Reporting from Finovate Europe 2015, World Finance asks if the financial technology sector will ever slow down.

Come back later for a full transcript of this video.

Reporting from Finovate Europe 2015, World Finance asks if the financial technology sector will ever slow down.

Come back later for a full transcript of this video.

A merger between two of the world’s largest cement companies has been called off after the Swiss firm, Holcim, said circumstances had changed since it was announced last year. The deal between Holcim and France’s Lafarge was unveiled last April and would have been worth around €42bn. Intended as a coming together of two equal companies, the deal would have given shareholders equal stakes in the opposing company.

Holcim’s financial performance has been considerably stronger than that of Lafarge

However, over the last 12 months, Holcim’s financial performance has been considerably stronger than that of Lafarge, leading to the Swiss firm calling for a renegotiation of the merger that would better reflect its dominant performance. On Friday, shares in Holcim and Lafarge put their values at around €23bn and €18.5bn respectively.

Holcim released a statement explaining why the deal, in its current form, was off. “The Holcim Board of Directors has concluded that the combination agreement can no longer be pursued in its present form, and has proposed to enter into negotiations in good faith around the exchange ratio and governance issues.”

The final terms of the agreement had yet to be confirmed, but it had been announced that Lafarge’s CEO, Bruno Lafont, would lead the newly-created cement giant. While there was potential in many jurisdictions for legal challenges over competition issues, European regulators had given their approval in December for the merger to go ahead.

The merger would have created the world’s largest cement maker, with manufacturing capacity of 427 million tonnes a year far surpassing that of the 227 million tonnes a year of current market leader, China’s Anhui Conch Cement Company. The two firms had claimed it would save them around €1.4bn a year.

While the deal as agreed last April is no longer on the table, it seems both groups are keen to find some form of resolution. However, Lafarge says many of the agreed principles of the original deal must remain in place. “Lafarge’s Board of Directors remains committed to the project that it intends to see implemented. The Board said it is willing to explore the possibility of a revision of the parity, in line with recent market conditions, but it will not accept any other modification of the terms of the existing agreements.”

World Finance speaks to Brett Scott author of The Heretic’s guide to Global Finance on where responsibility lies.

World Finance: Now Brett: you’ve said that the financial industry is amoral, but wouldn’t you say it’s just society as a whole that lacks morals?

Brett Scott: Amoral means, in a sense, it doesn’t mean it’s immoral. It kind of, like… it tries divorce itself from the sphere of ethics.

You could argue that society itself is always complicit in forms of… lets, for example, say unsustainable investment. The average person maybe doesn’t understand or necessarily care about future issues like, for example, climate change; but we can argue that a large financial intermediary is in a much greater position of power to do something about that than, for example, a pensioner.

So that’s why in a sense you target financial… like, big banks; when you are trying to make changes in the system. In a sense you demand more of a fund manager than you do of a pensioner who is relying on the fund manager.

More collaboration between traditional banks and the financial technology sector will help both to thrive, the KPMG partner tells World Finance.

Come back later for a full transcript of this video.

The commodity trading advisor (CTA) sector has in recent months posted a string of impressive returns, with falling oil prices playing into the hands of those utilising the strategy and hoping to capitalise on budding investment opportunities. By identifying longstanding market trends and using carefully constructed computer models together with asset management expertise, those employing the model to good effect have recorded double-digit percentage returns in a climate rife with challenges.

Since the economic crisis took hold, many investors have chosen to embrace managed futures as a means of protecting against a market downturn. Yet the model is still seen by many as an unsatisfactory way of securing healthy returns in an otherwise volatile market. The spotlight focused on managed futures has the potential for disastrous consequences across the industry – for those employing it to ill effect. Only those with a thorough understanding of the model and the risks and rewards contained will reap the rewards.

Never has there been a better time to demonstrate that there are profits to be had in unfamiliar places

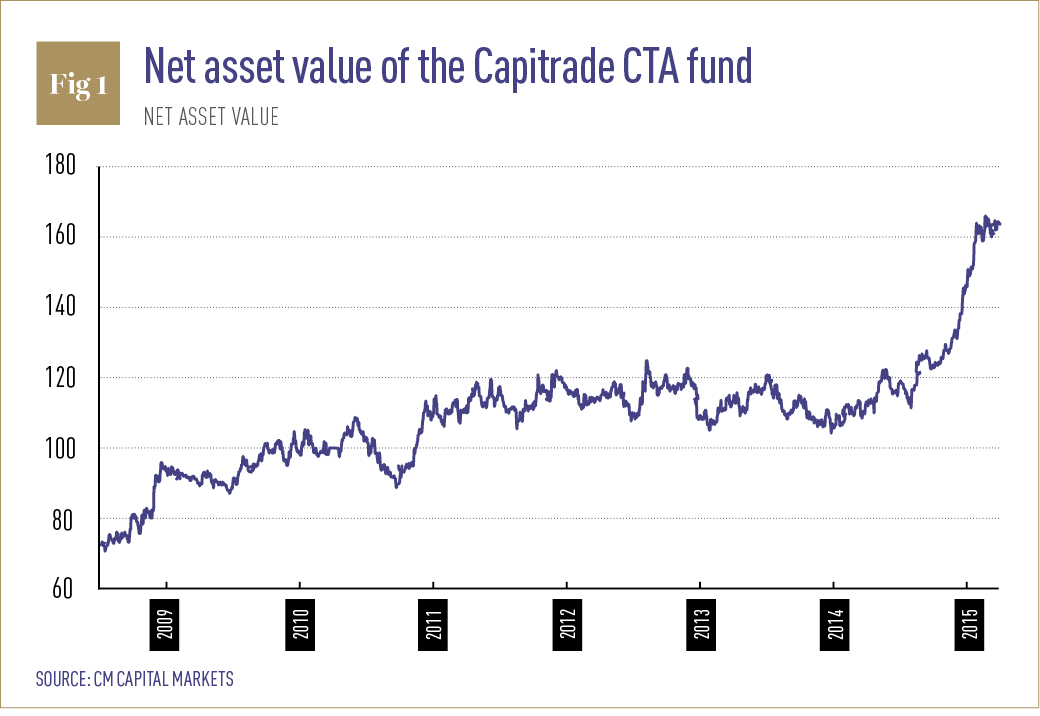

With the global economy in a state of constant change, and the pressure on those in financial services at an all-time high, never has there been a better time to demonstrate that there are profits to be had in unfamiliar places. As a pioneering name in the financial services industry, Notz Stucki has a proven track record of successfully developing and delivering solutions for those invested in the asset management arena. By securing the brightest talents and covering a diverse range of funds, the firm has quickly come to be seen as a leading European name, and a likely candidate for success in international markets. One particularly impressive fund is the Capitrade CTA (see Fig. 1), developed in-house by the CM Capital Markets Automated Systems team.

