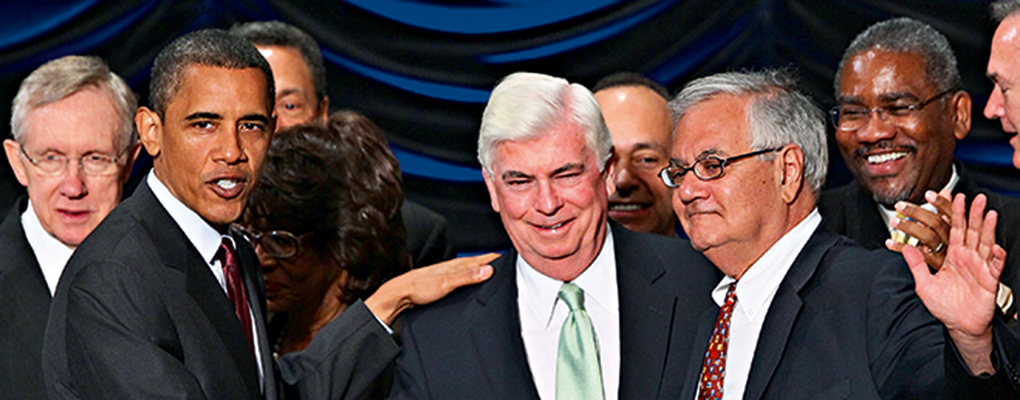

The Dodd-Frank Act was signed into law by the Obama administration in the summer of 2010. The aim was to try and curtail extreme risk-taking that had become rife in the over-the-counter (OTC) derivatives market and, in so doing, attempt to prevent a repeat of the financial crisis two years prior. The legislation established a number of new government agencies, such as the Stability Oversight Council and Orderly Liquidation Authority, which now work to ensure institutions that are deemed ‘too big to fail’, don’t.

Another key provision from Dodd-Frank was the ‘Volcker Rule’. Paul Volcker argued that more red tape must be placed around banks and financial institutions in order to stop them making high-risk, highly leveraged, speculative investments. Without it, he claimed, not only would financial institutions continue to act in a manner that was to the detriment of their customers, but also that such reckless behaviour would continue, remaining a threat to the stability of the entire US financial system.

Financial regulation such as Dodd-Frank, along with other regulatory proposals in the pipeline, aimed at curbing casino-style banking in the OTC derivatives markets, has made its mark. So far, the reforms have managed to mitigate the risk that naturally arises when transactions are made outside the supervision of regulators, and it has helped to instil “confidence in the financial markets by boosting transparency and liquidity, reducing the opacity of sell-side trading operations and mitigating counterparty concentration,” according to Ebbe Kjaersbo and Justin McBride, chief business consultants at SimCorp.

End of the Wild West

Before the crisis hit in 2008, many financial institutions had managed to build up a ton of unrealised losses by placing highly leveraged, speculative positions within the OTC derivatives market, and because of the lack of oversight – unlike that offered on exchanges – it was impossible to calculate the level of exposure participants had acquired. To counteract this, recent reform has reduced risk by authorising central clearing and pushing for greater levels of capital to act as collateral in derivative trades in a bid to turn the previously unregulated Wild West of OTC markets into something a little more tame. Dodd-Frank also includes a provision that requires market participants to begin executing trades on regulated exchanges or trading screens, which necessitates prices be made public knowledge, allowing regulators to more accurately quantify the level of exposure in the market at any given time.

The need to hedge risk will not change and has not changed

But increased regulation in OTC markets has left a vacuum that must be filled. Traders are always looking for better returns and increased exposure, leading many to shift their focus and move to exchange-traded futures. To help facilitate this mass migration, exchanges have created fresh financial products that offer similar risk profiles to their OTC counterparts, but that are not subjected to the increased regulatory scrutiny brought on by increased regulation.

Products ranging from bundle futures, which allow investors to buy a predetermined amount of futures contracts within each quarter delivery month over the course of two or more years, to future block trades and swap futures have all helped make the transition into exchange-traded futures a no brainer. According to Lael Campbell, Associate General Counsel at Constellation Energy, a subsidiary of US electrical company Exelon, the transition has been smooth: “Everybody in our sector has been very happy with the transition to futures. It has given a lot of people some compliance and allowed them to breathe a little sigh of relief.”

Lack of liquidity

However, not all end-users are quite so happy about the market moving away from OTC trades in favour of exchange-traded securities, because exchange-based products simply do not cater for the nuanced requirements of those with a vested interest in the underlying. Not only do the products fail to meet the demands of end-users, but also, with huge sways of investors scurrying away from OTC markets, as a result of regulatory uncertainty, those who are left are concerned about the lack of liquidity, which is essential for end-users to effectively hedge.

