Although it may not sound feasible from a financial point of view, the declared figures recently released by the securities commission of Zambia show that the capital market still made remarkable gains in the first trading quarter for this year. This, despite the downturn in the world’s economy following the outbreak of Covid-19 in 2020 and the Russia–Ukraine war in 2022. According to Securities and Exchange Commission (SEC) chief executive officer, Philip Chitalu, despite external and internal shocks the Zambia capital market increased its total savings from the equivalent of $3.46bn in 2021 to $3.74bn at the end of the first quarter in March this year.

Positive performance in the face of both external and internal economic factors, together with support from macro-economic and financial market fundamentals, was responsible for the 8.65 percent growth. While the pandemic lockdowns, the war in Ukraine, confusion in the local copper mining industry and other factors have a telling effect on the economy in Zambia, the capital market still shows resilience having recorded significant growth.

Local financial analysts attribute the increase in savings to assumptions by many that the country has a promising economy due to its political stability and abundant natural resources, which tends to attract investors and capital. A growing economy is definitely a good bet for a buoyant capital market due to increased financial activities.

At the same time the increase in share prices for companies listed on the Lusaka Securities Exchange (LuSE) and collective investment schemes assets contributed to the rise in savings. Statistics show that collective investment schemes’ assets under management grew by 18.3 percent to reach $84.5m last year from $71.5m in 2021. In this same period the number of investors increased from 141,538 to 271,631.

The LuSE All Share Index (LASI) went up by 22 percent last year relative to the same period in 2021. On a monthly basis in the first half of last year market increases were noted from January to February where it went up by 7.65 percent. Hence at the end of the second quarter of 2021 LASI was at 6,854 points before reaching 7,342 points at the end of the third quarter in that year. At the end of December 2022 LASI closed at 7,337.79 points leading the SEC chief executive to make an optimistic statement on the future dealings of the capital market. “If the figures are anything to go by then we have a bright future for the capital market in Zambia,” Chitalu said.

A master plan

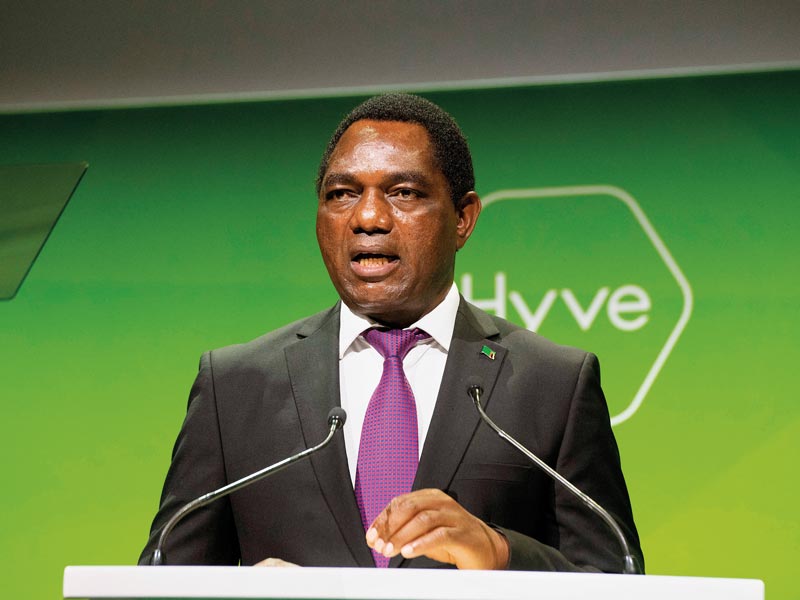

The growth of the Zambia capital market has so far incentivised the government to seek the participation of commercial banks in the treasury bonds it floats on the LuSE floor. It wants the financial institutions to quote, buy and sell their bond securities on the country’s capital market at all times. When launching the Capital Market Master Plan for 2022, Zambian president Hakainde Hichilema said the plan, once implemented, would contribute to greater transparency for all treasury bill participants and at the same time enhance efficiency in the government bond market.

Hichilema said his government wants to make it compulsory for all commercial banks and other financial institutions in the country to buy and sell their securities on the primary market in order to benefit all participants. This is after realising the crucial role of both the primary and secondary dealerships on the capital market. The government is expected to reduce investment costs and to create a more dynamic liquid market. Although the plan sounds attractive, more so with the advent of electronic trading platforms, banks and other financial institutions have not yet bought into the idea.

On the part of Bank of Zambia the government plan requires completion of the bond yield curve while also determining the benchmark of the rates on a number of securities. It is also vital to assess the country’s current government bonds situation as plans are devised to develop the capital market further. Meanwhile, Zambia is one of the 10 countries in Africa whose capital market is under study by the Africa Trade Barometers, according to Stanbic Bank.

The study will assess that country’s trade openness, access to finance, macro-economic stability, infrastructure development, foreign trade, governance, economic performance and trade financial behaviour.

It is not all plain sailing though. Zambia has considerable financial problems to solve and it would be foolish to pretend otherwise. It has external debt of more than $20bn and has not yet accessed the remaining part of the International Monetary Fund’s loan it badly needs to restructure the economy.

The global digital economy and African Trade Exchange initiatives are expected to have a positive growth bearing on the capital markets of many African countries including Zambia, and for this developing country it is a promising sign for a better and more prosperous future.