We spoke to Notz Stucki Europe CEO Paolo Faraone and the Head of CM Capital Markets’ Quantitative Department, Manel Sarabia, about the performance of managed futures accounts in years past, why the strategy is gaining in popularity, and what differentiates the firm from others like it in the market.

Why have assets in managed futures grown in recent years?

MS: The only way to improve profitability relative to the risk of a portfolio is through diversification, so adding carefully chosen assets is one method of boosting performance. Managed futures offer exactly that, and using them allows those concerned to reduce their exposure to risk, as well as meet profitability targets and increase competitiveness. In these well-diversified portfolios, managed futures provide an attractive and consistent annualised return over time, and that is probably the main reason for its growth. It’s also important to recognise that there are models that do not attempt to predict the future but take their positions depending on what is happening in real time, which makes them less vulnerable to an unexpected crisis.

How do you rate your CTA?

MS: We are trend followers and try to make the model as balanced as possible in all aspects that define the characteristics of an account; we want to be able to adapt to all kinds of trends or stages and control very precisely our volatility. Therefore, our model is 100 percent systematic and automated, which is essential in finding a good balance in the medium- to long-term.

We are reasonably pleased with our results in the past seven years, and our model is among the best in its class, irrespective of its relatively short history. Another example of this good performance is the percentile ranking on Bloomberg, where we are regularly placed above 90 percent. In absolute terms we have achieved an annualised return of over 13 percent since May 2008, though our worst year during this period stood at 2.17 percent in 2012, which shows the model’s ability to preserve capital under management even in adverse times.

What are the differences between the Notz Stucki CTA and the rest?

MS: If we are honest, we cannot say exactly without first analysing all other models out there. The balance we have achieved in combining our mix of strategies, namely neutral asset allocation and the process of risk control, may also play an important role in the comparison and in gauging a passionate and sceptical attitude, which are intangibles that generate the competitive edge we all seek.

Generally speaking, what is the management model of your CTA?

MS: Our futures management model is 100 percent automated, 24 hours a day and based largely on trend-following strategies. We also ensure we choose a product with daily cash flow. The fund trades only in electronic and organised future markets with high liquidity levels, which allows the investor to assess the risk in real time, and we only operate in electronic and organised future markets while refraining from option markets. Diversification is a big part of our strategy and the fund is designed to invest in the eight main sectors of the economy (interest rates, metals, softs, global stocks, grains, energies, currencies and meats).

The model changes positions depending on the trend, for example: flat markets with high volatility and high correlation are the worst situation for the model.

Tell us more about your investment process

MS: We are trend followers simply because markets are inefficient and this always causes the appearance of trends that we will try to detect and exploit. To detect and exploit these trends we have designed a dynamic combination of robust strategies, which enables us to calculate which investments we make.

However, given that we do not know where or when these trends will appear, we do not want to be predictive. Instead we seek the greatest degree of diversification and allocate assets neutrally; the investment in each sector depending on the number and liquidity of selectable items and the correlation between them.

There are four key aspects in managing the risks involved: matching of the underlying investment to the same volatility level, the maintenance of the annual volatility of a fund keeping between 13 to 17 percent, draw down control (reduction in leverage from 15 percent of the draw) and a value at risk (VAR) control that is fixed at six percent with a 99 percent confidence – so that hedge fund leverage will not exceed the VAR established.

Tell us about your successful track record in appointing leading asset managers and how you’ve been able to do this

PF: At Notz Stucki, portfolio management is mostly focused on choosing talented managers. We target managers that satisfy our strict due diligence criteria, including capital protection, risk adjusted returns, diversification and risk management. We are constantly looking for the managers that are capable of performing while also capitalising on diversification.

How important is international expansion to the continued success of the company?

PF: International expansion of our business is very important for us. Notz Stucki Europe has earned the AIFM and the Management Company Chapter 15 Licenses, which enables us to offer specific services like fund engineering, EU distribution to qualified investors and a robust risk management framework. We are therefore fully equipped to distribute our funds and services over Europe and to offer the highest fiduciary standards and the utmost integrity, with a specific focus on service customisation.

What new products have you introduced since 2010, and how have they hanged/improved the business?

PF: Notz Stucki has introduced several products, such as systematic CTAs, a long/short fund and traditional UCITS IV funds with several talented managers from different areas. All these products are very important for us if we are to expand our business beyond our own boundaries, and in doing so, better respond to the client’s needs.

What are your ambitions for the future of the company?

PF: The European private clients base remains very important for Notz Stucki Group.

In Luxembourg, Notz Stucki was first to gain a dual license for UCITS funds and non-UCITS funds (AIFMD). In Switzerland, Notz Stucki & Cie has been supervised by Swiss Financial Market Supervisory Authority since 2014 and acts as authorised asset manager of the collective investment scheme. These licenses allow us to serve institutional clients.

Globally, we position ourselves more as an asset allocator. Talent selection and asset allocation are the skills highlighted.

We take advantage of our size, international presence and overall regulation to support our strategy, we will continue to hire managers however it is compelling that people who join us share the same values.

In addition to our Swiss and European presence, we continue exploring opportunities in growing markets while at the same time keeping in mind our specific expertise and core business.

MS: As for CM Capital Markets, we are trying to increase our range of products; we already have a new model (smart beta Europe) launched as a managed account and we are working to develop other types of models. Each of these new models will be 100 percent systematic and – of course – based on statistical analysis, quantitative strategies and our in-house designed platform, which allows the control of the whole process in a totally automated way and enables us to avoid the psychological factor in the decision

making process.

How a renowned economists ideas could hold the key to successfully targeting terrorists by removing a major source of discontent

Come back later for a transcript of this video.

The rapidly growing ASEAN market offers infinite opportunities for real estate developers and fund managers. CapitaLand, a Singapore-based real estate firm that boasts a diversified portfolio as well as one of the largest real estate fund management businesses with assets in Asia, is one company that has made the most of this. World Finance spoke to Lim Ming Yan, President and Group CEO, about the company’s focus on integrated developments, and what it has planned for the future.

