan. “He explained how they have great growth; the CEO and founder of the company is great, and he thought compared to other Japanese companies they were very aggressive in trying out new things. Despite all this, he ended the conversation saying that, ‘the only thing I don’t like about the company is it’s in Japan.’”

It appears that, at the very least, poor corporate governance forces overseas investors, who may be a little less experienced in how the Japanese market works, to exercise an extra degree of caution.

At least this “global pariah” clearly acknowledges the damage that is being done by its poor treatment of corporate shareholders, with its decision to introduce a new set of rules being a promising sign. Though this is not the first time that investors have heard of a plan to overhaul corporate governance only to be left wanting.

Toothless proposal

There is a level of pessimism for this new proposal. It derives from the fact that the plan is completely voluntary. The new rules may attempt to address rights of shareholders, cross-shareholdings, anti-takeover measures, whistleblowing, and board diversity, but without the ability to prosecute companies that do not adhere to the new code, it is unlikely they will comply.

But there is reason for investors to crack the faintest of smiles, as unlike previous attempts, this time round the government, the Tokyo Stock Exchange (TSE), and Nikkei (the leading financial media company), are all behind the proposal.

“That kind of behind the scene pressure could be very influential in the Japanese market, and I do think that the Abe administration is pushing for these changes quite hard”, says Hogan. “The TSE is using some of the elements in the new corporate governance code, almost as conditions for listing or for being on their new JPEX 400, which is a new benchmark.”

Instead of making the new rules a legal requirement these three key players are trying to gain some momentum behind the reforms. Nikkei in particular has been a big cheerleader for the new corporate governance code.

“There are a number of articles of an anecdotal nature almost every other day about a company coming along and either raising dividends, increasing pay-out ratios or more companies that are adopting outside directors, these types of things”, says Hogan. “It may not be very quantitative in nature, but Nikkei is throwing out a lot of anecdotes that show the benefits of complying with the new rules.”

By moving the market by influence, rather than trying to make every company move all at the same time in order to meet a new set of rules and regulations, this is approach aims to gently ease corporate Japan away from the entrenched ideals of the old keiretsu structure of corporate governance.

The aim of the new rules is to make the Japanese market more palatable to foreign capital, something that the country is in desperate need of considering the tough economic times that it is enduring. However, it is always easier to introduce rule changes when profitability is better; when it is easier to raise dividends, when pay out ratios are higher, and discussion about return on equity targets are more optimistic. Perhaps this momentum driven approach can find success. Either way, with such a poor corporate governance track record, investors will certainly welcome any progress in how shareholders are treated, no matter how small.

Pictures of a particularly jovial bunch of workers were splashed across the internet earlier this year when in April the CEO and founder of credit card processing firm Gravity Payments took a quite spectacular stance. Responding to an academic paper that said any salary under $75,000 could threaten workers’ emotional wellbeing, the company’s CEO Dan Price set about making $70,000 the minimum annual pay for his 120 staff.

Justified on the basis that better pay promises to generate profits in the long term, the hike has put Gravity in and among the ranks of America’s most admired companies. Taking over four years to implement, Price reduced his almost seven-figure salary to $70,000 and took a chunk out of Gravity’s earnings, though not without a great deal of fanfare.

Introduced in a time when the chasm between employee and executive pay is something of a hot topic politically, Price’s methods – while extreme – prove that there is real and growing pressure to take seriously the issues of rising executive pay and income inequality.

Sceptics have suggested meanwhile that Price’s sympathies, while commendable, will do little to powder the company’s financial complexion, with radio host Rush Limbaugh going so far as to proclaim: “It’s going to fail.” The fact remains that this is a privately-held company of only a few dozen employees, and one that shares little in common with the oft-criticised corporate giants, whose executive hand-outs number in the millions and executive-to-worker pay ratios in the hundreds.

Both sides of the debate feed into a far broader point about the balance of pay in the workplace, and the issue of whether executive remuneration for those at the world’s leading firms is at all justified stands idly in the firing line.

Rising executive pay

Figures provided by the Economic Policy Institute show that inflation-adjusted US executive pay in the period through 1978 to 2013 increased 937 percent, more than double what the stock market expanded in the same period. More important is the degree by which it eclipsed the 10.2 percent rise for typical workers. Whereas in 1965 the CEO-to-worker ratio stood at 20-to-1, by 2013 the ratio had widened to almost 296, even with much of the population still reeling from a financial crisis.

