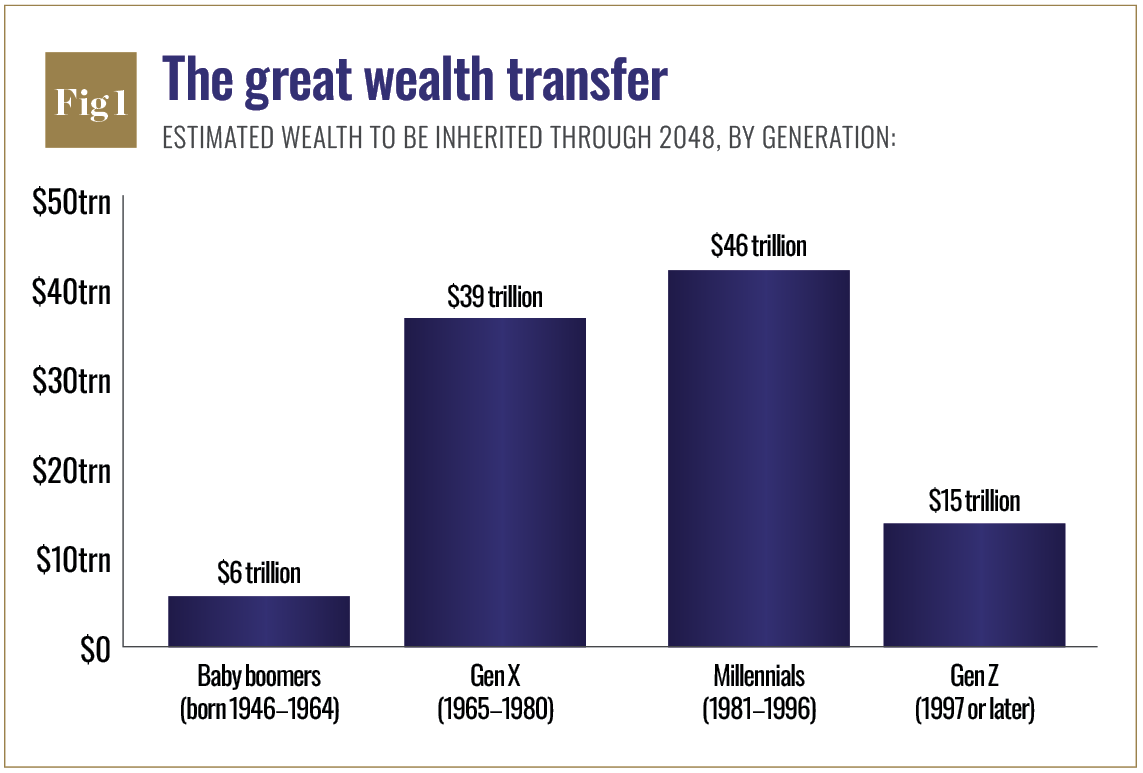

Over the next two decades, the largest intergenerational wealth transfer in history will take place. Baby Boomers and the Silent Generation are expected to pass down roughly $124trn by 2048, a tidal wave of capital that will reshape families, philanthropy and the financial services industry. The numbers alone are enough to grab headlines. But behind the dollars lies a deeper story about who will inherit this wealth and what they will do with it. For the first time in history, women are positioned not as ‘plus ones’ in financial planning, but as primary inheritors and decision-makers.

Statistically, women live longer than men, meaning they are more likely to control assets for longer stretches of time. That reality shifts the centre of financial gravity. “With women holding more wealth for longer periods of time, their decisions have the potential to shape our economy more than ever before,” says Megan Wiley, CFP of Badgley Phelps Wealth Managers. This historic handoff is more than just a matter of economics. It is a social and cultural inflection point that is already reshaping the way families talk about money, how advisors work with clients, and how women see themselves as stewards of wealth.

Generational divide in wealth’s purpose

A recent Harris Poll report, The Great Wealth Transfer, sheds light on the attitudes shaping this moment. According to the findings of this American market research and analytics firm, older Americans – those 55 and up – see wealth primarily as a source of security (42 percent) and lifestyle or enjoyment (35 percent). By contrast, younger heirs emphasise legacy-building (22 percent) and personal fulfillment (18 percent), alongside far greater interest in ESG and impact investing.

This generational divide signals a profound change in how capital will be deployed. Millennials and Gen Z are less content with simply holding and growing wealth; they want their money to work in service of values and social change.

Families that talk about wealth transfer create heirs who thrive, not heirs who guess

Confidence, however, tells a different story. Sixty-four percent of older Americans say they trust their heirs to manage wealth responsibly, while 83 percent of heirs say they feel confident themselves. But beneath the surface optimism lies unease. Younger inheritors cite concerns about taxes, legal complexities and the possibility of mismanaging assets. They also carry an emotional load: guilt, grief and anxiety that older generations often underestimate. These cross-currents will have a direct impact on financial firms. Nearly half of heirs – 43 percent – say they plan to switch providers after receiving their inheritance, citing mismatched values and a lack of personal connection. For wealth managers, the message is clear: retaining the next generation of clients will require more than investment performance. It will demand trust, transparency and alignment with values.

One of the biggest hurdles women face in this transition isn’t financial – it is cultural. For decades, daughters were often excluded from wealth conversations. Many grew up hearing, ‘Dad handles the finances,’ a phrase that subtly reinforced the belief that money was not their domain.

“All too often, heirs are looped in at the 11th hour, when the will has been written or after someone’s death,” says Michelle Taylor, a financial advisor at GFG Solutions. “The fear of making a wrong move with family money can paralyse them into inaction.”