What is the rationale behind CapitaLand’s focus on integrated developments, and how does it intend to execute its strategy?

An emphasis on integrated developments allows us to leverage our competitive strengths in the retail, office, serviced residence, residential and fund management businesses. This, therefore, maximises economies of scale and increases our competitive edge, as well as provides stable and sustainable returns from both recurring and trading income. CapitaLand has an established track record in integrated development projects, differentiating the group from its competition.

The growing trend of decentralisation to reduce the load on transport networks will further enhance the prevalence of integrated developments

CapitaLand’s nine Raffles City projects in Singapore and China are testament to our leading position in integrated developments. In fact, the Raffles City collection is our most recognisable brand in China today. The completed Raffles City Shanghai, Raffles City Beijing, Raffles City Ningbo and Raffles City Chengdu are all landmarks in their respective cities, while the remaining four Raffles City projects – Hangzhou, Shenzhen, Changning in Shanghai and Chongqing – are in various stages of development. CapitaLand’s Raffles City developments will total more than three million square metres, with their total value exceeding SGD 12bn ($9bn) upon completion.

Typically, CapitaLand’s integrated development ventures are well-designed, well-built and well-managed projects that sit atop easily accessible transportation hubs or in prime locations. In addition, these projects are more resilient despite the continued growth in mobile connectivity and e-commerce.

Riding on the two megatrends of urbanisation and social media, CapitaLand will build a Pan-Asian portfolio with a central focus on integrated developments. China and Singapore, where CapitaLand already has a significant presence, as well as ASEAN capital cities in Malaysia, Vietnam and Indonesia, will be the core markets. Urbanisation that drives the growth of infrastructure developments, for example, the MRT/transportation system, has the potential to change the face of cities, as well as provide endless opportunities for integrated developments within close proximity to transport hubs. Even with the proliferation of social media and e-commerce, consumers still want unique experiences, and transportation nodes continue to be the focal point.

CapitaLand intends to develop a total of 12 integrated developments, of which five would be in the city clusters of Beijing/Tianjin, Shanghai/Hangzhou/Suzhou/Ningbo, Guangzhou/Shenzhen, Chengdu/Chongqing and Wuhan in China, and another five from Singapore and ASEAN capital cities such as Kuala Lumpur, Ho Chi Minh and Jakarta over the next three years.

Alongside integrated developments, we will also continue to expand our ventures in shopping malls and the residential market, as well as double the number of serviced residence units to 80,000 by 2020. In fact, around 50 projects totalling an investment value of SGD 36bn ($27.1bn) are due to be completed over the next three years, with over half of those in China. We will also press forward with our existing business model, which involves capital recycling with our Real Estate Investment Trusts (REITs) and fund platforms, providing diversified sources of capital to grow our assets under management, which amounted to SGD 68.1bn ($51.25bn) as at September 30 2014.

Our strong balance sheet, together with diversified capital sources and capital partners, will allow us to invest in new opportunities as they arise. CapitaLand is in a strong position for its next stage of growth and to achieve its vision to be a leading global enterprise that enriches people and communities through high-quality real estate products and services.

How does CapitaLand intend to compete?

Over the next three to four years, besides residential projects, about 15 major investment projects will be completed, all of which will complement our existing portfolio well. These include an additional four Raffles City projects in China, Jewel Changi Airport, an integrated development at Cairnhill which comprises a serviced residence with a hotel licence and a residential component, and a further 10 shopping malls. Once these are completed, CapitaLand will be in possession of one of the most enviable investment portfolios in Asia.

To further strengthen our position, CapitaLand will continue to grow. In addition to our residential projects, we aim to secure another 12 new investment projects in China, Singapore and Southeast Asia over the next two to three years, some of which will involve the redevelopment of our existing projects. In Shanghai, we have obtained planning approval for a new Capital Tower Shanghai as well as a Hanzhonglu integrated development, which comprises retail, office and residential components. Aside from the redevelopment of existing projects there are endless opportunities in many of the key gateway cities that CapitaLand is operating in. That said, it’s important for us to pursue projects with the right economic fundamentals.

What measures will the company take in the next 12 months to improve its competitive position?

Despite the headwinds and ever-changing operating landscape, CapitaLand is in a strong position relative to many pure residential peers. With a diversified portfolio made up of assets that generate trading and investment income, we are better able to ride property booms and busts. As at September 30 last year, CapitaLand’s residential portfolio constituted 26 percent of its SGD 31.6bn ($23.8bn) total assets, with Singapore and China contributing 21 percent and 32 percent respectively. In addition, three quarters of CapitaLand’s assets from integrated developments, shopping malls, offices and serviced residences generate recurring income, which will help to mitigate any slowdown in the Singapore and China residential markets.

Where will the company’s investments be focused over the next year?

Trends in Asia favour integrated developments, and this sits well with CapitaLand’s integrated development strategy. The growth of mega cities combined with the increasing population density in Asia leads to traffic congestion, which then causes increased demand for public transport. Given the high investment cost of transport infrastructure, the land surrounding subway stations or transport nodes will be put to best use to yield maximum value, and integrated development is the natural outcome. The growing trend of decentralisation to reduce the load on transport networks will further enhance the prevalence of integrated developments.

In China, opportunities could emerge within the next few years as the real estate market consolidates. Weaker players in the commercial space could be flushed out. Moreover, few competitors are competent in the full suite of shopping malls, offices and serviced residences, and only a few have experience in integrating various real estate products.

We will expand our footprint beyond Singapore into an ASEAN presence by adding on Malaysia, Vietnam and Indonesia. In Malaysia, Kuala Lumpur and Penang offer great opportunities for CapitaLand, while there is good long-term growth potential in Vietnam, given macroeconomic stability in the past year. CapitaLand has been in Vietnam for 20 years and is one of the leading foreign developers there, further supported by new government policies to encourage more foreign property ownership. For the Indonesian market, CapitaLand recently entered a joint venture agreement to develop an integrated development in central Jakarta. Globally, we are also actively seeking investments in gateway cities through Ascott, CapitaLand’s serviced residence business.

We are well-positioned to execute our strategy. We have a robust operating portfolio, a steady pipeline of projects under development, potential projects in China and the broader region, and a strong team to make it all possible. CapitaLand’s current organisational structure will allow us to do many things that we’ve set out to achieve. We firmly believe that we are well poised for growth; to be a leading global enterprise that enriches both people and communities through high-quality real estate products and services.

