Planet Earth will be home to more than 9.7 billion people by 2050, following a population jump of 2.8 billion in the past four decades alone. As the global population continues to swell, we are now witnessing the growth of ‘megacities’ – sprawling urban centres with more than 10 million inhabitants – with 33 in existence as of 2018, according to the UN’s World Urbanisation Prospects: The 2018 Revision report. According to the UN, 68 percent of the world’s population will be living in urban areas by 2050, with megacities becoming an increasingly common geographical feature. This rapid urban growth will bring increased demand for housing, workspaces and infrastructure, inevitably resulting in the mass construction of new builds across the globe.

Being able to diversify our activity, from an asset perspective, by penetrating the residential market will help us mitigate downcycles

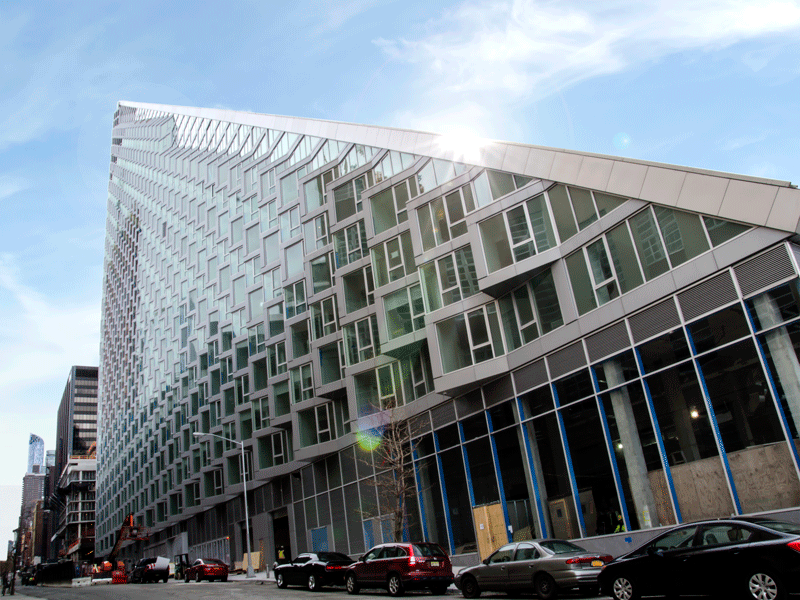

Urbanisation presents a unique set of challenges and opportunities for the global construction industry. With the world’s 20 largest cities currently accounting for over 80 percent of the planet’s energy consumption, there is a pressing need to make our urban spaces more sustainable. Fortunately, the buildings sector has been diligently developing innovative products and exciting new technologies to significantly reduce both consumption and emissions, signalling a new, sustainable era for the global construction industry.

In addition to incorporating energy-efficient solutions, it is imperative that new builds are secure and safe for their future inhabitants. From the devastating wildfires across Greece to the recent flooding in Japan, the extreme weather events of the past year have served as a reminder of the importance of secure, reliable housing. Innovative products such as impact-resistant windows for hurricane-prone areas and low-emissivity (low-e) glass offer crucial protection in at-risk areas, and are increasingly considered an essential element of new builds in such locations. World Finance spoke with Santiago Giraldo, CFO of Tecnoglass, about these promising developments within the industry.

Which trends are currently driving growth in the glass products market?

The construction glass market is currently growing at an impressive rate – it was valued at $83bn in 2016 and it is expected to reach $110.9bn by 2021. The principal factors driving this growth are the demands for energy-efficient buildings and increasing environmental regulations, which are both stimulating significant advances in the industry. Interestingly, the Americas accounted for 19.9 percent of this growth, exhibiting a boom in residential construction projects, hotels and commercial building projects. In the US, we are also noticing increased demand for impact-resistant building materials in hurricane-prone costal states, in addition to new regulations concerning building structures in high-exposure regions.

33

Number of megacities in the world in 2018

9.7bn

Predicted global population by 2050

68%

Predicted percentage of global population living in cities by 2050

Energy-efficient windows are also a major trend at the moment, as they reduce energy needs in buildings while increasing the natural light and visibility of homes and offices. At Tecnoglass, we have focused on investing in research and development (R&D) in order to respond positively to these evolving trends. Our hurricane-resistant glass has earned the company the prestigious Miami-Dade Notice of Acceptance, while our innovative low-e coatings are helping clients to cut energy costs by limiting heat transmission.

How are sustainability concerns shaking up the glass industry, and why are these trends important to consider?

As sustainability becomes an increasingly pressing concern for our industry, companies are investing heavily in R&D so as to meet both evolving consumer demands and environmental-focused legal requirements. Today, companies simply must have defined sustainability initiatives if they wish to remain relevant within the industry. From reducing CO2 emissions to cutting waste material, sustainability efforts are now at the very heart of the construction market.

