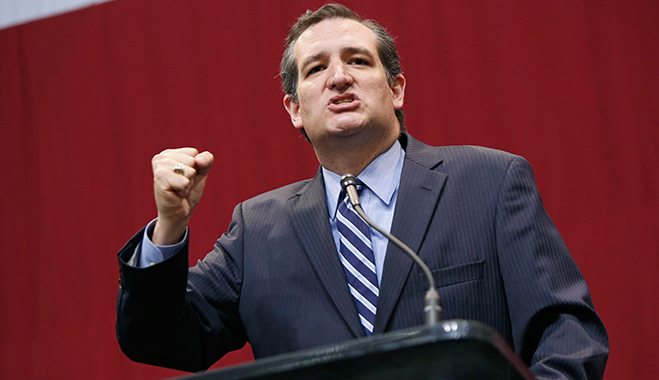

Other than a brief lull in the 1890s, Americans have been paying into a progressive tax system since 1862. That those with the broadest shoulders should carry the heaviest tax burden became a fixture of the American state in the early 20th century. If Ted Cruz, the first Republican to announce his presidential candidacy for 2016, has his way, this would all change. In his candidacy announcement at Liberty University, he floated the idea of instituting a flat federal-tax rate in the United States. This would mean that all Americans, regardless of income, would pay the same percentage of income tax. Tapping into American resentment at the complicated nature of their tax codes, Cruz promises such flattening to simplify revenue collection. The presidential hopeful claimed that a flat tax would allow “every American to fill out his or her taxes on a postcard,” a reference commonly repeated by flat tax advocates. Flat tax proposals have been a recurring feature in American presidential races since the 1990s, despite its questionable economic benefit.

It seems unlikely that Ted Cruz will win the Republican nomination, but even among more hopeful (unannounced) candidates, [the idea of flat tax] remains popular

The rise of the flat tax

In the United States the idea of a flat tax has increasingly become a plank of American conservative platforms. Opposition to progressive tax measures is not something new. In 1866 Republican Representative of Vermont Justin Morill claimed that progressive taxation “can only be justified on the same grounds as a Highwayman defends his acts”. But it was in 1962 that Milton Friedman, in his Capitalism and Freedom, first popularised the idea of a flat tax among what would become the American New Right. While Friedman managed to hold the ear of the Reagan administration with his ideas about monetary policy and general philosophy of rooting freedom in the freedom of markets, his flat tax advocacy made little headway in the 1980s within national politics. Although progressive taxation was “once denounced by Reagan as the invention of Karl Marx,” says Iwan Morgan, Professor of United States Studies at UCL’s Institute of the Americas, the Reagan Presidency “left a legacy of a two-band tax system of 15 and 28 percent on incomes.”

A flat tax first started to be touted in American national politics in the 1990s. In 1992 hopeful Democratic presidential nominee Jerry Brown became the first serious advocate for a flat tax, which was embraced by both the left-wing New Republic and right-wing Forbes magazines. Various other American politicians, from both sides of the bench, went on to propose various flat tax schemes. Most significant was Steve Forbes’ advocacy of a flat tax in his 1996 Republican campaign. As the American Prospect notes, soon after a flat tax became the “default option for [Republican] candidates.” So far this reached its apogee in the 2012 presidential race, which, according to Morgan, “gave the idea the most thorough airing in recent times – especially Herman Cain’s 9-9-9 tax idea.”

Render unto Creaser

Although flat tax ideas have, since the Forbes presidential candidacy, been consistently floated by Republican candidates, no flat taxer has yet had the perilous task of instituting such a scheme. The current progressive tax system has a graded rate of tax between 10 percent and 39.6 percent and any flat tax would have to find a rate somewhere between these two figures. According to the editor of the Left Business Observer, Doug Henwood: “the effect would be to turn a now moderately progressive scheme (at the federal level – most state tax systems are regressive on balance) into something that would disturb even Adam Smith.”

A flat rate of, say, 20 percent (which is advocated by Texas Governor Rick Perry) would result in a tax hike for those in the 15 percent tax bracket of $8,926 to $36,250. Someone earning $30,000 pays 13.46 percent of their income in taxes; a jump to 20 percent would be crippling. There are provisions for low income earners such as Earned Income Tax Credits. Yet unless EITC – which is determined by income and dependents – and other provisions were to increase along with the increased tax burden, a significant amount of citizens in this tax band would see their income decline.