How do you think technology will have an impact on your businesses and how will CapitaLand respond to take advantage?

Technology has changed the business environment and looks set to continue to do so. This is evident by the shift to mobile internet through the use of smart phones, which will change the way we operate through e-commerce, online reviews and social media platforms. We will utilise technology to complement our real estate, so as to deliver even better customer experiences.

Therefore, to respond to this fast changing world, we will harness the talents and creativity of all our people. We will need to change to be a more inclusive and open organisation. In fact, CapitaLand has embarked on various initiatives, including the setup of an innovation hub in Singapore, as well as a lab to pilot test projects for our shopping mall business.

Those in the energy market are up against a range of challenges at the present time, and without first adopting the correct corporate governance controls and strategy to match, key industry names could fall by the wayside. Lukoil, the country’s second-largest oil producer is testament to the fact that there are still pockets of opportunity in a market rife with challenges.

By committing to international best practices of corporate governance and comprehensive qualitative and quantitative measures to analyse risk, disclosure and compliance, Lukoil has the necessary internal controls in place to shield it from external shocks. World Finance spoke to Andrei Gaidamaka, Vice President of Investor Relations at Lukoil, about the country’s changing energy market and how the company is equipped to weather the storm.

Another advantage for Lukoil is our broad portfolio of overseas assets both up and downstream

How have Western sanctions and falling oil prices impacted Russia’s energy market?

Thanks to the tax system, Lukoil faces fewer decreasing netback prices. At the same time, domestic currency depreciation has reduced our ruble-nominated costs and liabilities in USD terms. Increased competition between subcontractors in Russia allows oil producers to exploit the situation and obtain better prices from suppliers. This is primarily why we expect lower lifting costs and capital expenses in dollar terms for this year. Also, domestic demand for petroleum products remains strong, especially for high margin streams such as high-grade gasoline, low sulphur diesel, jet fuel, and lubricants. So we remain cautiously optimistic and plan to be free cash flow positive in 2015.

The company has several major green-field projects in Russia, which enable us to maintain stable and growing production in the short and medium terms. The shortlist of such projects includes the Filanovsky field in the Caspian, mid-size discoveries in the Timan-Pechora region – our two largest gas fields in Yamal – shale and tight oil developments in Western Siberia, and many more.

Another advantage for Lukoil is our broad portfolio of overseas assets both up and downstream. Up to 30 percent of our total assets are located outside Russia, and in the nine pre-crisis months of 2014 our international businesses generated over $3bn in operational profit.

We continuously monitor the effect of the sanctions on our financial position and operations, but there has been no direct impact to the company on the technology side. Since we don’t have projects in the Arctic offshore, deep production, or significant production from shale fields, the limitations do not currently affect us. An indirect impact of the sanctions however, is to increase the cost of our financing. Our current priority is to reduce capital spending to a level that is in-line with our cash flow generation at current prices, in order to ensure that we live within our means. We have done this successfully before: when oil prices fell in 2009, our operating cash flow fell by more than $5bn from the previous year and we reduced our capital spending budget by approximately the same amount, resulting in positive free cash flow for the year.

How do you see the decline in oil production playing out in the coming years?

As our top management noted before the current crisis, we are expecting a decline in Russia’s oil production if there are no changes to the tax regime before 2017 to 2018, in that it is unprofitable to implement tertiary methods on mature oilfields. Even still, the outlook for Russia’s oil production has worsened recently following the oil price collapse, and I think oil production may begin to decline before 2017. The government has recognised the likelihood of production declines in the absence of new major green-field projects, and is implementing changes to the tax system to focus on support for oil production. There is still time to arrest the impending decline with changes to the fiscal system, and, of course, a higher and more stable oil price environment would result in more investment as well.

What is your strategy to stay competitive?

We constantly monitor the markets and our competitors’ actions in order to maintain our competitiveness. In order to be cash-positive in the low oil price environment we are cutting our capital budget programme. However, this reduction will not affect important and strategic projects. In 2015, we will begin production on new multibillion assets in upstream (Filanovsky oilfield) and downstream (Burgas Hydrocracking Unit in Bulgaria, Catcracking Unit on our refinery in Nizhniy Novgorod, Coking Unit on our refinery in Perm).

Why was the sale of Lukoil’s stake in NPC necessary, and what benefits will this bring?

Our participation in NPC was as a minority, non-operating investor. The project is at an early stage and our incurred cost was only for the purchase of a 20 percent stake. This heavy oil mega-project would require a substantial financial commitment from Lukoil, and, at this point, we think that the project does not fit into our plans. The company prefers to be an operator of projects, so we decided to sell the stake to a partner and focus on other existing opportunities.

How will Lukoil’s investment in the Burgas refinery improve the business?

This year we are planning to complete the construction of a hydrocracking unit at the Burgas refinery with a capacity of 2.5 million tonnes per year, and after commissioning the unit we will reduce the output of low-value fuel oil by 0.9 million tonnes per year.

The refinery will increase the output of light and middle distillates by 0.8 million tonnes per year – up 20 percent – and high-sulfur fuel oil will be replaced by low-sulfur content, which will increase the profitability of the refinery. The project will also reduce our environmental footprint .

What are your current priorities, and have they changed at all in the past year?

Given the dramatic changes in 2014 we are revising our long-term strategy. We do not want to under-react to the changes we are seeing, but we do not want to over-react either.

Our goal is to earn a return that is higher than our cost of capital on every barrel produced over the life of a project, so that we can then pay that return to shareholders and be free-cash flow positive.

Our corporate priorities have not changed over the last year, and our top priority is the maintenance of competitive returns to shareholders and investors. The dividend policy is not being revised despite the turbulence on the markets, and we intend to keep a comparatively high dividend yield.

What differentiates Lukoil from rival oil companies in the region?

Lukoil is a global Russian private energy company with substantial international assets. We have a long and successful company history, respect for shareholders, and a solid dividend record, and as one of Russia’s largest national taxpayers and investors, Lukoil places large-scale orders with key parts of the national economy. As a responsible corporate citizen and an honest participant in the market economy, the company commits itself to socially responsible participation in the life both of the local population in the regions where it operates and in society as a whole. We consider it our duty to pay our taxes in a timely manner, which helps the state to solve social challenges in the regions where our company has a presence.