A cursory glance at some of the worst affected industries – fast food for example – has the ratio higher than 1000-to-1, and such numbers, according to a Demos report, threaten to bring “troublesome implications for the economy and for the companies”, if they’re allowed to continue on upwards. “Rising executive pay has played a big part in pushing up income inequality in the past 20 years”, says Deborah Hargreaves, Director of the High Pay Centre. “The average pay package for a leading FTSE 100 CEO last year touched £5m – that’s a five-fold increase since the late 1990s, while average incomes have barely risen over that period. That has driven a huge wedge between remuneration for those at the top and everyone else.”

Having risen largely without challenge for decades, it’s only in recent years that offending pay packets have been subjected to scrutiny, in boardrooms, in the media and in the wider public domain (see Fig. 1). In this time, millions of Americans have fallen on hardship and boards under far greater pressure to deliver shareholder value, and the issue of dysfunctional executive pay has made its way to the fore.

Research shows that rising levels of executive pay have perpetuated a poisonous societal gap between the richest one percent and the remaining 99, and for as long as pay fails to reflect performance, the issue threatens to breed resentment on an as-yet-unseen scale. “Pay levels have increased for highly skilled and highly talented individuals in many occupations – including athletes, surgeons, actors, professors, hedge fund executives, and software engineers – while the least skilled individuals in America keep falling further behind”, says Donald Hambrick, Evan Pugh Professor and the Smeal Chaired Professor of Management, Smeal College of Business, at The Pennsylvania State University. However, Hambrick adds that “rising executive pay plays a part — but only a minor part in America’s growing income inequality”, and the issue is not the amount paid out, but whether these sums are warranted.

Often justified on the basis that no less than stratospheric sums of money will drive candidates into the arms of competitors, a growing disconnect between achievement and reward is an issue more deserving of attention. “Current levels of executive pay are certainly off-putting, even offensive, for many Americans. But there’s no objectively defensible way to say that executive pay, or the CEO-to-worker ratio, is ‘too high’. How would we make such a determination?

“It’s important to recognise, for instance, that the CEOs of companies owned by private equity firms are paid just as highly as are the CEOs of publicly-traded corporations – after controlling for company size, industry, performance. Namely, owners who are vigilant, powerful, and intent on securing the best possible executive talent for their companies pay very handsomely to executives.”

Few would contest the point that any CEO capable of rescuing a major corporation from collapse is deserving of a multi-million dollar pay packet, though too often these same extraordinary sums are being paid out to those responsible for less-than-extraordinary work.

A pattern of rejection

For example, Barrick Gold took to the headlines in April when the company disclosed that 75 percent of shareholders had voted against its pay policies in a recent ‘say on pay’ vote. Chief among the grievances was an almost $13m pay package for Executive Chairman John Thornton, which in no way reflected the firm’s ever-so-slight improvement, both in terms of financial performance and share price.

Likewise, oil and gas major BG Group lopped millions off the top of its executive pay package late last year before the incoming Helge Lund took to the helm. Shareholders claimed that an initial share reward of £10m ($15.8m) for the first year marked an attempt to sidestep BG’s usual remuneration policy, and that the sum was far and above his $2.1m package at former employer Statoil.

Still, the discontent aired recently is far tamer than in the so-called shareholder spring of 2012, though remains an important trigger point for listed companies, particularly in instances where similar such grievances have been expressed previously. This growing pressure has brought greater rewards for the executives in question, according to some.

“Over the past 30 years”, says Hambrick, “increased pressures from activist investors, boards, and the press – especially in the form of more CEO dismissals – has made the CEO job riskier, thus contributing to increases in CEO pay.” Others claim, however, that a sharper focus on performance-linked pay has succeeded in putting a lid on wayward salary increases, and engagement with the issue has played a vital part in building more of a back-and-forth between boards and shareholders, and in raising transparency.

Having grown used to year-upon-year of double digit pay hikes for executives, analysis published by PwC in April showed that this trend could be grinding to a halt. Data for early 2015 showed that executive pay levels fell in real terms, and early signs indicate that 45 percent of FTSE 100 executives went without a salary increase in the period up to March 25.

“Companies are improving disclosure of bonus payments and targets in response to investor demands, writes Tom Gosling, Head of PwC’s reward practice, in a recent blog post. “Over the last few years investor pressure and regulation have led to a significant raising of the bar in executive pay. On the whole the right balance has been struck. Companies can still pay enough to attract talent, but the highest levels of pay are getting tougher to earn, with an improved link between pay and performance.”

Changing the rules