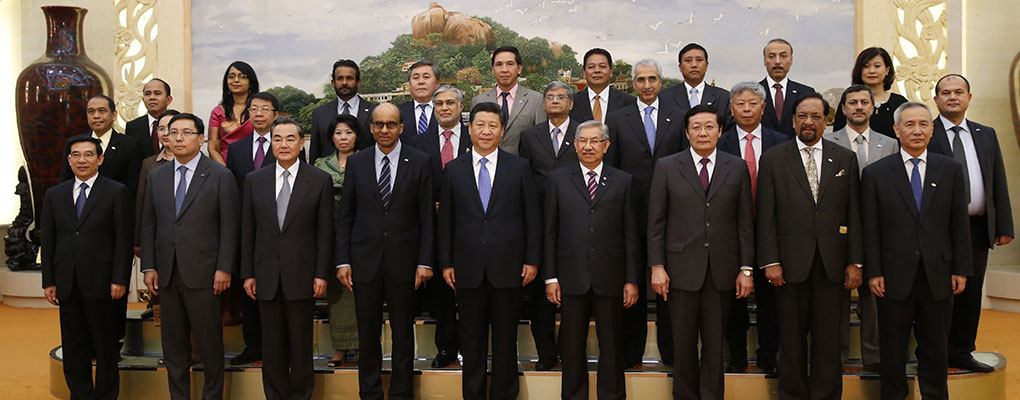

Created with a view to rivalling the world’s leading financial institutions, big plans are in the pipeline for the soon-to-be-established Asian Infrastructure Investment Bank (AIIB). The bank, which was proposed in October 2013 by Chinese president Xi Jinping, will provide financing for much-needed infrastructure development projects across Asia, beginning in 2015.

But not everyone is welcoming the banking scene’s newest arrival with open arms. Speculation that the AIIB is set to take on the IMF and World Bank is rife and at the AIIB’s inauguration in October the US’s closest allies in the region: Japan, Australia and South Korea, were among the notable absentees. The New York Times reported that the AIIB has met resistance from US officials, who have allegedly deemed it a deliberate effort to undercut other international financial institutions, and a political tool to draw Southeast Asian countries closer.

The bank is part of China’s efforts to expand its regional influence, which has so far not been achieved through membership of the existing Asian Development Bank (ADB), based in Japan. The bank’s creation appears to stem from China’s disappointment at how little participation and influence it has within the World Bank and the IMF, US-based institutions largely dominated by US powers. China is also backing the New Development Bank, or BRICS bank, founded in July 2014 as an additional alternative to existing international financial bodies. In a joint statement, its member nations voiced their dissatisfaction: “We remain disappointed and seriously concerned with the current non-implementation of the 2010 IMF reforms, which negatively impacts on the IMF’s legitimacy, credibility and effectiveness.” The reforms promised in 2010 included giving fast-growing emerging market countries a bigger say on operations within the institution and doubling the financial resources it makes available to its member countries – so it’s not entirely surprising that one of those member countries would eventually take matters into its own hands.

Among the notable absentees were the US’s closest allies in the region: Japan, Australia and South Korea

While the bank’s launch is provoking quite the reaction, Asia’s growing infrastructure gap is surely not up for dispute. Countries such as India, Thailand, Vietnam and the Philippines will likely be the main beneficiaries of the bank, as these are where the gap between developed and developing areas is widest, and domestic private capital lowest.

The most extensive research on the topic was conducted by McKinsey & Company in 2011, and put the continent’s infrastructure costs over the next decade at a whopping $8trn. In light of this, it’s clear that the funding currently provided by the state, the ADB, IMF, World Bank and various other institutions and private investors is just not enough.

“Though several Asian economies will see a high growth in the next few years, the government alone cannot fill the entire funding gap,” said Alka Banerjee, Managing Director of Equity Indices at S&P Dow Jones Indices. “The existence of a public-private partnership is a must and that can be met by creating a transparent and tradable infrastructure market with an efficient and standardised secondary market, with a regulatory framework that incentivises long-term investments.”

If sufficient funding was provided to sectors such as transport and energy, supply could finally begin to meet demand

Asia’s emerging markets are key contributors to the global economic recovery and the tourism potential of many of these countries is enormous. Although the infrastructure required to attract tourists en masse is lacking in many areas at present, if sufficient funding was provided to sectors such as transport and energy, supply could finally begin to meet demand.

According to McKinsey & Company, the deterioration of housing, energy, transport, communications and water facilities in Asia has restrained economic growth by between three and four percent of GDP since the early 1990s. For these reasons alone, it would surely make sense that the international community would support, rather than oppose, the AIIB.

Resisting the AIIB, and therefore resisting infrastructure developments in Asia, is a somewhat backward concept and the bigger picture, which encompasses Asia’s desperate needs for funding, must be considered. Plus, there’s nothing wrong with a bit of healthy competition, and other institutions should see the new arrival as an opportunity for collaboration, rather than a looming threat. Perhaps now is the time for those IMF reforms that were promised back in 2010; giving fuel to China’s fire is the last thing they want to do right now.