We also consider it important to be a socially responsible company internationally. For example, Lukoil is hiring local people to work on construction of the West Qurna-2 field in Iraq. More than 11,000 workers were employed at the height of construction, and more than two thirds of them were local people, working for both Iraqi and local companies.

Lukoil has also established standards of corporate governance in Russia with specific keystones to best represent the company’s success in the area that include being independently audited by KPMG since 1994; receiving independent audit of reserves from Miller & Lents since 1997; preparing financial statements under the US GAAP standards since 1998; being listed on the LSE and including independent board members into the board of directors (BoD) since 2002; investment ratings from all three leading international rating agencies since 2007; with the majority of the board of director’s independent since 2009.

The BoD plays a crucial role in Lukoil’s system of corporate governance, exercising overall control of company activities in the interests of investors and shareholders. In accordance with Russian legislation and the Lukoil Charter, the BoD defines priorities for company development and ensures the efficient functioning of the company’s executive bodies.

At the end of 2013 there were six independent members of the board out of 11 total, whose presence enabled objective opinion to be formulated on matters discussed and, therefore, to strengthen confidence in the company.

The scramble for even the smallest piece of real estate in Hong Kong over the last few years has led to the island experiencing an ever-expanding property bubble. It has become so inflated that many people have become priced out of the market. While this has predictably caused resentment from people towards the richest in Hong Kong’s society, the unfolding corruption scandal to hit the island’s real estate market during the last year has merely exacerbated the rage.

Last year, Hong Kong saw a series of prolonged, initially peaceful pro-democracy protests transform into a huge wave of violence as demonstrators complained of potential changes proposed to the electoral system on the island. The news swept around the world, as China’s government faced one of the largest challenges to its authority in recent years.

However, while all this was going on, another similarly damaging story was unfolding in the courtrooms of Hong Kong. Thomas Kwok, the property mogul and billionaire, was being tried in a corruption scandal that had lasted for seven months. Eventually sent to prison for five years, Kwok, 63, was convicted of bribing one of the city’s most senior officials, former deputy leader Rafael Hui.

The scandal went right to the top of Hong Kong’s business and political establishments, with one of the city’s most recognisable business figures and one of its leading politicians at the centre of the issue. It gave Hong Kong’s already angry citizens even more reason to hate the elite, not least because it showed how developers like Kwok were getting unfavourable advantages in an already hugely competitive and astronomically expensive property market.

Family feud

The Kwok brothers have played a prominent role in Hong Kong for many years now and are responsible for a lot of the dazzling new skyline on the island. The owners of Sun Hung Kai Properties – the most valuable real estate company in Asia and second largest in the world – the Kwok brothers have accumulated personal wealth of around $10.6bn each. Their firm has a market value of $32bn, which is around 14 percent of Hong Kong’s entire economy. Sun Hung Kai has become renowned for constructing some of Hong Kong’s tallest and most eye-catching buildings. These include the International Commerce Centre (ICC), which was built in 2010 and is the city’s tallest building. It is the world’s eighth tallest, and houses a number of leading businesses. It is one of many Sun Hung Kai buildings that adorn the city’s skyline, and shows how the city has become the financial capital of Asia over the last two decades since being returned to China by the British.

The Kwok family got their wealth from their mainland-China born father Kwok Tak-seng, who immigrated to Hong Kong after the Second World War. The family were in the news during the 1990s when Thomas Kwok’s elder brother Walter was kidnapped, kept within a wooden crate and tortured for days as part of the gangster Cheung Tze-keung’s efforts to bribe Hong Kong’s richest 10 citizens. The Kwok family eventually paid the ransom of HKD 600m ($77.37m), although Cheung was eventually caught and executed in 1998.

After the incident, Walter withdrew from running the company, eventually handing over the reigns to his mother, who in turn gave control to her two younger sons. However, a family feud emerged in 2008 that saw Thomas and Raymond remove Walter from the board, and he was then removed entirely from the family trust. Some observers think that it was this snub that led to Walter approaching the police over the bribery claims, although the authorities have refused to confirm who provided the evidence.

The scandal emerged in 2012 when Kwok, his younger brother Ramond and Hui were arrested by Hong Kong’s anti-corruption agency, the Independent Commission Against Corruption (ICAC). Pleading not-guilty the following year to corruption charges that involved loans and payments to Hui, the trial began in 2014.

Eventually, Raymond Kwok was cleared of all charges, but Thomas and Hui were found guilty in December. It marked the end of a turbulent year for Hong Kong’s elite, who now face far greater scrutiny than they had before the protests erupted earlier in the year.

Amid the backdrop of the protests, both Kwok and Hui were convicted of serious misconduct, further damaging the reputation of the establishment in Hong Kong. Before being sentenced, Judge Andrew Macrae told Hui that his crime was particularly noteworthy at a time when the eyes of the world were on Hong Kong’s political class. “To know that the former number two in government had received bribes must be a deep disappointment to many people in Hong Kong. It is vitally important in these times the Hong Kong government and business community remain and are seen to remain corruption free, particularly when the mainland is taking obvious and positive steps to eradicate the cancer of corruption in their own jurisdiction.

Progress or stagnation

While the scandal that has struck Hong Kong’s most famous real estate developers has rumbled on, the market itself has continued to swell ever larger. Hong Kong’s real estate industry has been in an ever-inflating bubble for a number of years now, and the city is currently the most expensive place in the world to acquire property. The scandal of the most prominent property developers in Hong Kong has only heightened the sense of feeling that something needs to be done to redress the balance in the market, so that there is more competition to build properties.

However, despite the scandal and tentative calls for reforms, some analysts believe that 2015 will see considerable gains in Hong Kong’s property values. According to analysts Cushman and Wakefield (C&W), Hong Kong’s property market is likely to experience even further gains during 2015.

Kent Fong, C&W’s Executive Director for Investment, Hong Kong, said in a report that the residential sector in particular was likely to remain strong. “We expect the residential sector to stay buoyant in 2015, while fundamentals in most non-residential sector will remain intact, further supporting investors’ confidence in the wider property market.”

Another senior executive at C&W, Vincent Cheung, added: “First hand sales will further increase in 2015 as developers launch more projects and capitalise on the strong demand for smaller units and mid-priced flats. Homebuyers will continue to execute purchases in 2015 due to expectations that it will take several more years for new supply to outstrip demand and that prices will continue to rise until this situation materialises. Exceptionally strong demand for properties priced below HKD 10m ($1.2m) will support another year of healthy price growth in 2015, whereas I expect prices for these properties will increase by an additional five to 10 percent.”