New technologies and high-security solutions such as low-e glass and fire-resistant windows have begun to reshape the glass industry as we know it. After years of investment in such technologies, Tecnoglass has emerged as a leading manufacturer of high-security glass products, and is forging ahead with innovative sustainable solutions for both commercial and residential buildings. Each year we evaluate our progress in these crucial areas, setting new goals while considering the economic, social and environmental impact of our work. In a demonstration of our commitment to this cause, we have recently joined the UN’s Global Compact programme, which ranks as the world’s largest corporate sustainability initiative. In terms of renewable energy, meanwhile, we have introduced an on-grid photovoltaic system at our production plant. As we inevitably consume a large amount of energy in our operations at Tecnoglass, this solar panel system will revolutionise our energy usage, and is set to reduce our CO2 emissions by 34.3 tonnes over 25 years.

Where is Tecnoglass currently active, and what is the situation in those markets?

Tecnoglass is currently active in the Americas and the Caribbean – with the intention of penetrating the European market. The US and Colombia account for the majority of our present revenues, representing 76 percent and 20 percent of total sales respectively. Tecnoglass’ US activity is largely based in Florida, where we have a dominant presence and about half our backlog.

The US construction market has shown a remarkable recovery since the 2008 economic crisis. As such, the sector now boasts a healthy growth and is expected to expand by about five percent per annum over the next five years. In Colombia, meanwhile, an improved macroeconomic environment has allowed us to capitalise on construction demand in our home market. Following a four consecutive years downcycle of slowdowns in growth, the Colombian economy has now entered a period of recovery, creating a promising environment for the construction industry given ample pent-up demand.

Which new markets will the company look to enter, and what opportunities do they offer?

We see a great opportunity for further penetration into the lucrative $25bn US market, seeking to build on the crucial foothold we have made in Florida. Over the past two years, we have embarked on an ambitious expansion plan, launching projects into the Northeast, Texas, and the West Coast, and will continue to pursue further diversification into 2019 and beyond. Given our efficient access to the western US through the Panama Canal, this region represents a promising new market for Tecnoglass as well as expanding into other foreign markets. Given this successful penetration and our expansion into the residential market, we expect to see our US sales continue to grow during the remainder of 2018.

These efforts to diversify into new markets will help us mitigate the effect of construction cyclicality in a specific country or region, given that construction cycles vary across markets.

How do construction cycles influence the glass industry?

Demand for architectural glass tends to be cyclical, largely driven by residential and commercial construction activity. Being able to diversify our activity not only from a geographical point of view, but also from an asset type perspective by penetrating the residential market will greatly help us mitigate downcycles. Over the course of its 30-year history, Tecnoglass has proven to be remarkably resilient to cyclical economic downturns. Thanks to our established presence in diversified markets in different regions of Latin America and the US, the company has managed to successfully reduce its cyclical risk. For instance, the company grew its revenues by almost three times from 2007, prior to the mortgage crisis, to 2013 after emerging from it.

What milestones has Tecnoglass achieved so far in its history?

Tecnoglass represents a Case Study by growing from an artisanal business into the only Colombian company listed in the Nasdaq stock exchange and one of the main players in the architectural glass space in a market as demanding as the US. Being listed on Nasdaq has significantly increased our exposure and reputation within the US and Latin America as whole. This has driven Tecnoglass to invest in new technology to meet the demands of new clients and tendencies to be at the forefront of the industry. In 2016, Tecnoglass shares also started trading on the Colombian stock exchange, Bolsa de Valores de Colombia, and later in the year we acquired the Florida-based distribution company ESWindows, in a move that demonstrated our commitment to the US market. Following this, 2017 was a crucial year for the company with the acquisition of GM&P, a glazing company focused on engineering and installation, which further allowed us to penetrate the US market and become a fully vertically integrated company toward the client. We are looking to new frontiers by opening offices in South America and Europe in order to further expand our presence.

How did the acquisition of GM&P play into your strategy?

Based in Florida but boasting a strong presence in Texas, the West Coast and the south-east, GM&P was Tecnoglass’ largest client prior to the acquisition. Given its established position in the US market, the deal enabled Tecnoglass to expand into previously unpenetrated regions beyond Florida. What’s more, GM&P’s extensive network of customers provides Tecnoglass with a wealth of new opportunities.

After one year of operations, we can happily conclude that this acquisition has far exceeded our initial expectations. The deal has provided enhanced vertical integration and streamlined distribution coordination, allowing Tecnoglass to become a real one-stop shop for customers.

How is Tecnoglass’ business strategy designed to cope with the challenges currently facing the industry?

One of the major challenges facing the glass industry is the rise in aluminium prices prompted by US-imposed tariffs on various metals. However, given that Colombia accounts for just 0.1 percent of US aluminium imports, Tecnoglass and other Colombian manufacturers are hopeful to eventually be exempted from these tariffs. We are keeping an eye on how this situation plays out, but in the meantime, sales are up for the entire sector and all players within the industry are taking advantage thanks to the strength of the overall economy.

For Tecnoglass, another challenge is maintaining sustainable growth in an increasingly competitive market. We hope to sustain our competitive advantage through consistent investment in R&D, innovative new products and increased geographic diversification. We are focused on continuous improvement across all aspects of our business, and we believe that our vertically integrated operations position us for continued success in the years to come.

We are constantly updating our business strategy and streamlining initiatives to achieve our vision – to be a worldwide leader of high-quality architectural products and innovative solutions for a sustainable future. Supported by a team of highly trained and motivated employees, Tecnoglass is well on its way to achieving this ambition.