Tax rates in America are marginal, meaning that the tax-payer only pays the tax rate they are in on income earned above the top end of the tax bracket below them. Someone in the current 25 percent tax band that earns $50,000 per year would see their actual tax contributions spike from 16.59 percent to the flat 20 percent figure. Anyone earning up to around $82,000 would suffer a tax climb. The overall result would be a decline income for Americans on low to medium incomes, the much vaunted and now struggling American middle class. As Dean Baker, Co-Director of the Center for Economic and Policy Research, notes, “If the tax is, in fact, revenue neutral then it would inevitably mean a large increase in taxes on the middle class to cover the cost of a sharp reduction in taxes on the wealthy. Presumably the bottom bracket will be set high enough so that the poor will be little affected.”

Any flat tax scheme which would see top earners benefiting from a tax cut, meaning tax revenues would take a serious hit. When American liberals propose higher taxes for the rich, the rejoinder of conservatives is often to point out the high amount of tax that higher income earners pay compared with the rest of the taxpaying population. For instance, the top 1 percent of earners in America paid 24 percent of all Federal Income Tax generated in 2011, while the top 10 percent paid 68 percent. Taking into account just the top one percent, with their contribution to tax revenue constituting nearly a quarter, the result of this on revenue is not hard to see. Top tier earners pay the top tier income tax rate of 39.6 percent. Under a flat tax scheme of 20 percent this rate would result in a significant tax cut for this income group, resulting in a shrinking of revenue; much to the detriment of debt-ridden America.

In the long run…

Of course flat tax advocates are not ignorant of such objections. The flat tax, they argue, will ultimately lead to economic growth, benefiting even those who would have a higher portion of their income gobbled up by the flattened-leviathan and filling tax coffers. The first argument is that by removing the supposed disincentive to earn more, America’s economy would see growth in the long term. People would no longer be discouraged from earning a higher income for fear of entering into a higher tax band. Relieved of the structured-leviathan, the productive potential of workers will be unleashed. However, the opposite is the case says James Livingston, Professor of History at Rutgers University. According to Livingston, a progressive and redistributive tax system creates “equal opportunity [which] ignites ambition and initiative… as every political regime in this country has recognized since Thomas Jefferson was elected in 1800.”

The argument is based on the idea that some citizens are supposedly loitering at the top end of their tax bracket, waiting to have their ambition liberated. That may be the case for some, but more significantly the American economy is suffering from a severe lack of aggregate demand; the potential benefit of loiterers-turned-strivers would most likely be cancelled out by the fall in consumer spending among lower to middle income earners – those who possess the largest marginal propensity to consume and who would take the biggest hit from the flat tax.

The resulting tax cut for higher earners is also said to result in economic growth through giving top earners more money to invest. A flat tax, governor Rick Perry wrote in 2011, “Provides employers strong incentives to grow and create millions of jobs”. According to this restatement of trickle-down economics, if higher earners have less of their income paid to the federal government, they will have more to invest in business, boosting economic growth to the benefit of all. This asks the majority of Americans to take a hit to their income with the promise of economic benefits in the long-term, which may or may not accrue.

There is one clear benefit to the flat tax: simplicity. America’s progressive tax system, with its list of different marginal rates and breaks, is incredibly complex. The present tax code is nearly four million words long. A flat tax would simplify this, making tax returns easier for citizens and closing loopholes more viable for the government. This point is made by Jacob Sullum, Senior Editor at Reason magazine: “A simpler, flatter tax would make compliance easier and less expensive while reducing the distorting impact that the tax code has on economic decisions, whether by driving people toward politically favoured investments or by encouraging inefficient tax avoidance schemes.”

While the simplicity of a flat tax is alluring, it is a red herring. There are real benefits to a simplification of America’s byzantine tax code, but a flat tax would exacerbate the main trouble with the American economy: low wages and inequality. The real problem plaguing the American economy is on the demand side. A flat tax would see tax rises for people in lower tax brackets, eating into their income and eroding their marginal propensity to consume.

It seems unlikely that Ted Cruz will win the Republican nomination, but even among more hopeful (unannounced) candidates, the idea remains popular. Jeb Bush has expressed his openness to the idea, while Mike Huckabee is a long term advocate, as is Rand Paul, known for his economic libertarian stance. Marc Rubio, another Republican seen to be a potential presidential contender for 2016, advocates for a two-tier tax system, yet opines for an “ideal world” where a flat tax could exist. Despite the inevitability of a flat tax resulting in a tax rise for many Americans and a fall in tax revenues, for the GOP the flat tax remains an enduring dream.