Time and again sources have spoken about the world’s dwindling fossil fuel reserves and the stress that is, increasingly, being put on what precious opportunities remain. Industry names have suspected that available reserves have come close to the end on more than one occasion – and have said as much – though the rate at which new discoveries are being made and demand for fresh supply is gaining has sparked resurgence in the global energy market. ExxonMobil estimates that global energy demand will continue to rise by approximately 35 percent in the period through 2010 to 2040, and technological developments alongside significant strategic changes made in that same period will no doubt embolden the industry’s cause.

In the case of the US, a shale revolution is lifting the world’s biggest economy out of the doldrums and setting it on the straight and narrow, whereas recent developments in China’s hydrocarbons sector have been instrumental in realising a more sustainable means of prosperity. In Europe, unanswered questions on the dangers of fracking have put the brakes on efforts to tap what reserves lie beneath the surface, and the opportunities and challenges associated with Arctic drilling have made headlines across the globe. Irrespective of an uncertain operational environment, what’s clear is that the oil and gas industry is in the midst of a major transformation.

To celebrate some of the brightest names in the business and bring attention to what we feel are the greatest industry-related achievements of this past year, the World Finance Oil and Gas Awards 2014 offer a glimpse into what advances are being made in the global energy market. Here we take a quick look at some of the most significant developments and how oil and gas companies have acclimatised to a much-changed marketplace.

Changing demographic

With emerging markets playing an increasingly important role in driving global economic growth, demand for oil and gas is far and above what it was. “According to the estimates of McKinsey Global Institute, by 2025 440 cities in developing countries will contribute up to half of the global GDP growth. At the same time the levels of consumption will grow,” reads Lukoil’s Global Trends in Oil and Gas Markets to 2025 report. “Urbanisation and growth of the consumer class in developing countries will, in turn, promote demand for real estate, infrastructure, cars, hi-tech goods and, as a result, energy resources.”

This shift in the oil and gas consumer demographic means that companies have had to respond to what is fast emerging as a long-term industry trend, with growth stemming principally from emerging markets. According to the UN, a population of just over seven billion today is forecast to reach 9.6 billion by 2050, with over half of the additional numbers attributable to Africa. What’s more, India’s population is forecast to surpass China’s in 2028 and Nigeria’s is expected to exceed the US’s before 2050. Elsewhere, Europe’s population is tipped to decline, and life expectancy in developing nations is expected to be around 81 years by the end of the century.

The planet’s rising population means that oil and gas companies must look to new frontiers if they are to capitalise on emerging opportunities and negotiate the ever-changing tides of the global economy.

Developed markets

This is not to say, however, that existing market powers are of any less importance. In the US, for example, oil and gas still accounts for approximately 60 percent of the country’s energy mix, and the so-called shale revolution has set the nation on the road to self-sufficiency. Increased oil and gas production, therefore, has created additional jobs and given the country a much-need measure of economic stimulus. Not excluded to unconventional sources of energy, however, US crude production is closing in on the country’s historical high of 9.6 million barrels per day, and imports as a percentage of total energy use are plummeting.

Crucially, increased oil production has stopped short of sparking a global oil price collapse, supported primarily by the costs associated with increased production and the continued depreciation of the US dollar.

“Looking at the bigger picture, some of the changes which are taking place are quite fundamental. It was already evident that worldwide flows have significantly changed over the past few years, with the US currently being an exporter rather than an importer and an ongoing increased demand from countries such as India and China, to name just a few changes,” writes Jeff Sluijter, Ernst & Young BeNe leader of Energy and Natural resources in the company’s Oil and Gas Industry Forecast 2014. “These are interesting times, with many changes and challenges still ahead of us.”