Hong Kong’s Chief Executive Leung Chun-ying told reporters in January that the island faced a difficult period in the coming months unless measures to take the heat out of the price of houses were made. In his annual speech he said that reforms were vital to regain the trust of protestors, as well as making a fairer society. “We must make choices. We have to choose between implementing universal suffrage and a standstill; on the economy, between progress and stagnation; and on people’s livelihood, between reforms and clinging to the status quo.”

With regards to increasing the supply of land for housing developments, and therefore helping to bring down the price of homes, Leung revealed that there would be around 14,600 new private homes built each year until 2020, which would represent a 30 percent increase over the last five years of building. “The consultation process for land planning and development has become drawn out with increasing controversies and uncertainties. Society as a whole must make hard choices.”

Last May, sensing the need to make things easier for buyers, Hong Kong’s government relaxed its rules over its double stamp duty policy. Before the changes, buyers were forced to sell their homes within six months of agreeing to buy their second if they wanted to receive a stamp duty refund. The changes meant that it wasn’t until the sale of the second home was secured that the six month time period began.

Cheung added that some of the reason for buyer confidence had come as a result of the changes to stamp duty rules last May. “Following the slight relaxation of double stamp duty in May, enhanced buyer sentiment lifted both first and second-hand sales in the second half of 2014 and helped push residential prices to a new record high. Strong first hand sales performance this year is credited to developers launching more projects with smaller units, which were met by ample demand among end-users and first-time buyers. They first-hand market continues to account for 25 percent of total transactions, with sales still heavily driven by developers’ more aggressive pricing strategies and the narrow price gap against second-hand homes.”

Too little, too late

Despite these steps towards reforming the real estate sector in Hong Kong, many observers believe that is not enough to placate the disgruntled population over high land values and a sense that those at the top have an unfair advantage within the market.

According to Hong Kong Baptist University political science professor Jean-Pierre Cabestan, Leung’s reforms are not likely to bring about an end to the resentment felt by large parts of the island’s population. Cabestan told Bloomberg Business in January, “Leung has decided to stick to his guns, unwavering, on the political reform. [His] proposed welfare and housing reforms may help him regain some popularity, but it will not solve the challenges that his government is facing. As a consequence, I sadly predict more trouble for the government, its relations with the community and the central government-Hong Kong society relationship.”

The past year has proven particularly challenging for Hong Kong’s elite. If it is to avoid the scenes of last year, the government needs to first distance itself from cosy relationships with high profile real estate developers, while at the same time making things far easier for its population to get a foothold in the city’s incredibly pricey property ladder.

World Finance speaks to Frank Abagnale author of Catch me if you can and The art of the steal on who is targeted and how to avoid it.

Come back later for a full transcript of this video.

An economic expert speaks to World Finance about how currency devaluation and a move towards low-tech manufacturing is key to reviving the UK and eurozone economies.

Come back later for a full transcript of this video.

In an effort to prevent the country falling into bankruptcy, the IMF has agreed to loan Ukraine a further $175.bn over the next four years. The bailout package will begin straight away with a $5bn payment that will help prop up the stuttering Ukrainian economy that has suffered considerably since last February’s political revolution and subsequent year of conflict with eastern separatists.

With the separatists widely believed to be backed by a Russian government intent on claiming back parts of its former Soviet-era territory, Ukraine has looked to the west for help. While political support has come in the form of sanctions against Russia, Ukraine has needed financial aid to plug a large hole in its public finances.

[Ukraine’s economy] should return to around two percent of growth by 2016 as a result of the economic reforms

A condition for the loan is that Ukraine’s government undertakes serious economic reforms that will include cutting pensions and slashing budgets. Announcing the bailout package, the IMF’s chief Christine Lagarde said that the majority of the funds will come during the first year, and that the country had achieved many of its requirements for receiving the loan. “Ukraine has satisfied all the prior actions that were expected and required of it in order to start running the programme… We are off to a good start.”

David Lipton, the IMF’s First Deputy Managing Director and Acting Chair, added in a statement that the conflict in eastern Ukraine had severely harmed confidence in the country’s economy. “Notwithstanding a strong policy-led adjustment effort in 2014, the Ukrainian economy continues to be affected by the conflict in the East and the attendant loss of confidence. The deep recession and sharp exchange rate depreciation aggravated existing vulnerabilities, weakened bank balance sheets, and raised public debt.”

Even though the IMF predicts Ukraine’s economy will contract by 5.5 percent during this year, it should return to around two percent of growth by 2016 as a result of the economic reforms. “Demonstrating strong resolve, Ukraine’s authorities have developed a new program to restore macroeconomic stability and address long-standing structural obstacles to growth, including weak governance. The authorities recognize that the resolute implementation of the program is critical to restore confidence and growth, bring inflation to single digits, keep external deficits manageable, and replenish international reserves.”

For those lucky enough to lead one of India’s top five majority state-owned banks, the perks include free housing, a company car and your very own driver. However, the benefits do little to detract from a pay package numbering in the region of $32,000-40,000 – only marginally more than a secretary or administrative assistant working in the US. “Here, 70 percent of the banks are in the public sector and they are paid very, very poorly”, said the State Bank of India Chief Arundhati Bhattacharya at the Delhi Economic Conclave, who went on to speak about how the system as it stands was breeding bad governance.

Average pay for those taking charge of any state-owned bank is less than five percent of what those in the private sector are currently earning, and the disconnect between the two has brought with it any number of consequences for the Indian banking sector. One report, published by the Reserve Bank of India (RBI) last year, showed that state banks’ share of the market is likely to slip to 63 percent by 2025, 10 percent less than in 2013 and fuelled – at least in part – by inadequate pay. However, worse still is that the further down the pay scale you go, the more pronounced the problem becomes.

After suffering in silence for years, employees at the country’s more than two-dozen state-owned banks took to social media late last year to condemn what they believed to be inadequate pay and unacceptable working conditions. Demanding wages that were more closely in keeping with central government employees, retirement benefits and a five-day working week, workers made known the struggles they face on an almost daily basis.

PERKS: Health insurance, car and driver, free housing

PERKS: Health insurance

Source: Bloomberg. Notes: 2014 figures

For example, a teller at a state-owned bank can expect to make just shy of 20,000 rupees a month, or approximately $1.70 an hour over a 48-hour working week, and for this reason and many more like it, unions have time-and-again threatened to take strike action if their employers refuse to heed their call. Worse is that for as long as public lenders fail to dish out cost-competitive pay packets, state-owned banks will miss out on top talent and struggle to clock up the numbers they so need.

