Stock exchanges can be considered a motor for economic development. In Africa, the number of bourses has grown from five to 25 in just 20 years, as its economy and the need for regulated stock markets has grown. At the cusp of what could be one of the biggest economic booms yet to be seen, the continent is developing its financial infrastructure like never before, yet the overall sector is lacking, and stock exchanges in particular need to step it up.

Issues such as transparency, lack of technology and a surprisingly small amount of IPOs are all contributing to inefficient and ill-equipped stock exchanges across the region. There is an opportunity here to seriously contribute to Africa’s economic development, and industry experts are calling for governments and stakeholders to focus on stock exchanges and get them up to par.

Companies listed on stock exchanges:

1,000 approx.

Sub-Saharan Africa

1,700 approx.

India

3,500 approx.

China

Emphasis on African stock exchanges is even more pertinent now as the region is seeing a growing demand for new issues. Over the last three years, valuations achieved through private equity exits in Africa via a stock market listing, yielded a higher return than could have been achieved in any private transaction, proving that investments in African listed firms are paying off like never before. What’s more, the amount of investors looking to invest in African small-, medium- or large-cap funds is growing as this market continues to develop. Yet the number of listings is lower than comparable regions, with just over 1,000 listings in Sub-Saharan Africa, but 3,500 and 1,700 firms listed in India and China respectively.

Exchanges must step up

This provides challenges to tapping into Africa’s impressive growth. The region’s GDP grew by 57 percent on a purchasing power parity basis between 2005 and 2012 (see Fig. 1), slightly ahead of Brazil and Russia, and markedly ahead of developed economies like the US and Japan, which only grew around 20 percent. However, Africa’s growth lags behind that of China and India, which doubled the size of their economies over this period. According to experts, this comes down to the lack of access to listed equity in Africa.

“Ideally, investors in listed equity look for markets with high liquidity, many listed companies and high standards of governance. In many African markets, not all of these criteria can be met,” explains Rory Ord, the Head of RisCura Fundamentals, an African valuation service-provider.

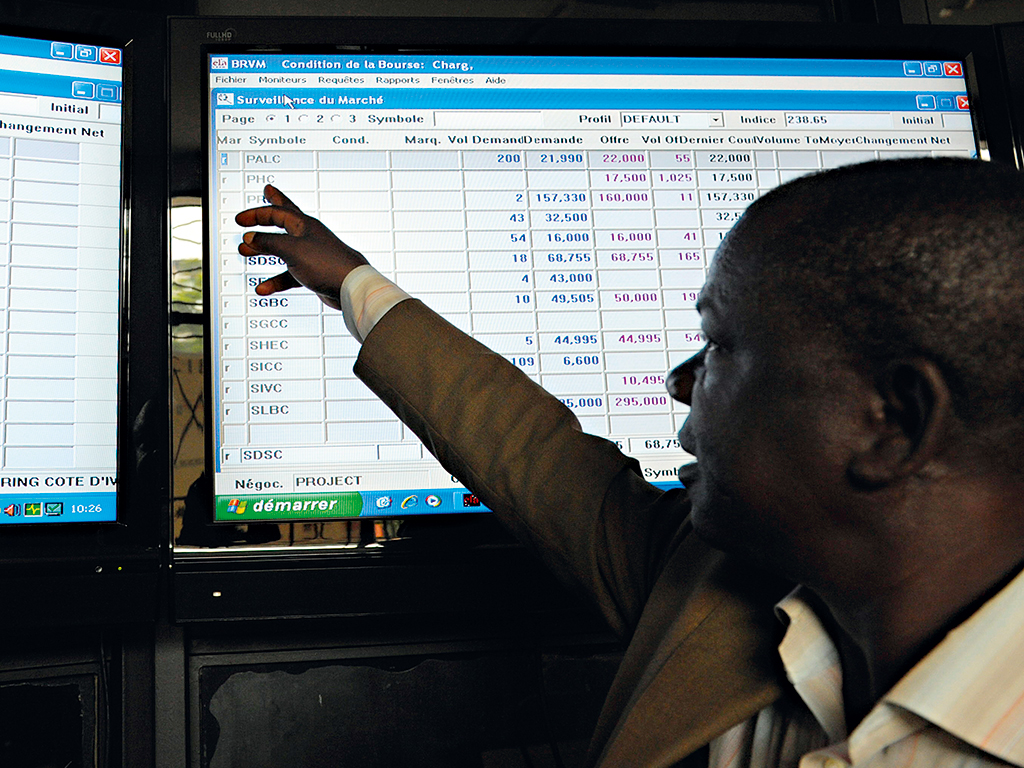

One key issue is that African stock markets are often dominated by a handful of large corporations. For example, the Dangote Group makes up about 30 percent of the Nigerian Stock Exchange, the Rwandan stock market has only three listed companies and trading in shares is less frequent and limited to a few firms. This stands in stark contrast to Nigeria being Africa’s largest and fastest-growing economy. What’s more, many bourses do not have access to reliable and up-to-date information technology; in some, trading is done manually and in many cases, the general public does not have confidence in the integrity of stock exchanges.

