Top 5

The commodity trading advisor (CTA) sector has in recent months posted a string of impressive returns, with falling oil prices playing into the hands of those utilising the strategy and hoping to capitalise on budding investment opportunities. By identifying longstanding market trends and using carefully constructed computer models together with asset management expertise, those employing the model to good effect have recorded double-digit percentage returns in a climate rife with challenges.

Since the economic crisis took hold, many investors have chosen to embrace managed futures as a means of protecting against a market downturn. Yet the model is still seen by many as an unsatisfactory way of securing healthy returns in an otherwise volatile market. The spotlight focused on managed futures has the potential for disastrous consequences across the industry – for those employing it to ill effect. Only those with a thorough understanding of the model and the risks and rewards contained will reap the rewards.

Never has there been a better time to demonstrate that there are profits to be had in unfamiliar places

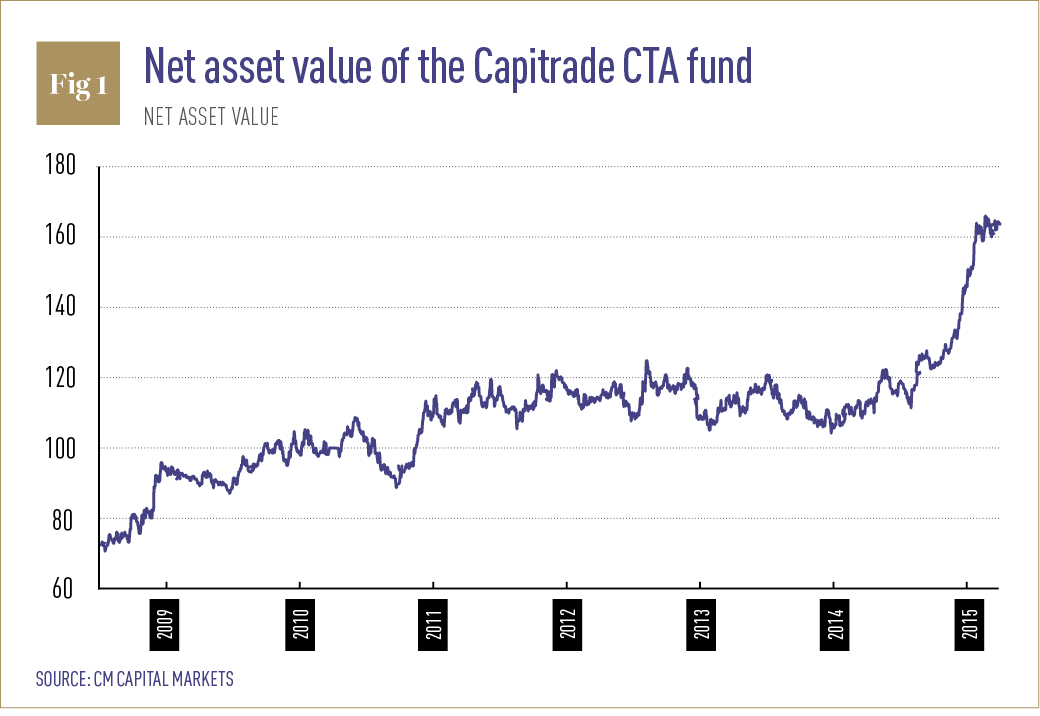

With the global economy in a state of constant change, and the pressure on those in financial services at an all-time high, never has there been a better time to demonstrate that there are profits to be had in unfamiliar places. As a pioneering name in the financial services industry, Notz Stucki has a proven track record of successfully developing and delivering solutions for those invested in the asset management arena. By securing the brightest talents and covering a diverse range of funds, the firm has quickly come to be seen as a leading European name, and a likely candidate for success in international markets. One particularly impressive fund is the Capitrade CTA (see Fig. 1), developed in-house by the CM Capital Markets Automated Systems team.

We spoke to Notz Stucki Europe CEO Paolo Faraone and the Head of CM Capital Markets’ Quantitative Department, Manel Sarabia, about the performance of managed futures accounts in years past, why the strategy is gaining in popularity, and what differentiates the firm from others like it in the market.

Why have assets in managed futures grown in recent years?

MS: The only way to improve profitability relative to the risk of a portfolio is through diversification, so adding carefully chosen assets is one method of boosting performance. Managed futures offer exactly that, and using them allows those concerned to reduce their exposure to risk, as well as meet profitability targets and increase competitiveness. In these well-diversified portfolios, managed futures provide an attractive and consistent annualised return over time, and that is probably the main reason for its growth. It’s also important to recognise that there are models that do not attempt to predict the future but take their positions depending on what is happening in real time, which makes them less vulnerable to an unexpected crisis.