“I hope uncleared OTC derivatives will continue to be an alternative available to end-users,” says Thomas Deas, Vice President and Treasurer of FMC Corporation, a chemical company that hedges its exposure to natural gas prices. “But there are certainly enough regulatory uncertainties that you’d have to say, at this point, it’s in question.”

The real disadvantage of exchange-traded futures for market participants with a stake in the underlying product, who are looking to mitigate fluctuations in price, is the products are standardised: they lack the specialisation afforded in OTC instruments, which have the advantage of being fully customisable. As a consequence, many end-users tend to remain in the bilateral market, but, as a result of the regulatory mandate, these market participants are subjected to increased costs.

The mutualisation of risk

The futurisation of financial markets has also been driven by financial institutions in the US wanting to avoid the clutches of the Commodity Futures Trading Commission rules on OTC derivatives. With so many large firms migrating to exchange-traded futures, it is bound to affect the volumes in the OTC market, again limited end-users capacity to mitigate their exposure.

“What Dodd-Frank required is the mutualisation of risk,” says Chris Scarpati, principal in the financial services regulatory practice at PwC. “So to reduce bilateral relationships is to neutralise risk by requiring certain OTC products to be traded on exchanges and cleared through derivative contract markets or derivative clearing organisations [and] the only way to do so, is with [financial] products that are very standardised. Today, simple vanilla interest rate swaps and simple credit default swaps are relatively straightforward and offer standard terms, which lend themselves to be cleared. However, some of the more bespoke products out there continue to remain bilateral and quite frankly will remain that way. Clearing those instruments would present a challenge to the clearing house.”

This is not to say end-users are left without an effective means of hedging their portfolios. A derivative instrument is used to protect against a certain risk profile and, whether that is someone who is looking to buy credit protection by purchasing futures to limit their exposure in the market place or by through acquiring an OTC forward contract, both are merely tools for hedging risk.

The real challenge comes when moving OTC products onto exchanges, which requires standardising those products, making the task of hedging with one financial instrument almost impossible. This leads to market participants who have a stake in the underlying tending to rely on the bilateral market provided by OTC derivatives. However, as mentioned, with the new regulatory framework driving up the cost of doing business in such markets, along with increased capital and margin requirements needed to safeguard the incidences of risk-taking, both liquidity and volatility are bound to be negatively affected.

“I think the regulations have caused firms to take a deeper look at their businesses and they are probably providing less liquidity, as I am sure they have got out of certain businesses,” says Dan McIsaac, Director of Financial Services, Regulatory Risk Practice at KPMG and former chairman of the SIFMA capital committee.

“Before, they would have done them, possibly as a loss leader, but as the margins get smaller, you have to make some decisions about what markets are not profitable to be in. I think you will see firms that may back away from providing everything, to providing what they are most specialised in and, in doing so, provide less liquidity in the market. End-users benefit from centralised clearing, but I think that it comes at the cost of liquidity and finding that perfect hedge. I think there is a trade off and I think the jury is still out on whether the benefits outweigh the cost. It’s a new landscape and it will take time for [market participants] to figure out how to mine this landscape.”

Compare and contrast

The new products made available in exchange-traded futures have been introduced to offer OTC alternatives for market participants deterred by the heavy regulation imposed on the once-unfettered OTC markets. But it is important to not only think about the issue from the perspective of financial institutions and end-users, but also the fact that there is such inconsistency between the way both markets are regulated, despite both OTC and exchange-traded products being so similar in nature.

“The need to hedge risk will not change and has not changed,” says Scarpati. “Whether or not that hedging instrument is done via a cleared or exchanged product or a bilateral OTC product really comes down to the economics of each instrument and the specific risk one is looking to hedge. Has volume in one market outshone volume in another market? The answer is that it depends from market to market. But what I have seen is a continual general uptick in cleared products, both from an interest rate swap perspective as well as a credit default swap perspective.”

The need for customisable products means OTC products will always be in demand because of the flexibility they offer, making them a great tool for those participants that are looking to hedge against a very specific risk profile. Since the inception of Dodd-Frank – the implementation of which has been swift – there has been significant change to the regulatory landscape, leading to uncertainty from those involved in OTC-traded derivatives on both the buy and sell side. This, combined with stricter rules and the rise OTC alternatives has seen flocks of investors fleeing to exchange-traded futures in order to arbitrage the regulatory inconsistencies present in both markets, rather than purely to avoid the regulation in its entirety.