“There are issues that certainly require attention – primarily, the enforcement of reporting quality, timing and frequency. Secondly, some exchanges are slow to adopt modern technology, which hampers the transparent price discovery mechanism, as some exchanges are still using open outcry. Lastly, restrictive trading times prevent investors from fully taking advantage of changing market information,” said Alain Nkontchou, Managing Partner at the Johannesburg-listed asset manager, Enko Capital.

More IPOs needed

The lack of African listings is largely thanks to the high financial costs associated with going public, such as initial and annual listing fees, as well as the direct and indirect costs that come with meeting exchange reporting deadlines and disclosures. What’s more, a lack of information on the advantages of listing and concerns about losing control have made many entrepreneurs wary of disclosing business details and ceding control.

“A limited number of listings in various African markets means that fund managers have a small number of promising shares to invest in. This leads to a lack of diversification of portfolios, and regional and sector concentration of assets. In addition, we have seen price distortions on liquid securities given the dearth of investable stocks,” says Nkontchou.

Because of this imbalance in the supply and demand of new issues, IPOs present a good opportunity for African entrepreneurs and for the growth of the stock exchanges on the continent. Statistically, most new listings in Africa perform well and are heavily over-subscribed, as investors continue to flock to the few listings made. Thus, it may prove crucial to change practices in African stock exchanges to attract foreign investors.

“In practice, investors use a combination of listed and private equity investments to fill their African equity allocations. This is expected to continue for the foreseeable future as an effective way to gain exposure to Africa’s growth potential,” explains Ord.

The bourse boost

Criticisms aside, there is strong evidence that a stock market can be an essential part of a developing economy. Studies by the IMF concluded that, supported by the right policies and reforms, stock markets can help African companies expand operations, contributing to economic growth.

Regulators therefore need to ensure that there is an organised, efficient market where the governance standard and permission requirements are on par with international standards. In this respect, experts suggest that fostering better grounds for listing in the African market will boost capital inflows into the region’s economies.

For instance, raising equity finance via the capital market is often considered more profitable than capital raising in private market groups. As such, African entrepreneurs could be motivated to list their businesses if they were made aware of the access to capital – this again would boost the economy.

“Companies are the backbone of economic growth as they drive output and create jobs. Hence, the ability of companies to access growth capital is paramount for increasing employment, domestic spending and investment, resulting in increased GDP,” says Nkontchou.

What’s more, listings enhance transparency and promote good governance, as IPOs subject companies to scrutiny and exposure – another criterion desperately sought after by investors.

Large-scale solutions

Large-scale solutions

Luckily, environments favourable to the growth and improvement of bourses are beginning to take root in Africa. Political stability is increasing inside many countries, including Liberia, Sierra Leone and Côte d’Ivoire, while sound economic policies and accountable institutions are slowly but surely being implemented in key economies such as Nigeria and Kenya. According to the World Bank’s 2013 Global Economic Prospects report, this political stability, as well as higher commodity prices and improved macroeconomic stability, has prompted increased investment flows to Africa. Rwanda, for instance, is now one of Africa’s fastest-growing economies, thanks to its pro-business policies and a positive investment climate.

In comparison, countries with high levels of risk, which may have weak investment laws or lack appropriate financial institutions, are not gaining the same favour with international investors. Uncertainty over the direction of its economic policies has seen the previously booming Zimbabwe Stock Exchange shrink in both size and value. As such, local governments need to weigh the cost and benefits of policies in order to relax principles such as fees, which will allow more international investor participation, while holding on to and enforcing those rules, which are necessary to ensure transparency and economic growth.

“There are certain exchanges that we prefer on the basis of liquidity and market depth, political and economic stability within the countries, and information availability, reporting quality and reporting requirements. In addition, currency stability plays an important role in how an investor views a certain exchange. For example, the trading currency for the BVRM regional exchange is the CFA franc, which is pegged to the euro, and hence more stable than several other local currencies,” explains Nkontchou.

And the creation of regional stock exchanges might be just the thing. With the small size of African stock markets and the absence of liquidity often cited by foreign investors as a major impediment to investing in the region, merging smaller exchanges into regional ones could improve liquidity and make stocks available to a wider range of investors.

Africa currently has two regional bourses serving West and Central African countries, which hold more listings than comparable economies like Libya and Cameroon. With the region poised to see explosive growth, some countries have enforced regulatory frameworks, specialised human capital, and advanced technology such as Nigeria’s X-Gen – the fastest trading platform within the African continent. Others still lag behind. With the potential to tap into an unprecedented economic surge, now is surely the time to introduce regional exchanges that give access to the more developed infrastructure of neighbouring countries.