Iceland was close to collapse in 2008, but it somehow managed to navigate the treacherous economic waters to become one of the top economic performers in Europe in terms of growth. Its financial sector was blamed for the country being hit so severely by the economic crisis six years ago, but unsurprisingly, it has also played a big role in rebuilding the overall strength of the economy ever since. According to the IMF, progress has been made in improving the financial stability framework, but it admits that gaps remain. Banking sector buffers are strong, but the organisation believes that there are a number of uncertainties surrounding the unwinding of crisis legacies, while legal risks, including challenges to CPI indexation, remain high.

The Central Bank of Iceland (CBI) and the Financial Supervisory Authority (FME) have made significant gains in improving macro-financial and supervisory stress tests, but there is still much work to be done in relation to bank supervision and the creation of financial safety nets. The national government recognises that its ownership of the core-banking sector must be normalised and put back into the hands of ‘fit and proper’ owners. One of the biggest challenges moving forward is for Iceland to reintegrate its financial markets with the rest of the world by removing its capital controls. While these controls were initially put in place to provide a level of stability for the country’s economy, and still do, now that the financial strength of the country has improved the tight controls are hampering growth.

The major challenge for the Icelandic economy at large is the abolition of the capital controls

Overall, the financial sector has weathered the economic storm effectively and reformation efforts, along with banks shifting focus to more sustainable banking models, have provided Iceland with a solid foundation for growth. In light of the news, World Finance tracked down Tryggvi Tryggvason, Head of Asset Management at MP banki to find out how the banking industry has changed since the economic crisis and what the future holds for the sector in the coming years.

Can you tell us briefly about Iceland’s banking industry and how it has changed in recent years?

The banking industry in Iceland, as well as the economy at large, is on a slow but steady road to recovery. After the financial crisis the Icelandic financial system dissipated. Basic banking business decreased significantly and lending to customers slowed to a fraction of what it was before the crisis. Many economists say that the Icelandic banks are too focused on the past, and not doing enough to make new loans and build a business for the future.

The three major commercial banks have also been criticisd for being conservative about continuing to optimise and downsize their operations, leaving their cost base high. At the same time MP banki has been focused on growing its business and developing the business model to limit cost and build a sustainable banking model for the future.

What are the major challenges and opportunities for banking in Iceland today?

The major challenge for the Icelandic economy at large is the abolition of the capital controls. The CBI has announced that it will make a significant move towards lifting capital controls in the next few months. This brings both challenges and opportunities for the banking industry in Iceland. Opportunities also lie in optimisation of the banking industry in Iceland through downsizing and mergers.

How has the bank turned around its operations?

The bank has strengthened its position significantly in the last two years through restructuring and cost-cutting measures. The bank implemented a rationalisation plan in 2013 to adjust the cost base to a smaller equity base than initial plans had assumed. The rationalisation measures included sale of non-core assets and a redundancy plan. As a result administrative expenses decreased by almost ISK600m ($4.55m) between 2013 and 2014. The bank returned a profit of ISK335m ($2.54m) after tax in 2014 despite considerable redundancy cost in the second quarter of 2014, compared to a loss of ISK477m ($3.61m) in 2013.

We have managed to reduce the cost base of MP banki and at the same time improve quality and increase financial strength. The capital ratio has grown to 17.4 percent at the end of year 2014 from 10.8 percent at the end of 2012. The capital ratio is high and significantly above the banks own internal capital assessment as well as regulatory requirements.

The bank is well prepared for implementation of additional CRD IV regulatory capital buffers in the near future. It is rewarding to see the result of that plan and an ongoing profit for the second half of 2014 and beginning of 2015.

To what extent has MP banki’s strategy changed in recent years, and why?

Our rationalisation measures and changes in strategy were based on the bank’s revised growth plans. Our strategy shifted to simplifying the bank’s business model with a firmer focus on segmentation and specialised banking services.

The change in strategy mostly affected our banking services with little or no effect on our asset management and markets units. These changes have increased the net profit considerably.

How important was the sale of the bank’s Baltic pensions business in the turnaround?

We are very happy to have supported the successful development of the business. It was a strategic decision to sell the bank’s Baltic pensions business at that time. MP banki today does not have a strategy to grow in the Baltics and there is very limited synergy with other parts of our businesses. The development of the business had been very successful; the company was at an attractive stage in its lifecycle and had therefore become attractive to other investors.

