For a product so heavily relied upon the world over, technological innovation in the car industry has moved at an almost glacial pace over the last century. Car manufacturers have made small and superficial changes to the capabilities of their vehicles every few years, but ultimately the product has always been the same: a gas-guzzling, manually operated form of private transportation.

However, many observers think that the next decade could see it change beyond all recognition. New technology, changing user habits, and a swathe of new entrants could dramatically change the face of an industry that has been dominated by a small number of firms for around a century.

In 1914, Henry Ford revolutionised the car industry by creating an assembly line that dramatically reduced the cost of vehicle production, and the market became mainstream. Suddenly cars became an essential part of everyday life throughout the world, revolutionising mass-transport. However, since then there has been little in the way of innovation, save for a few superficial concessions to comfort and speed. At the same time, cars have continued to spew toxic fumes into the atmosphere. With the world slowly coming round to the idea of cleaning itself up, the car industry has been challenged to develop a more sustainable method of operating.

Unprecedented challenges

The slow reaction to innovation by the industry comes at a time of considerable breakthroughs in technology. Many feel that it is outside influences that will really shake up the auto industry, and that the next few years could see a dramatically different market to what exists now.

New entrants into the market are sure to make waves in the auto industry

A number of recent reports have predicted how the car industry will look in the not-too-distant future, and what challenges there are for the industry’s leading manufacturers. In a report by global accountancy firm PwC published last year, the company said that despite recent years of record growth – not least in China and the US – the automotive industry was facing “unprecedented challenges”.

“New technologies are dramatically changing vehicles, from the advent of the ‘connected car’ and enhanced driver support to better fuel efficiency and new or improved powertrains. Automotive manufacturers and suppliers are confronted with ever-greater complexity as a result of increasing numbers of products and options, shorter technology cycles, increasing pressure to innovate and global supply networks. And at the same time they need to balance the needs and demands of customers, investors, regulators, non-governmental organisations and even the general public.”

In October last year, management consultants McKinsey published a note on the future of the auto industry, explaining the various challenges that manufacturers will face in the coming years. Alongside predictions of further geographical shifts in production and demand towards China, the company suggests there will be a number of technological innovations that will radically change the industry.

Electric avenues

Cutting the emissions of the industry and slashing the cost of powering cars has been the leading concern for many manufacturers. While Toyota’s Prius range of hybrids have proven popular in some markets, other manufacturers have been slow to adopt sustainable technologies. However, many see fully electric cars that don’t rely on petrol as the future of the industry.

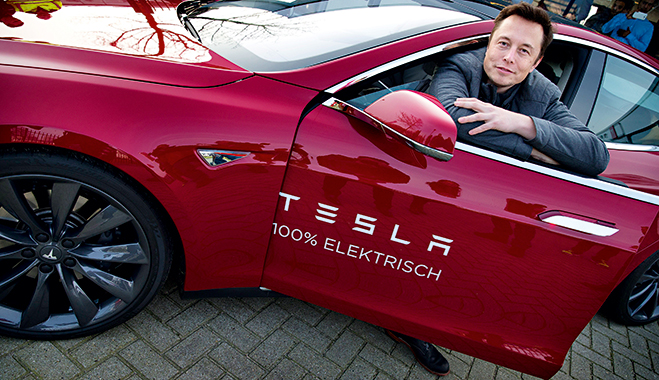

The leading proponent of electric car technology has been Tesla, the firm founded by US entrepreneur Elon Musk. Such has been his determination to see the technology take off that he has even offered his company’s patents to rivals for free in order to speed up adoption of electric cars.

Electric cars have been discussed for a number of years as being an extremely attractive, low carbon emitting form of personal transportation. But for a number of reasons the technology has taken longer to take off than many had expected, with existing car manufacturers not taking electric cars seriously. Musk lamented last year, “I was hoping other companies would engage more in serious electric car programmes.”

