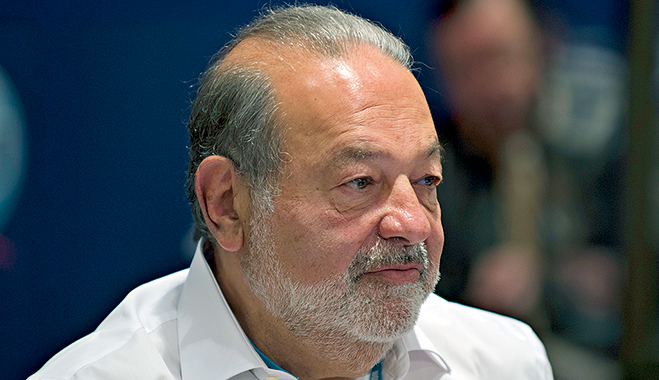

It’s not every day that Carlos Slim, one of the world’s richest people, decides to throw in the proverbial towel. But then Slim, who has amassed much of his multi-billion-dollar fortune in the telecoms market of his native Mexico, is a pragmatist, and has always been quick to grasp the political realities of a worsening business climate. In short, he needs to offload some of his domestic assets before he’s forced to do so, with local politicians finally tightening the screws on him and others.

Telecoms and broadcasting reforms now being implemented in Mexico also mean the enforced pruning of Slim’s America Movil empire will have ramifications, not only for the domestic market but also further afield. According to his own bankers, Slim will look to deploy a war chest, once the assets are sold, that could amount to $20bn.

Even when the dust settles and the newly slimmed down America Movil emerges, it will remain a major beast in the Mexican jungle

Though Slim has yet to indicate the assets to be sold off, America Movil, Latin America’s biggest telecoms company, which includes (former state enterprise) Telmex and Telcel, its fixed line and mobile subsidiaries, will see its overall domestic market share trimmed to below 50 percent. Telmex and Telcel presently enjoy market shares of 80 percent and 70 percent respectively.

Overall, it has more than 270 million mobile and 70 million fixed-line, broadband and TV subscribers, which includes 73 million subscribers in the Mexican market alone.

The new rules, signed into law in July 2014 by President Enrique Peña Nieto, marked the culmination of a pledge made when taking office 21 months ago to boost competition in Latin America’s second-largest economy.

Slim pickings

Slim’s initiative – aimed at escaping the antitrust measures being applied to dominant players by new watchdog the Federal Telecommunications Institute (IFT) – will still mean America Movil having to present its plan to the regulator.

The IFT, which has been given powers to break up dominant players if necessary, will only free America Movil from tougher regulations once effective competition conditions exist.

Slim, who has already come under pressure to share his infrastructure with domestic competitors such as Spain’s Telefonica (which has a 20 percent market share), is willing to play ball and keep the regulator happy if it means he can enter lucrative markets he has previously been kept out of, such as pay TV.

If the beefing up of powers for the new regulator sends out a strong political message it also reflects years of weak regulators and inadequate laws that allowed major companies to stall regulatory decisions in court, often for years.

Yet even when the dust settles and the newly slimmed down America Movil emerges, it will remain a major beast in the Mexican jungle.

Evidence of the negative impact of Slim’s market dominance, at least when it comes to cost and quality, can be seen in the OECD’s 2013 report Mobile Handset Acquisition Models, OECD Digital Economy Papers, No. 224, which found Mexico to be the most expensive of 12 major markets for a basic talk, text and data mobile phone plan (see table opposite).

Another survey, from internet metrics provider Ookla, found Mexico to be the 41st most expensive (of 64 markets monitored) for monthly broadband costs per megabit (US dollar terms).

Though Slim remains non-committal about how his assets will be offloaded he has indicated any sale will be to an operator with the necessary scale and financial clout to compete effectively in the Mexican telecoms market. Slim has always maintained the relative weakness of his immediate competitors has been down to their lack of capital investment. This would seemingly preclude Mexican companies – the attention instead shifting to foreign telco giants such as AT&T, which may be looking to directly enter the market.

Finding a buyer

Meanwhile, there are currently no plans for America Movil to sell its cell phone towers – the company looking instead to opening them up to anyone interested in renting them.

In a July interview with Reuters, Slim said the company would continue to pursue expansion into central and eastern Europe through its investment in Telekom Austria and reiterated he would likely sell his Mexican assets to a single buyer.

AT&T, a long time investor in America Movil, may yet prove to be a long shot though, having recently confirmed it intends selling its eight percent stake as it looks to buy TV company, DirecTV.

Other potentially interested parties include China Mobile, Huwai Technologies and Deutsche Telecom – all of whom would be entering the Mexican market.

Slim and Telefonica meanwhile have been crossing swords not just in Mexico but also in Brazil where Telefonica is the leader in that country’s mobile market through its Vivo unit, and where Slim may be looking to grow his relatively small market share of 25 percent.

