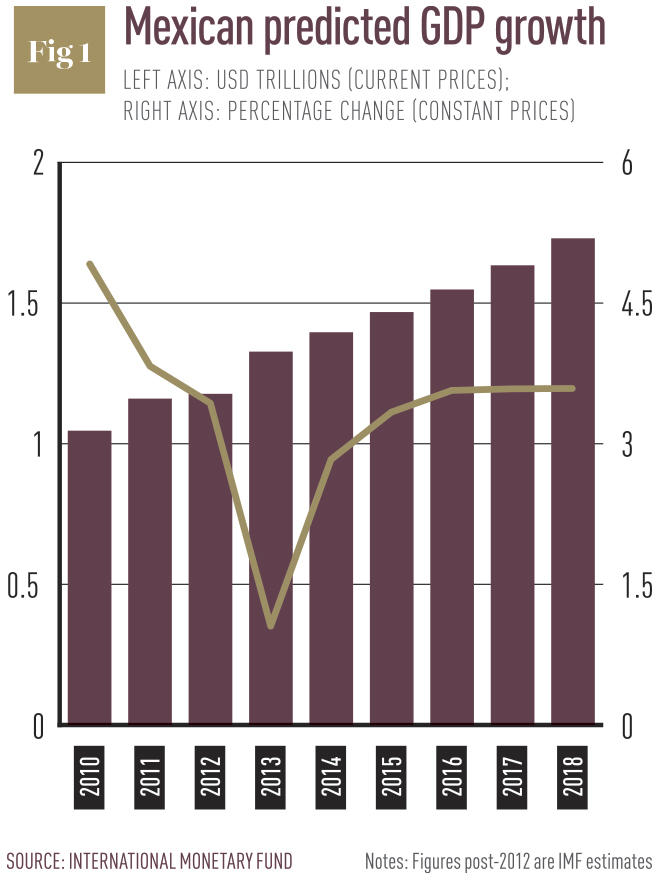

Mexico is a booming country. Its economy grew 3.6 percent in 2012, and is set to grow again this year, according to the IMF (see Fig. 1). In a world still reeling from economic turmoil, those are impressive figures. However, Mexico is a developing economy, and as such it faces many challenges before sustainable and enduring prosperity. Central to President Enrique Peña Nieto’s development plan is a sweeping reform that will tackle many of the shortcomings in Mexico’s archaic and flawed tax system.

Luis Gerardo Del Valle, Managing Partner at Jáuregui and Del Valle, SC, a prominent Mexican law firm specialising in tax consulting and litigation, has many years of experience dealing with tax regulation and dodging the bullets of Mexico’s system. He believes that though archaic, the country’s system is not that different from other jurisdictions around the world.

“Having had experience working with different systems of the world, I consider that most systems work alike,” he says. “It’s just that there are systems that are more developed and systems that are less developed and in this case Mexico has the main principles, but is not as developed as other jurisdictions. There are systems like the British and the American ones that have many more anti-avoidance provisions and that have been developed through regulations.”

The ruling party in Mexico, PRI, is proposing sweeping changes designed primarily to raise revenue and close loopholes, but the change will also raise sales taxes on the regions bordering the US and include a raise in the top rate of income tax and a capital gains tax. Though there has been an unprecedented level of cooperation so far between PRI and PAN, the main opposition party, there have been growing calls for PAN to abandon negotiations and allow the tax reform to fail.

A system in flux

Del Valle is sceptical of the reforms and believes that Mexico can flourish under the current system. “Mexico would have less regulations and less precedents than the UK or the US,” he says. “There are a lot of loopholes. You just need to have a good attorney or a good tax council who can guide the transaction because there may be challenges in the interpretation of the law, [things] that are just not regulated and which the courts have not yet ruled on. So you need to have a council that understands clearly how the system has developed during the past 20 years and where it’s going in the future so that a client can receive the right advice.”

But it is undeniable that the tax system in Mexico is changing fast, even before the tax reform is fully approved. As a tax attorney, Del Valle has learned how to navigate the changes in order to offer the soundest legal advice possible for his clients.

