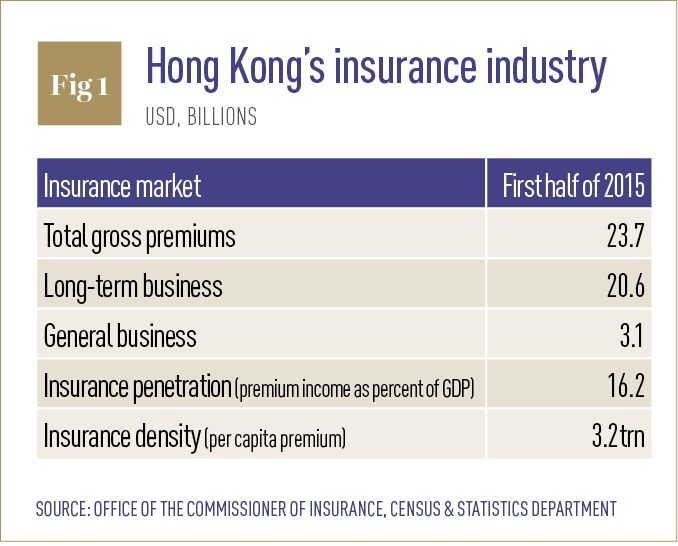

By keeping a close eye on consumer patterns, HSBC has performed well in Hong Kong’s solid insurance sector (see Fig. 1). The industry’s gross premiums for the first half of 2015 were up 13.6 percent on 2014, and much of the growth was attributed to the long-term insurance business. Endowed with a new regulatory framework, HSBC is taking strides to make good on new opportunities.

With a strong heritage and brand, HSBC is well placed to grow its Hong Kong insurance business as it looks to build on its 150 years of experience by improving its standing both locally and internationally. As a global and universal bank, the group serves customers from over 6,100 offices in 72 countries and territories, meaning that its Hong Kong insurance business can benefit from other key markets for HSBC, sharing their strengths, experiences and findings. Speaking on the group’s purpose, Candy Yuen, CEO of HSBC Insurance Hong Kong, stressed that its operations are united by a singular ambition to connect its customers to opportunities: “we enable businesses to thrive and economies to prosper, helping people fulfil their ambitions”. The bank also enjoys a distinct advantage over its competitors in that it already boasts a strong local presence in the Hong Kong insurance and Mandatory Provident Fund (MPF) market, where it is the leading player in the latter and one of the top players in life insurance business.”

HSBC boasts quite a few advantages when it comes to making good on the opportunities in Hong Kong

A focus on the customer

“Customers have been and will always be at the centre of everything we do”, said Yuen, speaking on the importance of strong customer relationships in realising new insurance opportunities in the market. “We are committed to do the right things for our customers in whatever we do. For example when we develop our insurance products, we start with the customers’ journey, analysing their needs and requirements.”

In terms of face-to-face service, the process is supported by a need-based financial planning process, through which HSBC is able to gauge a good understanding of the financial situation and wealth goals of each individual customer. “At HSBC, we want to really know our customers and therefore we dedicate resources to research and developing surveys to gather insight on what they need. We regularly produce global reports of our findings with our customers such as Future of Retirement and Value of Education”, said Yuen.

HSBC boasts quite a few advantages when it comes to making good on the opportunities at hand in Hong Kong. However, of equal importance is a thorough understanding of the economic climate and the way in which it has shaped the financial habits of individuals. For instance, a low interest rate environment means that customers now tend to seek attractive total yield on the long term. What’s more, “considering fluctuations in the equity market, customers may look for some investment vehicles that provide a stable return and maybe even certain level of guarantee, so insurance products not only provide comprehensive protection, they are also considered good savings options for certain financial goals”, Yuen added.

Finally, the RMB has been gaining popularity for some years now, and many customers in Hong Kong look for RMB as a currency option for their policies. Regardless of recent fluctuations, the currency, in the long run, is one that many customers will keep an eye on. “Knowing our customers’ preferences, we offer RMB options to our products, where suitable”, said Yuen.

In response to the ever-changing situation facing the locals, HSBC has tailored its products and services to its customer’s preferences. HSBC’s Income Goal Insurance Plan is a classic example, and the ‘grow-defend’ insurance solution targets customers looking for upside potential and steady income and caters for their education, wealth accumulation and retirement planning needs.

The HSBC Hong Kong’s Wealth Tracker 2014 report, which takes into consideration 1,000 individuals aged 18-65, indicates that children’s education, retirement expenses and mortgage repayments are currently in the top of minds of customers in Hong Kong. “As people progress through different life stages, their needs and life goals change. People who plan early are more likely to be in a better financial position as they have a longer investment horizon, can take more risk and are able to adjust their strategies”, said Yuen. Based on the insights, HSBC has created insurance solutions that allow customers to save for long term goals, such as education and retirement, while ensuring there’s sufficient protection for unforeseen events.

“Leveraging our strong brand and the strengths of the HSBC Group, Insurance Hong Kong is well positioned for further expansion and growth”, said Yuen. “In tandem with the group’s strategy, HSBC Insurance Hong Kong plays a critical role in the development in Asia, Pearl River Delta [PRD] in particular. HSBC intends to accelerate investments in Asia, developing its business in both the PRD in Guangdong province, China, and in the ASEAN region. HSBC will expand asset management and insurance in Asia with the aim of capturing significant opportunities from emerging wealth in the region. As part of the PRD, we are dedicating resources to accelerate the development of our Hong Kong insurance business.”

Personalised digitisation

The goal for HSBC Hong Kong is to deepen the bank’s relationship with its customers, and in doing so better serve different customer needs. Digitisation is also a major focus for the bank, and HSBC has been enhancing its platforms to create a customer centric, digitally enabled service. Allowing customers to conduct their business and manage the way they have contact with the bank, in a way they choose.

As with any other medium, customer experience is of the utmost importance: “We want to know our customers and their digital behaviour so we can deliver the best service and products to them,” added Yuen. “We have recently enhanced our platform and website. We will continue to improve our digital capabilities and mobile journey to make them simpler and easier for customers to use and navigate.” Yuen continued: “From time to time, we revisit the tools used by our branch staff and capture new technology – for example tablets with special purpose apps, which should serve to save time, paper and generally improve the customer’s in-branch and online experience.”

Knowing that customers appreciate the convenience of buying products online and on mobile, HSBC is constantly looking at new products that could be made available online. Already, the company sells more travel insurance online than it does through any other channel, and making more products and services available online means that customers can set about conducting their affairs in whatever way they want, whenever they want. However, while there are opportunities, there are also challenges for HSBC.

The challenges of regulatory change and the ever competitive landscape warrant attention. According to HSBC Hong Kong, the best answer to these challenges is to simply revert back to the most basic of principles, otherwise defined as the group’s purpose, which consists of connecting customers to opportunities. “We all need to stay focused, take ownership and be at our best for our customers and deliver the best experience we can.”

Looking at Hong Kong’s prevailing trends, HSBC notes that much of the opportunities will lie in health products, protection and wealth management products, with digital playing a key part too, as an ageing population increases demand for filling retirement and protection gaps and technology gives rise to rapid changes in customer behaviour. “As a prudent insurer, we have been monitoring these trends in order to set our short, medium- and long-term plan and make sure we adapt to the changing needs of our customers,” said Yuen.