Promises to deliver

Still, the qualms shared by those employed at India’s majority state-owned banks represent a relatively minor part of what is a much wider and multi-faceted crisis facing India’s hot-and-cold banking sector. And with the figures posted by state-owned banks far short of their private sector equivalents, President Narendra Modi must now deliver on a pledge to mend a market in desperate need of reform.

“The banking sector is on the cusp of revolutionary change”, said the Governor of RBI, Raghuram Rajan, at the Annual Day Lecture of the Competition Commission last year. “In the next few years, I hope we will see a much more varied set of banking institutions using information and technology to their fullest, a healthy public sector banking system, distant from government influence but not from the public purpose, and a deep and liquid financial market that will not only compete with, but also support, the banks. Such a vision is not just a possibility; it is a necessity if we are to finance the enormous needs of the real economy. As India resumes its path to strong and sustainable growth, it is the RBI’s firm conviction that the Indian banking sector will be a supportive partner every inch of the way.”

Not-so-identical twins

The banking sector nationalisation in 1969 and again in 1980 created an environment that, in terms of numbers, is dominated by majority state-owned enterprises. And with far too few incentives for public banks to compete on products and services, the sector has been insulated from healthy competition.

The nationalisation process has seen the government strike certain bargains with banks that serve only to distort market competitiveness and stifle performance, and only by retreating from these long-held agreements can public names match the progress made by those in the private sector.

For one, the central bank offers privileged access to low cost demand and time deposits, and to its liquidity facilities, provided that public institutions accept certain obligations. Under the terms of the contract, the banks in question must finance the government by acquiring a set number of bonds, maintain a healthy cash reserve ratio, set up branches in unbanked areas and offer loans to priority areas of the economy, meaning that the scope for improvement is limited.

Second, public sector banks and the government have agreed upon a set of terms whereby state-owned institutions must carry out certain services and on-board certain risks, only to be compensated, at least in part, at a later date. However, bargains much like the ones mentioned are from a bygone era, and in order to keep pace with the rate at which the wider Indian economy is developing, public lenders must be given greater autonomy in deciding how it is they operate. Whereas the so-called ‘grand bargains’ of old were created with a view to promoting equality and economic stability, the costs of failing to change with the times are far too great.

In showing that public banks are struggling to match up to their private counterparts, state lenders revealed in September that 12.9 percent of their total advances were made up of stressed loans, whereas the same percentage among private banks came to a much lesser 4.4 percent. Also, with confidence in the sector short of what it was and performance lagging, state lenders may soon be forced to foot $60bn in a bid to offset the risks associated with mounting non-performing assets.

The cumulative total of bad loans held by state lenders, estimated at $97bn as of November 2014, threatens to tip the sector into dangerous territory, and without the capital to support infrastructural development, capital shortages could put the brakes on essential projects. However, these capital shortages offer only a slight indication of the issues plaguing the public lending sector, and Modi must introduce relevant reforms if only to bring order to the sector.

Sell-off and reform

The prime minister unveiled key reforms in December to sell down the government’s holdings in public lenders, and, in doing so, inject an additional $26bn into the system. The recapitalisation will no doubt succeed in raising much-needed capital, though analysts claim that the amount the government expects to fetch as a result, at $38bn, is too optimistic. The main problem here is that these banks have been handicapped by anti-competitive practices, and will remain an entirely unattractive investment proposition for as long as they’re under state control.

The priority for Modi therefore, is to bring an end to stagnant banking processes and work towards improving often-inhibitive internal structures. Chief among the recommendations, laid out earlier this year by leading banking officials, is the formation of a ‘bank bureau’ to improve governance and capital requirements. “There are well-managed public sector banks across the world and even in India today. So privatisation is not necessary to improve the competitiveness of the public sector”, said Rajan. “But a change in governance, management, and operational and compensation flexibility are almost surely needed in India to improve the functioning of most PSBs.”

With a greater focus on appointing independent candidates to the board, struggling banks can more easily avert costly decisions and poor leadership choices. Modi has also pledged to grant state-run banks more autonomy in how they conduct themselves, therein – at least in theory – promoting greater competition and freeing banks from the shackles of old. In reducing lenders’ exposure to government borrowing, public lenders can offer higher interest rates than they are currently, which are below even consumer-price inflation. By giving bank officials more control over how the bank is run and allowing them to accept independent recommendations, public lenders can improve upon the desperate situation facing the sector at present.

There is work to do yet before the banking sector shakes the influence exerted on it by the state and begins to mirror the gains by those in the private sector. However, for as long as the government delays action on the issue and maintains its hold on banking, any recommendations put forward by those at the RBI and by bank officials will come to nothing.

Over the past 15 years, Malaysia has grown to become one of the deepest and most liquid bond markets in the whole of Asia, and its economy is booming. In line with the country’s gradual liberalisation, Malaysia’s investment climate has transformed into a highly competitive marketplace where foreign investments and businesses are now welcomed.

Among its key players is AmInvest, the biggest fixed income manager in the country, and one of its largest overall fund managers. The company has been expanding rapidly over the past five years, recording an average annual growth rate of 15 percent in terms of AUM as at December 2014 (see Fig. 1), according to its CEO, Datin Maznah Mahbob. That progress is being driven by a host of new initiatives that are helping to grow the fund house, and sustain its reputation as a pioneer in the investment field – both locally and beyond the Malaysian shores.

Diversifying assets

AmInvest has undergone substantial change since it was founding in the 1980s, with an increasingly diverse portfolio of assets that helps to fuel its success and carve out its reputation as a leader in the field. The company started out with domestic equities, mirroring the majority of the Malaysian market at the time. At the onset of the Asian financial crisis in 1998 when interest rates skyrocketed, it shifted to bonds and fixed income investments. The company set a trend in the local market that others swiftly followed; thanks to its shift, bonds have proven the fastest-growing segment in Malaysia over recent years. “I think we led the way by offering active fixed income management to first institutional investors, and launching quite a comprehensive suite of bond funds in the local market”, says Mahbob. That pioneering spirit was a telling sign of things to come.