“The environment is changing in the sense that we start out with an interpretation of a statute that establishes a tax, and in the past courts were much more literal in their interpretation of that statute. This environment favoured the taxpayer immensely and allowed tax structuring to take place,” he explains. “What is happening currently is that the tax authorities and the courts have brought in the possibilities and tools for interpretation of a statute. They went from being totally literal to justifying interpretations of the statute. The possibility for interpretation will be to the detriment of the taxpayer.”

I am optimistic in my view of the Mexican economy, because foreign investment is coming in and will finally translate into economic growth and development

For Del Valle, this change in approach can have the effect of pulling the rug out from under the taxpayer, who once relied on a literal interpretation of the law in order to structure their taxes and are now left at the mercy of subjective interpretation. “Now the tax authorities can [argue] and say ‘that’s not the way the statute should be interpreted’, and the down side of this for the tax payer is that the advice of an expert and a very capable professional with experience is required. And that means that the possibilities for the taxpayer to plan and restructure transactions are being restricted.

“We are still not close to where the English system is; there have been many precedents in the UK and we understand that they are still coming because it’s not totally clear where the line between authorised tax avoidance and unauthorised tax avoidance is. Clearly the Mexican tax system is heading more towards substance than form, while in the past it was the case that form would prevail over substance. But the principles under which Mexican taxes will evolve are still not clearly provided, either in the statutes or in precedents.”

It is a difficult place to be, and even more so because of the political implications a widespread tax reform would have. “From a policy perspective the Mexican tax system’s major role is to collect revenue, like any other tax system, and that is clearly the purpose of the Mexican tax reform as stated by the government,” explains Del Valle.

“The country is facing a deficit next year, so if the tax reform is not accepted as proposed by the government, the country will be facing even more of a deficit, and the government will have to spend less. It is not clear what that might imply from an economic perspective. What is clear is that there is a lot of investment coming into the country, but it’s still not being reflected in the numbers in terms of growth. But I am optimistic in my view of the Mexican economy, because foreign investment is coming in and will finally translate into economic growth and development.

“If the parties do not approve the tax reform then the government will just have less to spend, though I do not necessarily think that this will automatically mean less economic growth. There is an economic principle that dictates that resources are always better in the hands of the economy; that is, private entrepreneurs rather than the government. Of course if the tax reform is not approved it will affect the economy of the country in one way or another, but we will have to wait to see the results.”

Changing for the better

Mexico is currently tackling energy reform, tax reform and education reform, all at once. These are key policy changes for the current government. But political parties are failing to reach an agreement on many issues of these reforms.

“That just sends a message to foreign investors that the country is not as politically stable as the Mexican executive suggests,” says Del Valle. “But that does not mean that agreements cannot be achieved and the country is not ready to receive foreign investment. There are a lot of investment opportunities; I just don’t agree that by not approving the tax reform as proposed by the government, the executive will necessarily decrease economic growth. I also don’t consider that failing to approve the tax reform shows political instability – while that may be the message, in any democracy it is reasonable that different political forces opine differently. There just needs to be a compromise about the tax reform.”

In the meantime, while political parties scramble around legislation changing the tax codes, Jáuregui and Del Valle, SC has been investing in becoming the most comprehensive tax law firm it can be. In fact, the firm has recently announced a merger between Jáuregui, Navarrete y Del Valle, SC, and Del Valle Torres, SC, with Jauregui y Del Valle, SC as the surviving entity; another prominent Mexican firm. Together, their teams will be able to navigate the veritable minefield that is the Mexican tax code, and any future challenges tax reform might bring.

“We have decided to enter into a merger with Jáuregui Navarrete, and after the merger I will lead the firm as Managing Director,” says Del Valle. “Del Valle Torres, SC has vast experience in the tax field. Most of our staff have considerable experience in tax advice and litigation in Mexico, as well as cross border transactions with the US and Europe. Our biggest competitors are the so-called ‘Big Four’ consultancy firms, but we feel that we offer a robust alternative in the Mexican market. We feel that in the Mexican market, where the interpretation of tax statutes is so subjective, clients are better served by lawyers. We operate from a position of privilege in the Mexican market, where we offer expert opinions as lawyers and accountants who clearly understand the risk perspective from a comprehensive point of view. That’s where our added value is.”