As a result, Musk announced in June last year that all of the company’s patents would be made freely available. In a statement, Musk said his ultimate goal was to speed up the adoption of sustainable transportation, rather than make a profit. “Tesla Motors was created to accelerate the advent of sustainable transport. If we clear a path to the creation of compelling electric vehicles, but then lay intellectual property landmines behind us to inhibit others, we are acting in a manner contrary to that goal. Tesla will not initiate patent lawsuits against anyone who, in good faith, wants to use our technology.”

He added that while Tesla had initially created patents for its technology because they worried rival manufacturers would see the potential of the electric car; in reality few of the big carmakers had invested in developing their own versions. “We felt compelled to create patents out of concern that the big car companies would copy our technology and then use their massive manufacturing, sales and marketing power to overwhelm Tesla. We couldn’t have been more wrong. The unfortunate reality is the opposite: electric car programmes (or programmes for any vehicle that doesn’t burn hydrocarbons) at the major manufacturers are small to non-existent, constituting an average of far less than one percent of their total vehicle sales.”

The technology Musk has been particularly eager to see manufacturers adopt is his Supercharger system that powers the vehicles. The main criticism of electric cars is the necessity to charge them far more frequently than a traditional car would require refuelling. Musk hopes that as adoption of the technology increases, other manufacturers might be able to help develop better performance and a wider network of charging stations. A lack of infrastructure for the technology means that remote parts of the world would be off limits for electric cars that need to be charged regularly.

Power problems

Speaking to our sister publication The New Economy last year, John Gartner, Research Director for Smart Transportation at Navigant Research, said that the lack of a standard for charging was holding the electric car industry back. “The electric vehicle industry has thus far developed two competing fast direct current (DC) charging standards, through the Society of Automotive Engineers and the CHAdeMO standard originating from the Tokyo Electric Power Company (TEPCO). The Supercharger technology, while providing faster charging than has currently implemented by these standards, would have to be evaluated for its impact on the battery performance of competing electric vehicles, and this would take several years to determine if it is compatible.”

He added that an offer like Tesla’s could prove attractive to other car manufacturers that have yet to settle on a charging technology. “Automakers and electric vehicle charging companies would likely would be hesitant to support a third charging technology given the additional vehicle equipment cost, infrastructure cost in deploying more chargers, and potential for confusion in the marketplace for consumers from adding a third option for public electric vehicle charging. A single charging standard would be optimal to grow the electric vehicle market, but this will take many years given how fractured the market is today with hundreds of public DC chargers already in place.”

While Tesla has been leading the way in the electric car market, traditional manufacturers have finally started to look at the technology themselves. General Motors is the leading manufacturer of plug-in hybrid cars, with its Chevrolet Volt particularly popular in the US. Toyota continues to offer its popular Prius range, while Nissan is the biggest manufacturer of pure electric cars. Ford has also launched its own cross-over brands of electric and hybrid cars.

BMW launched its electric car range – BMWi – in 2011 and has gone on to offer a couple of vehicles. By the end of last year, the company had sold short of 18,000 models, with the US as the biggest market. However, critics have derided BMW’s electric car efforts, hailing them as the ugliest vehicles the company has ever made. While it has been the first major high-end car manufacturer to delve into the electric car market, other firms have also been looking to take the leap into using the technology.

Luxury car manufacturer Porsche – owned by Germany’s Volkswagen – was in March said to be developing its own form of sustainable, electric car. It’s thought to have targeted 2020 as the year in which it wants to debut a new model to its car line-up, and CEO Matthias Mueller has recently been effusive with his praise for Tesla, telling a conference in Stuttgart: “Tesla has built an exceptional car. They have a pragmatic approach and set the standard, where we have to follow up now.”

Connected cars

While relatively small firms like Tesla have carved out a niche for themselves in the auto industry, it is the potential for much bigger new entrants like Apple and Google that could turn electric cars into a mass-market proposition. Google has been experimenting with driverless cars for a number of years, and has been testing its technology on the streets of California recently.

Apple, however, is the company that many think could act as the biggest disruptor in the car industry. The extremely secretive tech giant has not made any official confirmation of its plans to make its own car, but rumours began to swirl in January when a number of mysterious cars fitted with cameras and sensors took to the streets of Cupertino, where Apple is based.