Nancy Butler, a financial planner with 40 years of experience, has seen how silence perpetuates unpreparedness. “If your great-grandparents didn’t teach sound financial habits to your grandparents, and your grandparents didn’t pass them down, then your parents may not have been equipped to teach you,” she explains. “Without this chain of knowledge, each generation finds itself repeating the same mistakes.” By contrast, families that talk openly about money tend to raise more confident heirs. “Families that talk about wealth transfer create heirs who thrive, not heirs who guess,” says Allison Alexander of Savant Wealth Management.

Financial literacy isn’t enough

Today’s young women may be more financially literate than any generation before them, but that doesn’t mean they are prepared to inherit. “You can have all the content in the world, but unless you understand it and implement it, the confidence gap will still be present,” says Taylor. Srbuhi Avetisian, Research and Analytics Lead at Owner.One, argues that the real gap is inheritance literacy. “Only seven percent of heirs in our global survey knew they typically have a three-to-six-month window to act before assets freeze,” she explains. “That window determines whether heirs – often daughters – retain access to their families’ lifestyle or lose it.”

Joyce Jiao, CEO of Herekind, a digital estate administration platform, points to another overlooked challenge: the administrative burden. “Financial literacy teaches you how to manage money, but it doesn’t teach you how to navigate the nightmare of probate, bank negotiations, funeral costs and dependent care – all while grieving,” she says. “Most often, the eldest daughter is the executor. Even highly educated women can feel overwhelmed and unprepared.” Money is never just money, especially when it arrives through loss. Inheritances often come tethered to grief, guilt, or a sense of unworthiness. “An inheritance can carry grief as well as opportunity,” says Alexander. Without support, those emotions can drive poor financial choices.

For many women, the emotional undercurrents run deep. “Impostor syndrome is huge. Survivor’s guilt is common. And wealth, for many women, still feels dangerous – like it comes with a cost and can be taken away,” says transformational wealth coach Halle Eavelyn.

Jiao sees the same dynamic in her work with executors: “They are the emotional bridge – grieving, paying estate costs out-of-pocket, and making financial decisions that affect the entire family – all before they can even access their inheritance.”

Advisors are slowly adapting

The advisory industry is beginning to take note. Where once women were treated as secondary clients, they are increasingly recognised as the lead decision-makers. “Women are happy to know the desired result will be achieved and give that more weight than the return they will achieve in a particular strategy,” says Taylor. Wiley sees a similar trend: “Clients want to see a holistic plan before making portfolio changes, allowing them to align investments with broader goals such as charitable giving.” That shift toward holistic, life-centric planning is critical. Advisors who focus only on products and return risk alienating a generation that values impact, caregiving and legacy alongside financial growth.

As women inherit unprecedented amounts of wealth, they are also rewriting its purpose

Technology is also reshaping the landscape. Interactive dashboards, inheritance simulations, and women-focused peer networks are creating safe spaces to learn and practise decision-making before the windfall arrives. “Institutions that run inheritance simulations – showing heirs what the first 90 days after a death look like – will build more confidence than any investment seminar,” says Avetisian. As women inherit unprecedented amounts of wealth, they are also rewriting its purpose. Unlike earlier generations, they are far more likely to view money not as an end in itself but as a means to community impact, sustainability, and family legacy. “When women control the purse strings, priorities change,” says Eavelyn. “Leadership gets more nuanced. Entrepreneurship gets more inclusive. Philanthropy shows up more. This isn’t just a transfer of wealth – it’s a paradigm change.”

Kristin Hull, Founder and CIO of Nia Impact Capital, an Oakland-based impact investing firm that builds public equity portfolios with a focus on companies advancing sustainability, social justice, and gender diversity in leadership, argues that the $124trn wealth transfer is positioning women as key decision-makers who want transparency, purpose and investments aligned with their values.

She notes that while younger women are digitally fluent and eager for tools and peer networks, gaps remain in inheritance literacy and emotional readiness. Her most urgent call: to make gender-lens investing (GLI) the default, embedding equity and impact metrics into portfolio construction, estate planning and wealth transfer frameworks.

This shift is not confined to the US. In Asia, women are on track to control nearly a third of investable assets by 2030, while in Africa and the Middle East, rising female entrepreneurship is accelerating wealth ownership. Yet cultural and legal barriers remain: in some regions, inheritance laws still favour male heirs, and in others, daughters face resistance in assuming financial leadership. For global financial institutions, the implication is clear – this transfer is both an opportunity and a stress test, demanding new frameworks that respect regional differences while empowering women as primary decision-makers.

The overlooked opportunity

Across the experts, one theme recurs: timing. Too often, women are brought into wealth planning too late – after a death, when grief and confusion collide with financial responsibility. “The most overlooked opportunity is recognising that women need not just a wealth plan but a wealth identity,” says Eavelyn. “Until a woman sees herself as someone who is worthy of holding, growing and enjoying her money, she stays stuck in fear and silence.”

Practical steps can shift this trajectory. Inviting heirs to annual family meetings, creating mentorship spaces, offering just-in-time educational tools, and reframing conversations around values instead of just numbers all help prepare women for stewardship. These early interventions turn inheritance from a disruptive windfall into a natural extension of life planning.

The $124trn wealth transfer is more than a reallocation of assets – it is a cultural and economic turning point. Women, poised to inherit and manage more wealth than ever, face both challenges and opportunities. For financial institutions, the path forward is clear: survival in this new era requires transparency, education, and treating women as the lead decision-makers they are. Whether this transfer becomes a burden or a breakthrough will depend on how well families, advisors, and institutions rise to the moment.