Although smart beta has gained traction across a number of key developed regions, it’s so far kept a low profile in the sharia-compliant space

Now the company is undergoing another fundamental shift as sharia-compliant funds take on a more prominent role in the AmInvest portfolio. Sharia-compliant investments are something AmInvest has been specialising in for a while, but it’s only recently that the segment has started to increase in momentum. Minimising elements of risks, for example in sukuk, that aren’t reliant on debt like ordinary bonds means the sharia-compliant investment space can be challenging in terms of generating returns. AmInvest’s larger scale, alongside its ability to innovate, has helped the company to overcome those challenges, giving it an advantage over smaller fund managers.

Equities are becoming more important for AmInvest again; according to Mahbob, annual growth over the past five years in this asset class has outpaced its fixed income investments. “Our strength was traditionally in the institutional space – in fixed income – and our core assets have always been domestic. Today, we are building up our capabilities in both the retail and institutional spaces; in equities, managing foreign assets particularly in sharia-compliant funds”, she continues. “I would say that, in a way, it makes our fee revenue much more stable than it was in the midst of market volatility.”

That development is being driven by a change in climate, according to Mahbob: “This year with the change in tone – a reversal in interest rate direction worldwide – we have been winning more awards for our multi-asset funds and our balance funds.”

Smart beta strategies

At the heart of its current diversification strategy is the company’s move into smart beta strategies – where holdings securities are weighted by factors other than solely market capitalisation. Such measures include volatility, dividend yield and revenue. Smart beta has attracted much attention of late, especially among institutional investors in Europe and the US, helping to further develop exchange traded funds that have already been growing rapidly over the past 10 to 15 years.

Mahbob believes the popularity of smart beta strategies is being driven by its ability to deliver more consistent, transparent returns – at a lower cost. But although smart beta has gained traction across a number of key developed regions, it’s so far kept a low profile in the sharia-compliant space.

“Smart beta, although common in the conventional investment space, is still in its infancy with regard to ethical funds and sharia-compliant funds”, attests Mahbob. Plans are already in the pipeline at AmInvest to offer UCITS-compliant global funds in its suite of offerings which adopt a smart beta investment methodology as an alternative approach to add value to investors’ equity investments, slated to be launched in the first half of 2015. At present, the company is on the lookout for distribution partners globally in the form of investment and financial advisors, fund distributors, family offices as well as direct institutional clients.

The development of smart beta strategies marks a milestone for AmInvest – and Malaysia’s investment market more generally – as the company moves into investing in new overseas markets. “We hope this investment will give us access to the international markets in Europe, the Middle East and some parts of Asia”, says Mahbob. It’s another pioneering move for a region largely domestic in focus, especially within the sharia-compliant sphere, according to Mahbob. That’s not only apparent in Malaysia; even the largest sharia-compliant equities fund in the world – based in the US – is invested in US equities by a US fund manager.

The move isn’t just helping AmInvest to grow investors domestically – it’s providing global investors with an exciting chance to capitalise on the investment prospects offered in developed equities markets. Mahbob believes diversifying assets via internationalisation is a move other fund managers will need to follow in order to remain competitive: “Throughout the years, it has been our quantitative approach to managing global investments that has allowed us to manage foreign assets while maintaining our headquarters in Malaysia.” She adds that some local investment managers have already started doing that, once again inspired by the precedent set by AmInvest.

That strategy of moving beyond Malaysia begun in 2005, when the country’s market was first opened up to foreign investments – giving local retail investors the opportunity to invest in foreign funds. “I think we were the leader in that space, providing the widest spectrum of foreign asset classes to domestic investors at the time”, says Mahbob.

Innovate to accumulate

It’s that emphasis on constantly innovating and leading that’s helping AmInvest to thrive in a fiercely competitive environment. Mahbob believes a sharp focus is also driving the company’s success: “We have always kept our eye on the ball which is consistent returns, the preferred outcome required by our investors. Beyond Malaysia, we are ready to offer our global best investment solutions to global investors.”

Being aware of the investment climate is also extremely important for AmInvest. “We are very conscious of the ever-changing market environment, which in itself provides opportunities for us to deliver consistent investment returns in an environment which is very inconsistent”, says Mahbob. The company certainly has a strong history of delivering consistent returns – and that solid record is contributing to a highly compelling value proposition for investors, both in the sharia-compliant space and in broader ethical and socially responsible investing – an area in which AmInvest specialises.

While the pioneering spirit has always been there, it seems it’s only now that AmInvest is really kicking things off and stirring up excitement not only among Malaysia’s investment community, but globally as well. As the funds management house leads the local market into new territory, diversifying its assets and branching out beyond the borders of Malaysia, it’s setting a precedent for other fund houses that could transform the face of investing – both in Malaysia and, importantly, beyond.

Thailand’s central bank has reduced its interest rate from two to 1.75 percent in a move unexpected by economists, according to polls carried out by Bloomberg and Reuters. The decision was announced on March 10 in an attempt to lift the sluggish economy, following a vote that had been decided four-to-three by the monetary policy committee.

Experts believe that the verdict was reached due to consumer prices having fallen again in February by 0.52 percent compared with the previous year, following a 0.4 percent year-on-year decline in January.

Thailand follows other economies in the region that are also trying to boost their GDP growth through such measures

Interest rates had been cut by 0.25 percent last year as a result of waning exports and tourism; the country’s biggest sources of revenue. Political and social instability in 2014 had led to a sharp decline in consumer confidence, followed by a drop in fixed investment and weak domestic demand. While the tourism sector was hit significantly as a result of the unrest, with tourist arrivals falling by 10.4 percent in the first half of 2014, according to the Asian Development Bank. Subsequently, GDP growth had dropped to a disappointing 0.7 percent, despite previous estimates by the World Bank of four percent.

Thailand follows other economies in the region that are also trying to boost their GDP growth through such measures; India has already cut its interest rates twice so far this year, while China, Singapore and Indonesia have implemented quantitative easing programmes. Decisions are also due to be made by the central banks of South Korea and New Zealand, which may also follow suit.

The general consensus is that the interest rate cut will do little to provide the impetus needed for the economy, whereas a fiscal stimulus package would be far more beneficial. “The main motivations for rate cuts have been the recent bout of deflation and relative currency strength,” Krystal Tan, an economist at Capital Economics, told the Financial Times. “Thailand’s nominal effective exchange rate has risen considerably, raising concerns about export competitiveness. That said, we doubt the BoT will make any further rate cuts this year. Deflation has been largely a reflection of the fall in global energy prices, rather than demand factors, and will likely prove temporary”.