How do you rate your CTA?

MS: We are trend followers and try to make the model as balanced as possible in all aspects that define the characteristics of an account; we want to be able to adapt to all kinds of trends or stages and control very precisely our volatility. Therefore, our model is 100 percent systematic and automated, which is essential in finding a good balance in the medium- to long-term.

We are reasonably pleased with our results in the past seven years, and our model is among the best in its class, irrespective of its relatively short history. Another example of this good performance is the percentile ranking on Bloomberg, where we are regularly placed above 90 percent. In absolute terms we have achieved an annualised return of over 13 percent since May 2008, though our worst year during this period stood at 2.17 percent in 2012, which shows the model’s ability to preserve capital under management even in adverse times.

What are the differences between the Notz Stucki CTA and the rest?

MS: If we are honest, we cannot say exactly without first analysing all other models out there. The balance we have achieved in combining our mix of strategies, namely neutral asset allocation and the process of risk control, may also play an important role in the comparison and in gauging a passionate and sceptical attitude, which are intangibles that generate the competitive edge we all seek.

Generally speaking, what is the management model of your CTA?

MS: Our futures management model is 100 percent automated, 24 hours a day and based largely on trend-following strategies. We also ensure we choose a product with daily cash flow. The fund trades only in electronic and organised future markets with high liquidity levels, which allows the investor to assess the risk in real time, and we only operate in electronic and organised future markets while refraining from option markets. Diversification is a big part of our strategy and the fund is designed to invest in the eight main sectors of the economy (interest rates, metals, softs, global stocks, grains, energies, currencies and meats).

The model changes positions depending on the trend, for example: flat markets with high volatility and high correlation are the worst situation for the model.

Tell us more about your investment process

MS: We are trend followers simply because markets are inefficient and this always causes the appearance of trends that we will try to detect and exploit. To detect and exploit these trends we have designed a dynamic combination of robust strategies, which enables us to calculate which investments we make.

However, given that we do not know where or when these trends will appear, we do not want to be predictive. Instead we seek the greatest degree of diversification and allocate assets neutrally; the investment in each sector depending on the number and liquidity of selectable items and the correlation between them.

There are four key aspects in managing the risks involved: matching of the underlying investment to the same volatility level, the maintenance of the annual volatility of a fund keeping between 13 to 17 percent, draw down control (reduction in leverage from 15 percent of the draw) and a value at risk (VAR) control that is fixed at six percent with a 99 percent confidence – so that hedge fund leverage will not exceed the VAR established.

Tell us about your successful track record in appointing leading asset managers and how you’ve been able to do this

PF: At Notz Stucki, portfolio management is mostly focused on choosing talented managers. We target managers that satisfy our strict due diligence criteria, including capital protection, risk adjusted returns, diversification and risk management. We are constantly looking for the managers that are capable of performing while also capitalising on diversification.

How important is international expansion to the continued success of the company?

PF: International expansion of our business is very important for us. Notz Stucki Europe has earned the AIFM and the Management Company Chapter 15 Licenses, which enables us to offer specific services like fund engineering, EU distribution to qualified investors and a robust risk management framework. We are therefore fully equipped to distribute our funds and services over Europe and to offer the highest fiduciary standards and the utmost integrity, with a specific focus on service customisation.

What new products have you introduced since 2010, and how have they hanged/improved the business?

PF: Notz Stucki has introduced several products, such as systematic CTAs, a long/short fund and traditional UCITS IV funds with several talented managers from different areas. All these products are very important for us if we are to expand our business beyond our own boundaries, and in doing so, better respond to the client’s needs.

What are your ambitions for the future of the company?

PF: The European private clients base remains very important for Notz Stucki Group.

In Luxembourg, Notz Stucki was first to gain a dual license for UCITS funds and non-UCITS funds (AIFMD). In Switzerland, Notz Stucki & Cie has been supervised by Swiss Financial Market Supervisory Authority since 2014 and acts as authorised asset manager of the collective investment scheme. These licenses allow us to serve institutional clients.

Globally, we position ourselves more as an asset allocator. Talent selection and asset allocation are the skills highlighted.

We take advantage of our size, international presence and overall regulation to support our strategy, we will continue to hire managers however it is compelling that people who join us share the same values.

In addition to our Swiss and European presence, we continue exploring opportunities in growing markets while at the same time keeping in mind our specific expertise and core business.

MS: As for CM Capital Markets, we are trying to increase our range of products; we already have a new model (smart beta Europe) launched as a managed account and we are working to develop other types of models. Each of these new models will be 100 percent systematic and – of course – based on statistical analysis, quantitative strategies and our in-house designed platform, which allows the control of the whole process in a totally automated way and enables us to avoid the psychological factor in the decision

making process.