There then emerged reports that Apple had put together a team of more than 1,000 employees dedicated to its electric car project. These included a number of key figures poached from the likes of Mercedes and BMW. There were even rumours, in the last 12 months, that Apple executives had met with Elon Musk over a potential acquisition of Tesla.

Nobody quite knows what Apple plans to offer with its new car – whether it is a self-driving vehicle or just an electric car. However, a company with such financial clout is undoubtedly going to create waves in the industry.

It would not be Apple’s first foray into the auto-industry, although it would be the company’s first attempt at actually building a car. Apple currently offers its CarPlay service to manufactures that helps drivers connect their iPhones to their vehicles and enabling a wide range of services. Such innovations aren’t new, but are a step towards simplifying how cars are connected to the web and people’s other digital devices.

McKinsey says that soon cars will be far ‘smarter’ than currently. They will be aware of their surroundings, able to communicate with other cars, and able to seamlessly work with a users’ other digital devices. “The car of the future will be connected – able not only to monitor, in real time, its own working parts and the safety of conditions around it but also to communicate with other vehicles and with an increasingly intelligent roadway infrastructure. These features will be must-haves for all cars, which will become less like metal boxes and more like integrators of multiple technologies, productive data centres – and, ultimately, components of a larger mobility network.”

Another direction the industry will likely head is towards autonomous cars. Google has long been experimenting with self-driving cars, with the ultimate goal of removing the need for a user to drive the vehicle, freeing them up to use their time more productively. While this might prove attractive to people unable to currently drive or busy workers trying to cram in an extra bit of productivity to their day, persuading driving enthusiasts might be harder. And there will be substantial safety issues around the use of such cars.

It’s not just Google that has been researching the technology, however. Mobile taxi firm Uber recently announced it would be investing in a robotic research facility in Pittsburgh that would help it built its own self-driving cars. The company’s move into the area is an interesting proposition, particularly for people who believe the days when people owned their own cars are numbered.

According to some, people will likely rent vehicles or share them with other users in the future, instead of owning their own cars. McKinsey believe that so-called millennials have far less attachment to ownership of cars as services like Uber and Lyft increase in popularity.

Driving innovation

New entrants into the market are sure to make waves in the auto industry. Companies like Tesla, Apple and Google could seriously disrupt an industry that has for years been dominated by the same sprawling international companies, by innovating at a rate traditional manufacturers have seemed reluctant to match before. In order for these manufacturers to stay on top, they need to speed up their research and development into new technologies.

PwC says investing in future technologies is an essential strategy for all car manufacturers if they want to remain relevant. “To avoid being innovated out of relevance, all suppliers – even those currently leading their markets – need to continually look ahead to future developments. New powertrains, new materials, new vehicle concepts or architectures – all of these trends are already changing the structure of the supplier industry. That’s a big opportunity for suppliers – but a risk too. New market entrants could threaten growth. The innovation playing field in automotive has gotten bigger than ever – and suppliers need to find their place on it.”

However, while the likes of Apple and Google can certainly bring a fresh approach to a somewhat staid industry, traditional manufacturers are still better placed to hold onto their market share in the future. They already have the manufacturing infrastructure and capabilities required for the mass production of cars, while such an undertaking could prove incredibly difficult for a tech firm. Building and shipping cars on a mass scale is somewhat different to developing web services or selling smartphones.

What may prove the most likely course is one of collaboration between tech firms and car giants. Indeed, such a situation has been rumoured recently in Germany with reports that Apple and BMW were discussing partnering up to build a potential Apple Car to challenge Tesla and remodel the German firms unpopular i series of cars.

Some in the industry have even welcomed the entry of tech giants. Fiat-Chrysler’s CEO Sergio Marchionne told the BBC in March that both Apple and Google were “incredibly serious” with their car intentions, and that it would shake up the industry. He added that such a disruption should be welcomed. “I think their interest is exactly what this industry needed. We needed a disruptive interloper to shake things up.”

Marchionne added that despite the news of tech giants looking to enter the auto industry, traditional manufacturers are more than capable of remaining relevant. “Don’t underestimate carmakers’ ability to respond and adapt to new competitive challenges.”