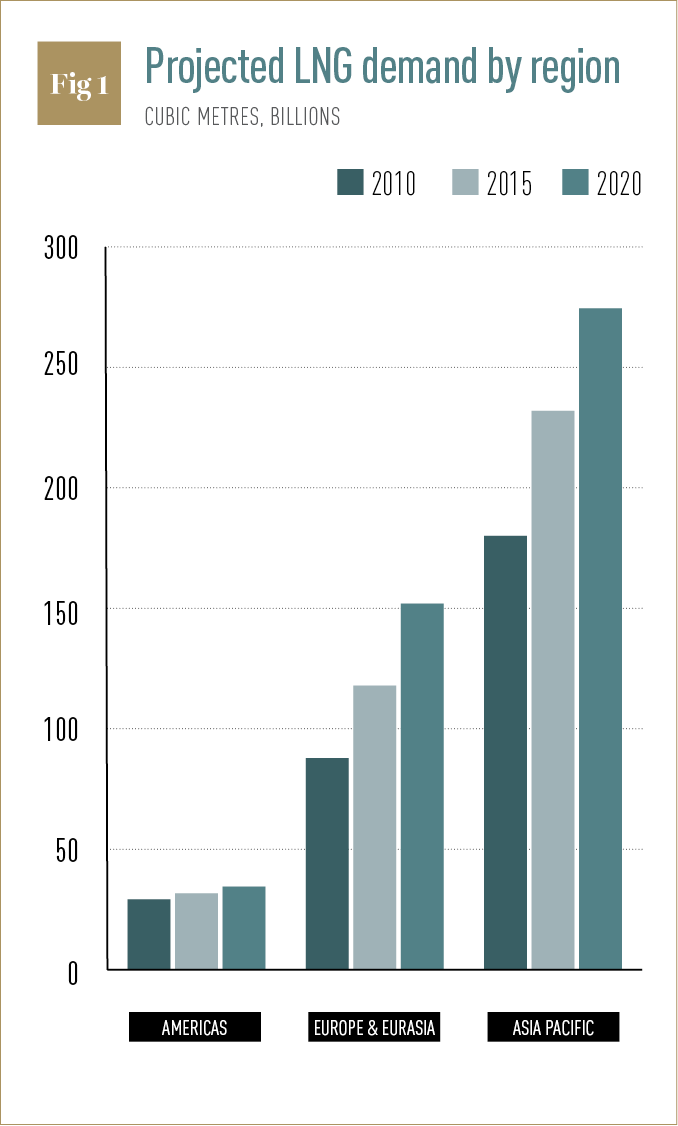

In Europe, production has declined, due in large part to more competitive alternatives in both Asia and the Middle East, and the public’s reluctance to embrace fracking in quite the same way they have across the Atlantic is stifling the region’s potential. However, many industry analysts anticipate that the coming years will mark a turning point for the continent’s gas market, as supply of LNG takes an upturn and prices dive. In preparation for a new competitive landscape, many of the region’s biggest players have decided on an LNG-first strategy and looked to improve their technological and infrastructural proficiency wherever they can in order to better capitalise on new opportunities (see Fig. 1).

New opportunities

To satisfy increasing levels of consumption, greater efforts must be made by those in the industry to exploit what recoverable reserves remain in the ground. Perhaps the most important aspect of this goal, therefore, is technological improvement and innovation, as firms look to increasingly hard-to-find, and so expensive, findings.

Perhaps the clearest indication of this quest to unearth barely recoverable reserves is the race to tap billions of tonnes worth of oil and gas in the Arctic. Unsurprisingly, the costs of setting up shop in the world’s most inhospitable climate are high, though the rewards for successfully doing so have lured a number of major international names to the fold. Rosneft and its Arctic project partner Exxon Mobil, for example, completed the drilling of the northernmost well in the world in September and took another step closer to realising the true extent of Arctic oil and gas.

In response to record high demand, major industry names have to look to unconventional, and so costly, methods of drilling. However, more important than that is the fact that companies must today look to the long-term if they are to occupy a greater share of the market.

Though the industry is so often associated with short-term gains, the technological demands associated with exploiting unconventional oil and gas deposits and setting up shop in difficult geographies means that companies will have to wait years before they see a return on their investment. Whereas in years passed money has been spent primarily on exploration, many are now moving towards infrastructural developments and taking a step closer to production. Evidence of this trend can be seen with increases to midstream and downstream capital spending, according to Deloitte, as well as a drop in M&A numbers, as companies look to focus on existing operations.

As the complexity of and expense tied to projects takes an upturn, those in the oil and gas market must take greater care to protect against uncertainties, whether they be regulatory, financial or technological in nature. Both oil and gas are still key energy sources for the global economy, even in today’s environmentally conscious society, and those responsible for satisfying demand play a key part in driving socio-economic development on a global scale.

The importance of the 2014 World Finance Oil and Gas Award winners, therefore, should not be underestimated, taking into account the work they have put in to improve the lives of countless individuals across the globe. Having each played an important part in spearheading industry developments and in making a difference to the many communities in which they work, the award winners represent the cutting edge of the energy market.