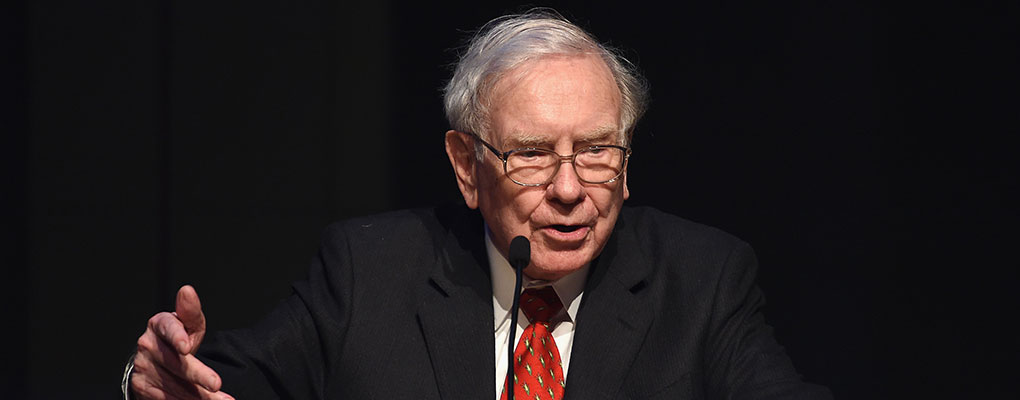

Warren Buffett’s appetite for deals doesn’t appear to be waning with age after news emerged that his investment vehicle, Berkshire Hathaway, is set to acquire aerospace manufacturer Precision Castparts for roughly $30bn. It would be the largest ever deal conducted by the 84-year-old Buffett.

The deal represents a change in focus for Buffett’s firm, which is set to continue looking at acquisitions in the coming months

The deal represents a change in focus for Buffett’s firm, which is set to continue looking at acquisitions in the coming months – as opposed to stock investing or insurance, according to The Wall Street Journal. Having previously grown the business through insurance, Berkshire Hathaway has been steadily moving towards M&A deals in recent years. These have included a wide range of firms from different industries, including clothing company Fruit of the Loom, brick manufacturing Acme Building Brands, utility company MidAmerican Energy Holdings, and press agency Business Wire.

Last year, Berkshire Hathaway announced a $4.7bn deal to buy battery-maker Duracell from Procter & Gamble, while it also holds investments in some of the world’s leading companies, including Coca-Cola, American Express, IBM, Wal-Mart, Wells Fargo, Goldman Sachs and Moody’s Corporation. Berkshire Hathaway’s previous record deal was the 2009 acquisition of Burlington Northern Railroad, which cost $26bn.

Precision Castparts represents a considerable outlay for Berkshire Hathaway – although with annual profits of $1.5bn and revenues of $10bn, it will certainly add to the group’s growth prospects. It’s thought that Buffett has pushed ahead with the deal because he sees aerospace firms growing their business thanks to the continued increase in orders from airline companies.

In a note to investors earlier this year, Buffett set out his plans to buy up more companies. Discussing the $4.1bn purchase of US car dealership group Van Tuyl in March, Buffett talked of how he was continuing to look towards M&A. “With the acquisition of Van Tuyl, Berkshire now owes nine-and-a-half companies that would be listed on the Fortune 500 were they independent (Heinz is the half). That leaves 490-and-a-half fish in the sea. Our lines are out.”