As part of the country’s two-year anti-corruption drive, Chinese authorities imposed an upper limit on executive pay in September and, in doing so, looked to rectify a number of employment market inefficiencies. In keeping with the ruling administration’s commitment to clamp down on state corruption and restore balance to the labour market, the world’s number two economy has agreed to legislation that its European counterparts could not quite stomach.

For instance, in 2013, a popular proposal to limit executive pay was taken to a Swiss referendum. However, the overwhelming majority (65.3 percent) rejected the motion that executive compensation should be no greater than 12 times that of what the lowest paid employee earns. And although the Swiss public voted in favour of outlawing ‘golden hellos’ and ‘golden goodbyes’ (signing and leaving bonuses) earlier that same year, the 1:12 referendum proved too radical a proposal for the voting public.

In China, however, the Assets Supervision and Administration Commission and the Ministry of Human Resources and Social Security have announced that executive pay at state-owned enterprises (SOEs) will be capped at 10 times the salary of any employee at the same firm.

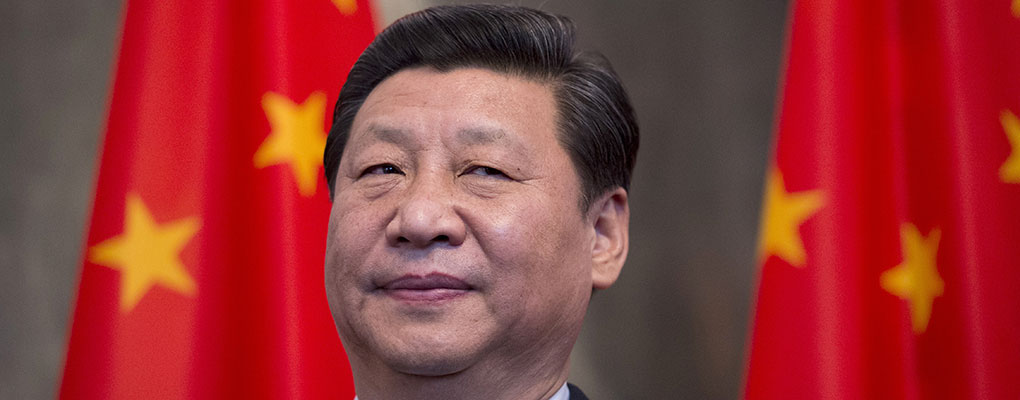

Power should be restricted by the cage of regulations – President Xi Jinping

The measures are surprising, given that China is typically viewed as more susceptible to corruption than its Western counterparts. Nonetheless, a closer look at what reforms have been introduced in months passed shows that the country’s ruling powers are working hard to right a muddied reputation and silence its critics.

Crackdown on corruption

The crackdown on corporate pay is only one facet of President Xi Jinping’s programme to arrest concerns of overly excessive government spending and instances of corruption. In the lead-up to his instatement as President, Xi vowed to expose any misdeeds and clamp down on untoward business leaders and bureaucrats.

“We must uphold the fighting of tigers and flies at the same time, resolutely investigating law-breaking cases of leading officials and also earnestly resolving the unhealthy tendencies and corruption problems which happen all around people,” he said in a speech broadcast by Xinhua in the January preceding his term. “Power should be restricted by the cage of regulations.”

According to figures cited by the newly created Central Commission for Discipline and Inspection, more than 182,000 party officials were punished in 2013, and eight of the 31 high level officials contained in the sample are currently facing legal prosecution. Whereas the ruling parties of old have succeeded only in the ridding of political rivals and currying favour among the masses, Xi’s corruption drive is closer to a sustained solution to what has been a long-running problem in Chinese politics. The party’s pledge to outlaw the “extravagance and hedonism” of years gone by, therefore, has been well received by the Chinese public and earned the president a favourable reputation among an emerging – and increasingly influential – middle class population.

Since 2012, the CPC Commission has introduced a raft of measures to stamp out corruption at every conceivable level, beginning with new powers for the party’s Discipline and Inspection Committee and ending with drink restrictions at company-sponsored dinners.

Crucially, the decision to impose a ceiling on SOE executive pay signals the party’s willingness to engage with what concerns Chinese individuals the most, and hone in on the prevailing issue of widening income inequality. “From an economic perspective this may not be optimal. But the state has to weigh up its ability to attract/retain the best talent against concerns regarding growing income/wage inequality,” says Alex Bryson, Head of Employment Group at the National Institute of Economic and Social Research (NIESR).

China leading the way

China is set to cap its CEO to average worker pay ratio at 10:1. But the inequality pay gap exists across the world, and has done for quite some time.

