In late September China took a massive step to tackle air pollution announcing it would ban low-quality coal imports in 2015 and switch to clean alternatives such as natural gas, nuclear and renewables. According to its commission’s website, from January 1 China’s government will encourage imports of higher-quality supplies and stray away from imports of ‘dirty’ coal. A blanket ban on domestic mining, sale, transportation and imports of coal with ash and sulphur content exceeding 40 percent and three percent is also being put in place, with utilities and other big consumers having to cut imports. This ultimately comes at a consequence for international traders as China looks at shifting its energy consumption and importation.

As the largest importer and consumer of ‘dirty’ coal in the world, China must ensure a cleaner and less-polluted country. Importing about 300 million metric tons of coal and consuming approximately 3.5 billion tons a year, China depends on the resource for 65 percent of its energy. NRG Senior Analyst Edgar Van der Meer says China’s needs are still visibly and rapidly growing with a new coal power plant commissioned every seven to 10 days, though he believes the impending ban will have a slow effect on China as the world’s top coal importer and consumer. “It will take a little while for policy to trickle down and really have an effect because China is such a behemoth in terms of its consumption of coal and electricity at the moment,” he says. “Coal isn’t going anywhere anytime soon for China at least.”

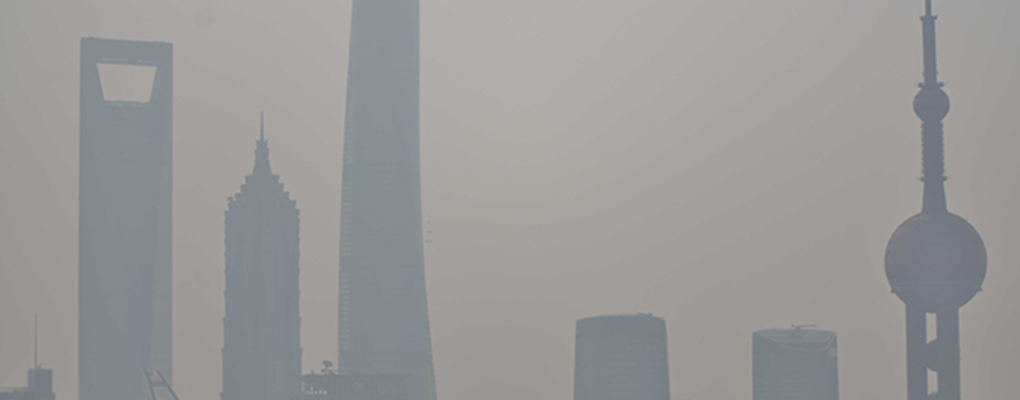

Analysts say China’s efforts to get rid of ‘dirty coal’ might be in vain

During the last decade, global coal demand has largely been driven by China, however this demand could fall as much as 15 percent to less than 300 million metric tons if the ban goes ahead. Therefore it is unknown whether the effects of the decision will be positive or negative or whether the country’s choice will create a shift in coal trade flows. Reuters states global thermal coal demand will shift away from China in coming years as it switches to cleaner energy and this shift will shake up the Asian seaborne coal trade, which currently focuses on routes between shippers such as Australia, Indonesia or South Africa to established consumers in China, Japan, South Korea and Taiwan.

Whereas some countries will lose out, others will step up in the game. London’s Business Monitor International put together a report released in September detailing China’s pre-emptive ban, concluding that if the ban went ahead in 2015, coal exports from South Africa and Australia would come under pressure, while Indonesia and Russia would emerge as winners with greater room to expand coal exports. Indonesian Coal Mining Association Head Bob Kamandanu told The Wall Street Journal Indonesian coal exports wouldn’t be adversely impacted because the country’s sulphur content is generally less than one percent and ash content is five to seven percent.

Eager not to leave this booming market to Indonesia, other major coal exporters, such as Australia, Colombia, South Africa and the United States, will also compete for new opportunities in countries like Vietnam, Malaysia, Thailand and the Philippines. According to BMI, Australian and South African coal will be worst hit since both countries have an ash content of 23 to 25 percent. The Australian stated Australia exports at least 49 million tons of thermal coal to China each year. About 55 percent of the nation’s thermal coal export mining capacity complies with China’s tough new coal import regulations, 29 percent does not comply and 16 percent partly complies. Van der Meer states Australia has more to lose if it isn’t able to remain cost-competitive.

Despite this, analysts say China’s efforts to get rid of ‘dirty coal’ might be in vain, with the effects on pollution and greenhouse gas emissions yet to be seen. Van der Meer says China has promised a slowing and not necessarily a reduction of pollution. A lot of the expansion is expected to be taken up by alternate fuel resources and renewable energies, thereby slowing the rate of increase and creating a levelling off of greenhouse gases, instead of a noticeable decrease.

There are several knock-on implications that may come from China’s impending move to ban the import and sales of ‘dirty coal’. A notable shift in coal trade flows will produce significant winners and losers, as demand for global thermal coal moves away from China. Indonesia will capture a larger share of the Chinese market, while countries like South Africa and Australia will look to re-direct their coal towards other countries. Seaborne imports will continue and so will competition amongst major coal exporters. Although the anti-pollution move could have significant repercussions for key exporters, straying away from ‘dirty coal’ is indeed beneficial for addressing China’s alarming pollution levels. And it seems the nation definitely has a strong will to tackle the problem.