Europe’s banking industry has hardened most banks after years of crisis, and taught them a thing or two about dealing with adversity and regulation. Now, the ultimate test still lies ahead for Europe’s banks, in the form of unnerving balance sheet evaluations performed by the European Central Bank (ECB). In an unprecedented effort, the ECB will unleash thousands of auditors and regulators to examine the books of 128 banks in the eurozone before early November when the it will assume oversight of the region’s largest financial institutions.

The so-called stress tests will take a detailed look at the quality of the banks’ balance sheets and their resilience to potentially adverse market conditions. Not surprisingly, this could result in the ECB requiring some financial institutions to make improvements – but more importantly, the regulator may go as far as to recommend that some banks be liquidated. This would be an unprecedented move signalling harsher regulation than we’ve ever seen and disturbingly, could seriously unsettle Europe’s financial sector.

The hope is that despite this, the experiment will sound the all clear for the eurozone, which has limped out of the financial crisis and poured billions of state-funded euros into the sector. To this end, the ECB is still providing emergency credit to some banks. However, the potential for elimination of these institutions could restore some much-needed confidence in the European economy, especially if the rest are granted a certificate of financial health.

The so-called stress tests will take a detailed look at the quality of the banks’ balance sheets and their resilience to potentially adverse market conditions

Destabilising effect

Yet the project is clearly a risky one. Should the ECB prove too strict, it could destabilise a European banking sector that has only just begun to show the first signs of recovery. But if it isn’t strict enough, the ECB’s credibility could be called into question. As such, the stress tests will provide the first indication as to whether the ECB can live up to the task of monitoring Europe’s banks.

Just three years ago, Europe’s first financial watchdog – the European Banking Authority – launched a broad stress test, only to see it fail miserably. The 50-person team in London proved to be completely overwhelmed and ironically, the agency’s credibility quickly vanished when some banks that had passed the test almost immediately ran into difficulties.

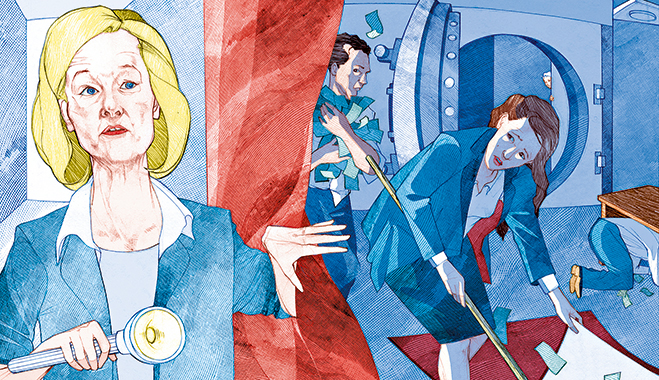

This is why Danièle Nouy, Head of the ECB’s supervisory arm, is making sure that the regulator comes off strong and as such, she won’t be holding back when it comes to weak banks. “We have to accept that some banks have no future,” she told the FT recently. “We have to let some banks disappear in an orderly fashion”.

Rumours have circulated that the ECB intends to fail around 30 banks in order to establish credibility and that German banks will be particularly hard hit, due to the sheer amount of banks there compared to countries like Italy and Spain. A particular issue for German banks is the billions of loans tied to the shipping industry that are set to default soon – a serious concern for banks like Commerzbank, which has a €14bn shipping portfolio and Deutsche Bank, which is tied to a large number of complex securities.

This is grim news for an economy that pretty much keeps the eurozone afloat. What’s more, estimates from the OECD and economic analysts suggest that European financial institutions could be worse off than we assume, billions short of a sufficient capital buffer, and that this could result in a far higher number of failures than expected.

Problematically, the ECB auditors have been unnervingly quiet about the stress test process and specifications have not yet been finalised, despite the deadline for the tests being not far away. It’s grossly concerning that banks affected have had little time to prepare and the majority haven’t received a schedule for the test or any associated documentation. Time spent on the evaluations is also limited, with the ECB committed to completing the balance sheet checks soon and with the second phase of determining how much capital each bank will need to withstand specific crisis scenarios, which was due to begin in May.

Further complicating the effort is the fact that while the first phase may already have begun, Nouy is still establishing her team. Of the 1,000 employees set to work at the ECB’s regulatory arm, only a few hundred have started work, and many of those are only on loan from national watchdogs. This means that the ECB has left much of the evaluation to external auditors who have only recently begun their work. This all raises the question whether the ECB is applying the necessary time and resources to actually conduct proper stress tests and whether these will have any credibility afterwards.

Too much transparency?

Finally, there are concerns about the amount of transparency associated with the tests and how this will affect the overall economy in Europe. Concerned industry voices have said that any results coming out of these banks post-test will be impossible to keep under wraps and that the examination of eurozone banks could actually unleash renewed turbulence instead of calming the markets. The ECB has said that test results may be made transparent and publically accessible, and this has raised concerns that speculators could target weak banks and make their problems even worse.

As such, it’s hard to gauge the outcome of the ECB stress tests, despite the anguish this is currently causing in the European banking sector. It’s clear that the process itself is somewhat lacking, without enough employees to conduct the stress tests and banks receiving very little information on what is necessary and needed in order for the tests to be conducted. What’s more, it is concerning that there is very little clarity on how much information will be available to the public on specific banks, and what criteria will be set up for whether a bank should be shut or not. This all creates growing uncertainty in the eurozone, which should otherwise be on the cusp of economic recovery and stability. Sadly, it seems that while the ECB was hoping to steady the region’s finances, it is more apparently, stressing Europe’s economy like never before.