10:1

1983

195:1

1993

301:1

2003

331:1

2013

Source: Yahoo! Finance

Competition and comparisons

As it stands, executive pay among China’s SOEs is far short of those in the developed west, although the rapid rate at which the figures have been growing of late has given some cause for concern. A recent report, authored by Bryson, his NIESR colleague John Forth and University of Nottingham Ningbo China professor Minghai Zhou, shows that executive pay at SOEs has effectively doubled in the period through 2005 to 2010. Add to that the fact that any increases to Chinese executive compensation were closely in keeping with firm performance in the period through 2001 to 2010, and it appears that the similarities between Chinese and western markets number in the many.

“Despite differences between China and the west in the composition of the public listed sector and the governance of market relations, its executive labour market resembles executive markets elsewhere,” reads the report.

“There appears to be something about executive jobs and how they are managed, which transcends national economic, political and cultural differences.”

Nonetheless, despite the rate at which executive pay has risen in China, the actual amount pales in comparison to similar-sized western firms. For example, Industrial and Commercial Bank of China Chairman Jiang Jianqing was paid $185,000 of the bank’s $38.5bn in 2012 net profits, whereas Goldman Sachs’ chairman Lloyd Blankfein was awarded over 100 times that amount, according to the Financial Times. The comparison, of which there are many like it, shows that executive pay has failed to keep pace with performance in China, though the ratio of executive to worker pay is still a cause for concern.

“There is such pressure for the simple reason that, as in any economy that is becoming increasingly developed, China relies on a fully functioning and efficient labour market where individuals are paid a rate that is commensurate with their skills,” says Bryson. “There are many instances of exploitation associated with monopoly firms that militate against this. The government is beginning to promote independent trade unionism, much of it in the foreign owned sector, to help redress these imbalances.”

China has an aversion to risk, and so, excessive compensation has kept a lid on executive pay, at least in comparison to those living in developed economies. Likewise, the fact that most of the country’s largest organisations are owned by the state means that excessive pay could be seen as contradictory to the stated purpose of the company. And, while efforts to close income inequality are well placed, the decision to limit executive pay has raised concerns about the ability of SOEs to attract international talent and compete on a global basis.

“The issue, of course, is that it seems as though the limits will only apply to state-owned firms. All other things equal, that it is going to limit their ability to recruit high-quality executives,” says Forth. “But pay is not the only thing that attracts people to state-owned firms – recruits may be attracted by career paths.”

Without a history of strong corporate leadership experience in China, many firms have been forced to look beyond their own borders

As the size and profit-making potential of leading Chinese SOEs has grown, so too has the need to bring in the appropriate personnel. Without a history of strong corporate leadership experience in China, many firms have been forced to look beyond their own borders; a practice that has put extraordinary pressure on what remains comparatively low executive pay. However, inflated executive wages may well be a necessary evil if the country is to attract experienced names, despite the ruling party’s efforts to enforce strict controls on pay. The danger is that the 1:10 executive pay limit could stifle Chinese talent at a time where international appointments are becoming a necessity.

“I wonder whether the impact of the move may go further though, because we know that the state plays a role in executive appointments beyond the state-owned sector,” says Forth. “So the state may be able to limit executive salaries beyond the state-owned sector, even if only indirectly, if it is sufficiently determined. There is also the question of whether state-owned enterprises set a ‘norm’ that other firms wish to follow in order to gain favour in the market. If either of these happens, then the impact on the competitiveness of state-owned enterprises is going to be limited, because the playing field won’t be so uneven.”

The implications

After months of speculation about how a crackdown on state largess might compromise China’s competitiveness, it seems the country’s political differences have buffeted what implications the measures might have had in a western market. “In a western developed economy one might worry about any measures taken which might inhibit firms’ ability to attract and incentivise their top executives,” says Bryson. “However, in the case of China, many of those incentives derive from political preferment and opportunities to move within the communist party. This incentive system also has strong economic benefits.”

The proposal to introduce a pay ceiling could also have far-reaching implications for those looking to enter the labour market for the first time. As of 2013, two-thirds of Chinese graduates set their sights on a government position or a role at a major state-owned firm, despite the part private companies have played in powering the economy onwards and upwards in years passed. Whereas, historically speaking, foreign firms paid far and above what the state did, the amount has more recently levelled out and the added perks have tipped the scales the state’s way.

Assuming the 1:10 proposal holds, positions at SOEs might not hold the appeal they have done, and the country’s top graduates might be tempted instead to look further afield and to China’s growing number of private companies. Though the decision to limit executive pay might stifle the ability of state enterprises to reel in proven international expertise, the positive impact this could have for the labour market far outweighs the risks taken.