Telefonica already has a potential conflict of interest being not only the owner of Vivo, but also an indirect shareholder in number-two player Telecom Italia’s TIM – a point already noted by Brazil’s regulators who are looking for some form of consolidation. Resolution of this particular issue could present an opening for Slim to raise his market share.

As Slim has expanded his substantial non-telecom holdings, which include oil, mining, banking, construction and a 17 percent stake in New York Times Company, among others, he has simultaneously striven to reduce America Movil’s dependence on the Mexican telco market. Indeed, 65 percent of its sales now come from outside the country against just 30 percent a decade ago.

International expansion

While Slim intends to commit more money to energy and infrastructure investment in Latin America, telecommunications investment overseas remains an attractive proposition for him.

Most intriguing of all, is whether Slim will use some of the proceeds from his forced sales to increase his footprint in the US, where America Movil’s TracFone unit is the fifth-largest domestic mobile provider. That unit, which rents space on networks run by the likes of AT&T and Sprint, provides pre-paid mobile services through well-known US retailers and has largely grown through the buying up of a clutch of smaller pre-paid operators.

Yet part of the problem for TracFone, with its 25 million subscribers, is that it barely saw any growth in the second quarter of 2014. The question remains whether Slim will be content to tread water in terms of market share or look to expand via a major share stake or acquisition.

T-Mobile US, the fourth-largest operator was seen as a possible target – not least because its proposed merger with Sprint the third biggest provider, was likely to fall afoul of US regulators on competition grounds.

While America Movil’s management was quick to quell any idea of buying T-Mobile US outright, it was then suggested America Movil could be in for assets that would need to be divested should any T-Mobile/Sprint merger be signed.

That would appear to be a moot point now with Sprint having walked away from the ‘merger’ that valued T-Mobile at $32bn.

But perhaps not. With Deutsche Telekom – 67 percent stakeholder in T-Mobile US – long interested in offloading its unit – news of the failed merger with Sprint effectively brings T-Mobile US back into play. Though America Movil may not be interested in an outright purchase there is little stopping it building a sizeable stake along with others.

The demise of the Sprint/T-Mobile US merger clears the way for French telco Iliad to negotiate with T-Mobile US over a $15bn ($33 a share) offer for a 56.6 percent stake, which was already on the table. While T-Mobile US will likely reject the offer as too low, Iliad is looking to improve it by bringing in more investors and is reportedly in talks with US satellite and cable operators, Cox Communications, Charter Communications and Dish Networks to climb on board. Other potentially interested parties include the Ontario Teachers Pension Plan (OTPP) and various sovereign wealth funds, such as Singapore’s GIC.

The problem for Iliad, which has a 13 percent share of the French mobile market, is that it needs partners because it’s unable to raise more debt than the $13bn lenders such as BNP Paribas and HSBC.

Though America Movil has yet to be mentioned as a would-be partner in any proposed deal, the changing cast of characters ensures it at least has the opportunity to come to the party late should it wish to do so. However, given Slim’s growing European interests he may yet be content to ‘let sleeping dogs lie’ and pass on this occasion.

European ambitions

In Europe, America Movil presently holds stakes in Dutch operator Royal KPN NV and Telekom Austria AG. In May 2014 America Movil, which had a two percent direct stake in Telekom Austria and a 25 percent indirect stake through its Carso Telecom unit, submitted an offer, along with partner OIAG (the Austrian state holding company) to buy the public shares in Telekom Austria they didn’t already own.

Under the new arrangement, which had become mandatory, OIAG currently holds 28.42 percent with America Movil (direct and indirect) holding 50.8 percent. The deal is likely to have cost America Movil up to $2bn.

Slim’s European intentions were further bolstered by an announcement of the share offer of the proposed creation by America Movil and Telekom Austria of one of the world’s largest fibre networks.

The network, to be established between Vienna and Miami, would have a joint footprint with 200 points of presence stretching across 47 countries, via the interconnection of networks offering voice, roaming, data and mobile services. For its part Telekom Austria’s voice traffic would in future be processed through America Movil’s Latin American voice hub in Miami.

Despite a subsequent $545m write-down on its Bulgaria operations that will likely push Austria Telekom to a full-year loss, Slim clearly sees the long-term attraction of its Eastern European operations, even if many analysts still question the strategy, due to obvious shorter-term security considerations in the region and Austria Telekom’s still relatively low subscriber base – 20 million compared to America Movil’s 270 million.

If there is one thing that can be said about Carlos Slim, however, it is his inherent adaptability and the ability to sniff out an investment opportunity. Having said this, his investments don’t always work out – last year’s failed $9.6bn takeover of Dutch operator KPN left him nursing an estimated $1.2bn loss, according to one analyst, having earlier built up a sizeable stake. Slim also failed in a joint takeover bid (with AT&T) to buy Telecom Italia back in 2007.

Despite this, Slim has increasingly become a global player in recent years, having lessened his dependence on the Mexican market. And that is precisely why analysts, competitors and investors alike will continue to be kept guessing about what he’ll do next after raising additional cash from his Mexican asset sales. It could prove an interesting ride for investors.