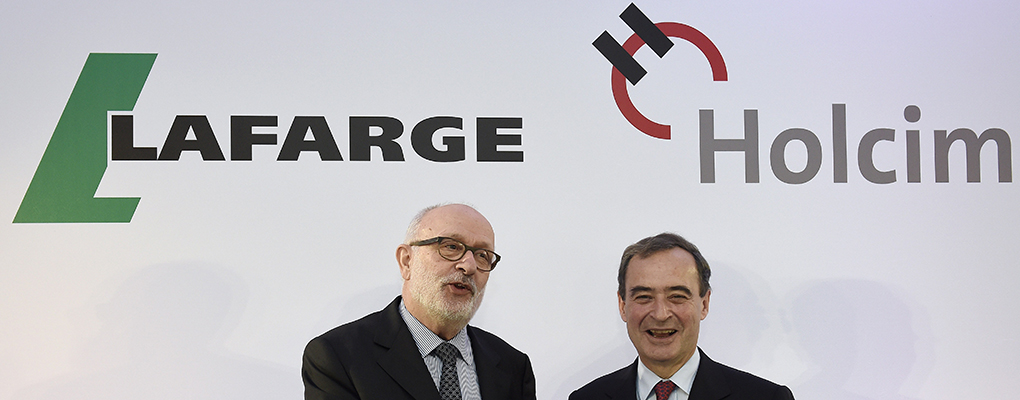

A merger between two of the world’s largest cement companies has been called off after the Swiss firm, Holcim, said circumstances had changed since it was announced last year. The deal between Holcim and France’s Lafarge was unveiled last April and would have been worth around €42bn. Intended as a coming together of two equal companies, the deal would have given shareholders equal stakes in the opposing company.

Holcim’s financial performance has been considerably stronger than that of Lafarge

However, over the last 12 months, Holcim’s financial performance has been considerably stronger than that of Lafarge, leading to the Swiss firm calling for a renegotiation of the merger that would better reflect its dominant performance. On Friday, shares in Holcim and Lafarge put their values at around €23bn and €18.5bn respectively.

Holcim released a statement explaining why the deal, in its current form, was off. “The Holcim Board of Directors has concluded that the combination agreement can no longer be pursued in its present form, and has proposed to enter into negotiations in good faith around the exchange ratio and governance issues.”

The final terms of the agreement had yet to be confirmed, but it had been announced that Lafarge’s CEO, Bruno Lafont, would lead the newly-created cement giant. While there was potential in many jurisdictions for legal challenges over competition issues, European regulators had given their approval in December for the merger to go ahead.

The merger would have created the world’s largest cement maker, with manufacturing capacity of 427 million tonnes a year far surpassing that of the 227 million tonnes a year of current market leader, China’s Anhui Conch Cement Company. The two firms had claimed it would save them around €1.4bn a year.

While the deal as agreed last April is no longer on the table, it seems both groups are keen to find some form of resolution. However, Lafarge says many of the agreed principles of the original deal must remain in place. “Lafarge’s Board of Directors remains committed to the project that it intends to see implemented. The Board said it is willing to explore the possibility of a revision of the parity, in line with recent market conditions, but it will not accept any other modification of the terms of the existing agreements.”