The sale contributed to our turnaround but did not have a critical affect. The banks operations have returned a profit every month in the second half of 2014 and the first quarter in 2015.

Tell us about the performance of the bank’s asset management business, and how it differs to others in the region

We have been able to generate excellent risk-adjusted returns to our clients through the years. The strategies are actively managed and the goal is to achieve outperformance in comparison to benchmark. Investment policy for each strategy is flexible. This is the main driver for outperformance. It gives us the opportunity to add value and outperform. A considerable part of our assets under management (AUM) are invested domestically. This market is small and illiquid.

Our ability to act in the local market and make portfolio changes swiftly without impacting prices is also a major advantage. The emphasis on strategic view plays an important role for performance. An investment committee holds weekly meetings in which decisions are made on asset allocation and advice given on strategic and tactical views. Fundamental analysis on bond and equity market is the basis for strategic view in addition to our report on micro– and macroeconomics in the economy as a whole. Momentum, technical analysis and arbitrage are the basis for tactical view. The role of the fund manager is to run strategies according to investment committee advice and find opportunities for tactical allocation.

Why did MP banki’s asset management business prove so successful in 2014?

MP Asset Management has been the cornerstone of MP banki’s operation and has an established reputation. We offer a variety of investment strategies in domestic and foreign markets. Being a well-known asset management house in Iceland, our main objectives are to serve our clients to our utmost and maintain our trustworthy relationship. The most important frame of reference for our clients is decent returns with respect to their risk appetite.

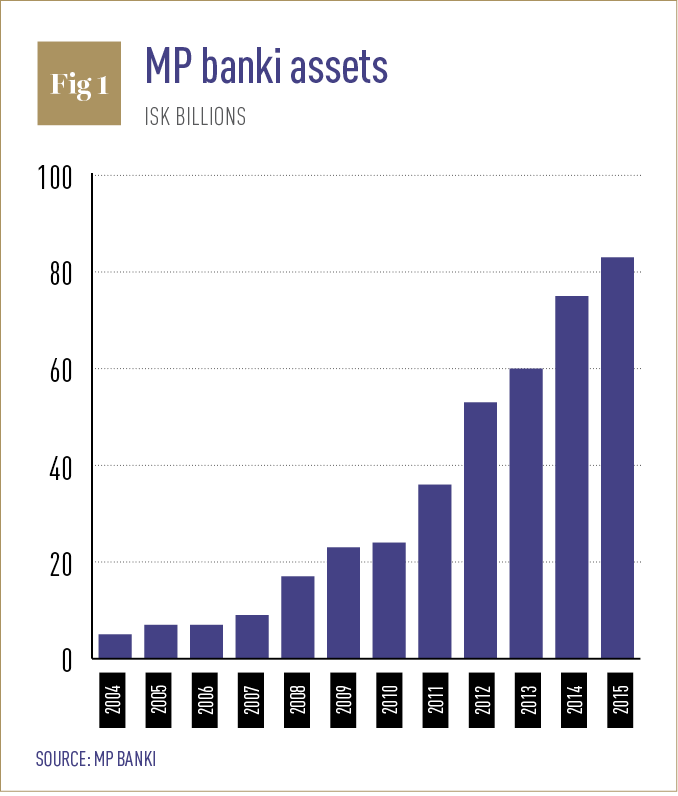

AUM are continuously and solidly increasing (see Fig. 1) as well as our range of products. The increase is attributed to both net inflow of AUM and capital growth. In 2014 we were able to generate excellent return for the portfolios. In addition, a lot of effort has been made to develop more efficient and transparent IT and risk-management systems, which entails that our time is better used to serve our clients. Transparency, access and quality of information are vital for our credibility and ongoing relationship with our clients. MP Asset Management has improved substantially its comprehensive automatic information disclosure to customers.

What plans do you have for the future?

The focus is to offer comprehensive solutions for individuals and institutional clients in major asset classes such as fixed income, equities and real estate – both in local and international markets. Our asset management business has grown continuously with inner and external growth. We expect that trend to continue in the near future. The goal is to continue to grow the asset management business. In 2012, MP banki bought two asset management companies – Alfa Securities and Jupiter Capital Management – and has announced merger talks with Straumur Investment Bank. The bank’s [goal] is to be a leader in the convergence of the smaller financial institutions in Iceland.